Change at the Top: Economic and Equity Market Implications

U.S. stock markets experienced positive performance in 2024, and that trend is expected to continue in 2025. However, 2025 also has the potential to experience increased market volatility and shifting trends due to policy changes from the incoming administration combined with uncertainty about inflation and global economic conditions. Policies on tariffs and changes to immigration limits could prove stagflationary while plans to deregulate and cut taxes may increase US investment, jobs, wages, and productivity. These changes will also have an impact on the Federal Reserve’s actions. The overall effects on inflation and growth and ultimately global market performance are difficult to predict. An extensive discussion of expected policies from the new administration and their market implications across asset classes can be found in the piece The Precariat Are Still Mad! Part III – How Should Investors Play the Next 4 Years? It Depends! In this paper we focus on US equity markets.

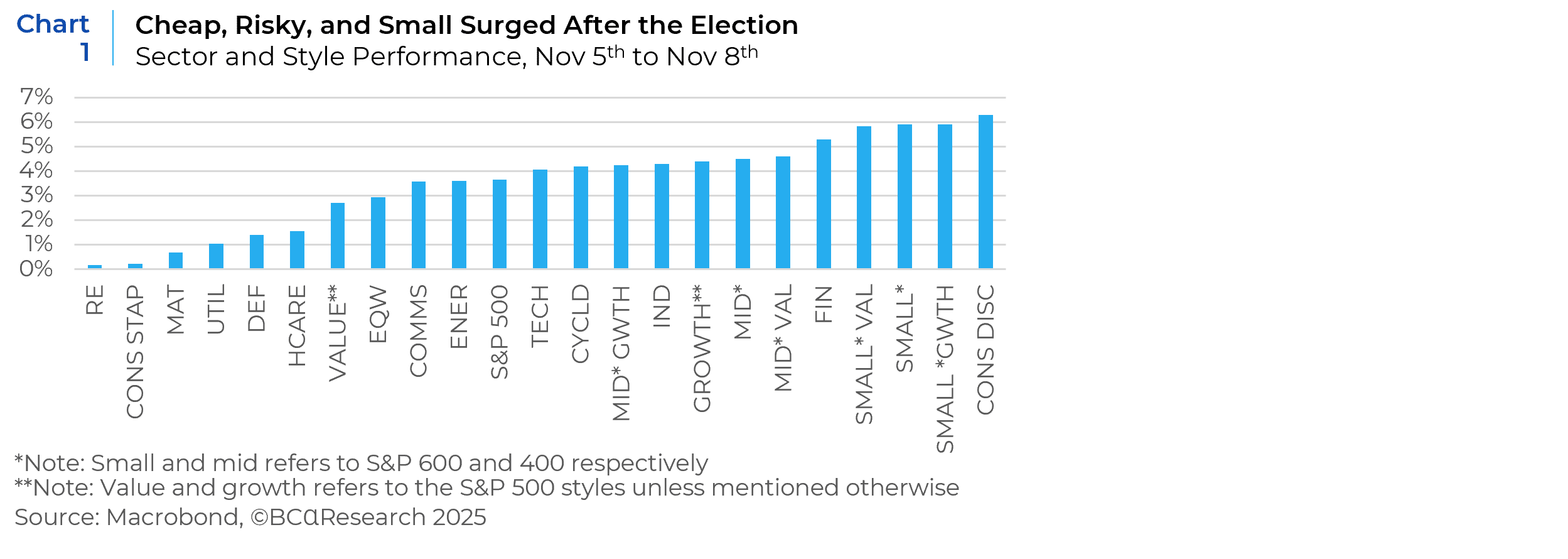

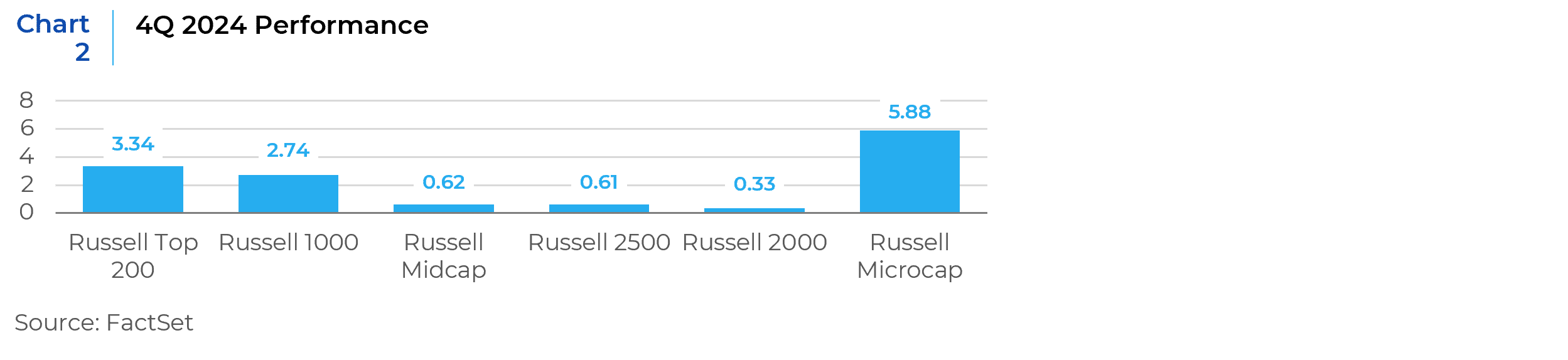

As we start 2025, a quick review of equity market performance and Fed policy in the fourth quarter of 2024 is worth mentioning to provide context for 2025 consensus market expectations. Equity markets saw risk appetites increase right after the November 2024 elections (Chart 1) and that was also reflected in the performance of the smallest names in the fourth quarter of 2024 (Chart 2).

