In a paper entitled Generative AI – Hope, Hubris, or Harrowing, our CIO, Tina Byles Williams, explored the medium to long-term effects of Generative AI on the economy, financial markets, and broader society. The task for investment managers now lies in navigating this promising yet unpredictable future, particularly as the market has priced in substantial premiums for those perceived to be the primary beneficiaries of this emerging technology.

Borrowing from the “gold rush” analogy, the most easily identified winners are akin to the manufacturers of “picks and shovels”, such as the chip producers, like Nvidia and AMD, along with cloud providers. Extending this metaphor further, the ownership of ‘mineral rights’ may be equated with the competitive edge granted to data-rich platform companies, as they form the basis for training these AI models. Which industries and companies will most effectively leverage these models is a more speculative endeavor. Some common areas of focus have been online retail, gaming, automation, tele-health and cyber security.

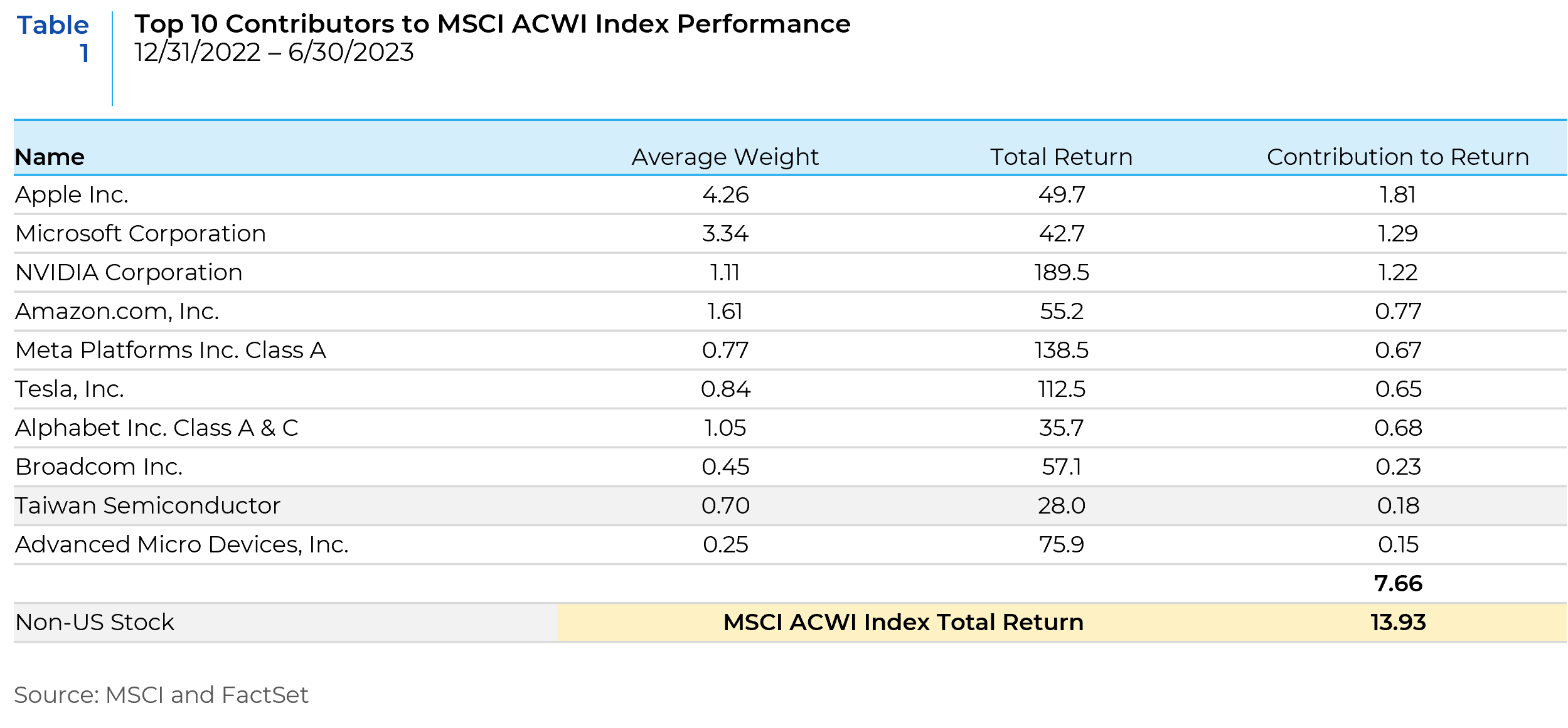

The concentrated speculative interest in the AI winners has created unique challenges for Global managers, in which there has been a decoupling of performance between growth stocks in the US and other developed markets. So far in 2023, the MSCI All Country World index, which represents over 60 trillion dollars of global equity market cap, has been driven by this single theme, and mostly in a small number of US stocks.

