Article Summary

Our outlook looks at global equity markets, earnings, emerging markets, and currencies through the end of the year in the face of another interest rate hike in December and impending political events in the U.S. and Europe. We also evaluate the longer term macroeconomic and investment strategy implications of impending monetary policy exhaustion and resurgent populism in a piece entitled: Goldilocks is on Life Support: Investment Strategy in Light of Monetary Policy Exhaustion and Resurgent Populism

Q4 2016

Global equity markets shrugged off political and policy uncertainty in both the U.S. and Europe by surging 5.03% in common currency terms and 5.3% in U.S. dollar terms. In Chart 1, we contrast the Equity Risk Premium of the S&P 500 index with the Economic Policy Uncertainty indices for the U.S., Europe and China. The chart shows that since 2011, policy uncertainty out of Europe and China dominated spikes in the ERP. The fear of a China hard landing that drove risk perceptions early this year has substantially abated as a result of the stimulus induced stabilization of production activity. The other source of risk this year was the June 23rd Brexit vote. While Sterling has dropped -14.3% since then, the BOE’s policy agility also helped the U.K. stock market to be among the best performers in local terms of any large market and is now up 10.5% YTD (see Chart 1).

On the earnings front, only Chinese companies demonstrated any discernible pick-up in profitability during Q3. A similar reversal occured after the last round of relationary policy in 2013. Therefore, we will continue to evaluate whether this is a durable profit recovery (see Chart 2). Despite what could only be described as a lackluster backdrop for earnings, the markets in the U.S. also rallied, especially in cyclical sectors like Technology, Industrials, and Financials. The 10-year treasury bond sold off modestly while the NASDAQ and the Russell 2000 rallied meaningfully in the quarter, up +10.2% and +7.8% respectively.

Emerging markets (EM) assets continued their rebound from oversold levels early in the year; with equities finishing the year up 11.3% YTD in local currency terms. The strong rally in EM currencies pushed up the return for U.S. dollar based investors to 16%. Notably, however, the EM rally was also not underpinned by a compelling improvement in fundamentals as measured by EPS and so far, has been entirely driven by multiples expansion. (see Chart 3).

This is likely why flows into EM equities were dominated by ETFs that are predominantly used for portfolio rebalancing or momentum strategies; while active managers (that are more likely to invest based on fundamental factors) were sources of net outflows. (see Chart 4 and Chart 5).

Additionally, the EM rally this year has been led by countries and markets that are most sensitive to easing in dollar financing conditions that have been supported this year by the combination of the shift by the Fed toward easier policy in Q1, the slowing of reserve sales, and abundant BoJ and ECB liquidity going abroad in search of yield in dollar assets. A Bridgewater Associates analysis showed that while EM assets in aggregate have benefited from the improvement in dollar financing conditions, Brazil and South Africa, that were among the top performing emerging markets this year, are the most sensitive to dollar sensitivity. These markets have reversed much of the relative underperformance of the last few years but further outperformance is reliant on continued easy dollar liquidity conditions. Economies that don’t need much capital, like India, or are more sensitive to euro financing conditions, like Poland, have seen a much smaller support and therefore would be expected to be less vulnerable to dollar liquidity. On the other hand, many EM borrowers (particularly in Asia) are significantly less reliant on dollar liquidity as they’ve cut their financing needs to secular lows. We believe that going forward, dollar liquidity will be less benign as a result of money market reforms that will tighten access by global banks to dollar financing, rising LIBOR rates as well as the possible resumption of Fed tightening in December.

Assuming that profits, corporate profitability and corporate financial health have any relevance to share prices and corporate bond markets, the rally in EM equities, credit markets and currencies will falter unless EM fundamentals catch up with stretched valuations. Thus far, outside of China where there is evidence of modest earnings improvements in previously bombed out sectors, there is little evidence of such a surge.

On the positive side, more dovish G3 central bank policies have also eased deflationary pressures (as represented by the Producer Price Index) in China by allowing the yuan to steadily depreciate by 7.2% year to date. (see Chart 6). These reflationary policies have allowed the private sector in China to reduce leverage and marginally improve its profit margin.

