Outlook for 2024: A Year of Bullish Hopes and Volatile Realities

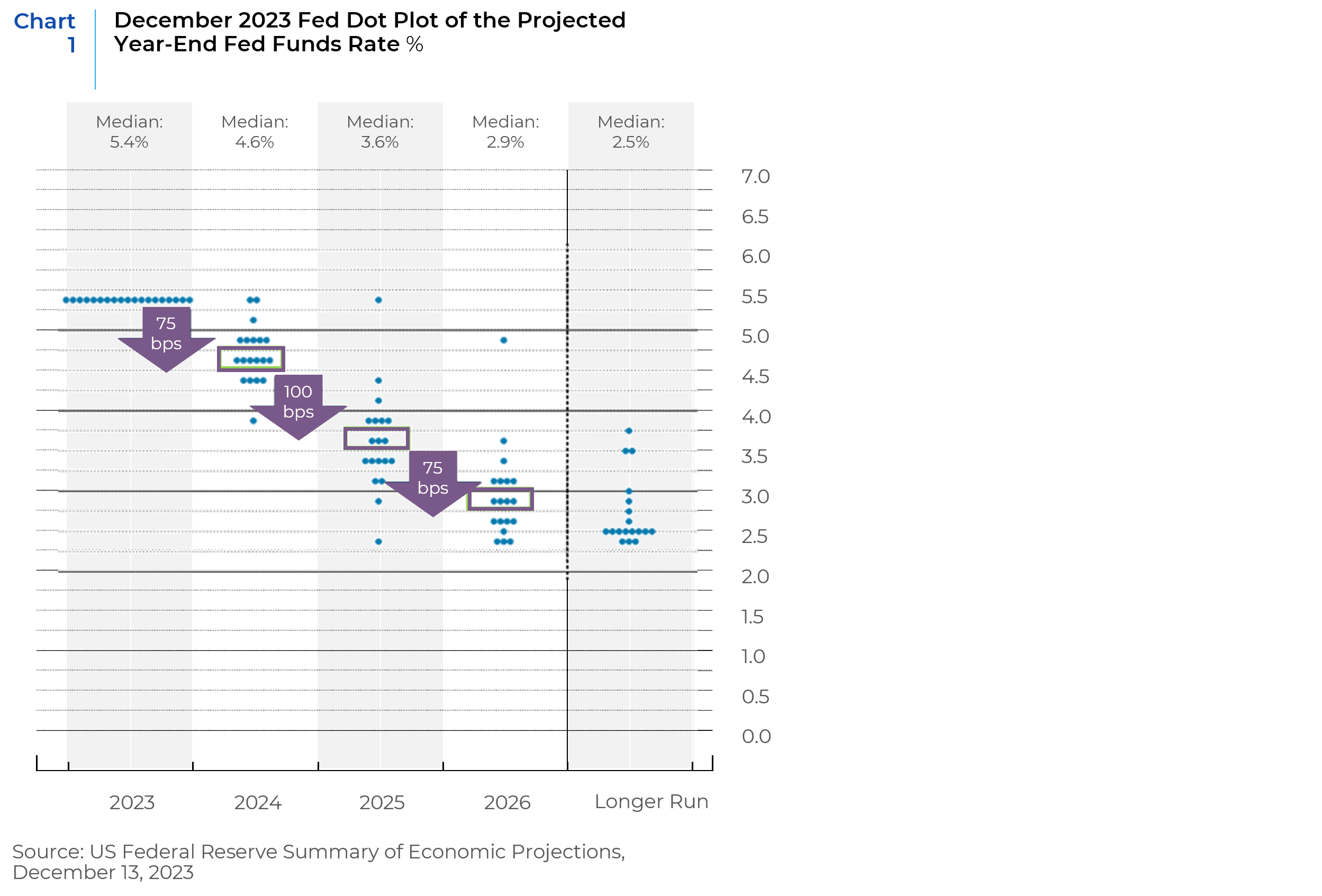

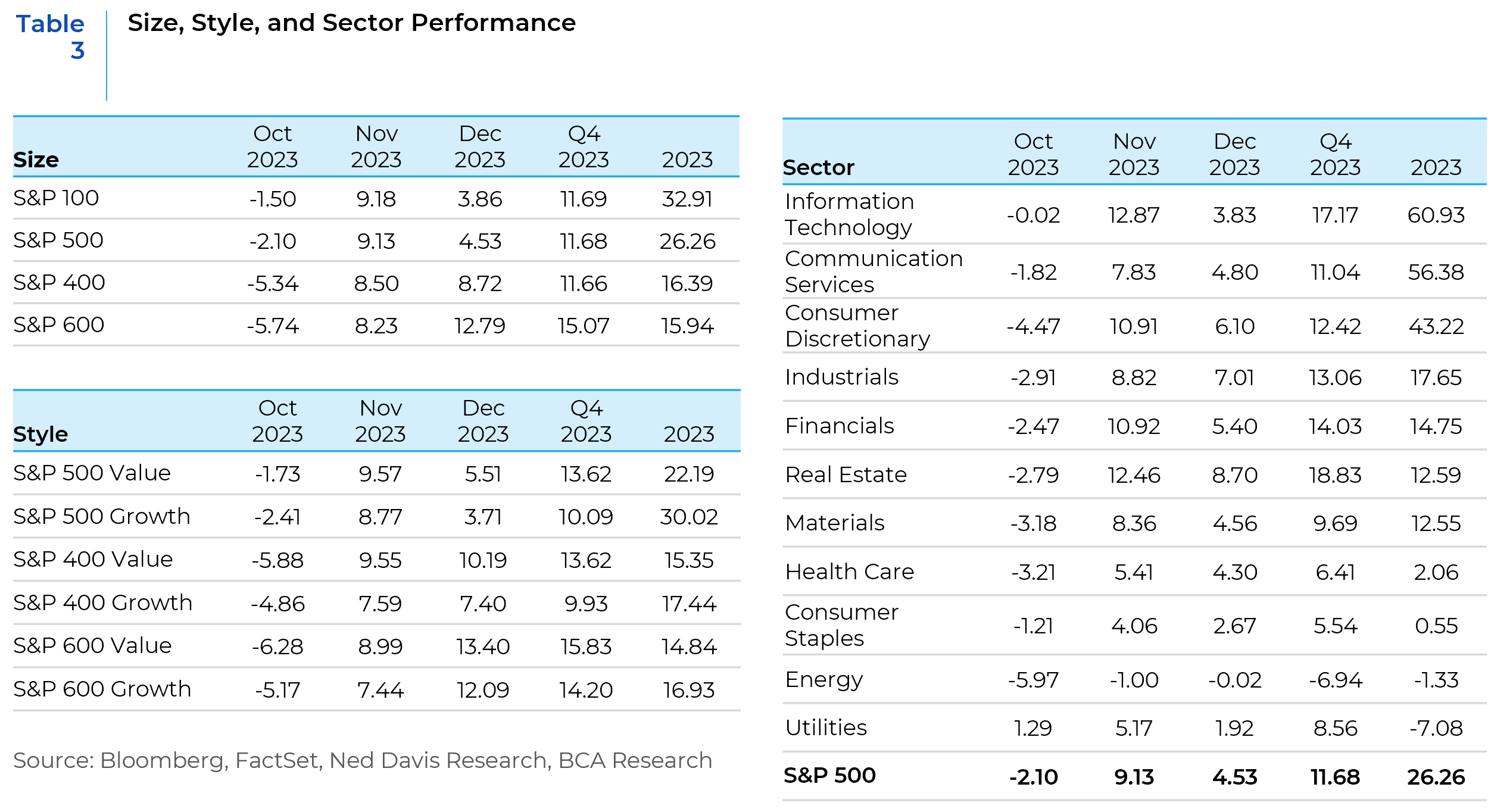

As 2023 drew to a close, the financial markets began to manifest the early signs of a soft-landing scenario, marked by a robust rally in equity markets in the fourth quarter, showcasing double-digit gains. This period was characterized by broadening of market strength, with notable outperformance by small-cap stocks, heavily shorted names, lower-quality companies, unprofitable tech, and a mix of long-duration, meme, cyclical, and value stocks. What drove market behavior was a combination of easier financial conditions in the last two months of 2023 which Federal Reserve officials acknowledged might reduce the necessity for further rate hikes, as well as ongoing disinflation, which led to a dovish pivot at the December FOMC meeting. This pivot, hinted at by a median dot plot suggesting 75 basis points of easing in 2024, fueled a positive feedback loop for risk assets and fostered optimistic investor expectations of a benign economic landing (Chart 1).

