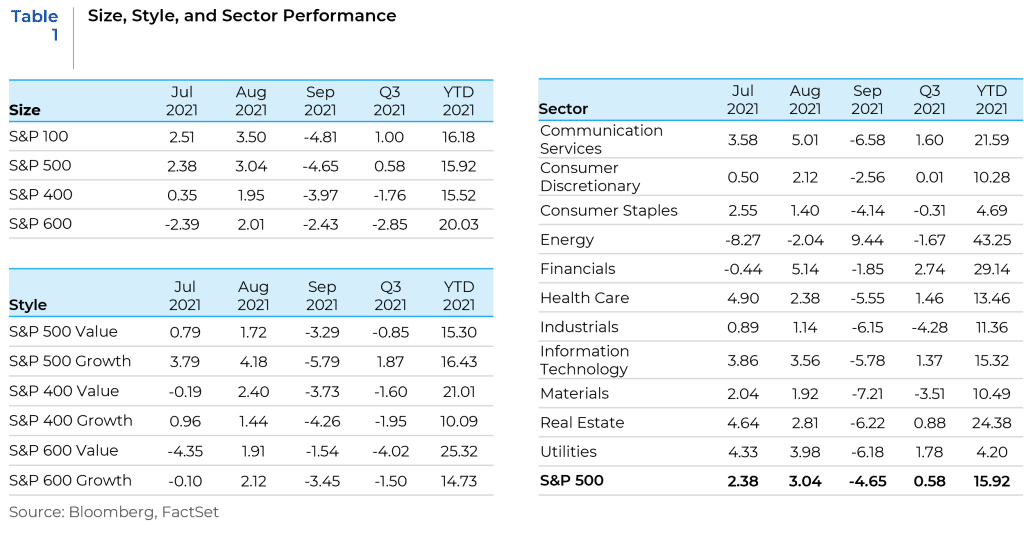

The majority of equity indices ended down for the third quarter of 2021 though the S&P 500 put up a positive return for a sixth straight quarter. For most of the quarter, markets performed well against the background of easy financial conditions, accommodative monetary policy, pent-up demand, big earnings beats, resilient operating margins, corporate buybacks, and retail inflows. However, sentiment deteriorated in September as peak policy, peak growth, and peak earnings themes gained more traction. In addition, the spread of the Delta variant dampened reopening momentum. There were some negative macro data surprises, and supply chain and input price pressures became more persistent. These dynamics drove a pickup in stagflation worries. Growth outperformed value for a second straight quarter after lagging meaningfully in the first quarter with all of the vaccine-driven optimism surrounding the reopening trade. Value and cyclicals were bogged down by negative economic surprise momentum and Delta variant headwinds on economic normalization. China was another overhang, particularly on the industrial metals complex, amid concerns about an energy crunch, Covid shutdowns, and a rapidly softening property market.

Second quarter earnings reported in July and August were a positive tailwind for stocks with earnings beat rates at or near record levels from companies across a wide range of industries amidst a very strong demand backdrop, still elevated operating leverage and margins, capital return boosts, and relatively sanguine commentary about the spread of the Delta variant. However, more persistent supply chain and input price pressures dominated the narrative and drove a pickup in profit warnings during September. The spread of the Delta variant was a big story in the third quarter as the seven-day average of new cases topped 160 thousand in early September, a level not seen since late January. The Delta driven flare-up was widely flagged as a headwind on reopening momentum. Much of the focus was on a slowdown in high frequency indicators surrounding dining out, air travel and other services, along with the sharp declines in the August consumer confidence readings. The spread of the Delta variant also exacerbated concerns about waning vaccine efficacy, which has long been cited as one of the biggest tail risks for the market. However, the Delta variant spread was not accompanied by any meaningful restrictions, vaccines remained highly effective against serious illness, hospitalizations, and deaths, and cases seemed to have peaked by the end of the quarter.

The Fed was a late third quarter story. As expected, the September FOMC statement offered explicit tapering hints and seemed to set the stage for a formal announcement in November. In addition, Fed Chair Powell highlighted expectations for the tapering process to be completed around the middle of next year. Fed leadership continued to highlight the distinction between tapering and tightening and emphasized expectations regarding the transient nature of current price pressures. This is an indication that monetary policy may remain accommodative for some time. The path to additional fiscal stimulus was further complicated as the quarter progressed. The fate of the approximately $1 Trillion bipartisan infrastructure package approved by the Senate in August looked uncertain as progressives threatened to block the measure in the House due to the lack of progress on a reconciliation bill focused on Democratic priorities such as education, childcare, health care and climate change. However, the bigger concern at the end of the quarter may have been the deep partisan divisions over how to raise the debt ceiling.