However, in our discussions with investors, there is growing unease about the summer rotation back into risk assets because it is based on the TINA (there is no alternative) effect and search for yield, rather than on any significant improvement in the fundamentals. The fact that many of the markets that have been on a tear this year (such as the U.S., Canada, the U.K, Brazil and South Africa) are trading above 1 standard deviation of their most recent 7.5-year cycle adds to the sense of unease. (see Chart 7).

Compounding this discomfort are the potentially unnerving prospect of the Fed resuming its hiking program in December; political events scheduled over the next six months both in the U.S. and Europe; resurgent populism and policy extremism in response to ongoing disequilibria (such as income inequality, the profit share of GDP versus the wage share, consumer versus investment spending, savings versus investment and stocks prices vs. zero to negative bond yields) and the fact that October has historically been an unpleasant month for global investors.

Chart 8 depicts a market which is still fairly complacent about the prospect for a Fed rate hike in December despite the pick-up in high frequency data (such as the ISM) and wage data as well as multiple members of the FOMC telegraphing heightened risk of a rate hike. In fact the market is forecasting only a 50 bps hike between now and December of 2017 (see Chart 8). We believe that in light of the recent pace of U.S. inflation and wage growth data, as well as changes in the investment environment (see Goldilocks is on Life Support: Investment Strategy in Light of Monetary Policy Exhaustion and Resurgent Populism), thus complacency is unwarranted.

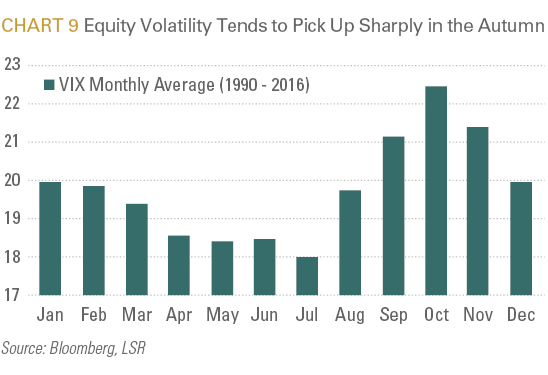

As shown in Chart 9, the August through October period has historically been the most volatile over the 26 year period between 1990 and 2016. While past is not always prologue, investors should however be encouraged that while this period has historically been the most volatile of the year for both bonds and stocks, the historical data also shows a strong Q4 finish, despite volatility in the fall (see Chart 9 and Chart 10).

While global equities may temporarily stumble as a result of heightened policy risk and historical fall volatility, none of our risk models: the global equity systemic risk indicator (see Chart 11), our sentiment indicator (which evaluates both changes in the futures curves as well as social media data) as well as the fractal score country models, are currently signaling alarm.

Our completeMarket Outlook for Q4 2016 as well as our strategic views are summarized below. The forecasts from our tactical model are also below. Our outlook represents a somewhat nuanced picture with respect to equity risk. Among countries and regions, we are neutral to the U.S. because of the defensiveness of that market, and overweight China H-shares because of less demanding valuations and the likely liquidity boost from the implementation of the Shenzhen-Hong Kong connect in November, as well as India and Central Europe because of favorable structural reform and policy settings (and the likelihood of a currency boost in the Czech Republic and Poland). While our portfolios underperformed the global benchmark as a result of our underweight to Brazil, we find that market even less compelling at current valuations. On the sector front, our models continue to favor deep cyclical sectors (with the exception of IT, representing a reversal from last quarter) with a neutral weight to certain defensive sectors, such as Consumer Staples and Telecom.

In the end, investors are left with the same basic question – what do you buy when nothing looks particularly cheap? Higher-than-normal levels of cash seem appropriate to us in a world in which further political surprises seem inevitable. At the same time, in the current absence of inflation, shareholder yields discounted by exceptionally low interest rates could push valuations even higher still.

Our research note entitled Goldilocks is on Life Support: Investment Strategy in Light of Monetary Policy Exhaustion and Resurgent Populism focuses on longer term changes in the investment environment in light of resurgent populism and growing monetary policy exhaustion.

