The Differentiated Income strategy is a yield driven approach that derives alpha from unique, and diverse income streams. Income/yield is enhanced through callable securities, optionality, security structure, and variable rate coupons. The strategy uses only investment grade, domestic securities and it is typically indexed to the Bloomberg Barclays U.S. Aggregate Bond Index (the Agg) but should be considered a benchmark agnostic, satellite strategy.

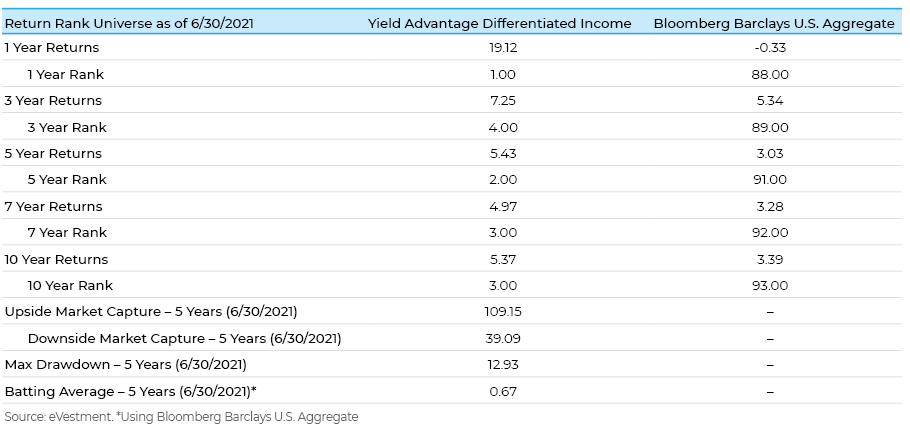

The long-term goal of the approach is to achieve an average of 150+ basis points of outperformance (vs. the Agg) on an annual basis over a complete market cycle. Performance is driven by the strategy’s significant yield/income advantage over traditional Investment Grade mandates. Given its propensity for optionality, it can be challenged by a significant downward move in rates or extreme volatility, due in part to the portfolio’s overall negative convexity profile. From an asset allocation perspective, the Differentiated Income strategy performs well in an increasing rate environment and/or a stable to trending rate scenario. It has exhibited some correlation to High Yield (a 5 year metric of .78 as of 6/30/21), but with slightly less downside risk. That said, with the exception of the Global Financial Crisis and pandemic, the strategy is most correlated to the Aggregate index. However, there remains the potential for the strategy to produce significant price appreciation during periods of extreme volatility or anomalous crises (as the max drawdown cohort shows below). Ultimately, the significant income/yield advantage relative to the index allows the portfolio to weather extreme scenarios, which can result in short-term portfolio drawdowns that are recovered over time.

An overriding premise of this strategy is our assertion that the bond indices, particularly the Aggregate Index, are inefficient in their construction. The index has evolved to contain 12,000+ issues and the ensuing inclusion rules are arbitrary at best. Investment grade securities are often excluded from the index due to issue or tranche size, which in turn causes them to be largely ignored by the largest investors in the bond market. Due to increased concentration, and investor focus on liquid, index-eligible bonds, liquidity premiums exist in securities either excluded from the indices/or with issue sizes that quite simply trade just less frequently. The negotiated nature of fixed income trading supports an ongoing discussion of liquidity related to on-the-run vs. off-the-run securities. Our assertion is that liquidity goes hand in hand with the speciousness of mark-to-market volatility and can be leveraged for increased returns in a primarily buy and hold approach.

In practice, Differentiated Income is driven by bottom-up security selection, contextualized through a macro construct that entails a view of the business cycle, shape of the yield curve, Fed policy and ultimately, a goal of ascertaining directional changes in market risk. These factors inform and facilitate macro risk buckets that are essentially ranges or caps on portfolio sectors weights. Most bond portfolios are a compilation of duration/curve, credit, prepayment/optionality, and structural risks. Our Differentiated Income strategy embraces these traditional security selection methods, along with a focus on esoteric structures (typically asset or collateral backed), such as single asset commercial real estate bonds, and securities backed by container leases and solar farms. The portfolio has also recently focused on the investment grade CLO market, typically investing in smaller tranches in the secondary market with floating rate securities and spreads above standard market rates. The portfolio’s credit component reflects a bottom-up orientation which has recently led to retaining a high financial sector concentration where coupon rates are both variable and structured based on market conditions such as the steepness of the swap curve. These positions reflect a yield curve view that provides income well above typical investment grade credit, especially in rising rate environments. This bespoke concentration differs from traditional index-eligible credit in that it is not issued off the standard capital markets trading desk, but is instead a result of banks looking to hedge specific risks, including a flat/inverted yield curve or a precipitous decline in an equity index. We continue to be opportunistic in capitalizing on specific risk exposures that banks are seeking to hedge. For routine liquidity purposes and duration management, the portfolio maintains approximately 20% in U.S. government treasuries and agencies, often in long callables and/or range accrual notes.

The Differentiated Income strategy relies on structure, coupon variability and optionality to derive its significant yield and coupon advantage. It embraces liquidity premia that exists within a market structure dominated by extremely large players. The strategy is not a “traditional” core strategy but should ideally be utilized by allocators such as endowment/foundations, corporate or public pension plans who value long-term results and can appreciate the idiosyncratic opportunities that mark to market volatility can provide.

For questions regarding performance, characteristics etc., please contact: Len Oremland – Managing Director, Head of Distribution and Client Engagement / Marketing & Client Service at: Tel: (267)765-1207 or Loremland@xponance.com

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.