AI’s Power Surge: Boosting the Utility and Technology Sectors

In this update, we begin by reviewing the state of the economy as we enter the second half of the year. We then pivot to discussing the potential impact of Artificial Intelligence (AI) on the Utilities sector and the performance of the Technology sector, driven by ongoing AI trends.

A Moderating Economy in the Second Half of 2024

The U.S. economy started 2024 with stronger-than-anticipated inflation and employment. Market expectations for monetary accommodation consequently diminished significantly in the first half of the year. As we enter the next six months, moderating economic indicators point to a potential slowdown ahead. In timing interest rate cuts, the Federal Reserve faces the challenge of preventing a hard landing while avoiding the reacceleration of inflation. Maintaining higher rates for too long may lead to a hard landing or deep recession. However, cutting rates too soon could fuel inflation and growth, re-heating the economy. The debate over the Fed’s ability to engineer a soft landing will continue throughout the rest of the year.

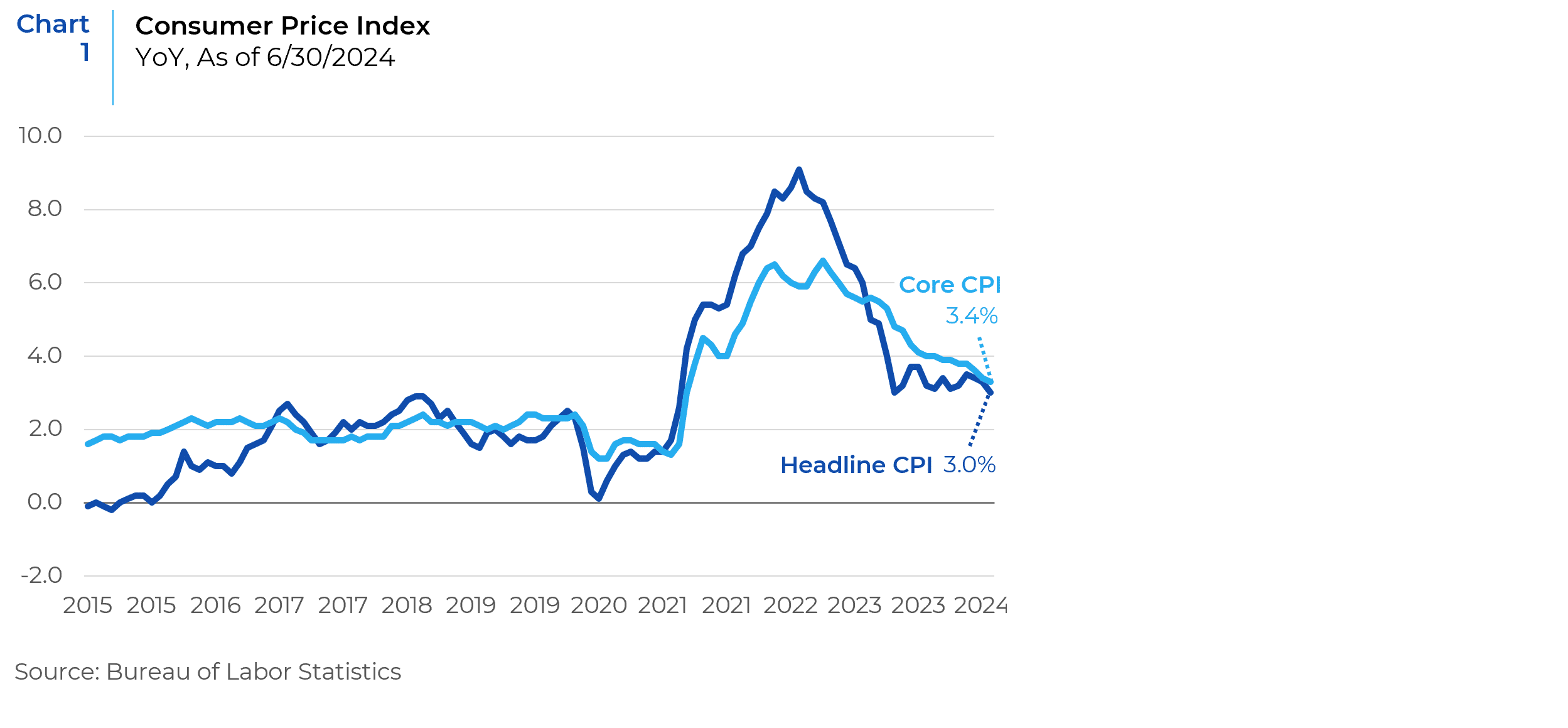

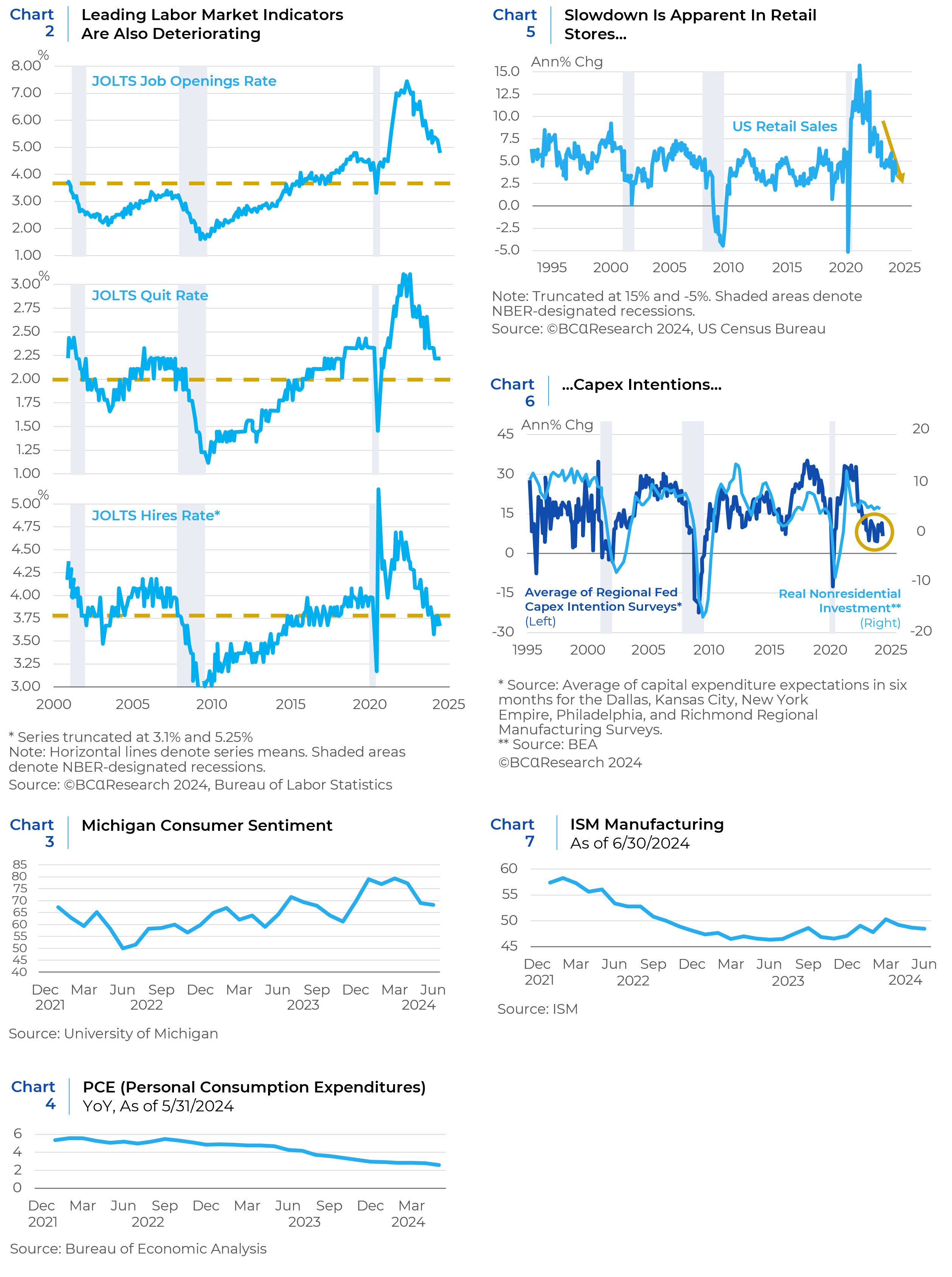

Positive trends in inflation indicate that price increases have started to slow (Chart 1). Additionally, the lagged effects of tight monetary policy are becoming apparent in labor markets (Chart 2), consumer confidence (Chart 3), consumer spending (Chart 4), retail sales (Chart 5), corporate capital expenditure expectations (Chart 6), and ISM Manufacturing data (Chart 7).

