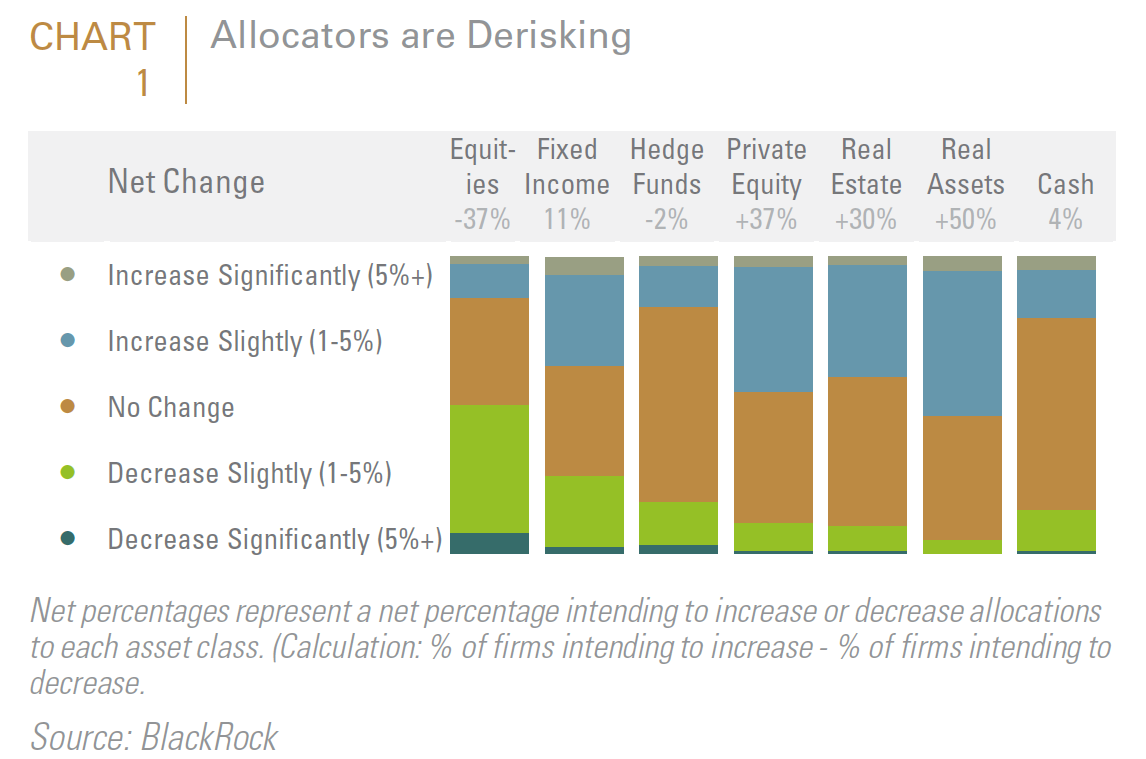

Global institutional investors are selling public equities in favor of so-called safety assets, such as bonds and real assets. This rebalancing activity is driven by signs of an aging economic cycle and bull market (U.S. and Canadian investors) as well as elevating geopolitical risks (investors outside the U.S.).

A January 2019 survey of 230 clients representing +$7 trillion in assets conducted by #BlackRock revealed that 51% of their clients intended to derisk by reducing their global equity exposure this year. This number is an uptick from:

- 35% in 2018

- 29% in 2017

The 2019 trend is most pronounced in the U.S. and Canada:

- S. & Canada 68% intend to derisk

- DM Europe 27% intend to derisk

Among Corporate pensions globally, 60% intend to decrease their equity allocations and 48% plan to increase fixed income (see CHART 1).

What is the context for allocators’ reducing their global equity investments?

You can read our 2019 analysis of institutional investor derisking trends and strategies, Battening Down the Hatches, Part 1 here: FIS Research: Battening-Down-the-Hatches-Part-1.pdf