It has been the best of times, it has been the worst of times…for growth and value…over the last decade.

Since the end of the Great Financial Crisis (GFC), economic and market conditions have been generally favorable for US growth stocks. The economy grew at a slow and steady pace, rates remained anchored near historic lows and inflation was benign. As a result, growth’s outperformance has been strong and especially pronounced in the last 12 to 18 months. However, conditions are gradually changing, and the extreme divergence in style performance may be waning. While it is impossible to predict the future, a look at the performance of the growth and value styles and the prevailing economic environment could offer valuable insights into what’s ahead. We delve into this issue in a 3-part post. Part 1 looked at the disparity between value and growth, Part 2 examines the reasons behind it, and Part 3 will discuss why things could change.

Part 2: Why the Disparity in the Performance of Value and Growth

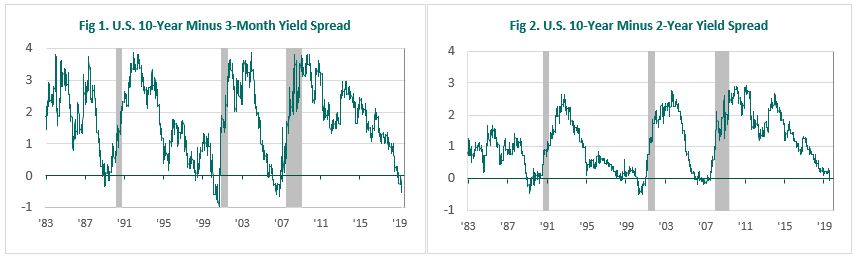

Over the past decade, value investing has endured one of its deepest droughts of underperformance relative to growth investing. This shortfall has spanned market capitalization and geography—engulfing small to large companies throughout developed and emerging markets around the globe. In the past 12 to 18 months escalating trade concerns, an inverted yield curve, and decelerating economic data has exacerbated the underperformance of value and smaller cap stocks and the outperformance of momentum factors. An economic slowdown is in progress driven by manufacturing weakness, trade conflict, the lagged effect of the Federal Reserve’s 2017-2018 tightening, the fading impact of US fiscal stimulus, and euro zone economic weakness. We look at some of the key reasons why value has been lagging.

Low Yields and Rates – Low rates are more favorable for long duration growth stocks and less favorable for short duration value stocks. Equity duration is a measure of a share’s cash-flow maturity. Stocks that pay a large fraction of cash flows in the distant future are long-duration stocks. In contrast, stocks of mature companies with near term cash flows are short-duration stocks. By decomposing duration into a portion due to tangible value (assets in place) and franchise value (future growth opportunities), the weight on franchise value is higher for growth stocks than for value stocks. Long duration growth stocks are therefore more sensitive to interest rate movements and low rates allow them to benefit more than short duration value stocks.

Note: Shaded area denotes recession

Source: Federal Reserve, NBER, Piedmont Investment Advisors

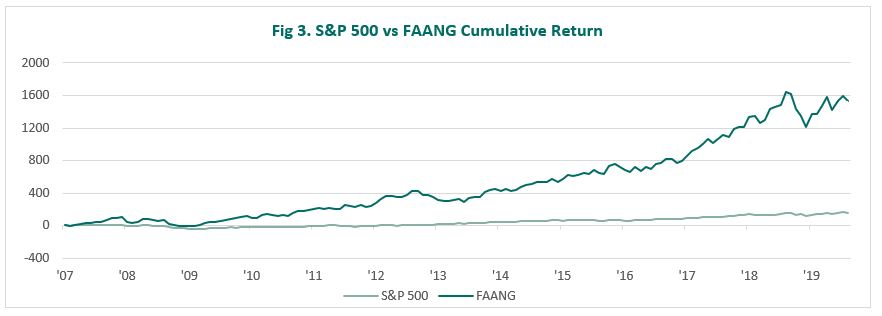

New Technology Destroying “Old Moats” – The growth style’s dominance since the global financial crisis a decade ago has been particularly propelled by a narrow group of technology titans. Fast changing technological developments have enabled these growth companies to disrupt traditional industries. These companies have come up with innovative products and services, created new business models, and changed the way people live their lives. In addition, as these companies have spread their tentacles in different industries across the economy (from transportation to health care to consumer goods to retail, etc.), they have grown their footprints, their revenues, and their earnings, at an impressive pace. These growth companies have relegated most traditional value companies to the background and have been the primary drivers of the stock market’s returns in the last decade.

Note: FAANG stocks are Facebook, Apple, Amazon, Netflix, Google (Alphabet Inc. Class A and Class C)

Source: FactSet, Piedmont Investment Advisors

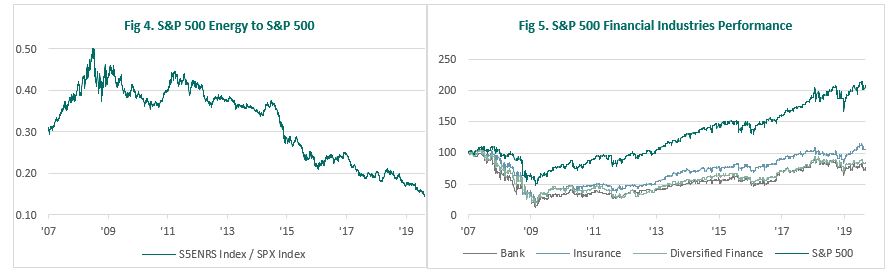

Sector Performance – Many of the value-oriented sectors have lagged the broad market since the end of the financial crisis. Financials, a key value sector, have been limited from using leverage and excluded from key businesses as a result of regulation. In addition, financial companies like banks and brokerages, mortgage companies, and insurance companies’ margins and earnings are hurt when interest rates are low or falling. Commodity driven sectors like Energy and Materials which have high weights in value indices have also lagged, especially in the past couple of years that have been characterized by an industrial slowdown. Due to the challenging macro-economic environment and the significant downturn in global demand, commodity industries are at an inflection point. Multiple factors are at play – depressed commodity prices, oversupply, increased regulation, a continuing trend towards vertical integration, lack of liquidity and credit, and new entrants, from private equity-backed businesses to state-owned entities and sovereign wealth funds.

Source: Bloomberg, Piedmont Investment Advisors

In our next post, we will discuss why the performance disparity between Value and Growth can normalize.

Source Material providers for this post include Credit Suisse, Loomis Sayles, J.P. Morgan, and RBC Capital Markets