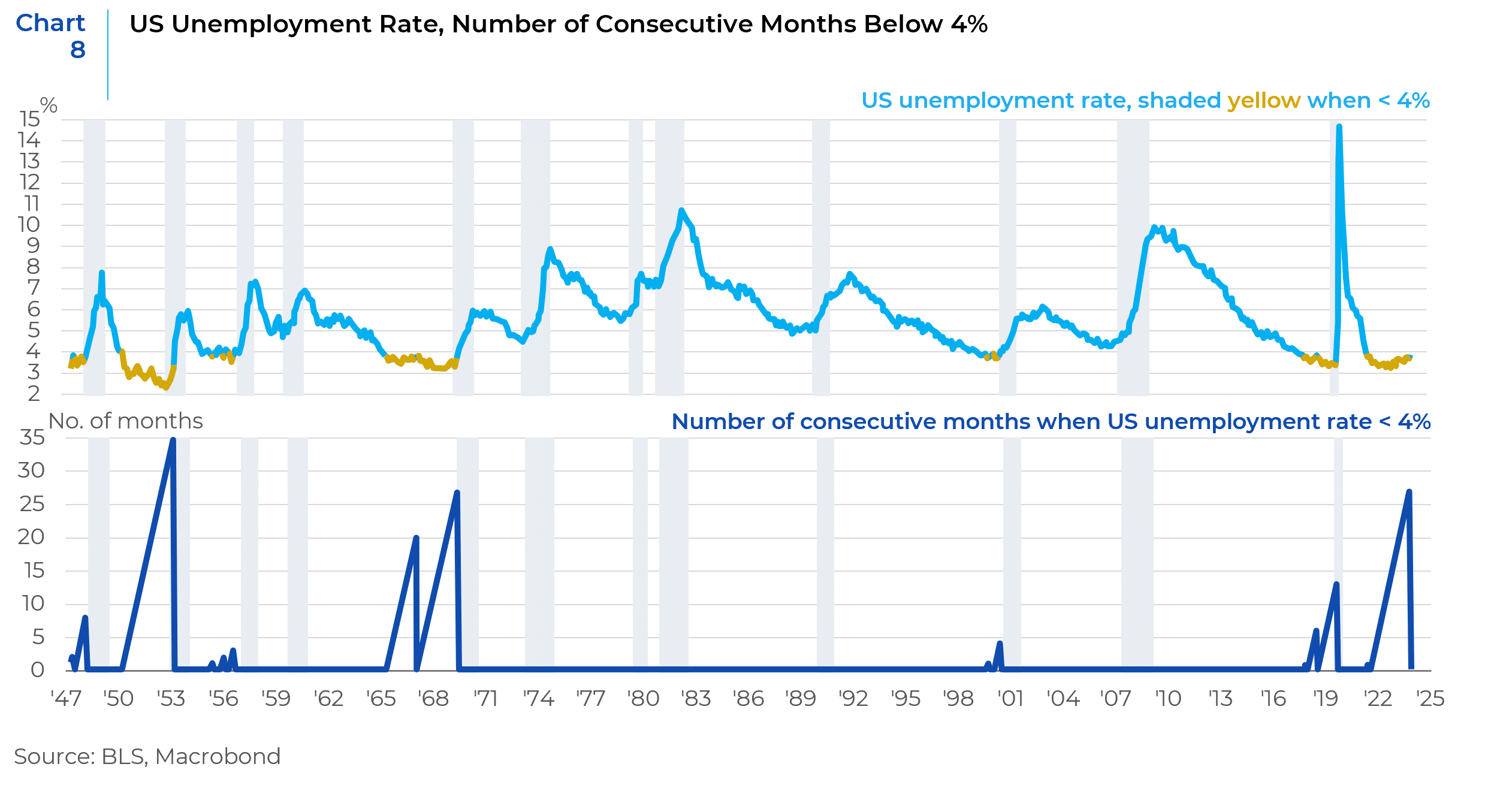

Chart 8 above shows the U.S. unemployment rate and the number of consecutive months it has remained below 4%. The red line in the top pane shows periods when the unemployment rate is below 4%, while the blue line represents periods when it is above 4%. The bottom pane represents the number of consecutive months the unemployment rate has remained below 4%. The most recent streak, marking the longest since 1970, has just ended. Historically, once the unemployment rate breaks a long streak below 4%, a recession often follows. The Fed and investors will be watching this statistic closely in the coming months.