The Fed made their third and final rate cut of 2024 in mid-December to bring down the target range for the federal funds rate to 4.25% to 4.5%. The Fed also predicted that they will cut rates to 3.9% in 2025, suggesting that they will make just two rate cuts next year as inflation has not moderated enough and the economy remains strong. The initial forecast had been for four cuts for 2025. In other words, an easing cycle is in place, albeit at a slow and data-driven pace.

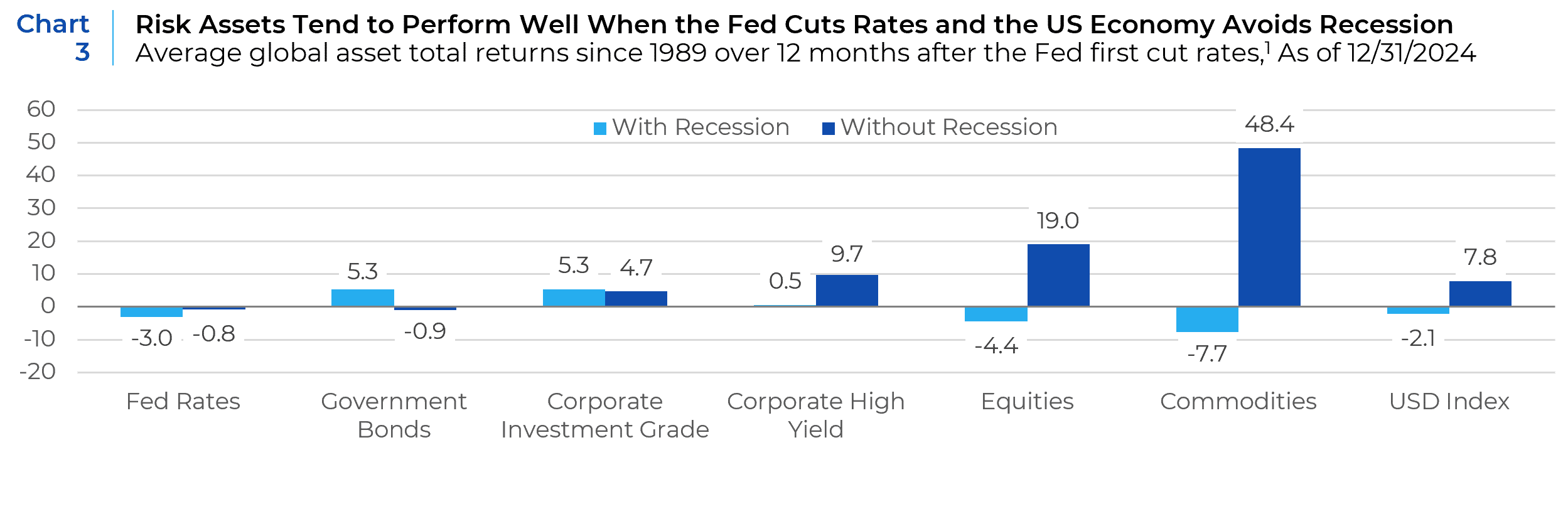

The US stock market has historically posted strong returns after the start of an easing cycle if the economy did not fall into a recession within the subsequent 12 months. Global equities, commodities, and credit have all seen positive performance in rate-cutting cycles when the US avoided a hard landing. Given that most of the economic data continues to hold up and the risks of a hard landing appear limited, risk assets are likely to trade well in 2025 (Chart 3).

The consensus outlook for 2025 assumes equity markets will maintain their upward march amidst a broadening out of markets with mid and small caps beginning to participate in performance along with value sectors like financials and industrials. The technology sector’s dominance may wane in 2025 although it is still expected to generate positive returns.