The past year and a half has been quite a journey with market and economic metrics swinging chaotically. The list below, provided by Credit Suisse, highlights some of the most interesting observations on how a number of key metrics have shifted over the past 20 months. While some measures might be similar to pre-Covid levels, others are at multi-year highs.

- Stock prices are 27% above pre-pandemic highs, and

93% above post-pandemic lows - Forward earnings expectations are 21% above pre-pandemic levels

- The market is currently trading at a forward P/E of 20.0x, down from its peak of 23.2x last September, but modestly above its pre-pandemic level of 19.0x

- The dividend yield for the market has fallen from 1.8%

pre-pandemic to 1.3% currently - The 10-year Treasury yield, at 1.52%, is almost back to its pre-pandemic level of 1.56%, after troughing at 0.51% in August 2020

- The current 5.2% unemployment rate has recovered dramatically from its 14.8% pandemic highs, but still remains above its pre-pandemic level of 3.5%

- The recent 61.1 ISM reading signals robust economic growth, and is well above its pre-pandemic level of 51.1

- At 5.2%, CPI is the highest it has been in the past 13 years

Risks and Opportunities on the Horizon

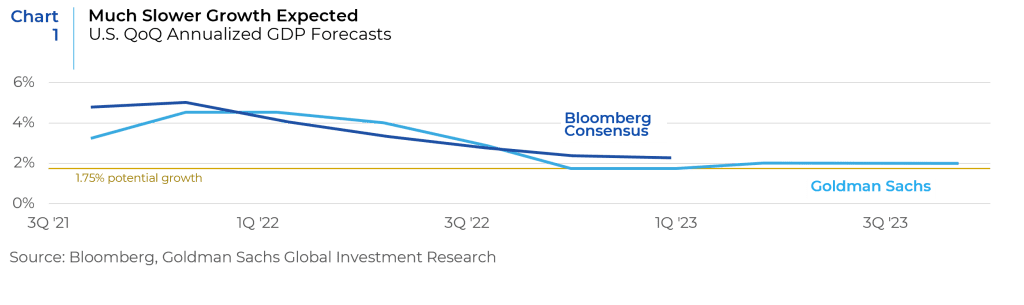

Growth is moderating after staging a V-shaped recovery, and the economy appears to be in a mid-cycle expansion with increased equity volatility as some downside risks loom in the horizon. Even as the impact from the Delta variant is beginning to abate, it has highlighted the possibility that COVID is likely to be an ongoing concern and it may take a few more quarters for the world to go back to its pre-pandemic environment. Where monetary policy is concerned, the impact of tapering and the timing of tightening are key factors that can influence the performance of markets. The proposed Democratic fiscal policy agenda continues to inch forward, but its scope remains in flux. Based on the size of the eventual package, the net effect on 2022 earnings will be determined by the balance of the upside from higher GDP growth and the offsetting negative impact of higher taxes. The U.S. is again approaching a potential debt ceiling crisis and while the expectation is that the matter will be resolved, the risks are now greater than at any point over the past decade.

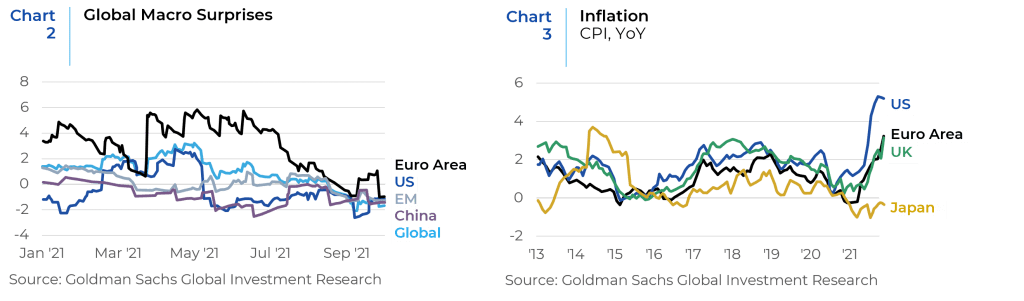

Growth (Chart 1) and inflation concerns picked up in the third quarter. Supply chain issues globally have contributed to growth downgrades and have led to upside inflation surprises. Macro surprises have been negative since August (Chart 2), especially for the U.S. and China, while inflation has been sticky (Chart 3), increasing pressure on central banks to tighten policy. More recently, rising energy prices have added to inflation pressures and growing China concerns have started to weigh more on global growth expectations and sentiment.

