Tariffs, Tension, and Opportunities

Understanding the interplay of policy, market sentiment, and regional dynamics is critical for successful investment positioning in this era of renewed protectionism and global economic realignment. Donald Trump’s return to the U.S. presidency has reignited trade policy uncertainties, with potential tariffs, immigration restrictions, and fiscal measures poised to reshape economic dynamics worldwide. These policies, discussed at length in our recent research pieces (I, II, III), are centered on U.S. interests but have significant spillover effects for global equity markets.

This paper delves into the possible impact of these policies on non-U.S. equity investments, examining the effects across regions, styles, and capitalizations. It explores what is already priced into the markets and identifies potential shifts if the Trump administration adopts a more moderate policy approach than anticipated.

Analyzing the potential impacts of Trump’s proposed trade policies solely through the lens of first-order effects risks overlooking broader, more complex dynamics. Retaliatory trade measures by affected nations, shifting supply chains, and the realignment of geopolitical and economic alliances could significantly alter the anticipated outcomes. While initial effects such as tariffs and policy shifts might seem straightforward, the interplay of these second- and third-order consequences underscores the necessity of maintaining flexibility in your allocation decisions, since a more nuanced and comprehensive analysis is likely to produce precision without accuracy. This report attempts to peel back some of these layers but recognizes the need for a patient, watchful eye in the coming year.

What Is the Market Currently Discounting?

The immediate market reaction to Donald Trump’s reelection has been mixed. While equity markets in the U.S. surged, driven by expectations of deregulation and fiscal stimulus, non-U.S. markets have displayed muted optimism. A popular narrative for this divergence lies in region-specific vulnerabilities and varying exposure to trade disruptions. The data relating to this narrative is mixed, at best.

In Europe, fears of auto tariffs and industrial goods levies continue to weigh on sentiment. Despite corporate reform tailwinds, Japan’s Large-Cap equities are vulnerable to currency appreciation as the yen strengthens amid global uncertainty. While poised to benefit from supply chain realignments, emerging markets such as Mexico and Taiwan remain sensitive to broader geopolitical shifts and dollar strength.

