Market Review

US equities were higher in 2021 with the S&P 500 up for a third straight year. There were a number of big themes in focus during the year. Covid vaccinations formed a key piece of the bullish narrative, particularly over the first several months of the year. The biggest tailwind may have come from the continued expansion of central bank balance sheets and related easy financial conditions. Fiscal stimulus was another widely discussed positive. Record earnings beats, driven by a better demand backdrop and resilient margins, also helped underpin risk sentiment. There were a number of high-profile headwinds this year as well. These included the ongoing Covid pandemic, the emergence of new variants, supply chain constraints, more persistent inflation pressures, the Fed’s policy pivot, and longstanding concerns about stretched valuations and crowded positioning.

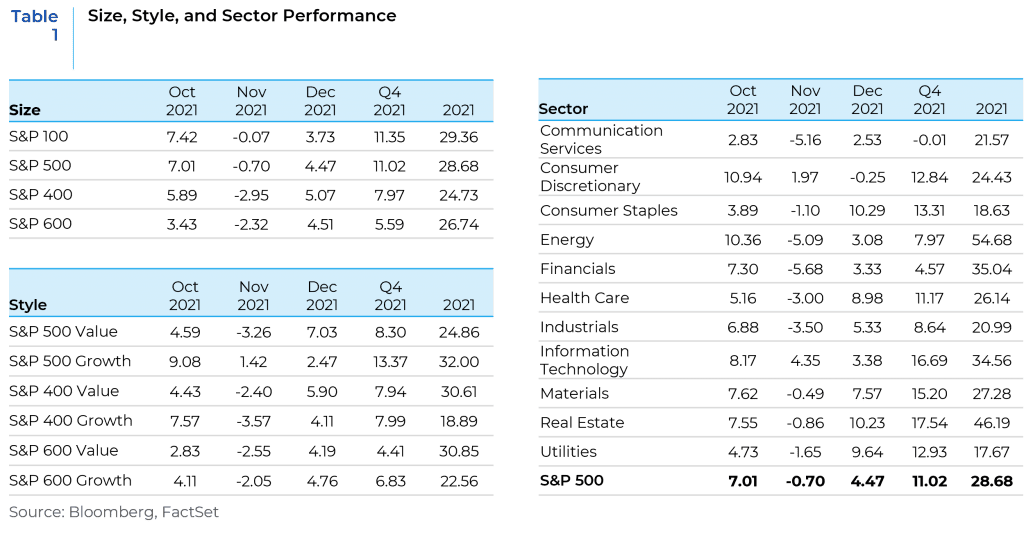

For the year growth outperformed value in large cap while the opposite was seen in mid cap and small cap. Big tech fared well despite the ramp in regulatory scrutiny with some continued focus on its leverage to structural growth and disruption themes. This also allowed the largest names in the market to post the biggest returns for the year. Energy was the best performing sector with oil prices boosted by favorable demand and supply dynamics. Real Estate, Financials, and Information Technology were the next best outperformers for the year.

Market Outlook

2022 is expected to be a year of transition and regime change as the economy moves from early cycle to mid-cycle and the market’s focus shifts from COVID-19 to the state of growth and inflation and the response of central banks. The Fed has started to taper its monthly asset purchases and is expected to hike rates starting in March followed by another two or three hikes over the course of the year. Moreover, these policy actions will take place at a time when growth is moderating. This will create a highly complex environment and a more volatile backdrop for markets.

