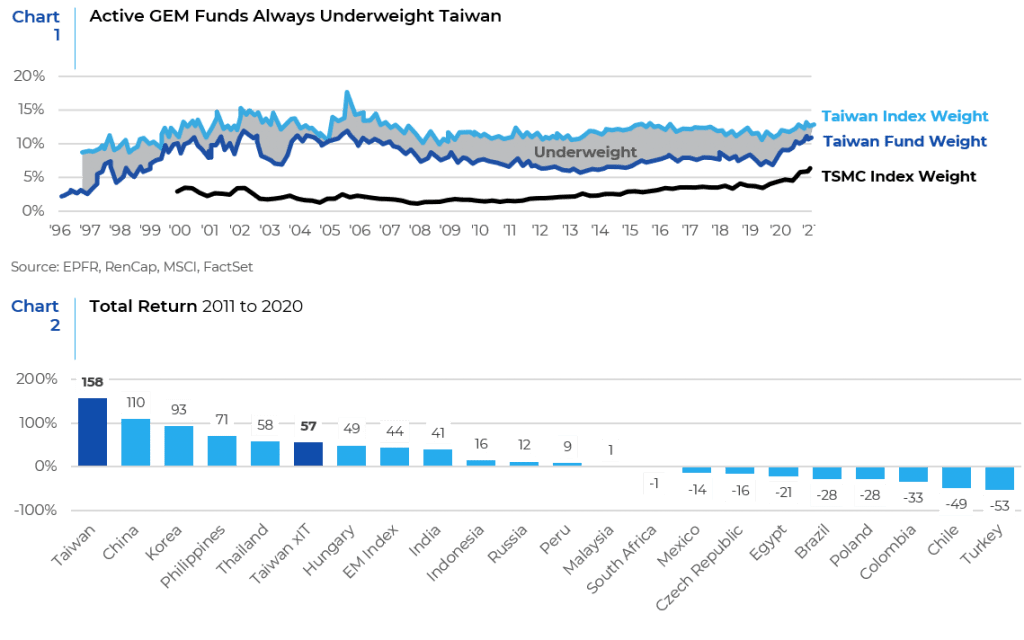

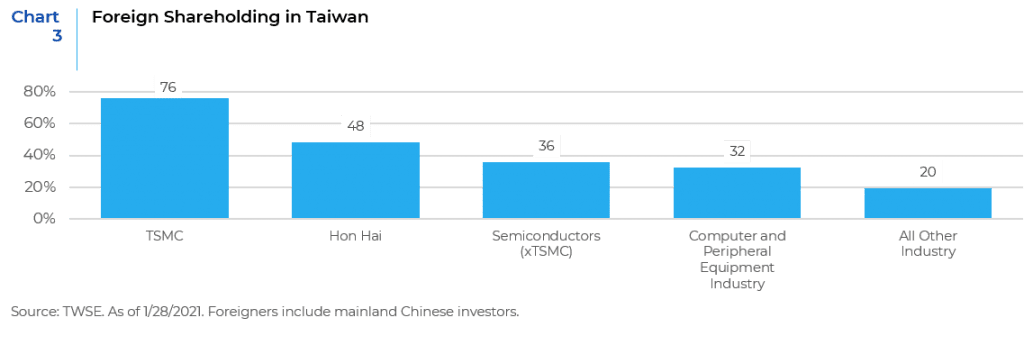

The best performing emerging market of the past decade gets no love from investors. Taiwan is a perennial underweight for active global emerging market (GEM) funds (see Chart 1), despite being the best performing market over the past decade (see Chart 2).