Overall, the macro data has shifted towards a less encouraging outcome as the pro-cyclical drivers that have supported U.S. growth begin to fade. Equity markets have so far shrugged this off, with a focus on AI continuing to motivate investors.

In this context, we want to highlight the impact of AI on two sectors: Utilities and Technology. The impact of AI trends on technology companies, particularly the largest names in the S&P 500, has been a dominant market theme for several quarters. However, the question remains as to how long this dominance will continue. A less discussed topic that we address in the following paragraphs is the impact of AI on the Utilities sector.

The Power Couple: Utilities and AI

Companies in the Utilities sector are predicted to be major beneficiaries of the growth in Artificial Intelligence. Electric utility companies are anticipating a significant increase in power demand driven by various AI-related trends. Data centers, critical infrastructure for digitalization, require a robust electricity supply. The growing volume of digital data necessitates the expansion and evolution of data centers to process and store it. Electricity demand in data centers comes from three primary areas: computing (40%), cooling requirements to maintain stable processing efficiency (40%), and other associated IT equipment (20%). The impact of rising electricity demand is becoming evident in utility companies’ earnings calls. Growth outlooks and balance sheets are strengthening, rewarding investors with secure, growing dividends.

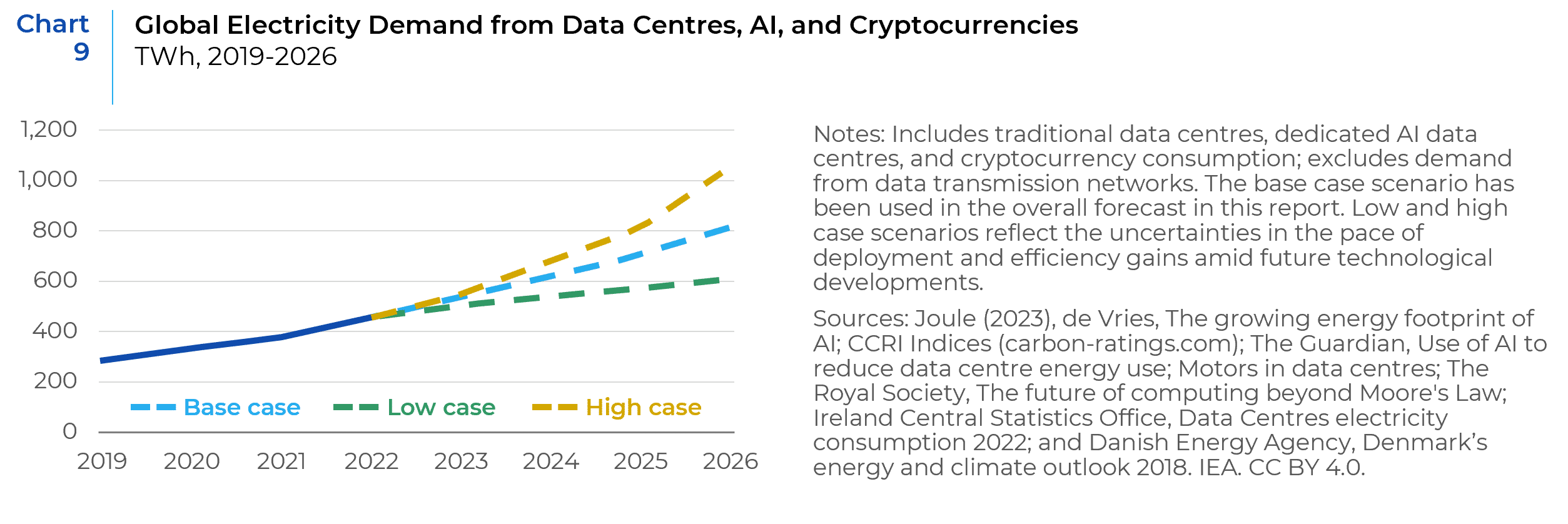

In 2022, data centers, cryptocurrencies, and AI consumed approximately 460 TWh (terawatt-hours) of electricity worldwide, nearly 2% of total global electricity demand. Depending on the pace of deployment, efficiency improvements, and trends in AI and cryptocurrency, global electricity consumption by these sectors is expected to range between 620 to 1020 TWh in 2026, with a base case of just over 800 TWh, up from 460 TWh in 2022 (Chart 9).