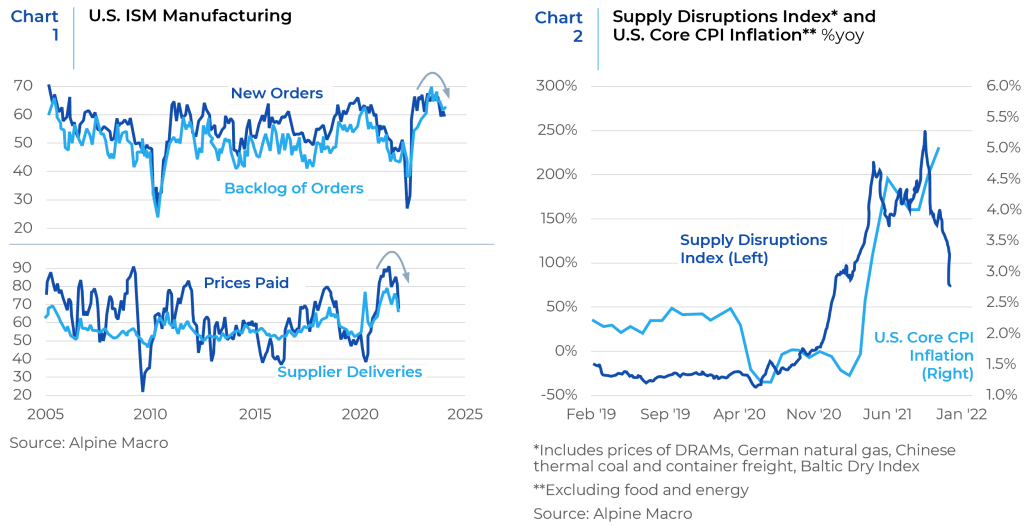

Rising inflation has become a concern for investors since the second half of last year. Brisk demand for goods and shortages of intermediate goods such as semiconductors have pushed 12-month inflation to its highest readings in decades. Core consumer prices, which exclude the volatile food and energy categories, are well above the Fed’s 2% target. The Fed is therefore prepared to raise rates to cool down demand across the economy in an effort to reduce inflation. However, while inflation steadily built over the course of 2021 and is expected to remain elevated, there is evidence suggesting that inflation trends will start easing in the coming months. The ISM Prices Paid Index, which leads CPI by about three months, has dropped precipitously, while delivery times have shortened (Chart 1). Also supply disruptions which have contributed significantly to rising prices have started to fall (Chart 2). Supply chain constraints are easing as freight costs have rolled over, the number of containers sitting on docks has dropped, and factory production is improving around the world.

Investors are expecting some easing in inflation trends later in 2022 because of the reverse base effect and a boomerang effect. Reverse base effects will result in a slowing of CPI growth rates as YoY changes in 2022 are measured against 2021’s surge in prices. The boomerang effect refers to the fact that companies have been building inventories to satisfy recent demand which could create somewhat of a supply glut next year and result in falling prices. Although wages are indeed rising and contributing to inflationary pressures, labor productivity is also improving. Labor productivity growth needs to be accounted for to assess whether or not wage growth is as inflationary as perceived.

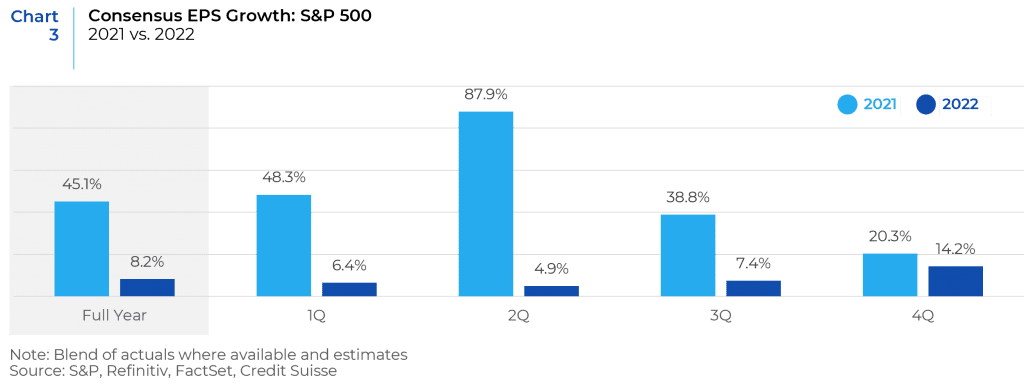

Moderating growth will be another important theme in 2022. Economic growth is expected to slow but remain above trend supported by strong household and corporate balance sheets. After a dramatic rebound in corporate earnings during 2021, slower economic growth and persistent cost pressures are expected to challenge profits in 2022. Companies were generally able to pass higher costs along to customers in 2021, resulting in a dramatic rise in profit margins and a nearly 50% rebound in earnings. With profit margins back at all-time highs, it will be more difficult to increase them going forward. Companies will face wage cost pressures, as they struggle to find workers to fill open positions. With that in mind, investors are expecting solid but much slower high single-digit profit growth in 2022, which seems reasonable given the mixed economic and inflation conditions that seem to be ahead (Chart 3).

Equity market performance against this backdrop will be marked by increased volatility. While we have a constructive outlook for equities in 2022, returns are likely to fall short of what we saw in 2021. We expect to see more balanced performance from style factors in 2022 when compared to the extreme skewness of factor performance in the past two years. Also, we expect correlations between value and growth to normalize as opposed to the extreme negative correlations experienced during the pandemic. Rather we anticipate some style volatility as the ball goes back and forth between the two styles.