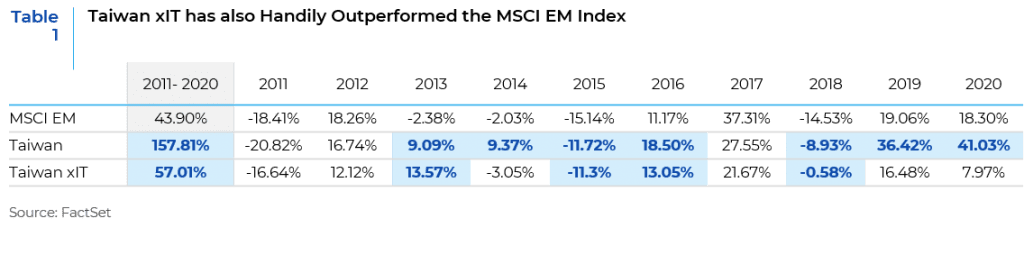

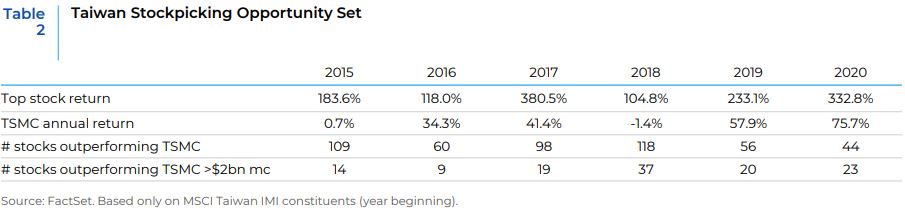

Moreover, the disregard from GEM managers is even more pronounced outside of the major market champion, Taiwan Semiconductor Manufacturing Co. (TSMC) and a handful of other tech and electronics companies (see Chart 3).

Yet, the data indicates this is unjustified. While Taiwan’s huge IT sector (led overwhelmingly by TSMC) has represented the bulk of the market’s returns over the past decade (+241% cumulative), Taiwan xIT has also handily outperformed the MSCI EM Index over this time, with especially strong downside protection (see Table 1).

Where is the Herd?

Defying the behavioral biases that seem to be plaguing other markets, Taiwan’s decade of outperformance has failed to attract the attention of independent fund managers both GEM and Asia specialists. Those who “disregard” Taiwan generally fall into two camps:

- “Development diehards”, who ignore Taiwan because they deem it an already rich country, “emerging” in name only, without the potential of outsized market returns based on the tailwinds of demographics and concomitant economic growth.

- The tech uninitiate, who see Taiwan as a glorified Apple supply-chain market and feel they can just buy TSMC at index weight and spend precious travel and research time on their “core areas of competence”.

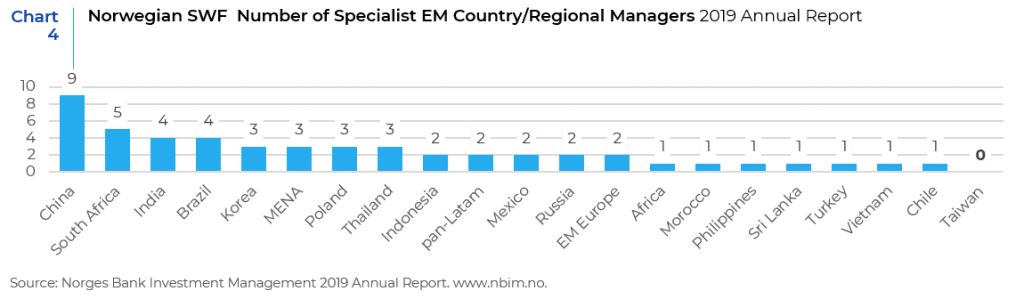

Adding insult to injury, Taiwan gets no love at home or from its neighboring markets either. One of the largest local independent asset managers in Taiwan, with over $2bn in AUM and a team of 76 people ( 63 of them in Taipei), offers a half dozen different strategies in Chinese equities, but not a single one for Taiwan. Taiwan’s largest asset management business (with over $35bn in AUM and a 15% market share) told me recently that there is simply “no market for active Taiwanese equities” (most of their business is in ETFs and smart beta products). Even Norges Bank, famous for their use of local EM specialists, has not a single allocation to a dedicated Taiwan manager (see Chart 4)! A former analyst for one of the world’s largest multi-managers with over $300 billion in AUM, told me in a recent interview that the lack of specialized expertise in Taiwan was the main obstacle preventing them from launching their version of a global EM multi-manager product using country specialists.