Style & Size

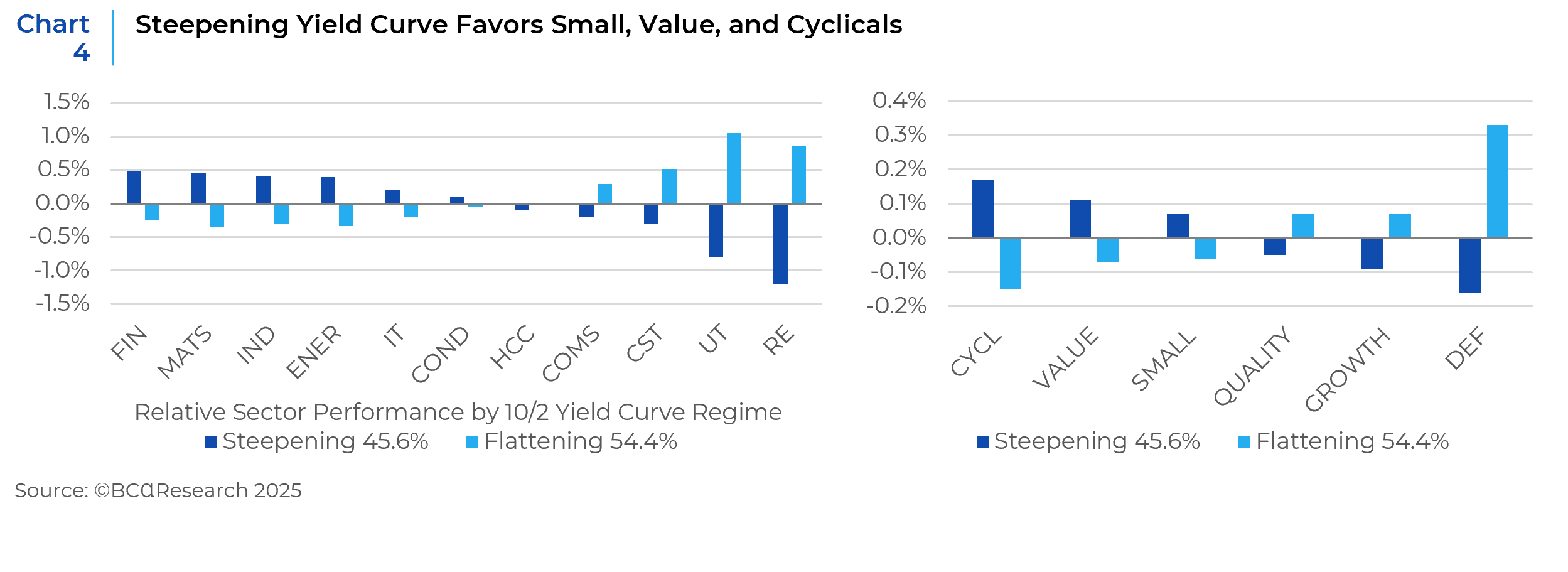

Value outperforms Growth when interest rates are rising or the yield curve is steepening, if that happens in anticipation of more economic growth (Chart 4). If the Fed continues its rate cutting campaign, lower rates should reduce the interest burden faced by smaller companies that are heavily financed with floating rate debt or that have nearer-term refinancing needs. In addition, the Trump administration’s pro-growth, domestically oriented policies, tax cuts, and deregulation, is expected to benefit mid-smid-small cap companies. Protectionist policies should benefit domestic industries, while other countries’ retaliatory policies may hurt US multinationals. Moreover, deregulation may also serve to broaden market performance.

