#derisking #assetallocation #equities #bonds #geopolitcal #negative yields #yield curve #cyclically adjusted earnings

- The world faces an economic meltdown, or

- There is a buying panic in safe assets and thus a buying opportunity in risk assets.

For allocators, if the latter is correct, then significant equity derisking in the short term could present a meaningful funding opportunity cost. This is why we would recommend a gradual and systematic reduction to investors’ equity exposure. These dynamics ward against prematurely and aggressively reducing equity exposures:

a. Yield curve inversions’ record of predicting recessions is mixed, has a highly variable lag (from a few months to up to 18 months) and is much less significant outside of North America

b. At current bond yields, the short-term potential for capital appreciation – nominal or real – diminishes, while the potential for vicious losses increases dramatically.

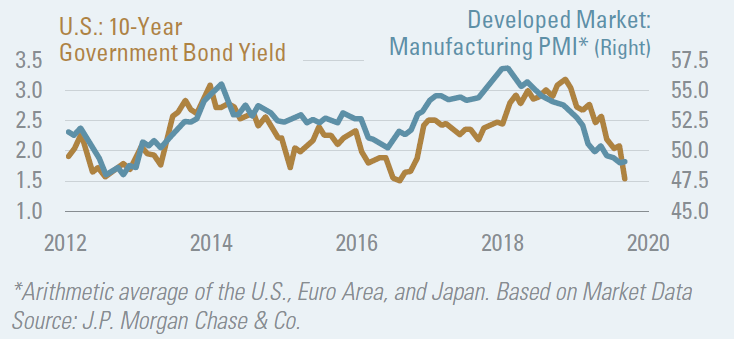

c. Long duration bonds are highly vulnerable to a positive economic surprise as bond yields closely track the Purchasing Managers Index, which in turn tracks economic output. A positive upturn would not only likely lead to a late cycle equity rally; but it could also lead to negative total returns for long duration bonds.

d. While low bond yields can be bearish for equity and credit markets, they can also signify expectation of a dovish monetary policy stance and hence be bullish for global risk assets.

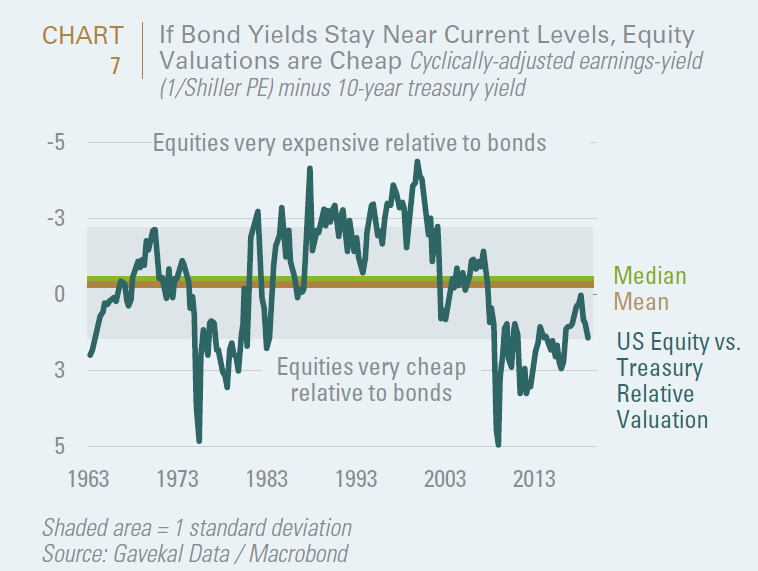

e. Falling discount rates applied to cyclically-adjusted earnings flatter valuations. If bond markets are right in predicting zero interest rates, then US equities on a cyclically adjusted price-earnings ratio of 29—equivalent to an earnings yield of 3.4%—could be viewed as a bargain. If earnings either stabilize or increase, this valuation dynamic could provide the basis for a powerful late stage rally (such as what occurred in 1/1996 through 12/1999, when the S&P 500 index rose by 155.2% or 1/2005 through 12/2006, when the S&P 500 index rose by 21.5%).

You can read our 2019 analysis of institutional investor derisking trends, Battening Down the Hatches, Part 1 here: FIS Research: Battening-Down-the-Hatches-Part-1.pdf