Goldilocks is on Life Support: Investment Strategy in Light of Monetary Policy Exhaustion and Resurgent Populism

With the November presidential election in the US, populist uprisings in Europe which will again be on display through the November constitutional referendum in Italy, an apparent hardening of Britain’s negotiating stance as it prepares for impending Brexit negotiations as well as ongoing elections in Spain, investors will once again continue to grapple with heightened political and policy uncertainty over the next 6 months. Investors have for the most part, shrugged off these serial political crises, with risk appetites emboldened by extraordinary monetary accommodation which has punished safe haven assets and created a so called Goldilocks environment which was “just right” for risk assets. Additionally TINA (there is no alternative) encouraged yield chasing, irrespective of weak fundamentals. The winners in the post GFC environment have been the “Dividend Aristocrats”, high yield debt (particularly before the sharp drop in oil prices in the fall of 2014 and again in 2016) and emerging market debt. The losers have been active management strategies that screen for improving fundamentals and attempt to purchase securities trading below their implied valuation and sell when their target valuation or price movement has occurred. What’s different today, is that the expected ratcheting up of political risk comes against a backdrop of apparent monetary policy exhaustion across the G3. As a result, we are beginning to transition to a fundamentally different investment environment wherein the Goldilocks environment of the last few years, which has supported the bull market in both bonds and equities, is becoming unsustainable. The most likely candidate for even more extraordinary monetary measures is Japan; where QE has failed to sustain positive inflation growth, and negative interest rates in late January further eroded confidence in the BoJ and exacerbated Japan’s deflationary impulse through an appreciating yen. QE is also facing constraints in Europe, but the ECB would face significantly more challenging legal and cultural hurdles to adopt even more unconventional monetary policies.

Monetary Policy Exhaustion?

QE or more specifically, central bank asset purchases, affect spending and inflation in several ways, including (1) lowering interest rates, (2) boosting money supply, (3) raising asset prices, (4) improving liquidity, (5) raising confidence, (6) encouraging bank lending and (7) lowering the exchange rate.

While in the U.S. QE has in large part accomplished all seven objectives, it has struggled to achieve the widely used 2% inflation target and GDP growth has remained well below pre-GFC norms. For example, Chart 12 shows that each round of QE by the Fed has been less effective at lifting long term inflation expectations. Monetary policy exhaustion was one of our core predictions for 2016, in that we felt that despite zero or negative real rates, core inflation (and equally important, inflation expectations) would continue to fall short of 2%. This is because the underlying cause of weak growth has been insufficient demand to spur business investment, which has woefully lagged during the recovery. Weak demand is in turn a function of the debt overhang from the GFC as well as worsening demographics. The impact of demographics is wide-ranging and important. The main point is that the slowdown affects both the supply and demand sides of the global economy. Consumers tend to spend less after age 50, and especially after retirement. We would expect this trend to be exacerbated by millenials’ propensity to consume through the sharing economy. Moreover, a slower pace of labor force growth implies a permanently lower level of capital spending relative to GDP. The demographic effects result in weaker economic growth, poor productivity performance and deflation pressures. They also suppress interest rates and bond yields via one of the key global disequilibria that has been around since the “conundrum years” of the mid-2000s: a business sector which is reluctant to aggressively invest at a time when the desire to accumulate savings has heretofore intensified. The GFC also brought an end to the Debt Supercycle , which reinforced the desire to save or pay down debt before retirement.

By lowering rates to essentially zero, QE facilitated balance sheet repair, particularly among households and inflated the present value of financial and real assets. Through the latter so called “portfolio balance” effect, QE has been able to spur household consumption; but it has achieved limited success in sustainably raising wages or prices (see Chart 13).

While real GDP has not returned to its pre-GFC trend, U.S. labor markets have for the most part healed core inflation has exceeded the 2% target: the Fed’s preferred measure of inflation, the Implicit GDP Price Deflator has been approaching the 2% target. For example, more recently, real wages have also begun to pick up. In the month of September, Average Hourly Earnings of all employees increased +$0.06 M/M to a record $25.79, representing a 2.59% year on year increase. While still the subject of much debate, the FOMC appears to be contemplating resuming their rate hike program with likely “re”-lift-off in December 2016.