Part of the problem may be with Taiwan’s market champion, TSMC. The enormous weight of TSMC in the index (now over 30% of the local TAIEX index and 46% of the MSCI Taiwan), is a material barrier to local active managers given market regulations. Local Taiwanese regulations limit single stock weights to 10%, without any index relative weighting in active funds, whether for government pension funds or mutual funds. Given the exceptional returns of TSMC over the past decade, this makes it difficult for active managers to outperform. Many, including some of the firms mentioned above, have thus taken to closing their active funds and shifting to passive funds and ETFs. Local regulations do allow active funds to own ETFs at high portfolio weights, allowing managers to increase their weight in TSMC indirectly through local sector ETFs, but fees are a steep 50-70bps, serving as a drag on fund returns. Meanwhile, restrictive regulation has essentially eliminated the local market for independent hedge funds altogether.

There are talented specialists in the Taiwanese equity market; however, most of them can now be found (or are at least headquartered) in Hong Kong or Singapore. There, they have been increasingly drawn towards the booming market in Chinese e-commerce stocks, so most talented Taiwanese specialists are actually running tech or consumer/tech funds focused on “greater China.”

The Taiwan Opportunity

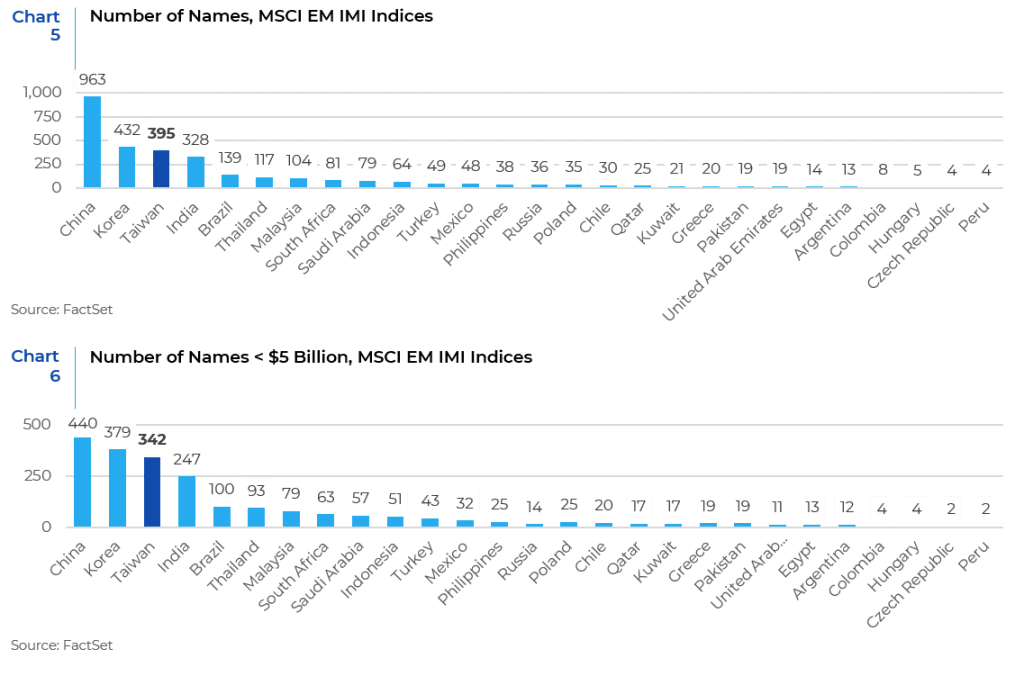

This phenomenon of relative “indifference” has created one of the world’s deepest markets in neglected (and attractive) small and mid-cap stocks. Of Taiwan’s 395 “investible” companies, (as classified by MSCI), 342 are under $5bn and thus effectively cut off from most global EM funds (73% of the market is less than $2bn market cap, see Charts 5 and 6). Meanwhile China has over half of its investible market in large cap stocks.

Thus, investors are ignoring an abundance of potential alpha from high performing, liquid stocks beyond just TSMC. The Taiwanese market is well known for above average corporate governance and healthy dividends. Moreover, Taiwan increasingly appears to be a safe haven economy due to its fiscal prudence, monetary orthodoxy, and super effective public health management. In our opinion, GEM investors should give Taiwan a second look and more love in the 2020s!

To learn more about how Xponance employs local experts in Taiwan, please click here›.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.