Navigating Market Crosscurrents

Market narratives have shifted significantly this year—from excitement surrounding artificial intelligence (AI) to apprehensions about big tech expenditure, and from recession worries to confidence in the resilience of the U.S. economy. In September, the Federal Reserve reduced interest rates by 50 basis points, marking the first monetary policy easing in four years. This policy shift is expected to bolster growth, stabilize a decelerating labor market, and prolong the current economic cycle. Equity markets are likely to respond positively to the Fed’s actions in the upcoming months, with signs of increasing market breadth and a reduction in the extreme concentration within a few mega-cap technology stocks seen earlier this year.

The Fed’s Policy Shift: A Historical Perspective

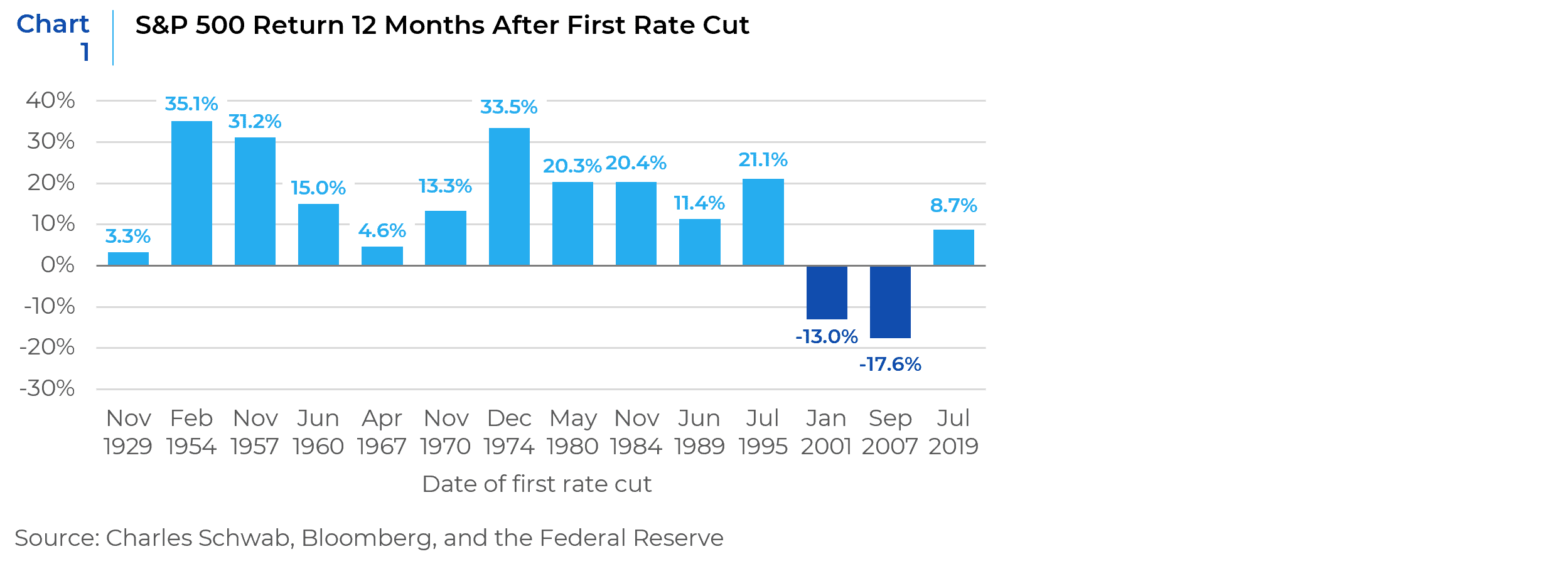

Since 1929, the Federal Reserve has initiated 14 interest rate cycles. While past performance is not always indicative of future results, the data does show that in 86% of cases, the S&P 500 Index posted positive returns 12 months following the initial rate cut (Chart 1). This bodes well for investors looking for market stability in the coming months. However, it is worth noting that the two exceptions to this trend occurred in 2001 and 2007, during periods of significant economic upheaval—the dot-com bubble burst and the subprime mortgage crisis, respectively—neither of which mirrors the current environment.

One interesting characteristic of interest rate cycles is that the Fed typically raises rates gradually but cuts them rapidly in response to economic threats. In contrast, the most recent cycle saw the Fed raising rates at an unprecedented pace in response to soaring inflation, and now, the reduction is expected to be more gradual.