After six quarters of successive declines in output in the Euro Zone since 2011, Mario Draghi’s “whatever it takes” speech was a turning point and soon thereafter, the ECB announced Outright Monetary Transactions (OMT), dousing concerns about a break-up of the euro. The OMT announcement significantly reduced sovereign credit risks, particularly in the periphery countries (such as Spain, Portugal and even Greece) and improved liquidity. But in spite of these considerable improvements, growth remained below its trend rate and deflation worries resurfaced as private debt levels remained high and bank lending was moribund.

Rising concerns about the euro zone recovery forced the ECB to finally adopt aggressive QE in January 2015. Of the seven channels mentioned above through which QE affects spending and inflation, the portfolio balance effect has been particularly pronounced in the credit markets, especially after the ECB’s decision to buy corporate sector bonds in March of this year. However, through a depreciating Euro, the FX channel has most significantly affected the Euro Zone’s real economy. Since QE was signaled in the summer of 2014, the euro depreciated by 10% in nominal trade-weighted terms. Because of its relative openness to trade, the euro area is very sensitive to the exchange rate. Therefore exports have been a key growth driver of the euro zone’s recovery in 2015 and far exceed domestic demand as a contributor to GDP. (see Chart 14). Unfortunately, Chart 14 also shows that, the euro has actually strengthened this year, which has again dragged down both competitiveness and inflation.

Like the U.S., core inflation in the ECB has been stuck in the 1.5% range and headline inflation was 0.2% in 2016. The ECB itself expects headline inflation to bounce back to 1.2% in 2017 and 1.6% in 2018; while market based inflation forecasts continue to point to more subdued price pressures.

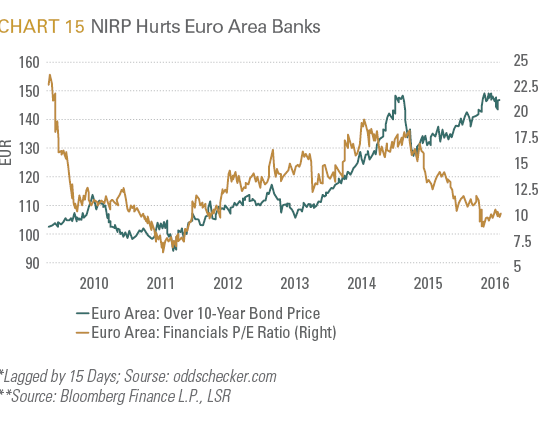

Additionally, while the ECB’s Bank Lending Survey found that QE led to a net easing of the lending policies of euro area banks, credit growth in the European Area at 1.8% remains quite tepid (say, in comparison to the U.S., where credit growth is at 7.8%). Weak loan demand has been the most significant dampener for credit growth. However a key constraint on the supply side is poor profitability where flatter yield curves and negative interest rates spawned by QE have seriously impaired European banks’ valuation and profitability. Additionally, the high level of NPLs, which surged after the GFC have also dampened loan growth. On a positive note, the health of EA banks has improved since 2011 as a result of a concerted effort to strengthen their capital bases. The key exceptions are Italian banks (especially Monte dei Paschi di Siena) and Deutsche Bank. (see Chart 15 and Chart 16). Since over 80% of credit is financed through the banking system, profit impairment in the banking system could ultimately be self-defeating. The good news is that policy makers have indicated that they are unlikely to push rates further into negative territory; so that with rising credit demand, the worst of the European banking sector may be behind it.

Additionally, the ECB’s QE program is facing constraints as a result of the scarcity of eligible bonds to complete just its current target for asset purchases of €80 billion per month (see Chart 17). The current pace of asset purchases is expected to continue until March 2017. Meaningfully expanding QE would require relaxing the asset purchase eligibility rules or raising the issuer limit for asset purchases. Either course would likely be a tall order because of German policymakers’ resistance, particularly in light of its unwanted effect on the banking sector. Consequently, we would not be surprised if the ECB does not actually start tapering over the next 12 months, particularly if inflation accelerates in line with or above the ECB’s forecasts.

