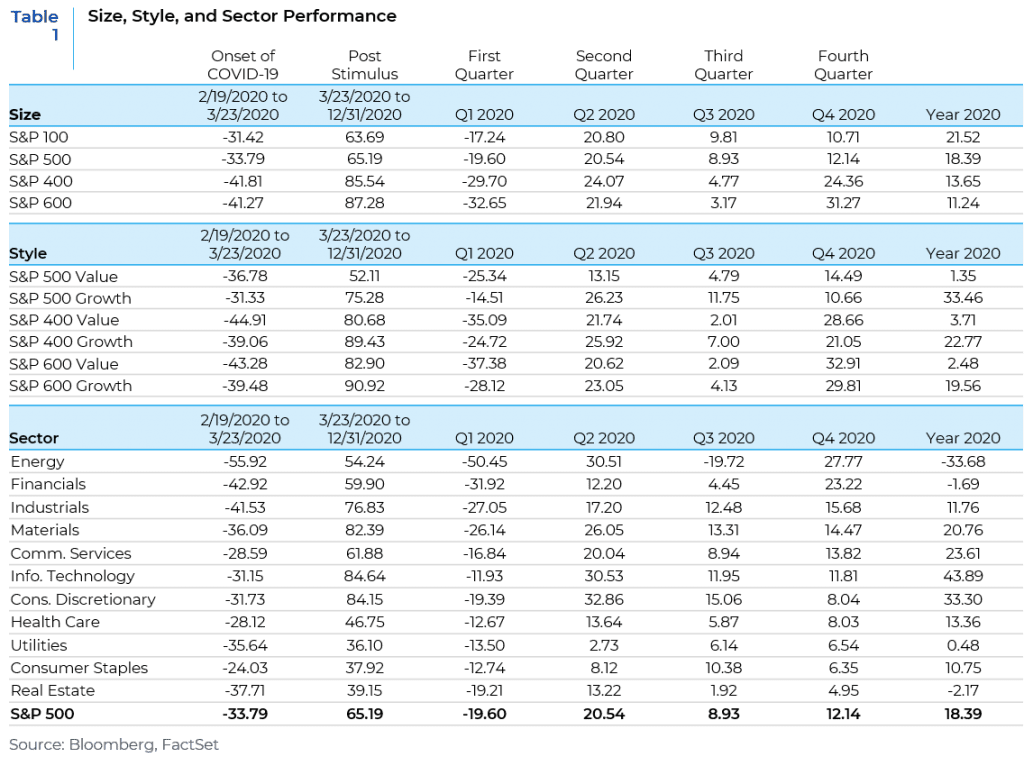

2020, a year characterized by a global pandemic, saw dramatic reversals in sentiment and leadership in equity markets. After being panic-stricken in the first quarter when the pandemic broke out, markets finished the year with a record-breaking finale. Here are some of the year’s highlights:

An Optimistic Start (Jan 1–Feb 19) – Equities across the world went up led by the US, despite a virus outbreak in China and other parts of Asia.

Covid-19 Collapse (Feb 19‒Mar 23) – The trigger – surging Covid-19 cases in Italy. The virus spreads across several countries rapidly, lockdowns bring world economies to a standstill, and stocks go into freefall.

Recovery Supported by Policy (Mar 23–Sep 2) – Central banks launch aggressive monetary intervention, while governments across the world pass massive fiscal rescue packages.

Coronavirus Second-wave Concerns (Sep 2–Nov 8) – A resurgence in Covid-19 cases raises doubts about the economic recovery and stirs market volatility.

Vaccine Optimism & US Elections (Nov 9–present) – Risk rally accelerates on US election results, new rounds of monetary and fiscal stimulus, and positive vaccine news.