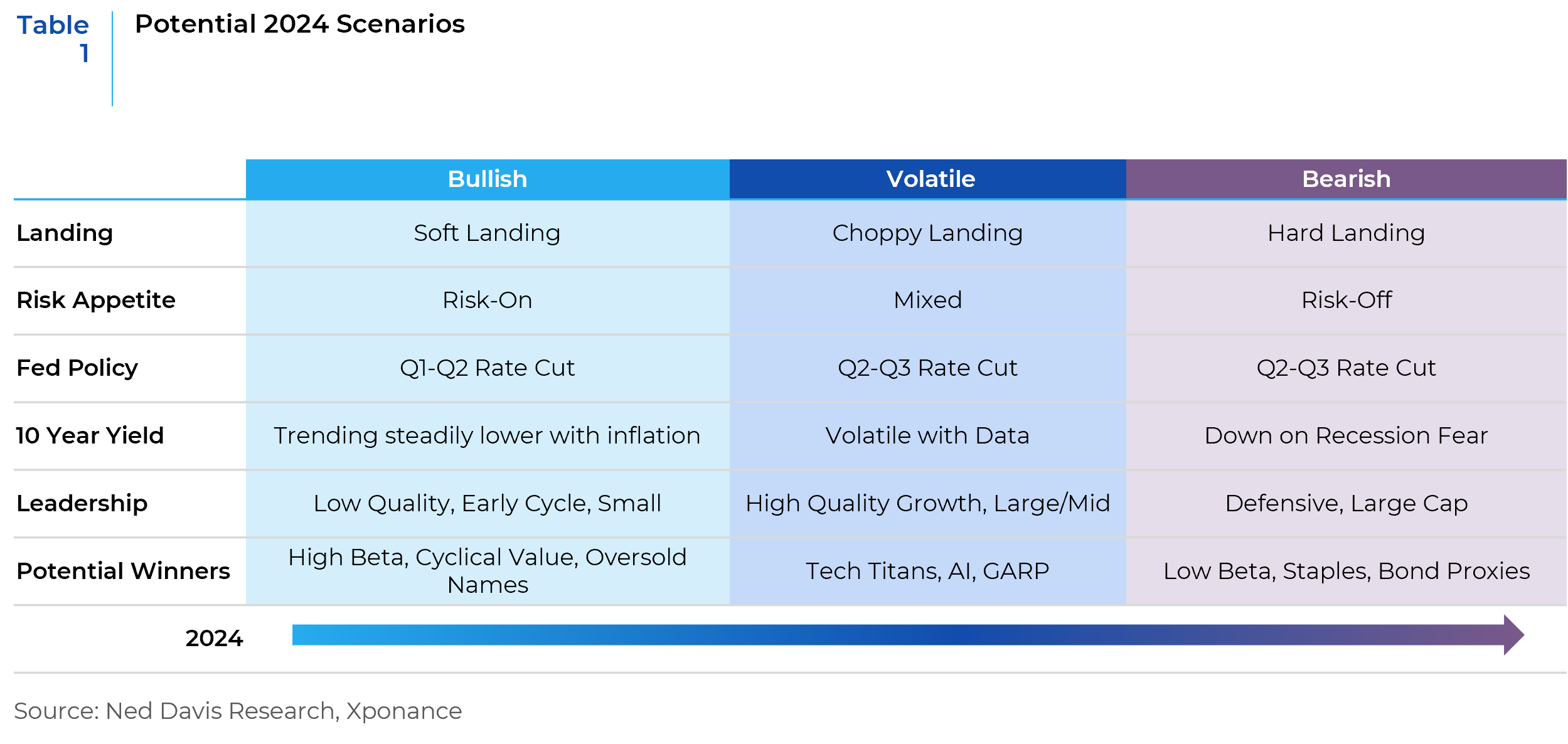

In 2024, we see the possibility of three different scenarios playing out as the year progresses – an economic soft landing which would be the most bullish for risk assets; a mixed landing, which would spawn market volatility; and a hard landing, which would be bearish for risk assets. Each scenario and the dynamics behind them are depicted in Table 1.

Bullish Scenario (Soft-Landing):

- Key Features: Inflation is under control, and a recession is avoided. Interest rates decline from their peak in October 2023.

- Market Impact: This scenario favors a rally in sectors that were previously underperforming, such as small-cap stocks. Lower interest rates could reverse the cautious stance of investors towards these sectors.

- Investment Strategy: Focus on sectors that are recovering, small caps, and possibly other beaten-down sectors from the past two years.

Volatile Scenario (Mixed-Landing):

- Key Features: Gradual decline in rates and inflation, with increased market volatility. The Federal Reserve might cut rates around mid-year, depending on economic data.

- Market Impact: Technology and communication services, particularly large and mid-sized companies, may continue to find favor with investors, especially if valuations of the largest tech companies are deemed too high.

- Investment Strategy: Diversification across technology and communication services, with a focus on value assessments of these companies.

Bearish Scenario (Hard-Landing):

- Key Features: Triggered by the Fed maintaining high interest rates for an extended period, leading to an economic slowdown in the latter half of the year.

- Market Impact: Defensive sectors, large-cap, and low-beta stocks are likely to outperform in this scenario.

- Investment Strategy: Emphasis on defensive investments, with a focus on large-cap and low-volatility stocks.

