Read our blog post here: #derisking #asset allocation #equities #bonds #geopolitical #negative yields #yield curve # stagflation # inflation # stock and bond correlation # populism

Stagflation would most likely be prompted by a negative supply shock caused by either the escalating U.S./Iran conflict and/or the Sino/U.S. strategic rivalry. The latter has all the hallmarks of a cold war “Thucydides Trap,” and is already fueling a broader process of deglobalization which will increase global production costs and prices.

While stagflation represents a lower probability recession scenario, it would be most challenging for both policy makers and asset allocators.

- For central banks, attempts to accommodate stagflation through monetary and fiscal stimulus could entrench inflation as it did in the 1970s, and ultimately depress growth.

- For allocators, it would materially change their asset allocation models’ assumptions about both inflation and the correlation between stock and bond prices.

Asset allocation models typically assume 2.5% inflation; vs. 8% during the stagflation decade and a long-term rate of 3.26%. Under a stagflation scenario, duration and credit risks (both of which outperformed post GFC) would be challenged.

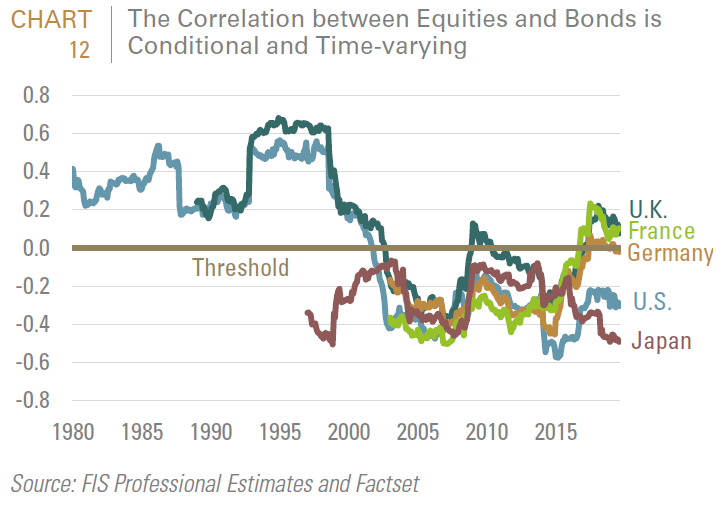

Stock/bond correlations are foundational to asset allocation models and products (such as target date and risk models). But this correlation is conditional and time-varying (See Chart). Most studies show that negative equity-bond correlations are due largely to pro-cyclical inflation, i.e. higher inflation coinciding with better economic performance, as opposed to countercyclical inflation or stagflation. Inflation is more likely to be procyclical if it is low or in deflation and driven by demand rather than supply shocks.

You can read our 2019 analysis of institutional investor derisking trends, Battening Down the Hatches, Part 1 here: FIS Research: Battening-Down-the-Hatches-Part-1.pdf