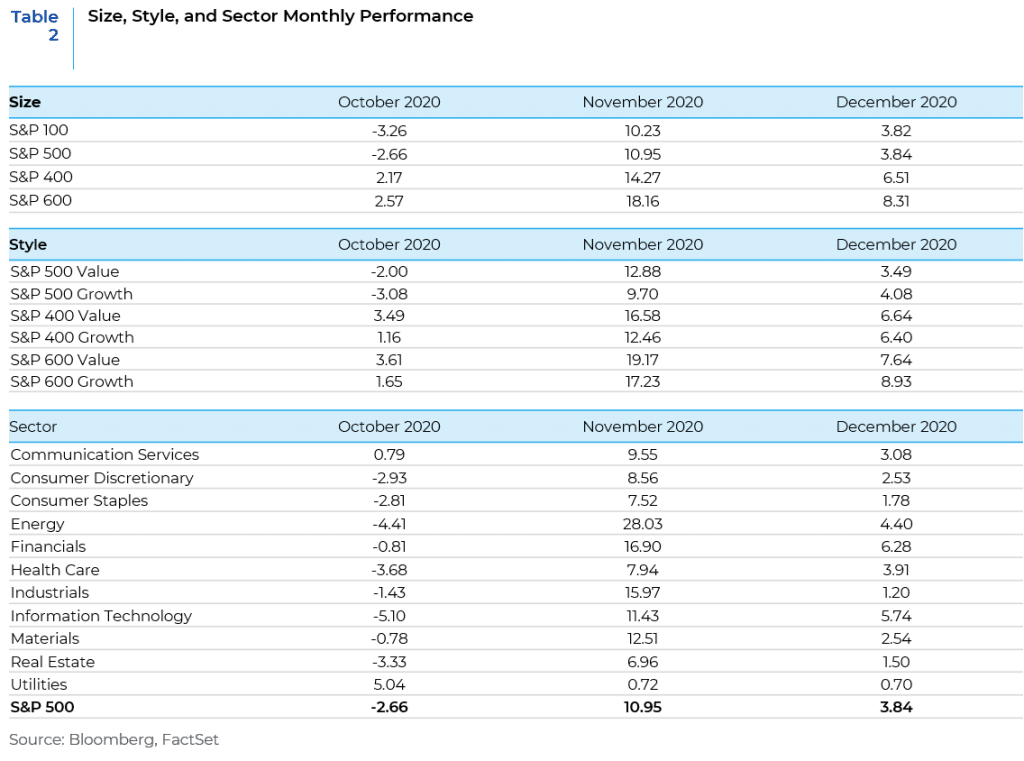

The fourth quarter of 2020 saw a resurgence in the performance of smaller stocks after the persistent dominance of large cap names for most of 2020. Value stocks also gained some ground in October and November, while growth names made a small comeback in the last month of the year. Among sectors, Energy had the best performance for the quarter primarily driven by the strong value rally in November. A remarkable day in equity markets occurred on November 9th, 2020 with the announcement that the coronavirus vaccine developed by Pfizer Inc. and partner BioNTech SE showed more than 90% effectiveness in protecting people from COVID-19, a much-better-than-anticipated result that marked a milestone in the march to stop the pandemic. This led to a massive rally in value stocks and a severe drawdown in the performance of the momentum factor that translated to a 19-standard deviation event. The rally in smaller sized value-oriented stocks picked up further steam after that announcement.

2021: The Road Ahead…

We enter 2021 amid a market environment supported by a bullish narrative surrounding vaccine administration, central bank liquidity tailwinds, fiscal stimulus, upside risk to consensus economic and earnings growth expectations and FOMO (Fear of Missing Out). While the third wave of coronavirus infections continues to worsen, there remain good reasons to believe that the economic outlook will brighten over the second half of the year. This is the consensus base case scenario among investors at this time and markets appear to be banking on this panning out.