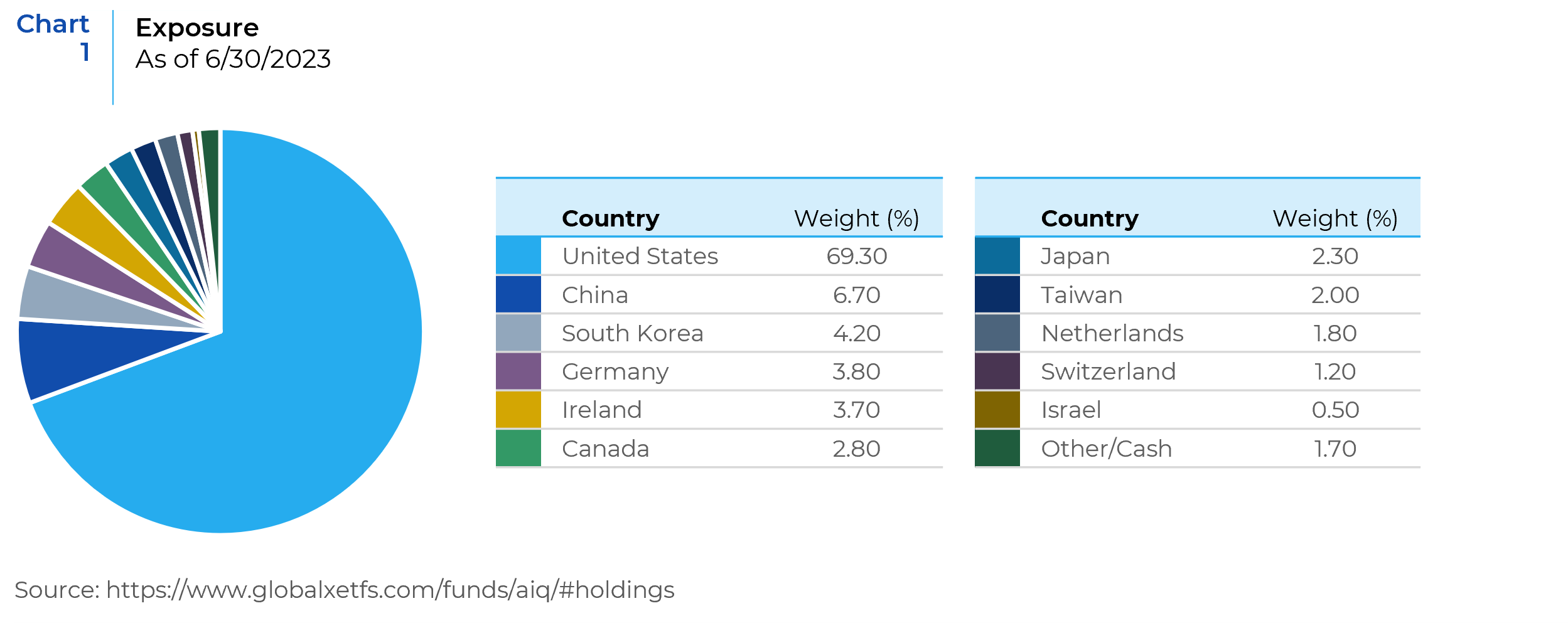

Opportunities to invest in AI-related themes are simply not plentiful in Non-US developed markets with a smaller, less concentrated tech sector. Of the 85 stock Global X AI and Technology ETF, less than 15% of the weight is in developed, Non-US markets.