In Japan, entrenched deflationary dynamics from negative demographics and deficient aggregate demand have overwhelmed the Abe administration and BoJ’s efforts to lift inflation to its 2% target. As in Europe, NIRP has decimated bank profitability this year and severely undermined the market’s confidence in the BoJ. Consequently, in its September meeting, the BoJ added yield curve targeting to its monetary policy arsenal, where by targeting a floor for the 10-year government bond at zero, they would allow short term rates to fluctuate below zero in order to achieve a positive yield curve slope. Despite recent data suggesting some strengthening of the economic recovery, there are no signs that Japan’s tight labor market is fueling price pressures. While the Bank of Japan can blame the stronger yen for a sharp fall in goods inflation, the ongoing slowdown in services inflation and the drop in inflation expectations highlight that the benefits of its aggressive policy easing are increasingly elusive. Consequently, particularly for Japan, there has been increasing discussion about even more unconventional debt monetization policies and so called “helicopter money”; whereby the BoJ would finance increased government spending or tax cuts with freshly printed money (see Chart 18).

In summary, monetary policy measures have indeed achieved some measure of success in avoiding extreme liquidity crises and facilitating balance sheet repair, but there is a growing appreciation that it in order spur self-sustaining growth, policy makers will need to prime the fiscal pumps to expand aggregate demand.

Resurgent Populism

As of the writing of this research note, I was struck by the October 6th cover of the Financial Times which pictured the new U.K. Prime Minister and the decidedly “un-populist” head of the Conservative Party, with a buy-line stating that “(Theresa) May attacks elites as Brexit fuels policy tilt.” In the wake of the Brexit vote, our research note entitledBrexit: The Revenge of the Precariat over Davos Man focused on this phenomenon, whereby whole swathes of the populations in industrialized countries have collectively rejected their heretofore respected political, academic and corporate elites.

In the last three years, populist movements and policies have completely upended long established assumptions about economic and trade policy, as well as long standing geopolitical alignments that had been carefully crafted in order to maintain order in the aftermath of the second world war. This is unsurprising given the post-2008 global loss of confidence in governments and the low-growth, deflationary context of the global economy. Thus in the U.K., despite a chorus of doomsday scenarios from the global political and financial elite, Brexit prevailed in the June 23rd referendum and the previously pro-Europe prime minister Theresa May has further satiated an angry U.K. electorate by appearing to entertain an even harder Brexit negotiating stance. In the world’s largest economy, the flamboyant Donald Trump successfully gained the GOP nomination by challenging bastions of that party’s policy platform such as globalization and prevailing over 13 other more traditional candidates. In Italy, the world’s fourth largest sovereign debt market, comedian Beppe Grillo’s Five Star Movement is neck-and-neck in the polls with the status quo governing Democratic Party. In France, nationalist and ardent Eurosceptic Marine Le Pen will likely enter the final round of the May 2017 presidential election (though she is unlikely to win). Indeed, Chart 19 shows that populist parties have gained significant ground since the last election cycle.

Despite their often outsize personalities, the success of populist leaders is not purely based on their skills and leadership qualities. As Lee Ross and Richard Nisbett discuss in their classic The Person and the Situation, the context and the situation are often as important as the person. For example, the Philippine version of Donald Trump, Rodrigo Duterte, is as much a product of circumstance as of his own capabilities. After over a decade of mild-mannered and well-spoken, yet ineffective, leaders from the small Manila elite, Philippine voters decided to take a chance on the controversial ex-mayor from the poorest and southern-most island group despite his proclivity for describing his opponents in rather obscene and colorful terms and a penchant for extrajudicial killings in the name of law and order.