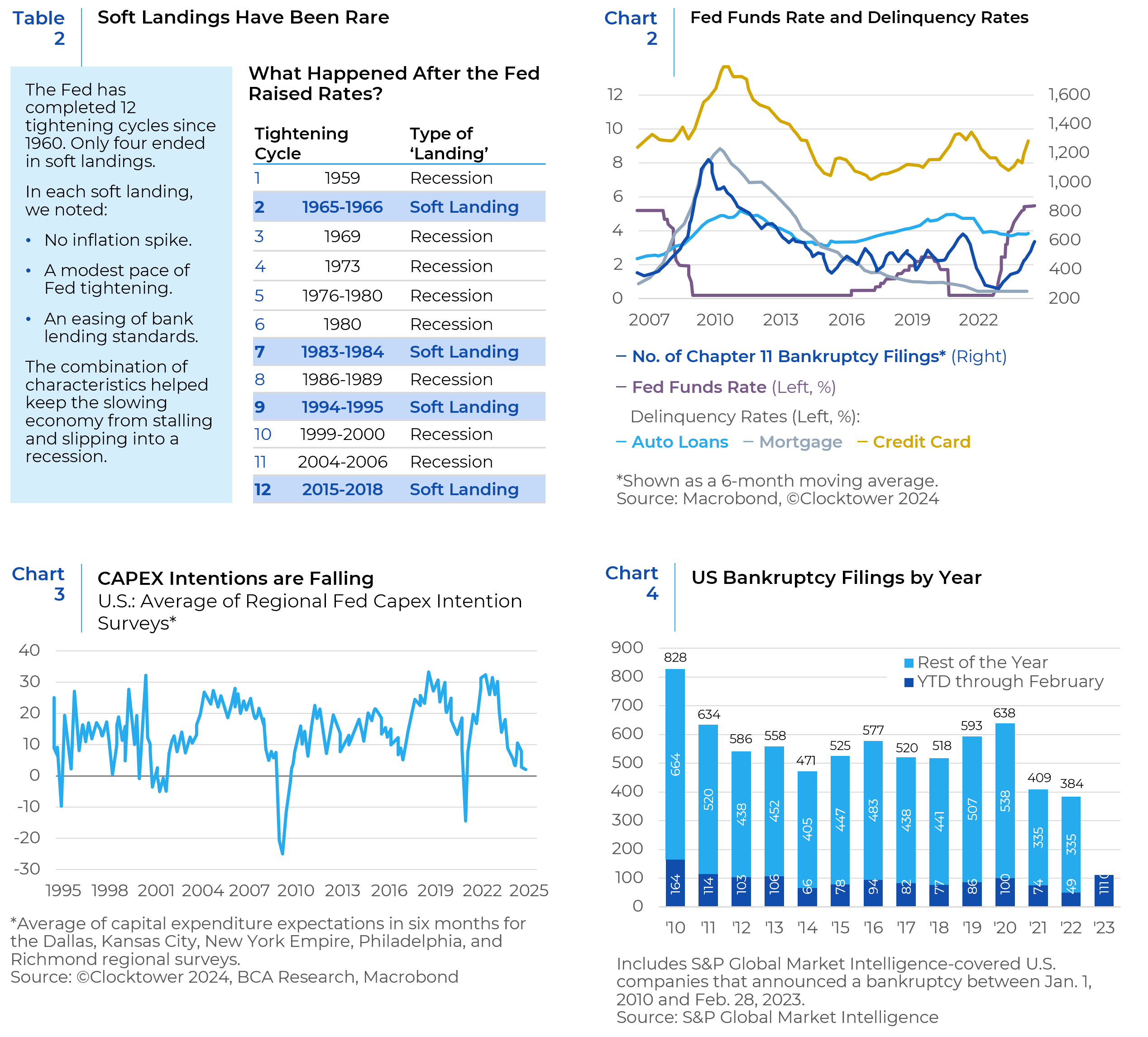

Market sentiments, as we closed out 2023, seemed anchored in the belief of sustained economic growth, a steady decline in inflation, solid earnings growth, and stability in geopolitical arenas, particularly regarding the situations in Ukraine and the Middle East. As we advance through the early months of 2024, there is a high possibility that the incoming economic data might prompt a recalibration of these optimistic expectations and create market volatility. Investors could face disappointment if the Federal Reserve does not initiate rate cuts in March, which the market has priced in. The federal funds futures market currently indicates over a 50% likelihood of a rate cut at the March FOMC meeting and almost a 70% chance of another reduction in May, with a similar probability for cuts at subsequent meetings throughout the year. We believe that these expectations might be overly optimistic, particularly considering that core inflation continues to hover above the Fed’s 2% long-term target. As shown in Table 2 below, soft landings are rare and hard to engineer and only occur under certain conditions.

Over the past 50 years, each time the Fed raised the federal funds rate by 300 basis points or more, regardless of the starting point, we experienced a sharp downturn in the economy. The current economic cycle, marked by a 525-basis point increase in federal funds rate since March 2022 – the most aggressive tightening since the early 1980s – is yet to fully reveal its impact on consumer spending and business stability. Despite the advantage of locked-in low mortgage rates for many households, the rising cost in variable-rate debts, such as credit cards, has strained disposable income, evidenced by the highest delinquency levels in auto and credit card loans in a decade (Chart 2). Simultaneously, an expected decrease in capex spending (Chart 3) and an increase in corporate bankruptcies signals potential challenges ahead for the business sector. (Chart 4).