Economic Forecasts

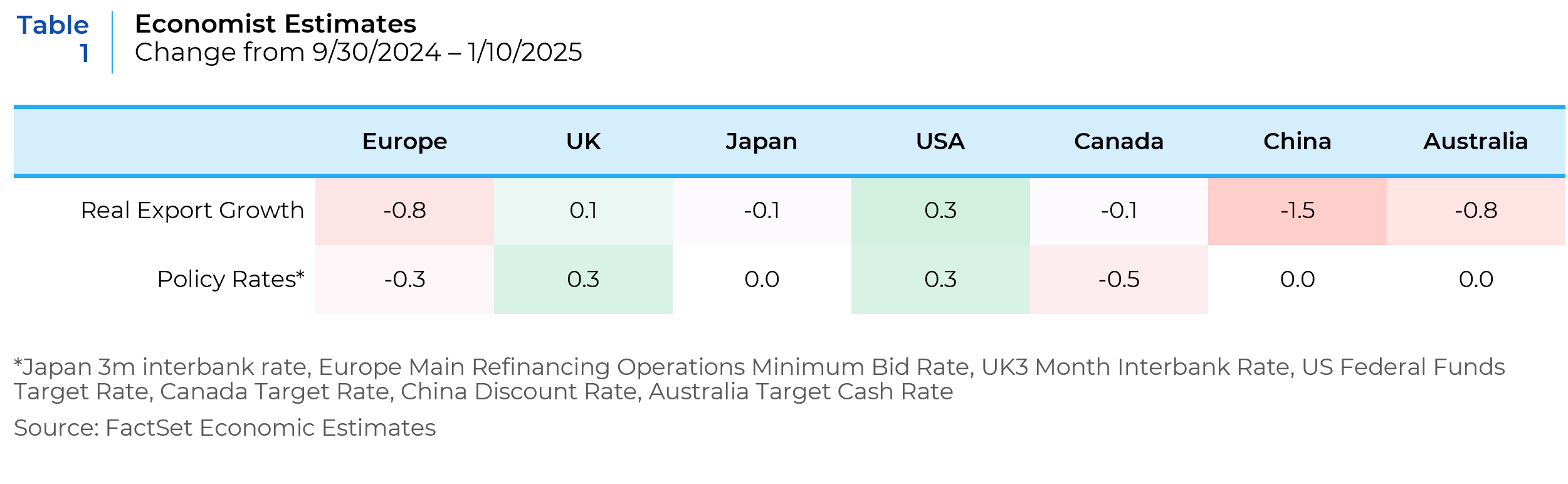

The easiest way to gauge professional forecasters’ expectations is to measure them directly. Since it became clear that President Trump was likely to win the election, Table 1 summarizes the change in economic estimates for Export Growth and Policy Rates, which we would expect to be sensitive to global trade policies. The data is always multidimensional and noisy, but at a high level, they tell of the expected slowing of exports in most major markets and associated pressure on central banks to loosen Monetary policy to combat slowing growth.