Markets have generally reacted negatively to populist candidates (see Chart 20). However most investors have repeatedly underestimated their popularity and dismissed their market impact because of the limitations they face either in actually winning or because of institutional constraints that would likely limit their ability to implement populist policies (such as the Congress, in the U.S.). The performance of global risk assets, and the FTSE 100 index in particular since the Brexit vote, further underscore investors’ complacency. Our response is that first, Brexit of course, has not yet occurred and its negative implications are likely to play once its ramifications are actualized. But, more importantly, we also believe that the underlying drivers of voter resentment will materially shift policy choices whether their explicitly populist representatives prevail or not, and that such shifts could significantly impact trade, wage and profit growth. Theresa May’s promises to review workers’ rights, new housing schemes and to take on big business; as well Hillary Clinton’s clear shift towards more populists stances on trade and immigration are glaring examples of growing populism from traditionally conservative or at least centrist politicians. This will in turn change the line-up of winning and losing economic agents and investments.

Why So Much Anger? The Upside and Downside of Technology

In theory, advances in technology hurt some workers in the short term, but benefit most workers in the long run because they raise national income. As lower-cost capital displaces labor, goods and services become cheaper, raising real incomes across the economy and thereby raising demand for existing and new products. Workers displaced by new technologies migrate to growing industries over time, and real wages rise roughly in line with productivity. In other words, labor eventually receives the spoils of the new technology.

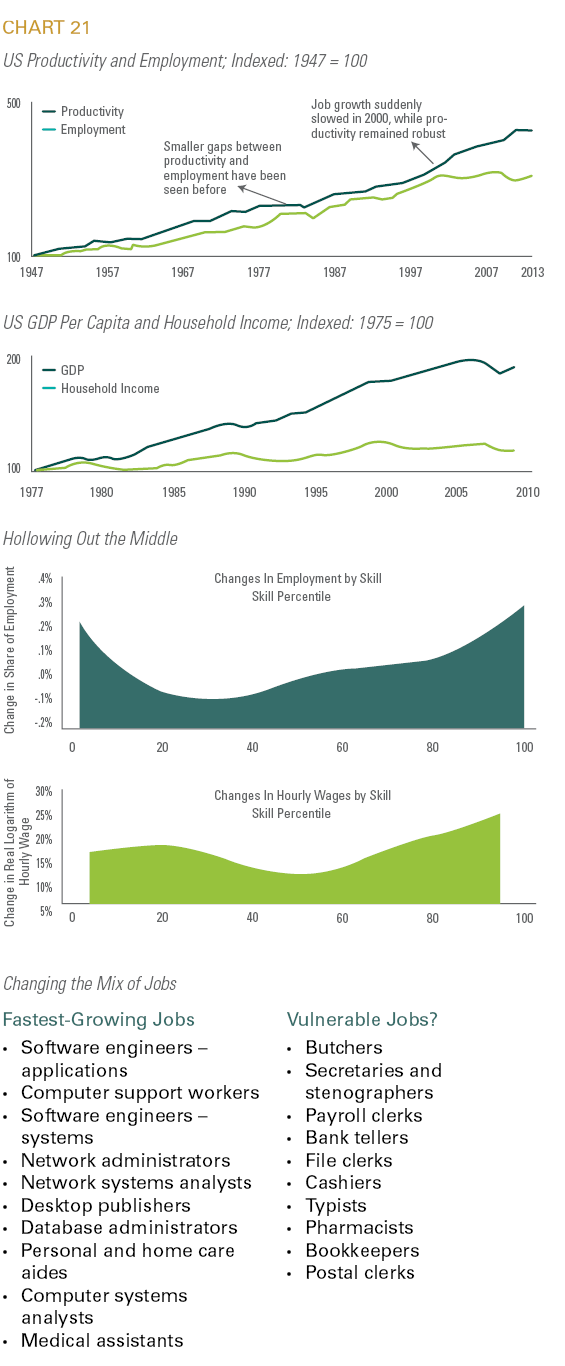

While the advent of major techinical revolutions and labor-saving devices did not lead to mass unemployment in the past, more recent research such as MIT’s Brynjolfsson and McAfee’s posit that at the dawn of the 21st century, rapid technological change appeared to destroy jobs faster than it was creating them, contributing to the stagnation of median income and the growth of inequality in the United States. Chart 21 contrasts economic growth and productivity —the amount of economic value created for a given unit of input, such as an hour of labor. For years after World War II, the two lines closely tracked each other, with increases in jobs corresponding to increases in productivity suggesting that as businesses generated more value from their workers, the country as a whole became richer, which fueled more economic activity and created even more jobs. Then, beginning in 2000, the lines diverge; productivity continues to rise robustly, but employment suddenly wilts. By 2011, a significant gap appears between the two lines, showing economic growth with no parallel increase in job creation (see Chart 21).

