![]()

U.S. Fixed

Income

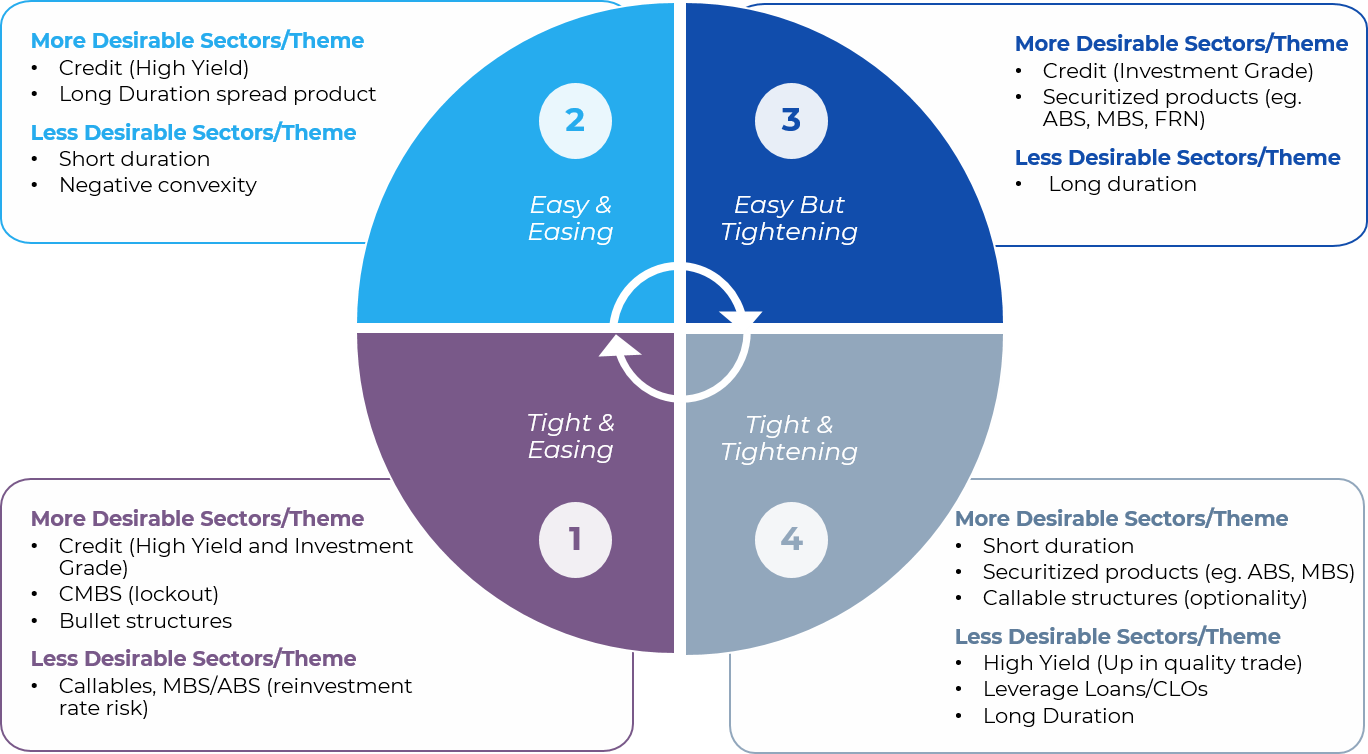

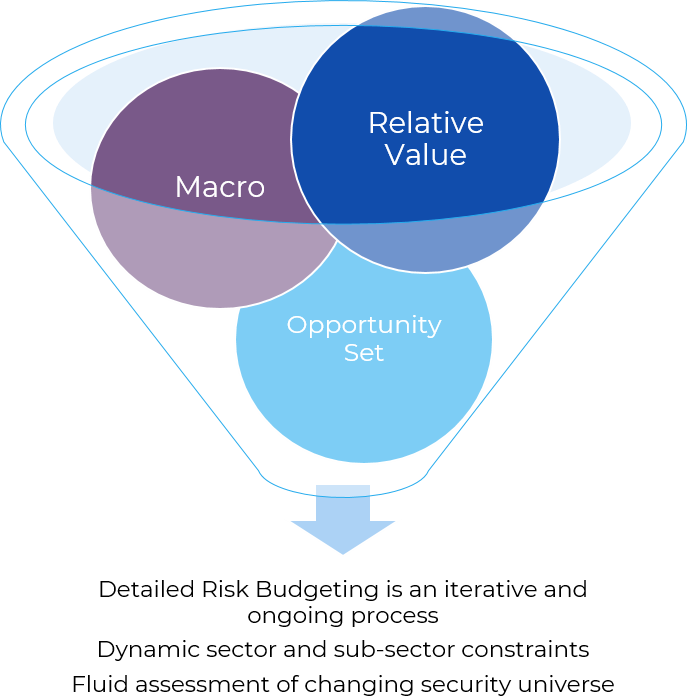

Xponance’s Yield Advantage strategies are grounded in the belief that yield is the most reliable tool for generating alpha and optimizing return per unit of risk. The goal of our philosophy is to deliver long-term results that maximize the contribution of yield to total return, while preserving capital. Typically, this yield advantage is derived through credit, optionality, and other spread products, but can be attained through duration based on the stage of the business cycle.

Macro Positioning

Portfolio managers leverage firm-wide macro insights to position portfolio’s duration opportunistically based on:

- Yield Curve Shifts/Flattening

- Rate forecasts

- Non-traditional market

Quantitative Idea Generation

Quantitative modeling generates insights on issuer and sector pricing anomalies including:

- Credit Quality

- Valuation

- Spreads

Fundamental Credit Research

Research analysts conduct fundamental work that forms the foundation for security selection and sector rotations including:

- Annual Industry reviews

- Quarterly Earnings/Credit reviews

- Monthly Portfolio reviews

- Weekly Holdings reviews

U.S. Fixed Income Strategies

Opportunistic Core

A yield maximizing total return bond strategy with primary investment objectives of current income and capital preservation. A secondary investment objective is long-term capital appreciation. Bloomberg Aggregate benchmark.

Limited Duration

A laddered, credit intensive, low turnover strategy, that typically significantly underweights treasury securities that in turn reflects a consistent yield advantage relative to the benchmark. The relatively short average life seeks to dampen mark to market volatility and effectively lets book yield win.