Broadening Market Leadership

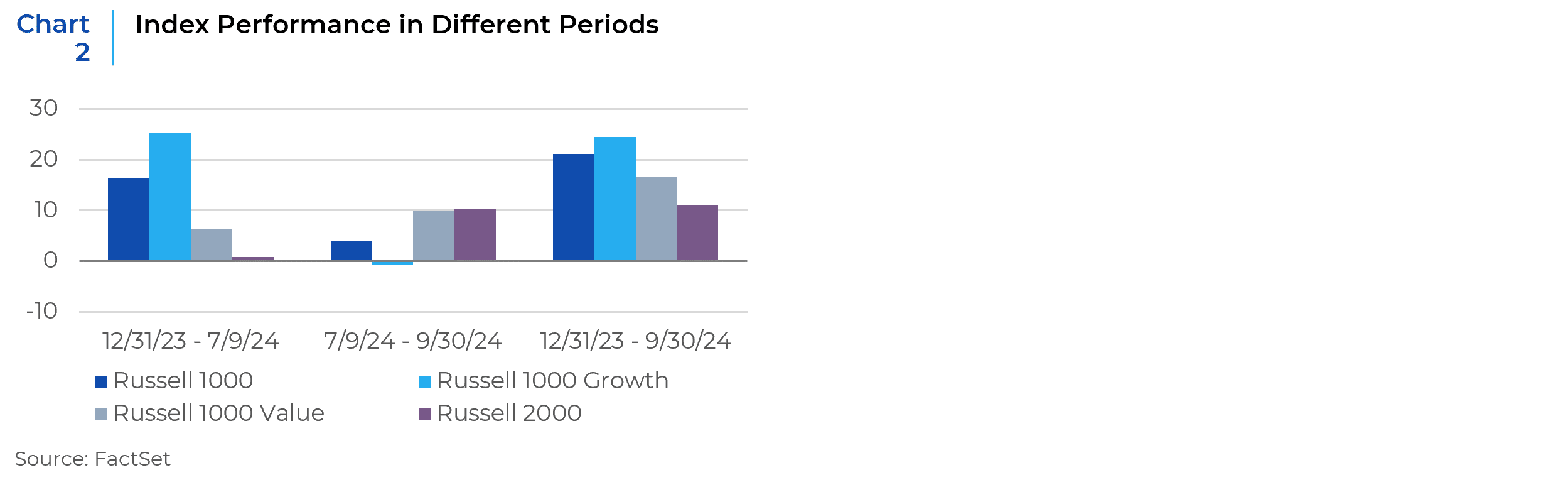

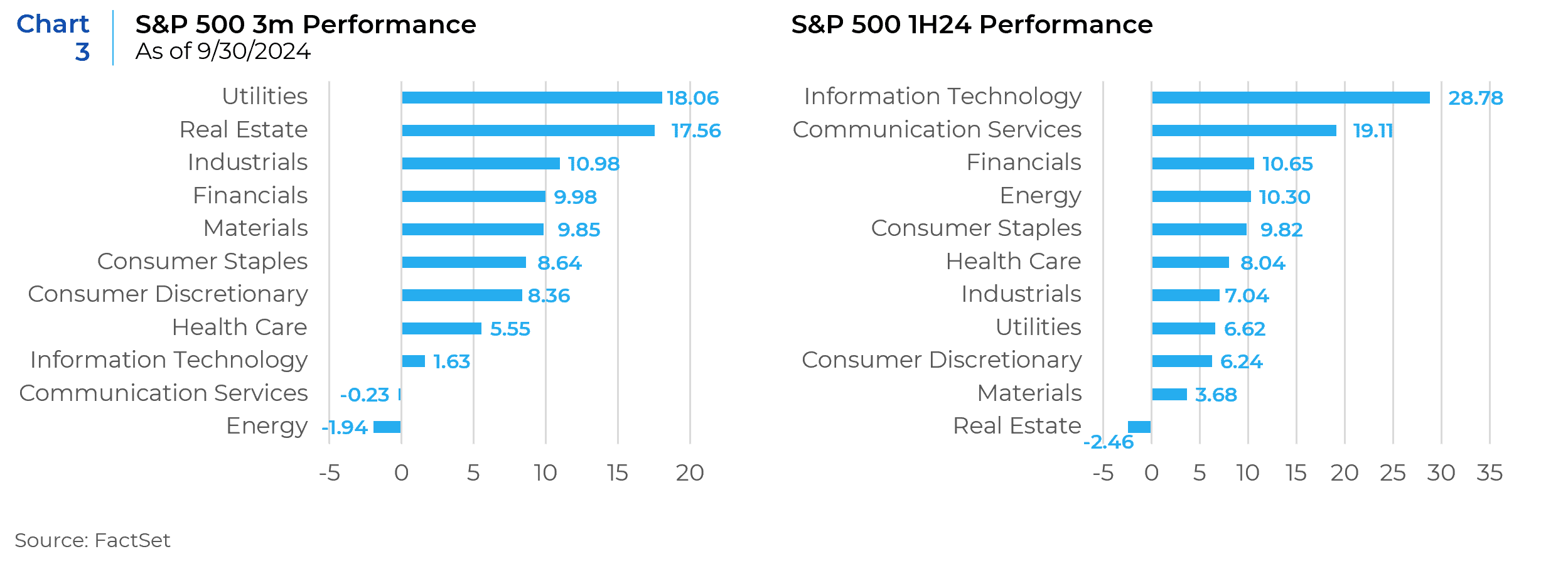

Broadening market participation has become a key theme in recent months. Earlier in the year, equity market performance was dominated by a small group of mega-cap technology companies, particularly those heavily invested in AI. However, signs of a shift began to appear in July, when small-cap stocks experienced their best performance in two decades. This resurgence has also expanded into sectors other than AI heavy Technology and Communications Services, indicating that the market is no longer solely reliant on a few large players. Smaller and value-oriented names saw a