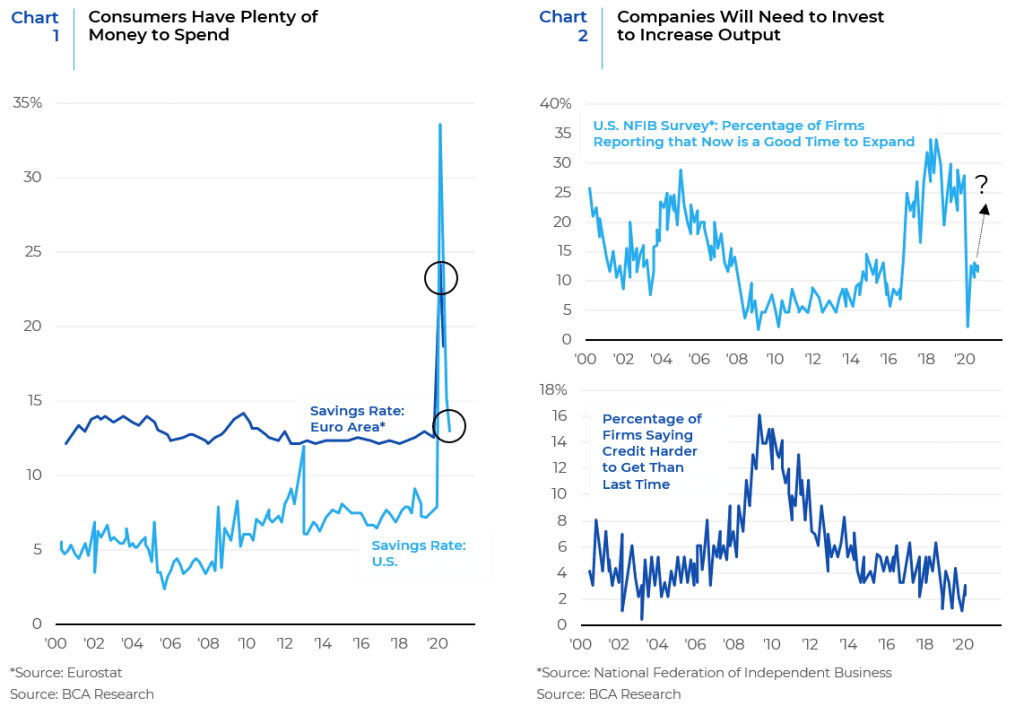

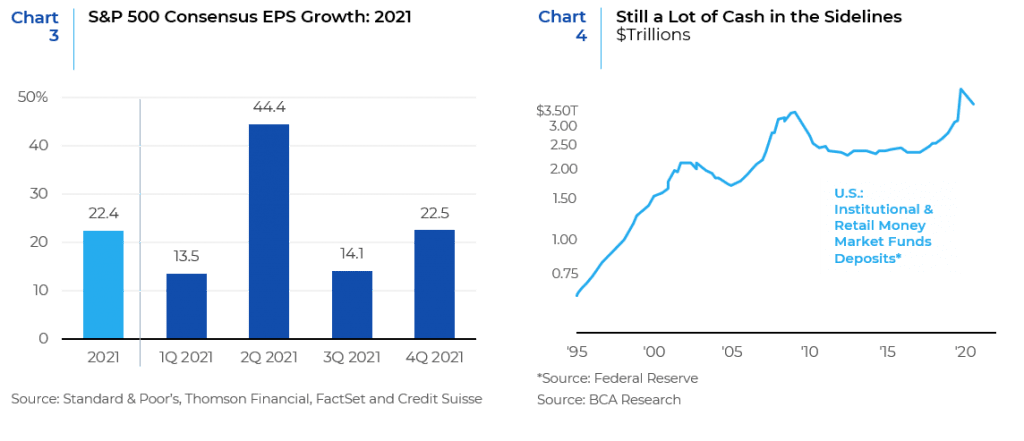

The expectation is that as more and more people get vaccinated and COVID restrictions are gradually rolled back, consumers will start to travel again and spend the savings accumulated during the pandemic lockdowns. Corporate decision makers are also expected to respond to this increased demand by spending on capex, boosted by access to low interest credit. In this scenario, earnings should rebound. Moreover, markets may be boosted further as the confidence in the recovery increases and cash sitting on the sidelines gets invested in the markets.

Earnings are expected to expand in each quarter of 2021.

But there are several risks to this view. The most immediate is that the current wave of increased infections that has started to manifest itself in a slowdown of economic activity, takes longer to control, and the rollout of vaccines is slower than we anticipate, held back by bottlenecks in production, distribution, or administration. Furthermore, there is a risk that the virus mutates in a way that makes the current vaccines less effective. In that scenario, the roll back of current restrictions on activity may occur more slowly than anticipated.

The prospect of a sudden rise in inflation is a risk but one with a very low probability associated with it. While inflation is likely to rebound over the coming months a significant pick-up in core inflation in 2021 is not expected. Instead, a more immediate risk is that policymakers either withdraw support or tighten policy prematurely, thus snuffing out the anticipated economic rebound. However, there is almost universal agreement among governments and central banks over the need to maintain fiscal and monetary support until recoveries are entrenched. But a fraying of this consensus would pose a threat to upbeat economic forecasts.

A different but related risk is that ultra-loose monetary policies lead to a misallocation of capital that ultimately threatens the stability of the financial system in one or several major economies. History shows that a combination of easy money and liberalized capital markets can cause asset price bubbles to inflate, which can then cause economic and financial market dislocation when they burst. But this process typically plays out over years, not months.

…And Beyond

The pandemic has caused systemic behavioral change and shifted the equilibrium of societal norms — creating both continued uncertainty and new opportunities in the long run. While we are most probably embarking on a period of recovery, at the same time, we must adjust to the continued evolution of corporate and consumer behaviors resulting from the pandemic. 2021 will be a period of transition that will require balancing the cyclical opportunities stemming from an ongoing recovery alongside longer-term secular trends that capture the evolutionary impacts of COVID-19 on our society. Technological innovation will continue reshaping our way of life and be the catalyst for new industries like telehealth and e-learning. We are likely to see demand for advanced medicine, improved structural health care processes, and remote access capabilities to support reduced-contact interactions. Digital payments will become more standard, while video games, streaming networks, virtual reality, social media, and interactive home workout equipment will likely move from being discretionary items to staples in the future. COVID-19 has also shifted our mindset toward infrastructure spending, given the number of individuals working from home and relying on connected devices. It has highlighted the need for crowd management, building safety protocols, and smart grids for changes in power consumption. While COVID-19 is a humanitarian crisis first, it has resembled a global security event in terms of travel restrictions, compromised video-hosting platforms, and a transition to digital payments that in turn has led to the need to have more improved cybersecurity measures. The pandemic has pushed the adoption of certain behaviors up by a few years and created new future growth opportunities. These changes are not one-offs for our society, but transcendent trends that will impact future generations across different parts of our economy. When targeting these broad-based thematic trends, a diversified investment approach may be the most optimal.

Source: Capital Economics, BCA Research, Bloomberg, Factset, State Street

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.