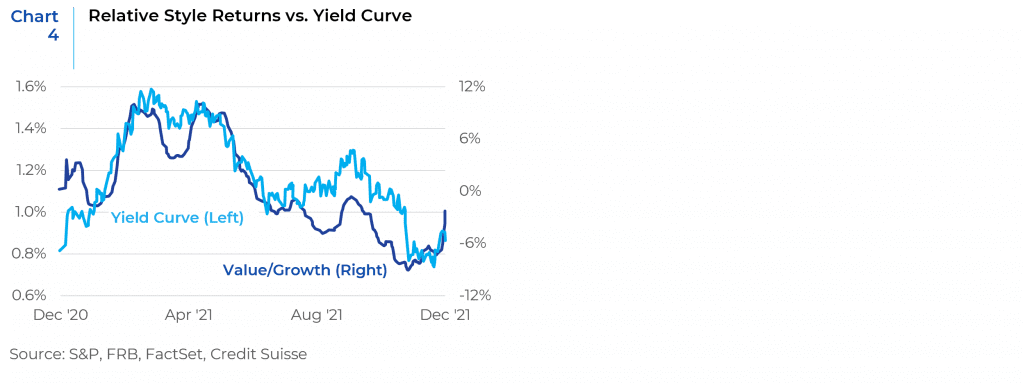

Cyclical groups appear quite attractive given robust demand, pricing power gains on the back of higher inflation, and favorable valuations. Valuation levels favor value stocks after the strong performance of growth stocks in the past few years. Odds are high that the force of “mean reversion” will benefit value and hurt growth. In addition, the Fed is getting more hawkish and short rates will be lifted, possibly aggressively. With the prospect for higher rates resulting from tighter monetary policy, longer-duration growth exposures could be further challenged from a return perspective. Value stocks tend to outperform when real GDP is running above average as is expected to be the case in 2022 and they also tend to outperform ahead of first Fed rate hikes. Over the past 30 years, growth stocks’ monthly excess returns to the broader market have a negative correlation to changes in interest rates (-17%), whereas value excess returns are positively correlated (+18%). In an environment characterized by rising rates and a steepening yield curve, cyclical industries and short duration value-oriented names tend to perform well (Chart 4). Thus, value and cyclicals are likely to lead in the next few months.

However, it is too early to write-off growth stocks as the persistence of value performance may not last as we head later into the year. As the Fed completes a series of rate hikes and the mid-cycle phase gets longer in the tooth, there may be a bumpy transition back to high quality secular growth companies. These names tend to outperform when GDP is running below average, and 2023 growth forecasts currently anticipate a downshift. Companies’ current level of profit margins will not persist in 2022 as the main drivers of stronger margins during the pandemic – labor and capital – also lose their persistence. Moderation in economic growth will ensure demand for firms with higher quality balance sheets and reliable profitability. Investor concerns related to any future spikes in virus infections will also tend to favor growth stocks.

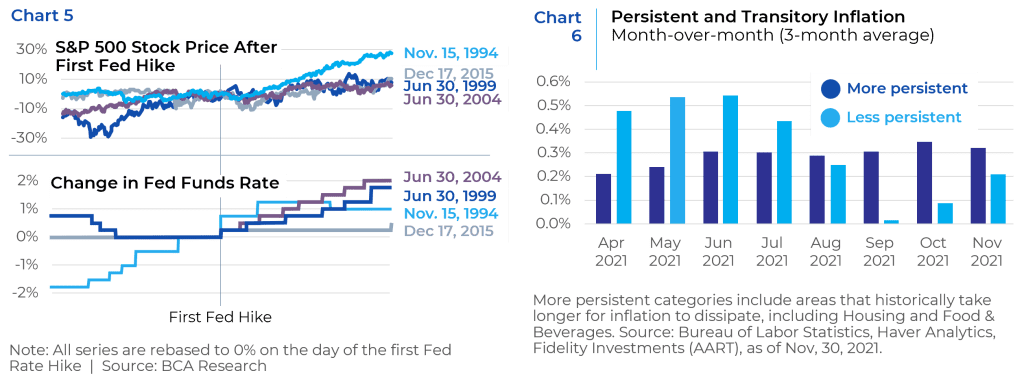

Risks to this outlook revolve around Fed action. The policy response to inflation will be a big driver of equity markets. The biggest concern regarding equity market performance is the risk of disruptive inflation leading to premature and overdone monetary tightening. The question facing investors going forward is whether equities are at risk as the Fed normalizes monetary policy this year. Although stocks typically sell off in response to the first Fed rate hike, the decline is ultimately fleeting. The chart below (Chart 5) shows that in all four of the recent rate hike cycles, the S&P 500 was higher 12-months after the first hike. This outcome however hinges on inflation levels which today is significantly higher than during the past four rate hike cycles. If inflation eases as economic activity normalizes this year and supply chain disruptions moderate, then the Fed will not be forced to tighten too aggressively. Alternatively, if elevated inflation expectations trigger a wage-price spiral, the Fed may be forced to tighten policy too quickly, derailing economic growth and equity market performance.

While inflation is expected to ease later in the year, there are signs that there is a rotation underway where goods inflation may cool but inflation in services may ramp up. While supply-related inflation tends to dissipate over a period of many months, price increases in categories that tend to be more persistent—such as housing and food—are now accounting for a larger portion of inflationary pressures (Chart 6). In addition, labor markets may remain tight enough to support solid wage growth, putting a floor under how far inflation rates may fall. In this scenario, the Fed could move too aggressively and continue tightening into a slowing economy, upsetting risk assets, and disrupting the underlying economic recovery.

A rising interest rate cycle consists of two phases – (1) In the early stages of monetary tightening, rising interest rates are reflective of a stronger economy and better corporate profitability, and thus often coincide with rising stock prices; (2) As the Fed continues with its tightening, business cycle expansion is challenged by higher borrowing costs. This is when the yield curve begins to invert, and the stock market runs into problems. As we start 2022, the first phase of the interest rate cycle is in effect and may persist for a while. If the Fed is able to gauge inflation and growth correctly and engineer a soft landing, the expansionary phase of the business cycle may have legs for several more quarters. The question is whether the Fed will crash land instead?

Source: FactSet, Alpine Macro, BCA Research, Fidelity Viewpoints, Credit Suisse

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.