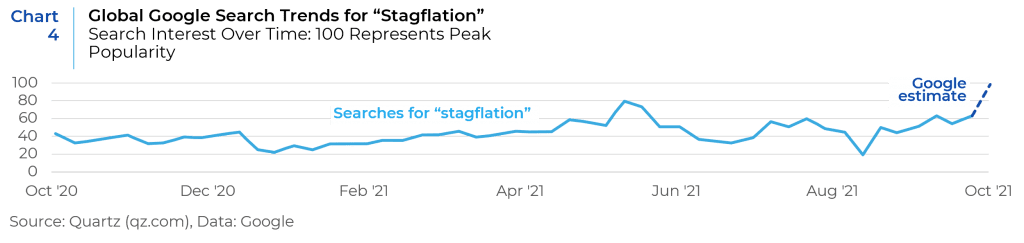

Rising energy prices, bottlenecks in the supply chain, and rising labor costs have raised concern regarding the risk of stagflation, a period defined by persistent high inflation combined with high unemployment and stagnant economic demand. (Chart 4)

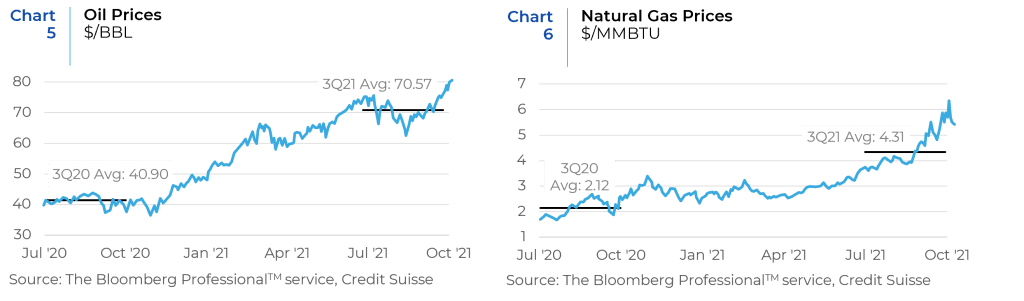

Crude oil (Chart 5) has risen 64% this year to a seven-year high. Natural-gas prices (Chart 6) have roughly doubled over the past six months to a seven-year high. Heating oil has risen 68% this year. Prices at the pump are up nearly a dollar over the past 12 months to a national average just over $3 a gallon. Coal prices are at records. Higher energy prices could push up inflation in coming months, damp consumer spending on other products and services, and ultimately slow the economic recovery.