Sectors

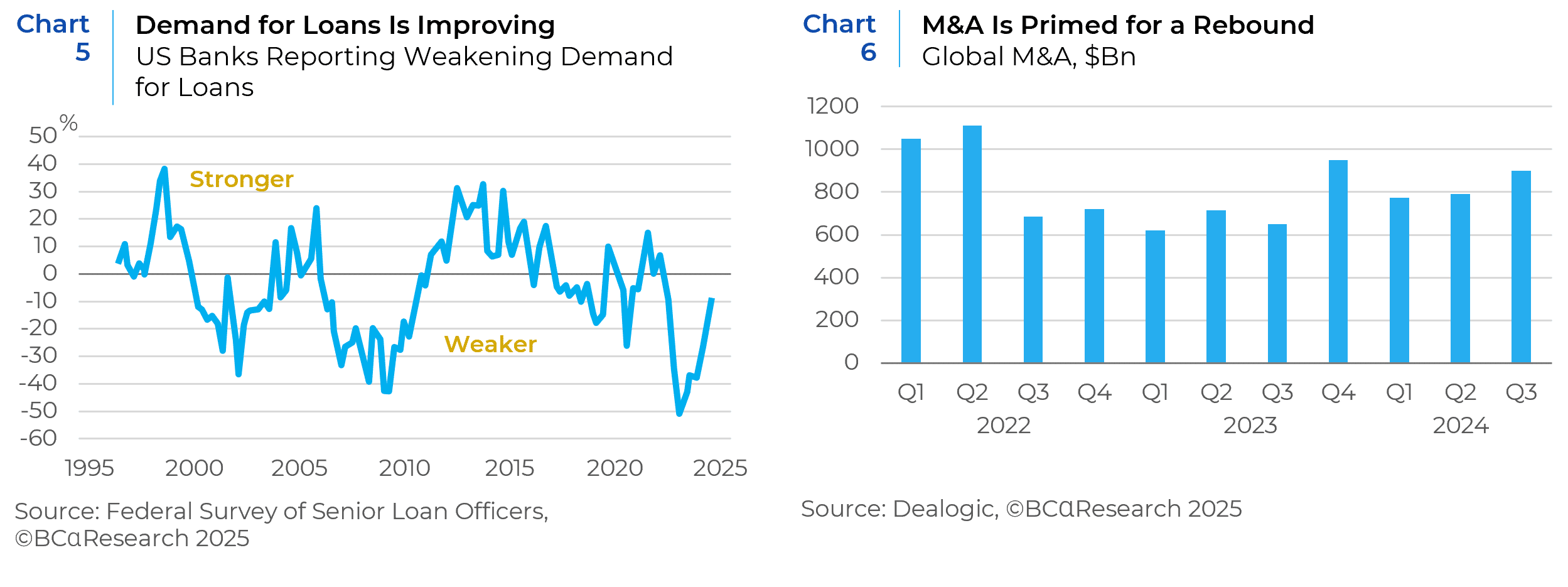

Financials: Consensus expects this sector to benefit from the policies of the new administration. Pro-growth policies and a steepening yield curve will benefit banks’ net income margins. The demand for loans is turning the corner (Chart 5) and banks should profit from the Trump Administration’s higher receptivity to mergers and acquisitions and a resurgence of capital market activity (Chart 6). In addition, Republicans favor rolling back some regulatory measures under the Dodd-Frank Act, offering relief to banks. They are also expected to curtail some pending Basel III proposals, which are designed to raise regulatory capital levels for regional and smaller banks. If the pro-growth policies of the Trump Administration are perceived as inflationary and result in interest rates remaining elevated, insurance companies would be beneficiaries of that trend.