In our previous work on “Alpha Opportunity,” Alpha Availability: Identifying the Drivers of Active Manager Returns Across Markets and Investment Styles, we showed that index returns driven by a few large companies are a headwind for active management. Table 1 showed this to be the case for Global managers this year. However, the fact that the theme has been further concentrated into US megacap stocks (that trade at a premium to their non-US growth counterparts), offers a deeper challenge to those managing global portfolios.

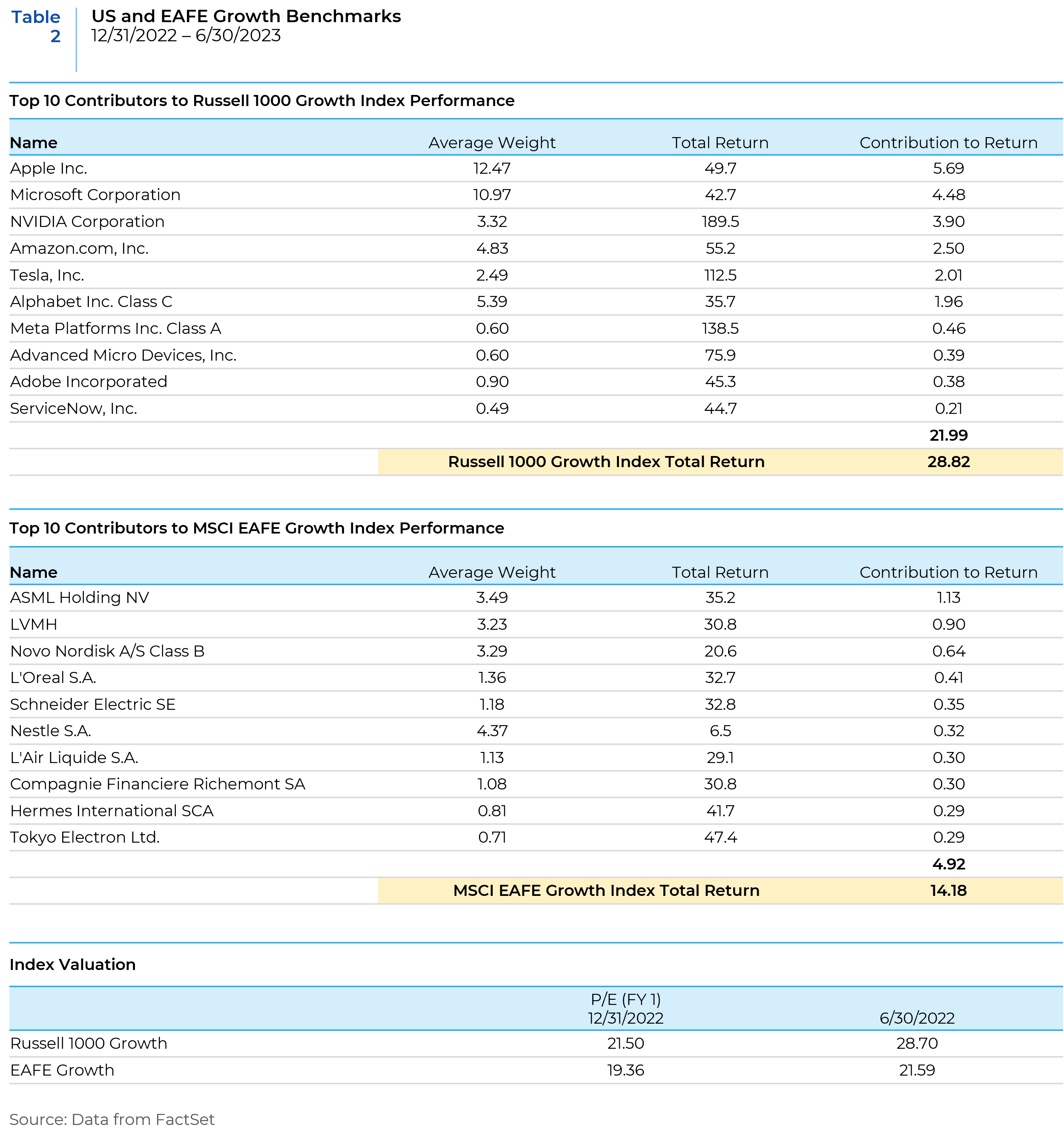

Outperforming the Global Growth benchmark was practically impossible without being overweight some of the US AI related stocks. The portfolio construction methodology used likely dictated how difficult it would be to outperform this year. Equal-weighted, conviction-weighted, risk-weighted (absolute, not active risk) positions were unlikely to beat the benchmark without near-perfect stock selection. The challenge was amplified for valuation-conscious managers, who have a more difficult time concentrating risk in the more expensive markets. Table 2 shows the extreme differences in how US and EAFE growth benchmarks performed. The returns within the EAFE Growth index were fairly concentrated, yet Apple contributed more to the Russell 1000 Growth index than the top 10 names contributed to the EAFE Growth index.

In an effort to understand how managers are dealing with this unique environment, we have engaged Maytech Global Investments, a high-conviction growth manager who has had a long-standing thematic position in the Artificial Intelligence theme.

Could you explain how you have thought about AI as an investible theme?

MayTech’s long-term belief has been that the next big computing platform shift would relate to machine learning, accelerated computing and Artificial Intelligence (“AI”). We see the AI transformation as one of the most important technological advances, potentially bigger than the development of the Internet.

Our investment approach to AI follows our proven path of focusing on where in an industry’s supply chain value will accrue, and which companies will potentially come to dominate. Our ongoing research around AI led us to several conclusions. First, that graphic processing Units (GPU) would be the central and foundational technology. Secondly, that the core intellectual ideas driving the algorithms will be open-sourced. Consequently, the cost and complexity of managing large amounts of data and fining tuning the algorithms will create a competitive advantage that will favor companies with large scale. Finally, each technology platform shift has given rise to new dominating companies.

The three essential ingredients for AI are data, algorithms and computing power. We are in a period where advances in the three ingredients have crossed a threshold where AI can become commercially viable. Individuals, companies and governments have access to massive amounts of digital data with more being created every day.