Market Action

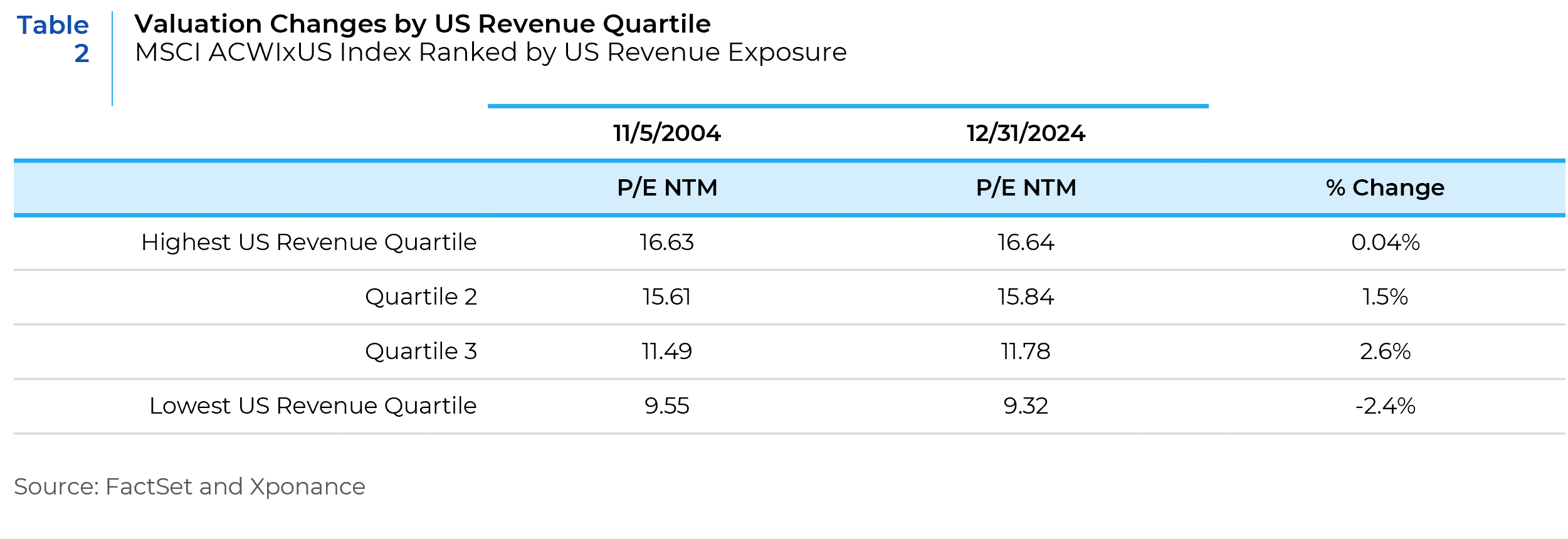

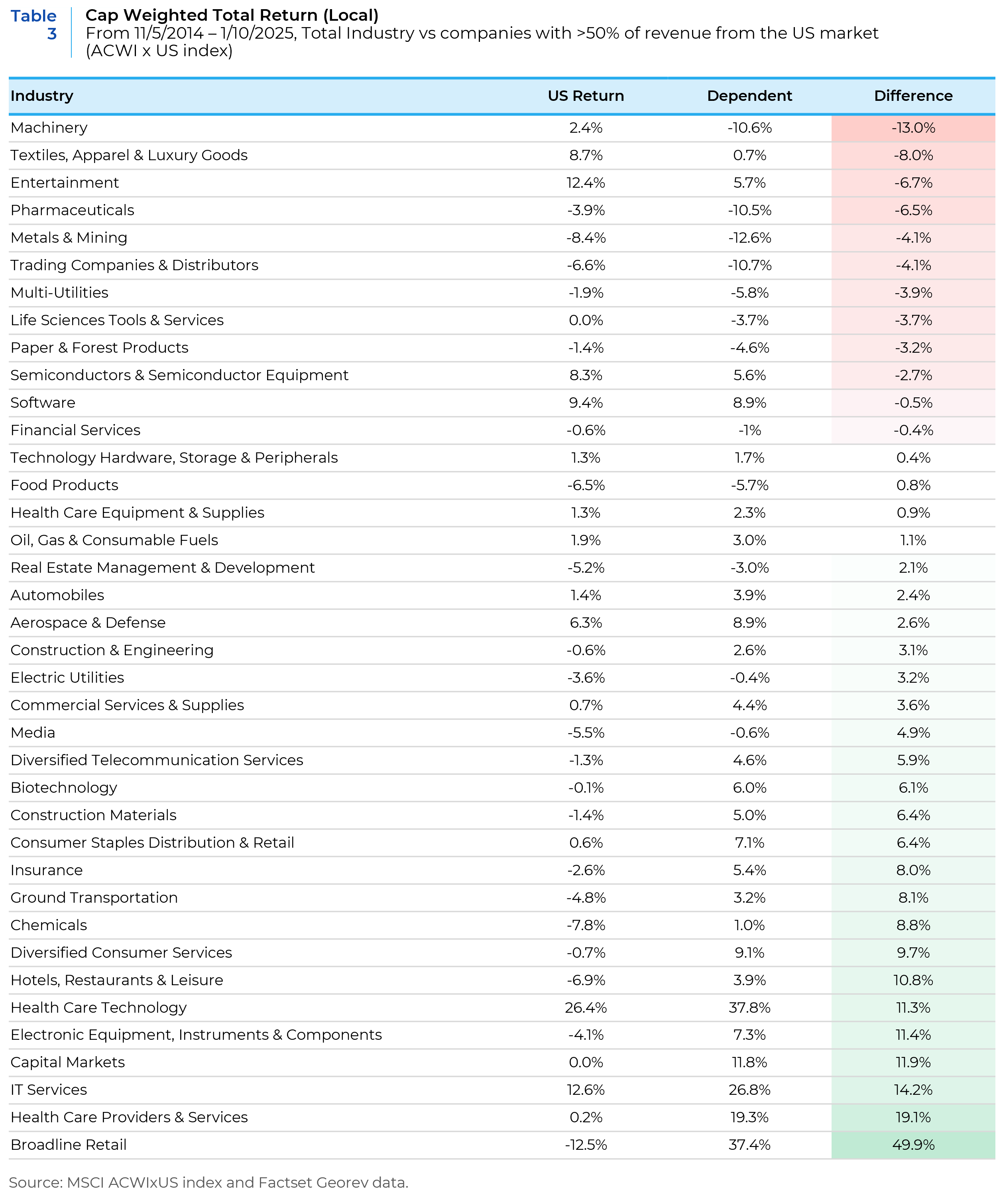

Table 3 tells a different story when looking at stock level performance. A first test to see if the market is taking US revenue exposure as a primary risk factor we break the Non-US market into quartiles based on US revenue exposure and see if there has been valuation expansion or contraction. Based on the data in Table 2, we can clearly see that US revenue exposure is not viewed as a primary risk at the stock level. However, US revenue exposure comes with a host of industry and size biases that could mask a true signal. To normalize for some of these biases we went to the industry level. Table 3 compares the cap-weighted performance of various industry groups from the ACWIxUS index. We compare the entire industry’s performance to stocks with greater than 50% of their revenue from the US market (excluding industries with no stocks above 50%). With some minor exceptions, stocks do not appear to be pricing on specific risks associated with US trade policy, which could represent an opportunity for stock pickers with a strong view of future trade policy.