In the United States and China, the world’s manufacturing powerhouses, fewer people work in manufacturing today than in 1997, thanks at least in part to automation. Modern automotive plants, many of which were transformed by industrial robotics in the 1980s, routinely use machines that autonomously weld and paint body parts—tasks that were once handled by humans. A less dramatic change, but one with a potentially far larger impact on employment as well populist insurgencies in developed countries, is taking place in clerical work and professional services. Technologies like the Web, artificial intelligence, big data, and improved analytics—all made possible by the ever increasing availability of cheap computing power and storage capacity—have automated many routine tasks. For example, research by MIT economist David Ator shows that between 1980 and 2005, the middle class suffered both in share of jobs and in wage growth. Chart 21 (bottom panels) also shows the share of employment held by workers of different skill levels; the bottom shows changes in wages. Since the 1980s, Ator posits that computers have increasingly taken over such tasks as bookkeeping, clerical work, and repetitive production jobs in manufacturing—all of which typically provided middle-class pay. At the same time, higher-paying jobs requiring creativity and problem-solving skills, often aided by computers and low-skilled jobs, (such as restaurant workers, janitors, home health aides, and others doing service work that is nearly impossible to automate), have proliferated. The result, according to Autor, has been an apparent “polarization” of the workforce and a “hollowing out” of the middle class—something that has been happening in numerous industrialized countries for the last several decades.

Globalization: Not Without Costs

Another key factor that has contributed to increasing economic vulnerability among lower and middle classes is globalization, especially through the integration of the Chinese economy. The impact of a trade shock is much like a technology shock; it undermines some workers in the short-term, but in the long-run these workers migrate to other growing sectors and society as a whole benefits from cheaper goods and services.

Traditional economic theory as well as heretofore establishment politicians overwhelmingly believed that global trade has been a key factor behind rising incomes over the centuries. However, a recent report by David Autor and Gordon Hanson highlighted that trade agreements in the past were incremental and largely involved countries with similar income levels. What changed the game was China’s entry into the global trade arena in December 2001, which interjected a massive (and cheap) addition to the effective global stock of labor. The report does not argue that trade has become a “bad” thing. Rather, it points out that the adjustment costs imposed on advanced economies were huge and long lasting, as Chinese firms wiped-out whole industries in developed countries. Employment has clearly fallen in U.S. industries more exposed to import competition, but the offsetting employment gains in other industries are harder to detect. This has resulted in a long-lasting drop in the labor participation rate – people laid off because of globalization have had a difficult time finding employment elsewhere, even decades after China entered the scene.

The “China effect” appears to be waning now that Chinese wages are rising relative to the developed countries, but the trade shock has likely contributed to both income inequality and the fall in labor’s income share in the developed economies. The surge in the global labor supply favored the profit share of income in the advanced economies as jobs shifted to lower cost factories in Asia. Corporate executives, whose pay packets are tied to company earnings, were well placed to benefit from the resulting boost in corporate profitability. This favored those in the very top end of the income distribution.

Additionally, the positive impact of trade deals has markedly diminished over time. Falling trade barriers have indeed been beneficial to consumers in developing economies. (For example, global sourcing is critical to the business model of most large retail organizations from Apple to Walmart). However, the gains from greater globalization have also run into diminishing returns in advanced economies as import tariffs have been quite low for over the last two decades. As a consequence, recent trade agreements have focused on standardizing rules and regulations governing international commerce. For example, the Trans-Pacific Partnership (TPP), emphasizes strengthening intellectual property rights much more than reducing tariffs. This is why most studies suggest its impact on growth is likely to be modest. For example, the U.S. International Trade Commission estimated that TPP would boost the level of real GDP by only 0.2% after 15 years. (see Chart 22).

