Recent Insights & News

The Precariat Are Still Mad! Part III – How Should Investors Play the Next 4 Years? It Depends!

This piece is the third in a three-part series on the issues that led to 2024’s anti-incumbent party backlash. Here, we evaluate the trade and other fiscal proposals put forward by the incoming Trump administration, as well as their investment implications.

Change at the Top: Economic and Equity Market Implications: Systematic Global Equities Q4 2024 Update

U.S. stock markets experienced positive performance in 2024, and that trend is expected to continue in 2025. However, 2025 also has the potential to experience increased market volatility and shifting trends due to policy changes from the incoming administration combined with uncertainty about inflation and global economic conditions.

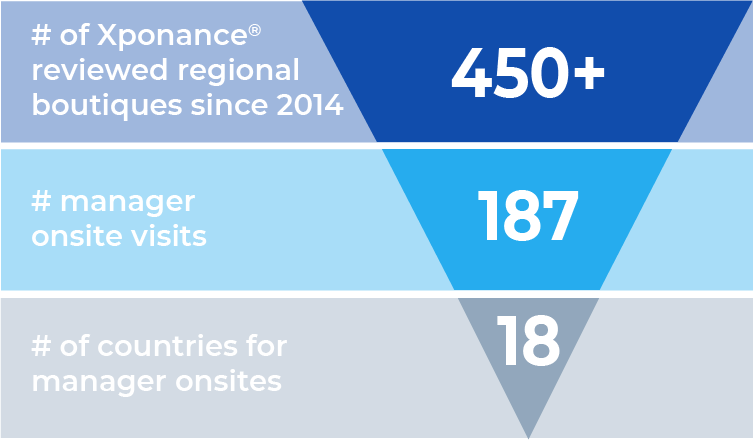

FIS Group Rebrands to Xponance®

Xponance Celebrates Five Years of Recognition as a Best Place to Work in Money Management by Pensions & Investments

Press Release Philadelphia, PA (Dec. 9, 2024) – Xponance, Inc., a multi-strategy investment firm, was recognized in the 2024 Best Places to Work in Money Management awards announced by Pensions & Investments today. This is the fifth year in a row that the company...

We Are Xponance®

We Are Xponance®