The Dismal Science of Forecasts & What Our Boutique Managers Are Saying About the Current Macro Environment

Geopolitical uncertainty, war, and commodity price shocks have been the headline talking points for the industry in 2022. These certainly contributed to the current stagflationary pressures in the market, however, …

The Times They Are A-Changin’: Q4 2022 Market Outlook

As I write this research note, (October 13, 2022) annual core inflation has hit a 40-year high at 6.6% from a year ago (8.2% for overall inflation), guaranteeing another punishing rate hike by the FOMC. Market commentators are prognosticating about …

Systematic Global Equities: Q3 2022 Update: When Good News is Bad News

Equity markets fell sharply for a third straight quarter in Q3, 2022. The big story for the quarter was the tightening of financial conditions driven by expectations for a more aggressive global rate hike cycle.

Alpha Potential in ESG

With the growing popularity of ESG and the incorporation of ESG metrics in various investment strategies, the debate on whether ESG is a source of alpha or not continues.

The Monetary Caped Crusaders Find Their Kryptonite: Q3 2022 Market Outlook

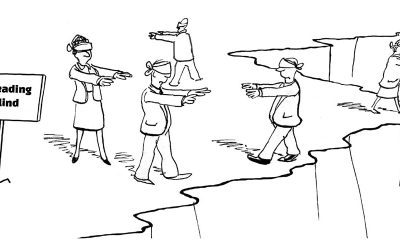

It’s not just Cardi B. asking the question! Economists, investors, CEOs of some of the country’s top companies and many in the general public are also worried that the economy is on the verge of recession. Plunging consumer and business confidence, contracting real incomes, and a peak in housing activity all point to a significant weakening in growth, even if the labor market remains healthy.

Opportunity Knocks or Prolonged Pain for Stocks?

Since the initial resolution of the European Sovereign debt crisis in 2012, many boutique managers have rated Eurozone equities as a particularly attractive risk/reward opportunity. The initial premise was related to profit normalization. Compared to their European counterparts, the Fed and U.S. government reacted faster and more aggressively to the Great Financial Crisis.