resurgence in performance (Chart 2). The broadening of markets was also seen in sector performance (Chart 3).

AI Capital Spending Jitters

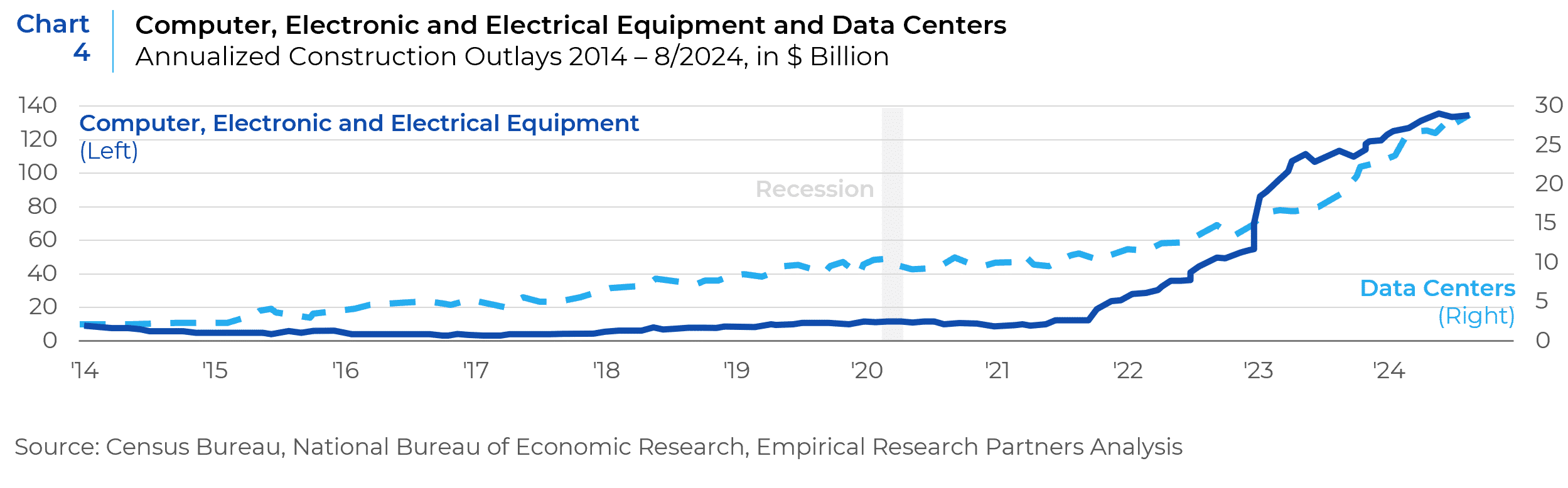

AI remains a key growth driver, but concerns are rising about the hefty capital expenditures needed to sustain it. Investors fear that the return on the massive investments by major companies may disappoint. The risk profile of AI ventures has worsened with increased spending, impacting ROICs. Government data in Chart 4 shows that construction spending in tech, particularly on data centers, has nearly tripled in two years, heightening investor anxiety and threatening the sector’s historically high returns.