The rapid incorporation of AI into software programming across various sectors has increased the overall electricity demand of data centers. Search tools like Google could see a tenfold increase in electricity demand with full AI implementation. Comparing the average electricity demand of a typical Google search (0.3 Wh) to OpenAI’s ChatGPT (2.9 Wh per request), and considering 9 billion searches daily, this would require almost 10 TWh of additional electricity annually. According to the VU Amsterdam School of Business and Economics, AI searches consume thirty times more electricity than traditional Google searches.

The rapid expansion of AI’s footprint has also reignited interest in renewable energy sources like solar, wind, and hydropower. Additionally, nuclear power is gaining attention as a viable clean power source due to its ability to provide stable, weather-independent electricity via fission, which is critical for powering AI data centers. The U.S. nuclear fleet, consisting of 95 reactors, is poised to play a pivotal role in meeting rising power demands by 2030. In Texas alone, data mining centers have requested the equivalent of 41 nuclear power plants to fuel their operations. These trends are expected to significantly impact the Utilities sector.

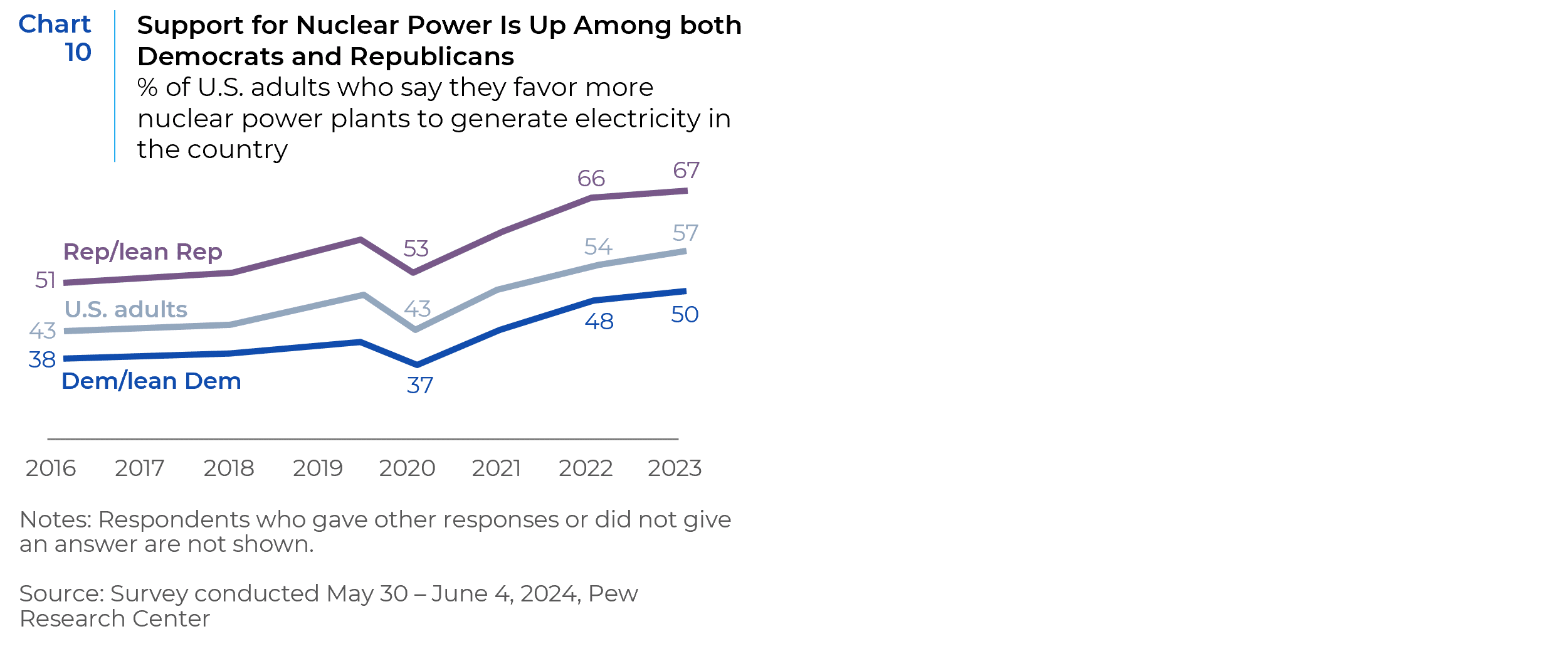