Outlook on the Effects of Trade Policy on Global Equity Opportunities

Europe

Both high-tech and traditional manufacturing industries are dependent on US buyers. Biotech and Pharmaceuticals generate close to half of their revenue from the US market. Most manufacturing industries, such as autos and machinery, have a significant portion of their revenue tied to the US. This could exacerbate structural issues in economies like Germany, which already grapple with productivity challenges and high energy costs. Disruptions or delayed realignment of supply chains could add to the inflationary pressures of rising energy prices in Europe. Other risks include political instability in major economies, and constrained fiscal flexibility to offset external shocks.

However, aggressive European Central Bank easing to deal with negative trade shocks could present tactical opportunities in underpriced European stocks.

The most likely path for European large cap equities will be negative in the near term. In the longer term, Trump’s ”America First” foreign policy and increased tariffs could provide a domestic political foil for nascent attempts at productivity-enhancing reforms, which could positively affect risk assets. In Germany, for example, the Bundesbank calls for more productive capacity investment.

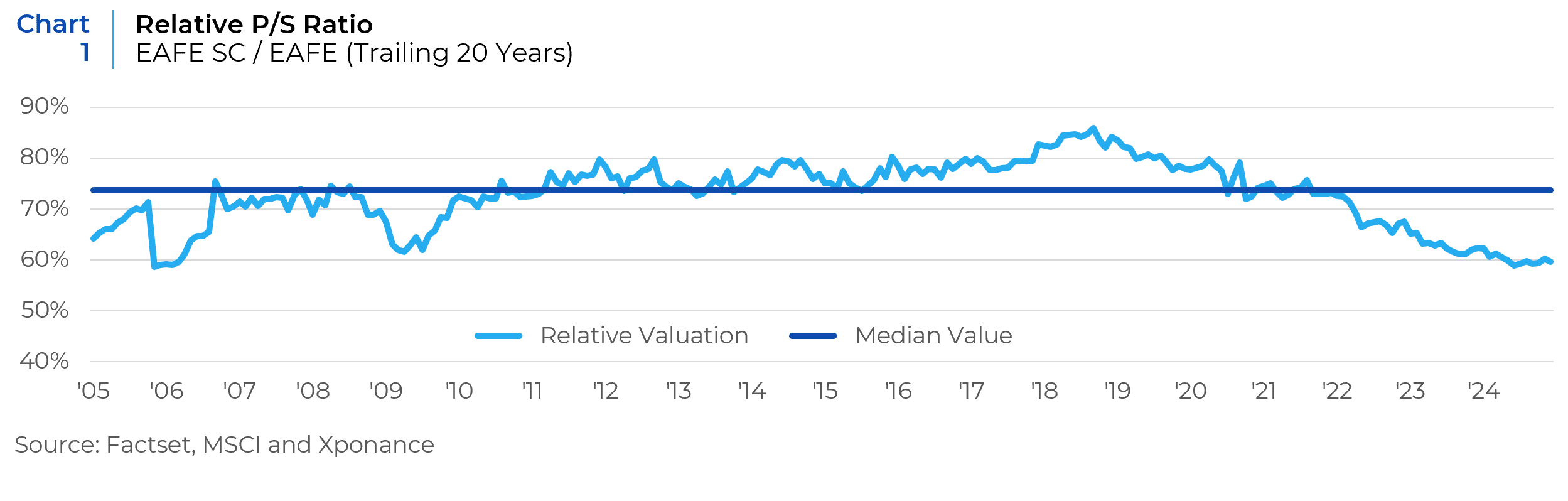

Over a multi-year horizon, a trade war will likely weigh more heavily on European large-cap stocks than on small caps companies, which are more domestically orientated. In the near term, heightened policy uncertainty, a stronger U.S. dollar, supply chain realignments, and postponed capital expenditures could weigh on European small-cap equities. However, in the developed market, small-cap companies are trading near 20-year lows in relative valuation (Chart 1) compared to their large-cap counterparts. While cheap valuation is not always indicative of limited downside risk. Recent market movements have shown small caps being more resilient during pullbacks. Historically, the EAFE Small cap index has a beta of 1.1 during market drawdowns. During the 4th quarter, small caps outperformed slightly during the quarter when MSCI fell by over 8%.

Japan

Domestic reforms and reduced export reliance are insulating factors. However, industrial sectors remain exposed to global trade slowdowns, and a strengthening yen increases the challenges for exporters. For example, Japanese automakers generate nearly half of their revenue from US trade. Outside of the export-specific industries, long-term positive trends in Japan remain, such as reflation, corporate reform, and improved investor risk tolerance. Despite that, second-order effects bear watching— increased interest rate volatility could disrupt the yen carry trade—prompting a sudden unwinding of these positions and exerting upward pressure on the yen and global risk-taking.

Japanese small-cap stocks are more immediately attractive. They will benefit from a strengthening Yen due to primarily local market revenue. In addition, moderate wage inflation and a steeping yield curve should benefit the sector positioning of the small-cap index, which has a higher number of Japanese banks and local consumer companies.

Emerging Markets

Chinese equities have minimal exposure to exports to the U.S. and are far more levered to Chinese property and consumer demand, which remains caught in a liquidity trap. Encouragingly, the December Politburo has shifted its rhetoric to reaffirm Beijing’s intention to prop up the economy further in 2025. China has already adjusted to a more hostile trade environment by offshoring production to U.S. allies. Thus, the threatened 100% tariff on cars imported from Mexico could affect EV car companies. Mexico, Taiwan, and Korea have much more exposure to U.S. imports. Still, Mexican risk assets have already traded down both from the summer’s election results and again since Trump’s election, with the equity market losing almost a third of its value in 2024, yet only 10% of revenues in the Mexican equity market emanate from the U.S. Other leading exporters to the U.S. in Korea and Taiwan are reliant on the chip trade. Semiconductor onshoring was a Biden-led initiative that so far has appeared politically uninteresting to Trump. Thus, there are few expected direct implications to EM equities from potential Trump policies.

Risks and Opportunities if Policies Are Moderated

The Trump Administration’s aggressive trade stance could face domestic political constraints or economic realities (as discussed in Part III), leading to a more tempered approach. Such a scenario would reduce the likelihood of retaliatory trade measures and provide relief to export-heavy economies. It does not appear that markets are discounting the full implementation of the incoming administration’s tariff plans (at least at the stock level). A significantly subdued trade policy would likely be positive for European markets, where investors would focus on the valuation, structural reforms and monetary support. Japanese equities are less impacted in either direction, with the biggest beneficiaries likely decided by the strength of the Yen (with a strong Yen benefiting small cap stocks more).

Analyzing the potential impacts of Trump’s proposed trade policies solely through the lens of first-order effects risks overlooking broader, more complex dynamics. Retaliatory trade measures by affected nations, shifting supply chains, and the realignment of geopolitical and economic alliances could significantly alter the anticipated outcomes. While initial effects such as tariffs and policy shifts might seem straightforward, the interplay of these second and third-order consequences underscores the necessity of maintaining flexibility in allocation decisions.

Trump’s trade policies, while disruptive, present opportunities for selective positioning across equities and currencies. Key sectors like European industrials and Japanese exporters face immediate pressures while emerging markets like Mexico and Korea could benefit from supply chain realignment. However, significant risks arise if these policies fail to materialize, highlighting the importance of actively managed and flexible investment strategies.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospective clients for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.