In summary, while the boost to growth from increasing globalization appears to be falling, the impact on inequality in developed economies has been rising, reflecting the growing share of trade between rich and poor countries. The increasing integration of the global labor market has effectively given companies in rich countries access to a large new pool of workers. As standard economic theory predicts, this has reduced the share of national income in developed economies flowing to workers. Not surprisingly, free trade has hit low-skilled workers the hardest, given that their jobs are the most at risk of being outsourced abroad. Increasing immigration, especially of less-skilled workers, has also exacerbated this trend. Twenty-eight percent of foreign-born workers in the U.S. do not have a high school diploma, which puts them into direct competition with less skilled domestic labor.

Fiscal Expansion in Response to Populism

After a brief spurt of stimulus following the global financial crisis, governments have in Advanced Economies since tightened fiscal policy (see Chart 23).

Additionally, it is far from clear that the shift from stimulus to austerity has done much to bring down debt ratios. Consistent with standard economic theory, recent empirical work by the IMF and others indicates that fiscal multipliers are quite high – probably in the range of two-to-four – in environments where central banks are not in a position to raise rates in response to stronger growth. In such settings, the positive impact on tax revenue and nominal GDP from increased government spending will largely pay for itself, resulting in little or no upward pressure on debt-to-GDP ratios. This is especially the case if government spending is channeled towards productive investment such as infrastructure and scientific research.

In his widely cited book, Thomas Piketty provided evidence that the labor share of income tends to decline and inequality rises when the rate of return on capital (RoC) rises relative to the overall growth of the economy. The RoC is likely to increase during periods of rapid technological change (see Chart 24).

According to a BCA study, the shift in income from poorer households, who tend to spend most of their paychecks, to richer households, who tend to save much of their earnings, has depressed U.S. aggregate demand by about 3% of GDP since the late 1970s. This finding is consistent with a recent IMF paper, which found that rising inequality reduced the level of real consumption by 3.5% between 1990 and 2013 – equivalent to more than one year of consumption. (see Chart 24, bottom right panel). The adverse effect on aggregate demand from rising inequality was less visible during the bubble years because poorer households were still spending. But they were spending by taking on ever more debt, a channel that is less accessible now. This has resulted in an economy that has struggled to grow at a lackluster pace even with interest rates near zero. As such, efforts to reduce inequality through more expansive fiscal policies particularly if they are spent in higher ROI areas, such as infrastructure, and skills training, are likely not only to blunt populist angst, but also could create a more resilient economy with more normal levels of interest rates.

Conclusion

The Goldilocks investment environment is fundamentally changing; with the key underlying dynamics being a retreat from global trade, a sharp increase in fiscal spending spurred on by resurgent populism (whether explicitly populist candidates prevail or not), as well as a shift to even more extreme monetary policy measures, such as debt monetization and so called “helicopter money”.

Taken together, these policy shifts will be inflationary. Investment assets that we would expect to outperform from such dynamics include Japanese equities (on a currency hedged basis), real assets and gold, as a possible hedge against further debasement of fiat money. Long duration bonds, that have enjoyed a 35 year bull market, will be most challenged. Additionally, corporate profits would be expected to be diminished by rising wages and global multinationals that have benefitted from new markets as well as the ability to source lower labor and input costs globally, would be expected to be negatively impacted by protectionist policies. Rising protectionism and reduced global cooperation would also be expected to escalate the armaments race, which would support defense stocks but ultimately hurt global manufacturing companies. One would also expect large cap companies whose operating profits are more leveraged to globalization to underperform more domestically exposed small cap companies.

Important Disclosures:

This report is neither an offer to sell nor a solicitation to invest in any product offered by FIS Group, Inc. and should not be considered as investment advice. This report was prepared for clients and prospective clients of FIS Group and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to FIS Group and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which FIS Group believes to be reliable, FIS Group does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from FIS Group upon request.

All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.