Nuclear energy lost favor for over a decade following the Fukushima nuclear reactor accident in 2011, leading many countries to scale back nuclear initiatives and investments in uranium mining. However, Russia’s invasion of Ukraine has revitalized concerns over energy security and independence, prompting a shift towards alternative energy sources. The push for nuclear energy is also enjoying bipartisan support in the U.S., with nearly 60% of Americans supporting more nuclear power plants—the highest level in a decade (Chart 10). Utility companies utilizing nuclear power stand to benefit from these developments.

The demand for power increases revenues and earnings for Utilities companies. Additionally, the use of AI to enhance efficiency and productivity helps these companies control costs and grow their bottom line. In an increasingly digitized world, the utilities sector is embracing AI to unlock new revenue growth opportunities. Key areas of focus include Intelligent Demand Forecasting, Dynamic Pricing Optimization, Asset Performance Management, Fraud Detection and Revenue Protection, Customer Insights and Personalization, Energy Efficiency Programs, Grid Optimization and Renewables Integration, Intelligent Customer Service, Data Monetization and Partnerships, and Next-Generation Energy Services.

Mega Cap Growth – Powered by AI

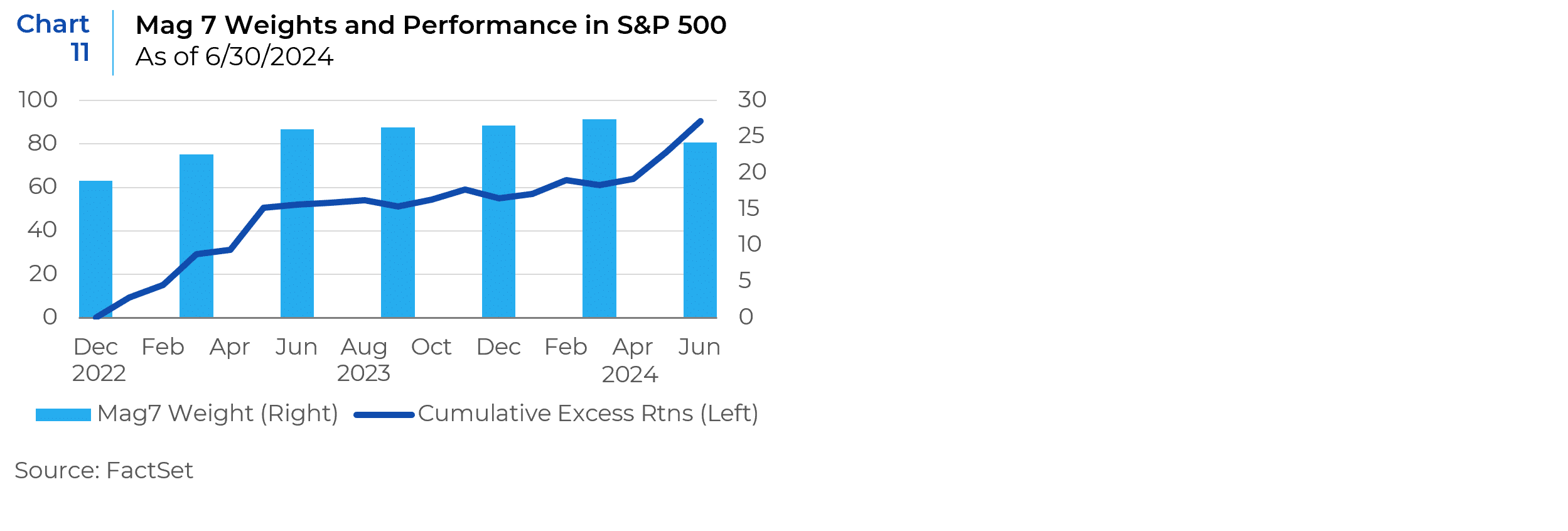

The powerful rally in mega-cap growth stocks powered by AI has significantly increased U.S. equity market concentration, as evidenced by the strong performance and soaring market share of the “Mag 7” (Chart 11).