We have long held that view that central processing units (“CPU”) would not be able to handle the workload of AI and that GPUs will become the central semi-conductor technology in the next wave. CPUs will still be needed but all the heavy lifting will be done by the GPU. This is because CPUs process instructions serially, one at a time. GPU on the other hand processes many thousands of instructions at the same time which is well suited to AI algorithms which are the same mathematical operation applied across billions of data. The potential for AI to radically improve productivity and drive change will increase the need for more semi-conductor chips.

We believe the underlying need for AI will increase, becoming insatiable and lead to an “arms race” for the most advanced chips. Originally, the demand for GPUs was from “gamers”, then expanded into data centers. Going forward, the need for this technology will include every industry.

How are you addressing other holdings in your portfolio that have seen sharp valuation expansion related to the strong sentiment shift toward anything “AI” related? Have you considered selling any names that you believe the market has “overreacted” to the benefit of AI to their business?

Many of the information technology holdings in our portfolio have seen their value increase in the first half of the year. Their exposure to AI is not the only contributing factor. At this point, we don’t see the valuation increase as an overreaction and have not made changes for that reason. We have trimmed some positions to keep them within policy limits.

Most of the AI-driven performance has been in the US market. Do you see any direct or second-order opportunities in other markets? Is there anything structurally about these markets that will hamper the business case of AI implementation, or is it simply the concentration of large tech companies in the US?

We do see some beneficiaries in other markets including Europe, the UK, Taiwan and South Korea. There are some structural issues which are contributing to the concentration of AI leadership in US companies. First, the large tech platform companies which have the data, computing power and financial resources to execute AI are based in the US. Secondly, foundational semiconductor technology is largely controlled by US companies or companies in countries closely allied with the US. Thirdly, potential regulation could impact various regions. Fourthly, politics inside of China have in our opinion delayed their progress in AI. Finally, geopolitics will play an important role.

Given the substantially higher energy consumption of AI-based computing, how are your AI-affiliated holdings planning for expected surges in power consumption that would come with the growth of AI utilization, in an already tight energy market?

Some companies in this segment have developed solutions to lower power consumption and cooling requirements within the data centers. Ultimately, this question will be about how AI increases productivity per unit of incremental power consumed. If AI leads to improved productivity overall power consumption could decrease as the world’s economy becomes more efficient.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.