Expanding AI Opportunities Beyond Tech

Despite concerns within the technology sector, AI innovation is expected to provide growth opportunities across a range of industries. Sectors such as healthcare, biotech, and finance are poised to benefit from AI advancements. For example, AI can improve return on equity for financial institutions through a more personalized customer experience that can help improve customer retention and drive innovation in new consumer products and services. Furthermore, the construction and energy sectors are seeing increased demand as data centers require extensive infrastructure and energy resources. AI’s reach is far from limited to tech companies; its impact will likely be felt across a broad spectrum of industries. New competitors could emerge out of the expanding use of AI. The number of AI patents has boomed and there are indications that rapid innovation will likely create a new wave of superstars, some of which may belong to non-technology sectors. There is a risk that, as competition increases, the returns and margins for the now dominant companies will begin to fade. In turn, the growth rates of these high-flyers would likely decline.

Threat of Regulatory Oversight

Another looming risk for mega-cap technology companies is the growing threat of regulatory scrutiny. The U.S. Department of Justice, for instance, has proposed measures to curb Google’s dominance in the search engine space, which could weaken its profitability and stall its advancements in AI. In Europe, concerns over data privacy have fueled calls for stricter oversight of tech companies, and similar sentiment is growing in the U.S. as well. A majority of U.S. voters already believe that tech companies need greater oversight. In fact, Americans now see tech companies as having as pernicious an influence as energy companies. If regulations increase, the headwinds for these companies could be significant.