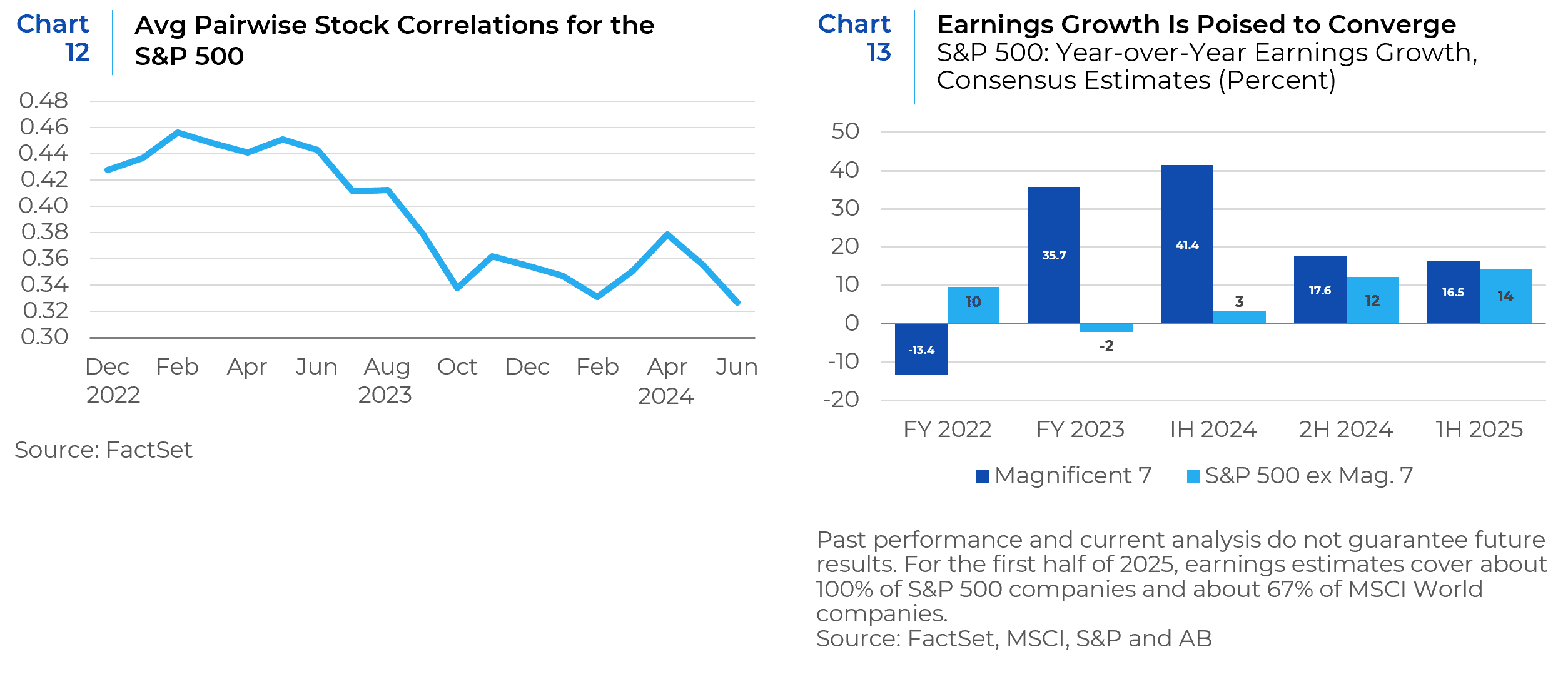

However, change may be on the horizon. Some of the Magnificent Seven have recently faltered after struggling to meet earnings expectations. Within the group, the dispersion of returns between top performers like NVIDIA and Meta Platforms and weaker names like Tesla has widened. There are also signs that market breadth is poised to widen. A very low pairwise correlation among stocks in the S&P 500 index (Chart 12), suggests that individual names are trading more independently. Additionally, earnings expectations for the broader market are expected to converge towards those of the Magnificent Seven in the second half of 2024 and early 2025 (Chart 13).