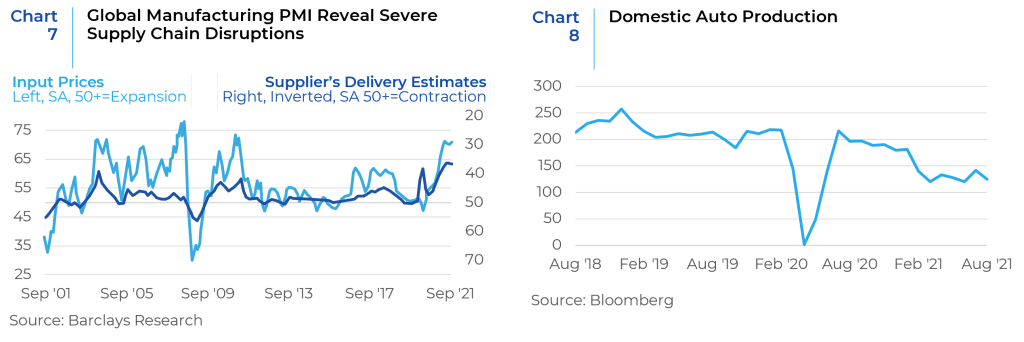

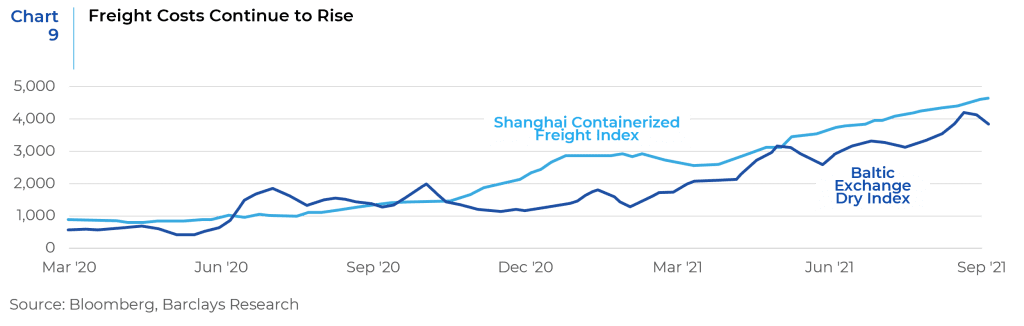

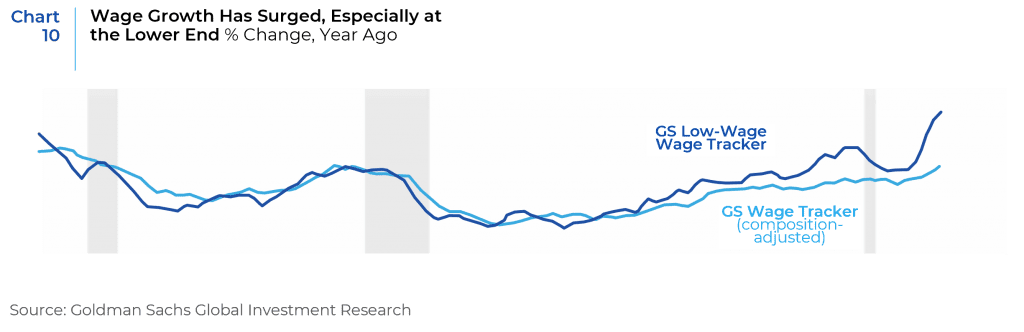

Global supply-chain bottlenecks are creating shortages of components and price surges for critical raw materials, impacting manufacturers around the world. The supply shocks are showing signs of choking off the recovery in some regions. Part of the problem is a global economy that is out of sync on the pandemic, restrictions, and recovery. Factories and retailers in Western economies that have largely emerged from lockdowns are eager for finished products, raw materials, and components from longtime suppliers in Asia and elsewhere. But many countries in Asia are still in the throes of lockdowns and other coronavirus-related restrictions and combined with low vaccination rates it is constraining their ability to meet demand. Meanwhile, global labor shortages, often the result of people leaving the workforce during the pandemic, are throwing further obstacles in the way of producers. The bottlenecks are forecast to constrain manufacturing output well into next year. As a result, global industrial output that rose above its pre-crisis level in early 2021 has since stagnated. Chart 7, 8, and 9 highlight some of these issues. Another negative factor is the rising pressure from labor costs. Recent commentary from companies across various sectors indicates an acute focus on rising wages and the lack of labor supply. Analysis suggests a 100 bp acceleration in wage growth would reduce S&P 500 EPS by 0.7%, all else equal. Moreover, this trend can further fuel inflationary pressures.

Another negative factor is the rising pressure from labor costs. Recent commentary from companies across various sectors indicates an acute focus on rising wages and the lack of labor supply. Analysis suggests a 100 bp acceleration in wage growth would reduce S&P 500 EPS by 0.7%, all else equal. Moreover, this trend can further fuel inflationary pressures.

The economic backdrop remains difficult near-term and the policy environment is no longer that bullish for stocks. President Biden’s fiscal package is in limbo, while the Fed is preparing to dial back stimulus. This means the marginal thrust of both monetary and fiscal policy has turned negative for stocks. Going forward, the stock market could continue to churn until underlying profit momentum grinds higher or a new policy impulse is forthcoming more quickly than anticipated. Equity returns may turn lower owing to elevated valuations, fewer growth tailwinds and more rates headwinds, as well as margin pressures from supply disruptions and taxes. Also, recent increased volatility might linger until macro momentum turns more positive and real yields settle. If the Fed abandons its hawkish bias and reassures the market that it will stand pat with rates for some time and markets get clarity on whether Biden’s spending programs will produce net fiscal stimulus or constraint for the economy going forward, the markets may be successful in climbing the wall of worry. At present, investors are largely in the dark. In this environment a balanced and diversified approach with risk allocations across growth, value and defensive sectors is the best for a portfolio strategy.

Source: FactSet, J.P. Morgan Markets, Barclays Research, Credit Suisse, Goldman Sachs Global Investment Research, Alpine Macro, BCA Research

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.