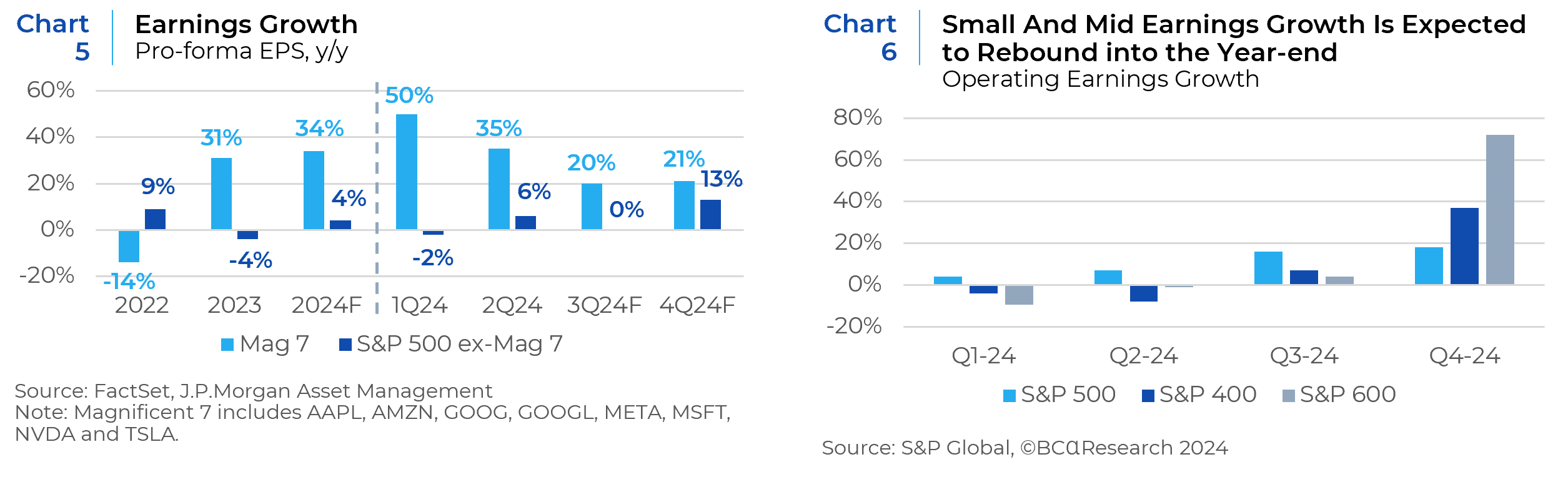

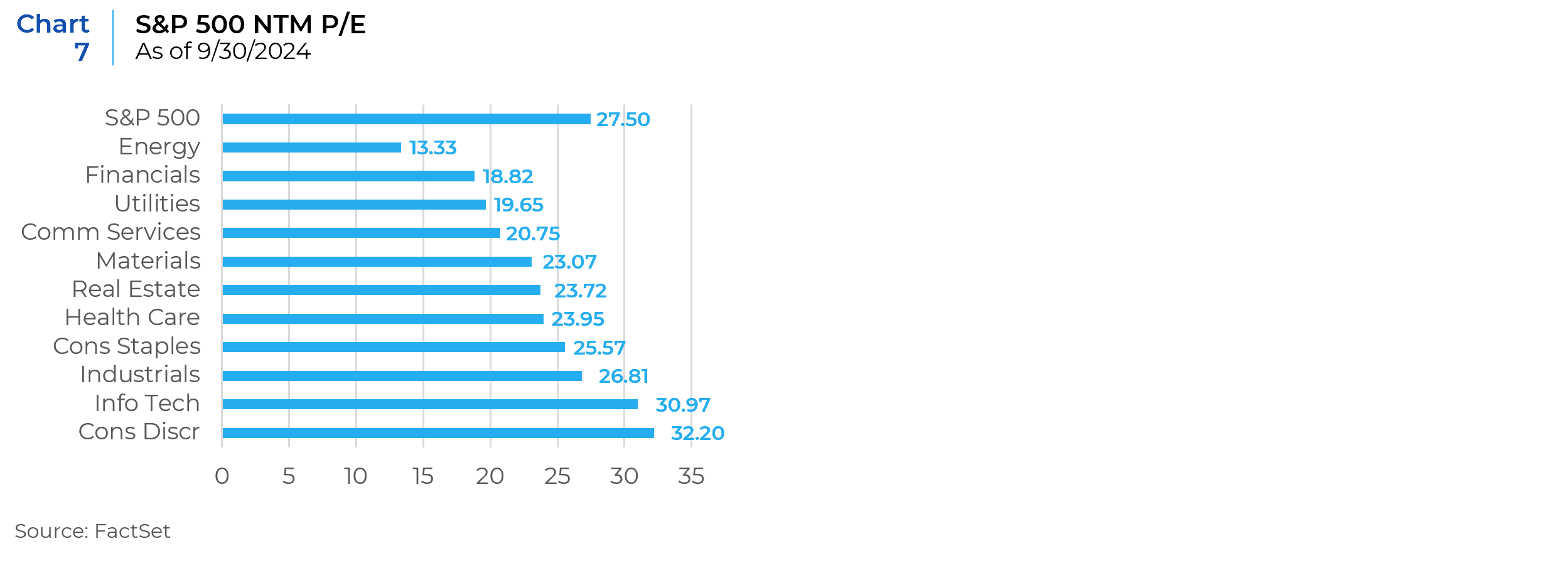

Earnings Growth Beyond the Mega-Caps

The outlook for earnings growth is improving outside of the mega-cap technology stocks. Companies across most sectors of the S&P 500 reported positive earnings surprises in the second quarter, supported by strong operating leverage and moderate capital expenditure growth (Chart 5). Mid-cap and small-cap stocks, in particular, are expected to see robust earnings growth in the fourth quarter, potentially outpacing their larger counterparts (Chart 6). Valuations for many sectors remain attractive, and as earnings growth picks up, these stocks may benefit from both fundamental improvements and increased investor confidence (Chart 7).

A Cautious Optimism Moving Forward

Looking ahead, the combination of a broadening market, attractive valuations, and solid earnings growth provides grounds for cautious optimism. However, uncertainty remains, particularly regarding future Fed rate cuts and the outcome of the upcoming U.S. presidential election. Any unexpected economic data related to inflation or employment could impact the market’s trajectory, potentially reducing the likelihood of further rate cuts.

In this complex environment, a balanced investment approach is essential. A barbell strategy, which pairs growth-oriented investments in select mega-cap technology stocks with value opportunities in smaller companies, may offer a way to navigate the market’s ongoing shifts. As the Fed’s gradual rate cuts take effect and operational leverage continues to improve, investors should remain focused on quality and profitability as key criteria for portfolio selection.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospective clients for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.