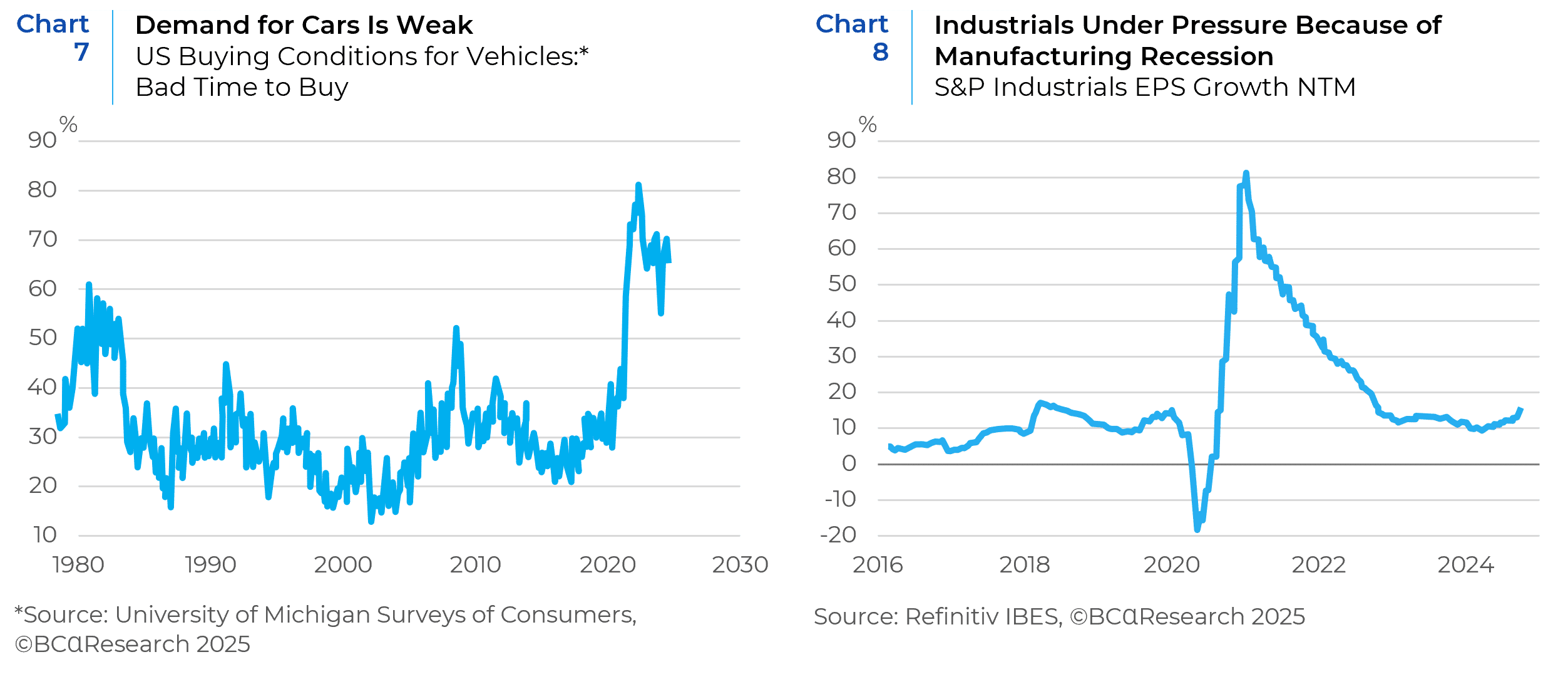

Autos and Industrials: Demand for Autos is weak (Chart 7), and Industrials are under pressure because of a manufacturing recession (Chart 8). However, these sectors are expected to benefit from any protectionist policies that go into effect. Regardless, it is important to note that higher input costs resulting from the imposition of tariffs will offset the positive effects of protectionist policy on these sectors.

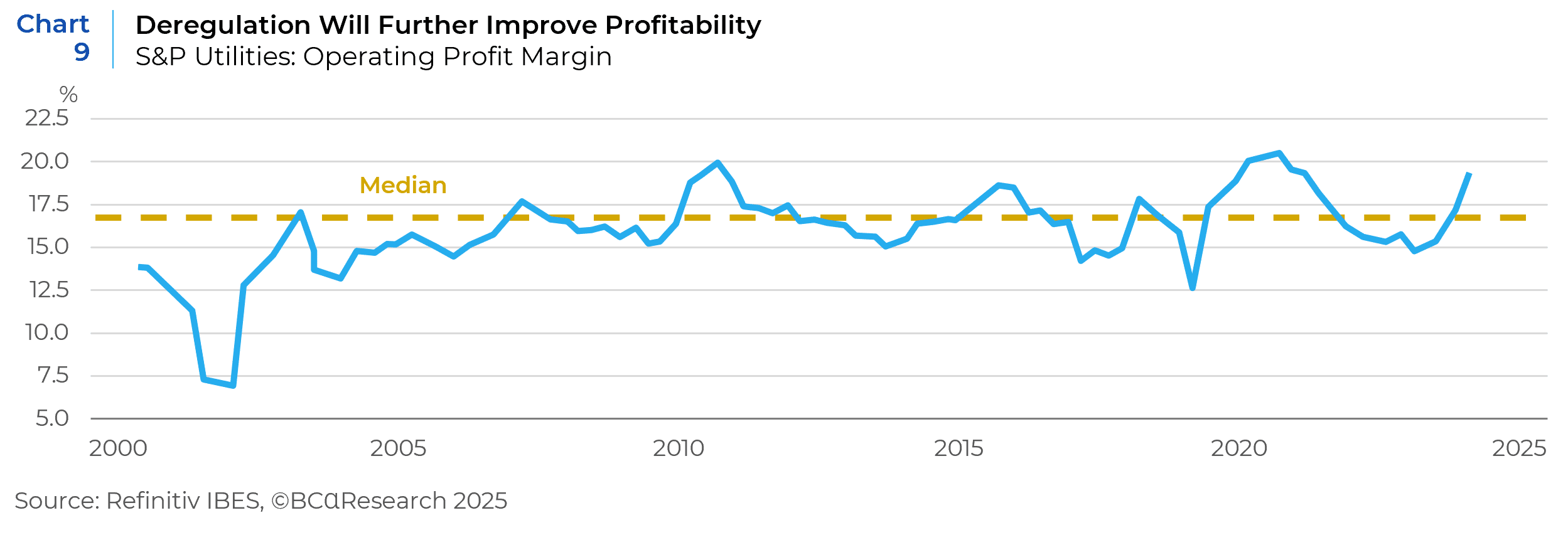

Utilities: Utilities are poised to benefit from the Republicans’ deregulatory agenda that covers building out more power-generation capabilities to secure and advance the AI lead. Emergency powers can be invoked to waive environmental regulations to allow for the building of new nuclear and other electrical generation capacity to power the big data centers for advanced AI models. This will be very favorable for the sector whose margins are already soaring (Chart 9).

