#derisking #leveraged loans #equities #bonds #yield curve # yield# interest income # inflation # negative yields # high yield#covenant-lite

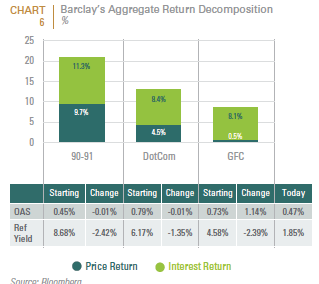

- Interest income is attributable for all or most of bonds’ downside protection; therefore starting yields are critical

Bonds have traditionally been an important component of any portfolio derisking strategy but interest income has been a significantly larger piece of the return pie during economic downturns; whilst spread compression has been less significant. Consequently, the starting yield and length of crisis explain essentially all the interest income of core bonds.

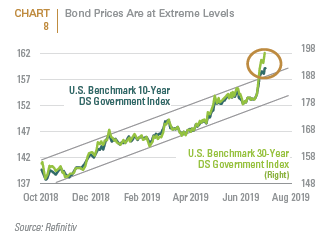

- Negative or extremely low yields today (see chart) imply less downside protection

Negative or extremely low yields partially reflect the impact of price-insensitive buyers (such as central banks engaging in quantitative easing (QE) programs; financial institutions that have increased their holdings of sovereign debt to meet stricter liquidity requirements and; insurers and defined benefit pension funds which have significant long-term liabilities), that have put downward pressure on long-term bond yields; However, it is hard to imagine that the bond market’s reaction function has become completely price inelastic. At a minimum, even if bonds do provide some diversification relative to equity risk assets during the next downturn, we would expect more muted protection than what occurred in prior recessions.

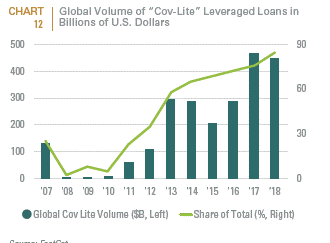

- A negative shock could lead to fire sales by loan funds if ratings downgrades push them into junk status.

With over a decade of historically low interest rates, the total of high-yield bonds and leveraged loans outstanding in Europe and the U.S. has doubled to about $2.65 trillion, according to the BIS. While high-yield bonds still account for more than half the tally, growth in lending to risky companies has outpaced sales of those securities. The total of outstanding leveraged loans on the market is around $1.6 trillion. By the end of 2018, 85% of all leveraged loans were “covenant-lite”, rendering them more vulnerable in periods of distress or constrained liquidity.

You can read our 2019 analysis of institutional investor derisking trends, Battening Down the Hatches, Part 2