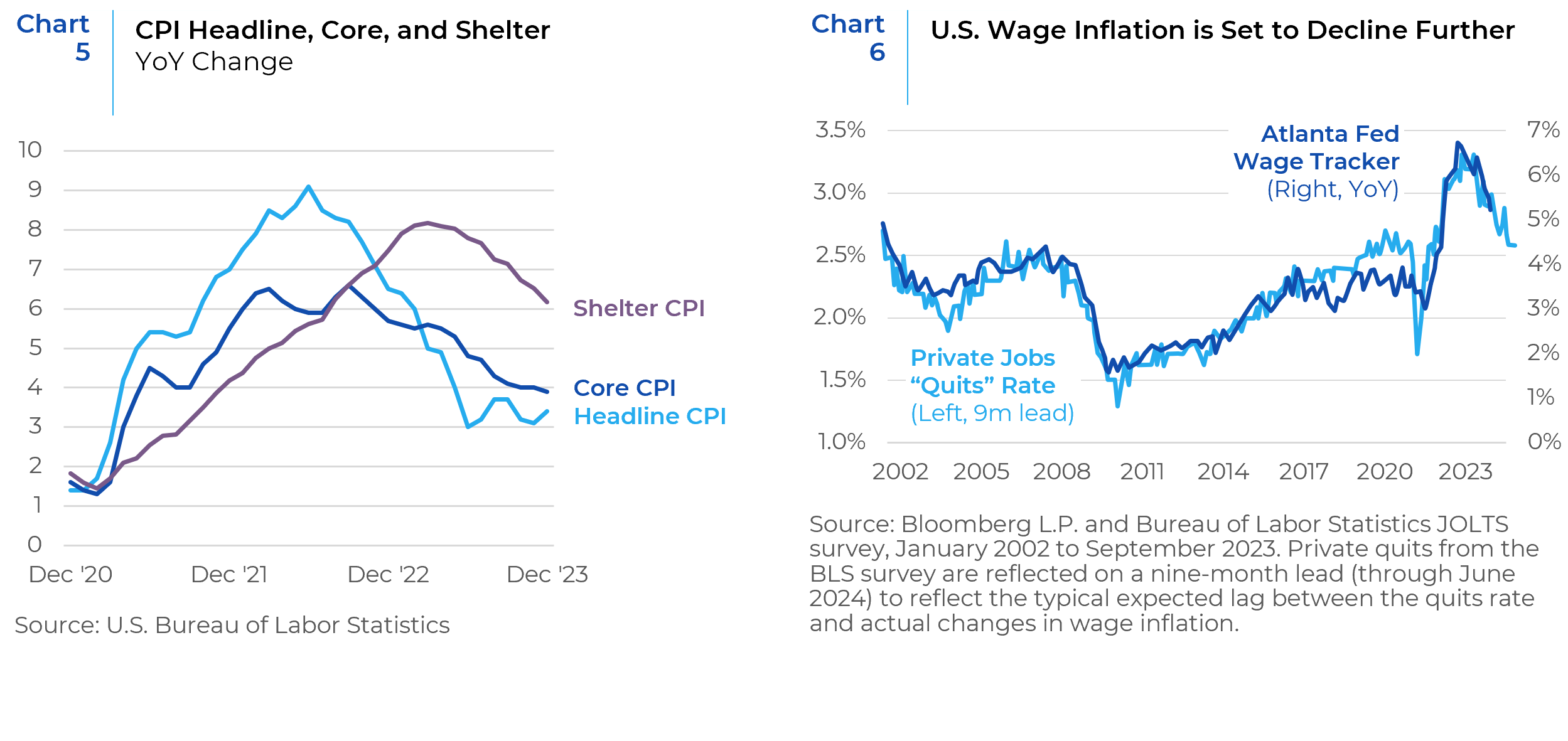

Inflation in the United States has clearly peaked, but just as in hiking, the risk of injury is higher when walking downhill than uphill. The peak of headline year-over-year U.S. consumer price inflation was recorded at 9.1% in mid-2022, which has since moderated significantly to 3.4% by December. This downward trend is also mirrored in core inflation, which strips out the volatile components of food and energy. Notably, shelter inflation has been on a steady decline for six consecutive months, with expectations of continued progress (Chart 5). Although wage inflation remains high, hovering above 5% annually, predictive indicators suggest a potential easing to around 4% in the coming year. (Chart 6). This trajectory sets the stage for a continued decline in inflation over the ensuing months and quarters.

