About Global Market Outlook Reports

Our CIO, Tina Byles Williams, publishes our market outlook on a quarterly basis, based on research that examines market conditions over a three- to six-month period. These quarterly analyses serve as key inputs to our fund construction process, which incorporates strategic tilts to the market segments we believe will outperform over a six- to 12-month time frame. For global equity portfolios, these tilts incorporate regional, sector, and capitalization strata as well as investment process and style factors. For U.S. equity portfolios, tilts include sector, capitalization strata, investment process, and/or style factors.

Our objective is to construct a portfolio of “best in class” investments with weightings consistent with our overall investment strategy.

FIS Group Global Market Outlook Reports

The Precariat Are Still Mad! Part III – How Should Investors Play the Next 4 Years? It Depends!

This piece is the third in a three-part series on the issues that led to 2024’s anti-incumbent party backlash. Here, we evaluate the trade and other fiscal proposals put forward by the incoming Trump administration, as well as their investment implications.

Change at the Top: Economic and Equity Market Implications: Systematic Global Equities Q4 2024 Update

U.S. stock markets experienced positive performance in 2024, and that trend is expected to continue in 2025. However, 2025 also has the potential to experience increased market volatility and shifting trends due to policy changes from the incoming administration combined with uncertainty about inflation and global economic conditions.

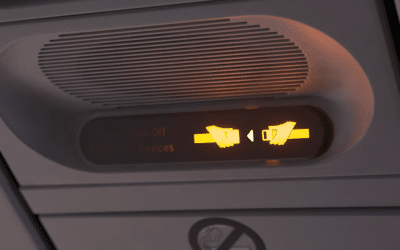

The Captain Has Elected to Keep the Fasten Seatbelt Sign Illuminated: Q4 2024 Fixed Income Update

Given the substantial price action in rate markets, we consider what outcomes the market is currently pricing, the risks to this “consensus” view, and what we think will or will not occur as the new administration begins its term.

Tariffs, Tensions, and Opportunities

Understanding the interplay of policy, market sentiment, and regional dynamics is critical for successful investment positioning in this era of renewed protectionism and global economic realignment.

The Precariat Are Still Mad! Real Talk on Immigration – Part II

This is the second of a three-part series on the two issues that led to 2024’s anti-incumbent party backlash. This paper evaluates salient macroeconomic, demographic, and social factors that have or should inform immigration policy, as well as the policy solutions put forward by the incoming administration to address unauthorized workers in America.

Laboring Under Pressure: Are Labor Supply Trends Breeding Long-Term Stagflationary Conditions?

As risk-on traders take a victory lap amid surging equity markets and now renewed monetary policy accommodation, the expectations for a soft landing in the U.S. economy now form the base case scenario for a preponderance of U.S. investors.

Market Insights Alert

Papers: FIS Group Proprietary Research

COVID-19 Is a Stress Test Exposing Structural Hurdles in Both Our Financial System and Society

We are in strange and scary times. We are at war with a virus which is all the more deadly in that it cannot be easily discerned but it is metastasizing geometrically. Moreover, COVID-19 and the measures required to contain…

The Sweet Spot in the US Equity Markets – Part 3

In the last post in this series, we update and expand on our analysis to explore the impact of rising and falling interest rates on the performance of various capitalization tranches. Finally, we now look at the performance of the “Sweet Spot” in different interest rate regimes.

Will U.S. Equities Continue to Trounce Non-U.S. Equities?

For global equity investors, the decade ending on December 31, 2019 was undoubtedly the American decade. The performance of U.S. equities more than doubled and in many cases tripled other countries and regions such as emerging markets…

Microbes, Markets, and the Dragon

The coronavirus outbreak in China, named COVID-19 by WHO, is understandably dominating news coverage and depressing Chinese risk plays. Since 12/9/2019 when the first coronavirus case was announced from the City of Wuhan, confirmed cases have risen rapidly to over 40,000 as of this report.

The Sweet Spot in the US Equity Markets – Part 2

In our previous post, we sought to identify and quantify the investment opportunity or edge within various market capitalization segments. We found that the top 1000 names in the Russell 2500 benchmark constitute a sweet spot across the entire Russell 3000.

Impacts of a Rejuvenating Workforce

As the secular bull market in long term treasury bonds approaches its 40th year, the consensus around falling interest rates has morphed from a shared opinion to an accepted reality. Reputations and fortunes have been made and lost by adherents and skeptics respectively.

Videos And Webinars

Market Outlook and Research Webinars

Video | 2019 Q4 Market Outlook

Video and Webinar | Outlook

Video | 2018 Q1 Market Outlook

Video and Webinar | Outlook

Video | Reality “Trumps” the Reflation Trade

Video and Webinar | Outlook Our Q2 Market Outlook evaluates the recent retreat in risk assets, trends in global equities, the impact of a strong U.S. dollar, and continued political uncertainty under the Trump Administration. Key points include: Policy expectations...

Video | Big Winners in the Neglected Frontier Universe

Video And Webinar | Outlook Our 2017 outlook for frontier markets, "Big Winners in the Neglected Frontier Universe", concludes that frontier markets remain attractively priced, with much lower valuations, relative to developed markets. "We remain bullish on Argentina,...

Market Insights Roundtable – 4th Quarter 2016-20161021 1800-1

Panelist Information: N/A

Duration: 57 minutes

Description: N/A

FIS Group 2Q 2016 Market Outlook Webinar-20160428 1759-1

Panelist Information: N/A

Duration: 43 minutes

Description: N/A