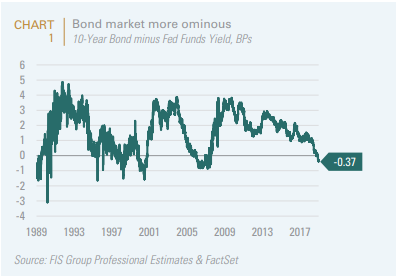

In my Q3 2019 Market Outlook I examined the contradictory messages sent by the bond vs. stock markets. Whilst the stock market continued to climb a wall of many worries, since May the yield curve has inverted, with 10-year yields falling from 2.5% to 2.0%, seemingly heralding a darker near-term outcome (Chart 1).

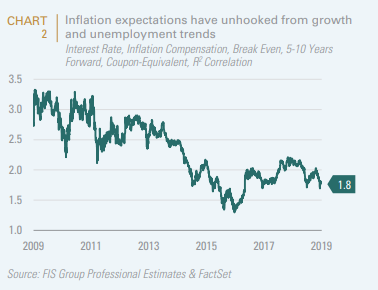

In this instance, we believe that the stock market is a better near-term forecaster. The key change which reconciles

the message being sent by the bond market vs. the stock market is that inflation expectations have unhooked from growth and unemployment trends (Chart 2).

Chairman Powell’s dovish tilt suggests the Fed has now done the same thing with monetary policy. Consequently, given the bond markets’ increasing focus on what the Fed will do with short-term interest rates, yields tell us little about U.S. growth prospects or recession risks.

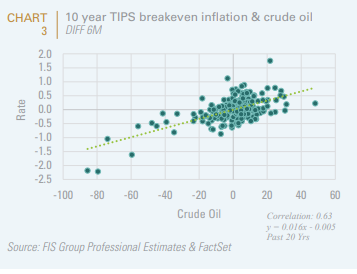

Inflation expectations are in turn highly correlated with oil prices (see CHART 3).

Much of the current oil-price volatility is being driven by worries over damage to aggregate global demand, growth expectations in the wake of the Sino-U.S. trade war, and by what now appears to be a too-aggressive posture by central banks attempting to begin normalizing rates last year. In 2H19, we believe that accommodative global monetary policy and fiscal stimulus will revive demand for oil, particularly in EM economies. On the supply side, this week’s extension of OPEC 2.0’s production cuts into 1Q20 means supply growth will remain constrained. Prices should rise, and forward curves, particularly for Brent, should steepen as refiners are forced to draw inventories to meet product demand. This is a key reason why we believe that U.S. equity investors are too optimistic on the path of interest rate cuts by the FOMC. Bond markets are pricing in 75 bps of interest rate cuts by the end of 2019 and 25 bps in 2020. We expect a much more modest 50 bps insurance interest cut in 2019, akin to what the FOMC did in the mid-1990s.