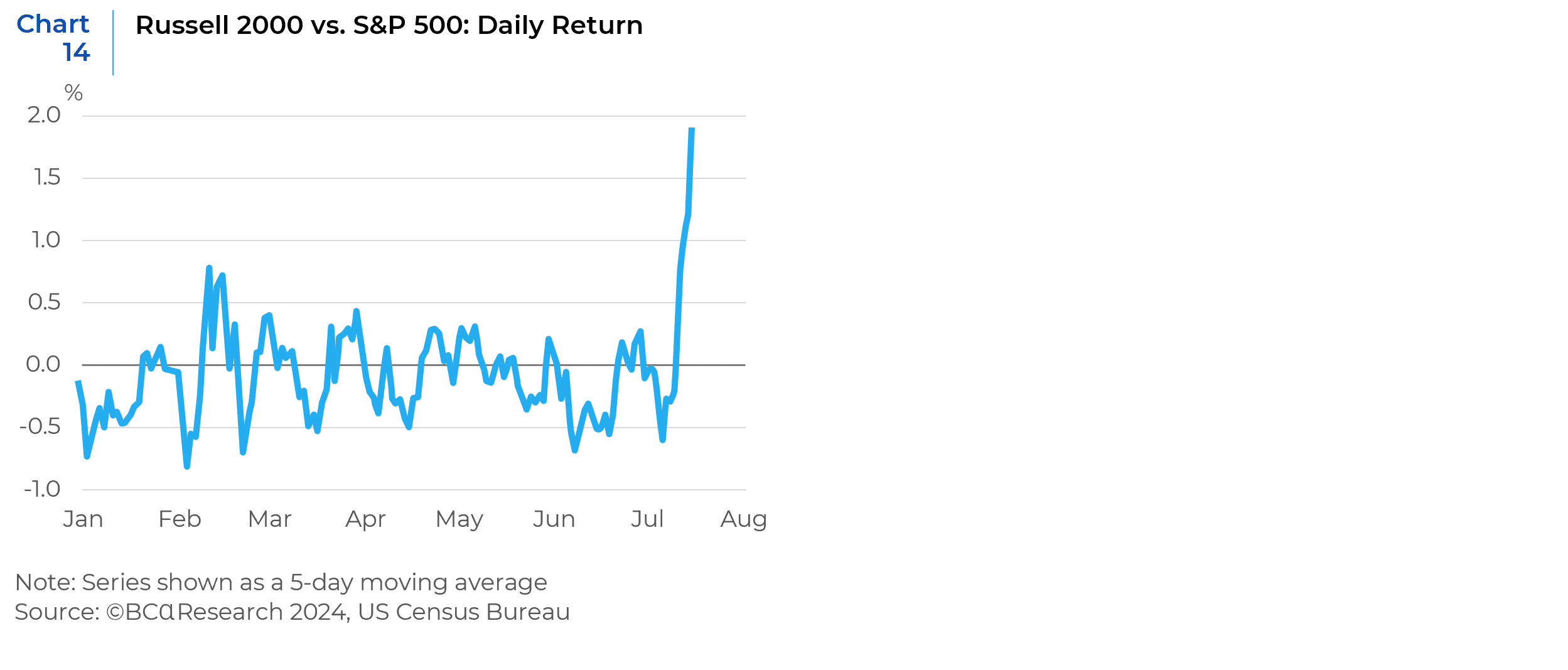

The June CPI reading, released on July 11th, 2024, triggered a rotation from AI-driven mega caps to small-cap companies in the following days. For the five-day period ending July 16th, 2024, the Russell 2000 Small Cap Index outperformed the S&P 500 Large Cap Index by almost 1000 basis points (Chart 14). This was one of the largest moves in the past 20 years. A widely anticipated rate cut in September could further support this rotation. On the other hand, strong earnings beats and positive outlooks from mega-cap names may prevent this rotation from gaining momentum. The second half of the year will test the ability of mega-cap growth names and the power of AI to sustain equity markets.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospective clients for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.