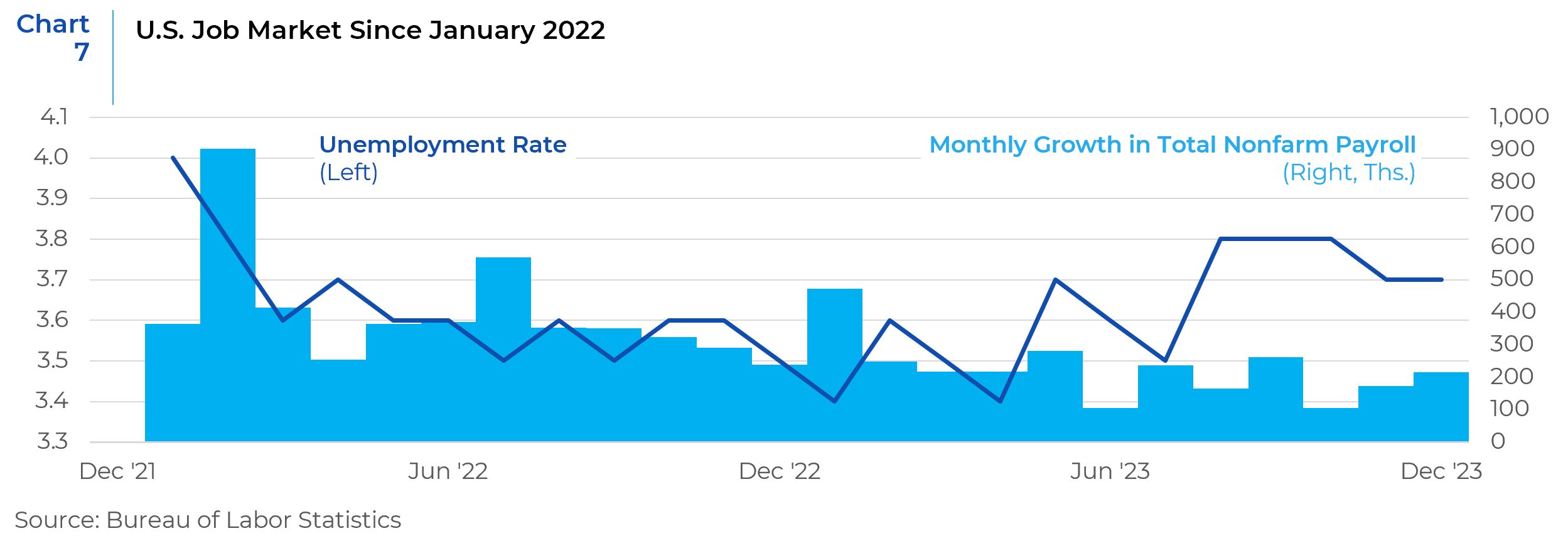

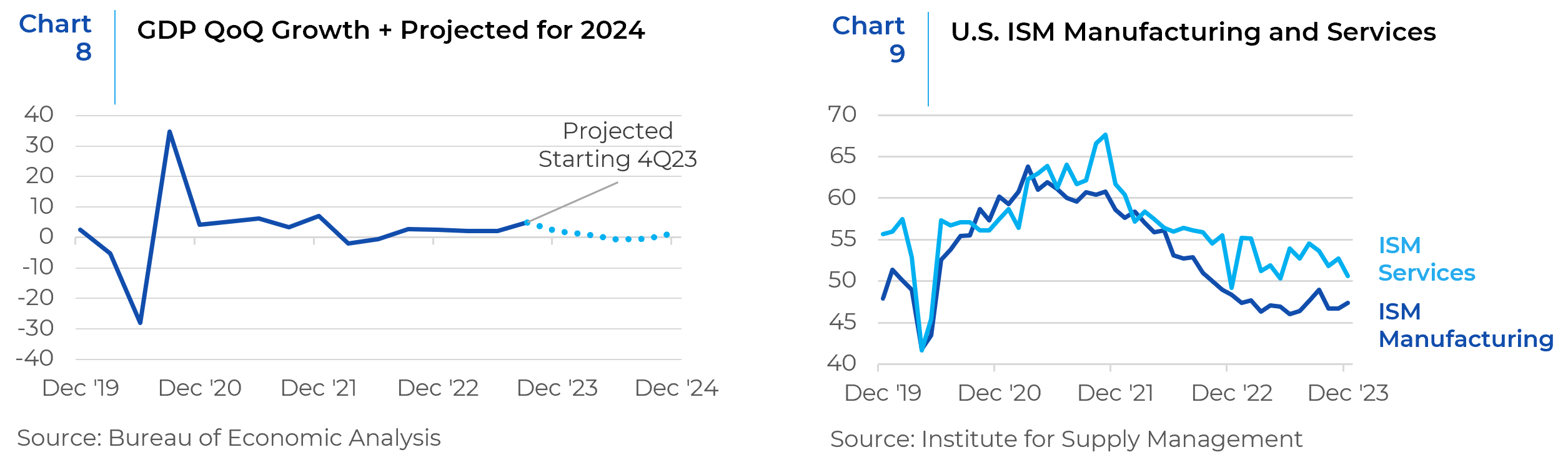

However, this optimistic inflation outlook comes at the cost of weakening growth prospects. A noticeable uptick in U.S. unemployment, rising by 0.5% from recent lows, coupled with a deceleration in job creation – from over 300,000 jobs per month at the beginning of 2023 to under 200,000 – signals a softening economy (Chart 7). While the consensus estimates for U.S. GDP growth in 2023 saw an increase of 2.0% earlier in the year, projections for 2024 paint a less rosy picture, with growth expectations reduced to -1.4% (Chart 8). Both ISM Manufacturing and ISM Services have also started to show signs of weakening (Chart 9). This scenario heightens the possibility of sliding into a recession or economic slowdown. Adding to this complexity are new geopolitical tensions in the Ukraine, Middle East, and East Asia. Consequently, a mild recession later this year seems increasingly probable. As economic growth slows and labor market conditions weaken further into the year, a shift towards rate cuts by the U.S. Federal Reserve may be anticipated, likely around mid-year.

The prospects of a cooling economy coupled with declining inflation has fueled expectations of a soft landing for the U.S. economy, a sentiment often observed towards the end of economic cycles. Such phases can be misleading as they resemble soft landings in their initial stages, only to potentially lead into recessions. The gradual erosion of the labor market, marked by increasing unemployment, reduced average working hours, and a narrowing range of industries reporting job growth, underscores the potential risks ahead. The current trend doesn’t offer strong indications of an imminent reversal, suggesting a continued economic slowdown that might elevate unemployment levels enough to trigger a recession. On a brighter note, the overall situation might lead to only a mild recession. This outlook is bolstered by the relatively robust fundamentals of households and the business sector. Additionally, certain industries such as housing and autos have already experienced downturns, which could potentially limit the depth of the anticipated 2024 recession. However, this period is also likely to see a growing divide between weaker and stronger segments of consumers, businesses, and industries. This bifurcation emphasizes the importance of prudent and active stock selection in navigating the uncertain economic landscape ahead.

Fourth Quarter Market Recap

References: Barclays Research, BCA Research, Alpine Macro, RBC, Raymond James, Credit Suisse

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.