Technology, Semiconductors, and AI: The Trump Administration is expected to be favorable for AI. Big Tech will benefit from the incoming administration’s lighter touch on antitrust enforcement, which may spur acquisitions in the AI space. However, protectionist policies like imposing new controls on chip exports to China, could become a headwind for the entire industry. Regardless, the AI trade may enter a new phase in the coming months after passing through two previous phases – “Phase 1” focused solely on Nvidia (NVDA), whose advanced chips made it the key enabler of the AI boom; “Phase 2” included companies that were essential for the buildout of AI infrastructure. “Phase 3” is expected to see investors turn their attention to companies monetizing AI. Software and services companies across the capitalization spectrum could be the primary beneficiaries of the next phase of AI’s evolution.

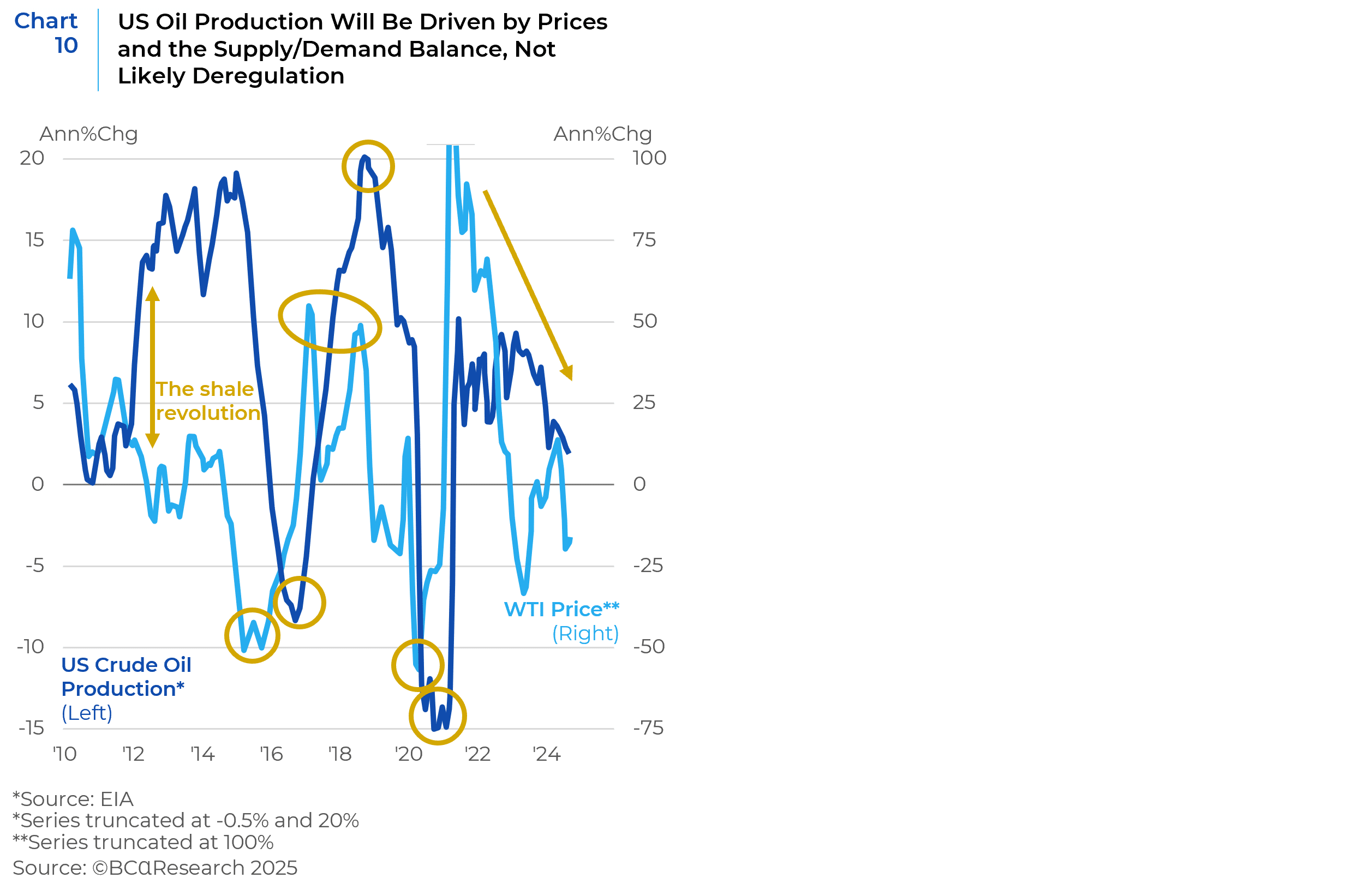

Energy: Energy production should be poised to grow under regulatory easing and policies that will support US energy independence. However, an increase in drilling will lead to lower energy prices, which will be detrimental to sector profits given the backdrop of weak global demand (Chart 10). Energy producers may therefore decide to maintain capital discipline and not increase production despite a favorable regulatory environment.

What Can Go Wrong?

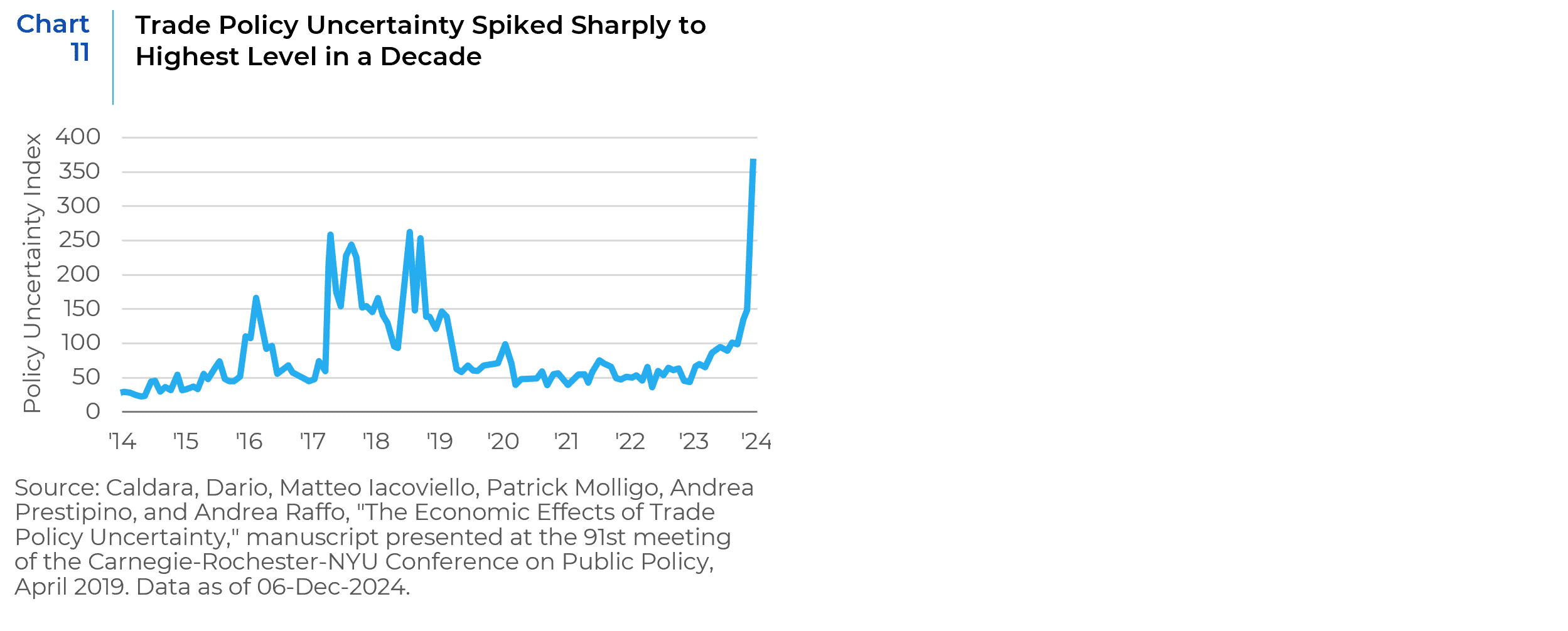

While the consensus view for 2025 assumes a macro environment conducive for domestic equity markets, there are a range of potential risks that could act as headwinds and heighten financial market volatility. Several key policy risks could disrupt markets. Trump’s “America First” foreign policy, characterized by tariffs, trade wars, and skepticism toward international agreements, could escalate tensions with major trading partners such as China, the EU, Canada, and Mexico. Although campaign promises are unlikely to be fully implemented, tariffs are expected to be used as a negotiating tactic and in all probability will rise to some degree. The rush to fulfill campaign promises in the early days of the administration could heighten global trade uncertainty and market volatility as investors reassess the impact of such policies on global growth, inflation, and corporate earnings (Chart 11).

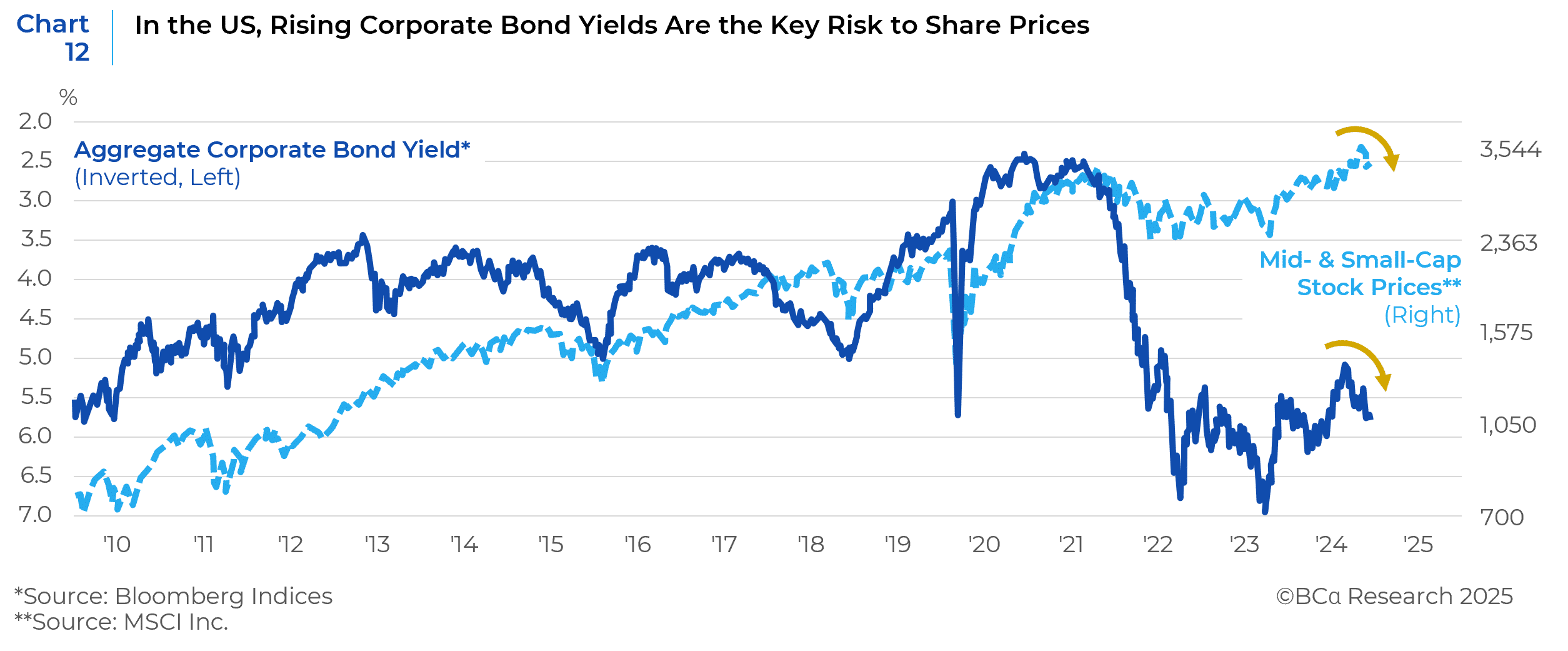

Aggressive government spending, combined with more tax cuts could exacerbate the already wide fiscal deficit, putting pressure on bond markets and raising borrowing costs for the US government. This could dampen investor sentiment and fuel market volatility. Additionally, with the labor market already tight, further fiscal stimulus may overheat the economy, leading to a resurgence of inflationary pressures. The Fed could then be forced to reverse course and hike interest rates to control inflation, negatively impacting equity markets. Under this scenario, the yield curve would continue to steepen due to the expectation of increasing budget deficits. Rising bond yields pose the biggest threat to US equities and have the potential to derail market expectations (Chart 12).

A renewed focus on restricting both legal and illegal immigration could lead to labor shortages in critical industries such as agriculture, construction, and technology. On the campaign trail President-elect Trump promised the largest mass deportation of undocumented migrants in US history. While an immigration crackdown may boost domestic wages in the short term, it could also hinder long-term productivity growth by disrupting the flow of highly skilled workers to the US from other countries. Companies and industries heavily dependent on immigrant labor may be subject to abrupt policy shifts, potentially increasing economic and financial volatility.

Given that President Trump was elected to curb inflation and spur economic growth, both voters and bond yields may impose restraint on fiscal policy and tariff impositions, forcing a pivot towards laissez-faire. However, the range of unknowns remains wide and there is an environment of caution and concern across policy areas. Investors face uncertainty due to shifting policy frameworks and unpredictable outcomes in fiscal, trade, regulatory, and immigration policies.

While pro-growth measures may support equity markets, the risks from rising tariffs, potential trade wars, and fiscal policy overreach necessitate a cautious yet diversified investment strategy to navigate the twists and turns of 2025.

The possibility of increasing volatility prompts us to monitor policy developments closely and adopt a cautious approach to portfolio construction by maintaining well diversified portfolios with tracking errors on the lower end of target ranges. Our fundamental principles of investing with a focus on earnings growth and reasonable valuations continue to remain in place. Our stock selection models are dynamic and nature and can adjust to changing market trends. The first hundred days of the new administration will be critical in understanding policy impacts on equity markets – sectors, Industries, capitalization, and style and in estimating the probability that consensus views are correct.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospective clients for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.