Geopolitical uncertainty, war, and commodity price shocks have been the headline talking points for the industry in 2022. These certainly contributed to the current stagflationary pressures in the market, however, the structural underpinnings of a significant regime change have been in place and were largely ignored by professional investors, strategists, and economists (see our Q4 2022 Market Outlook entitled The Times They Are A-Changin’). The result will appear to anyone relying on such forecasters as if the market’s prophets appear like the suits in the below cartoon.

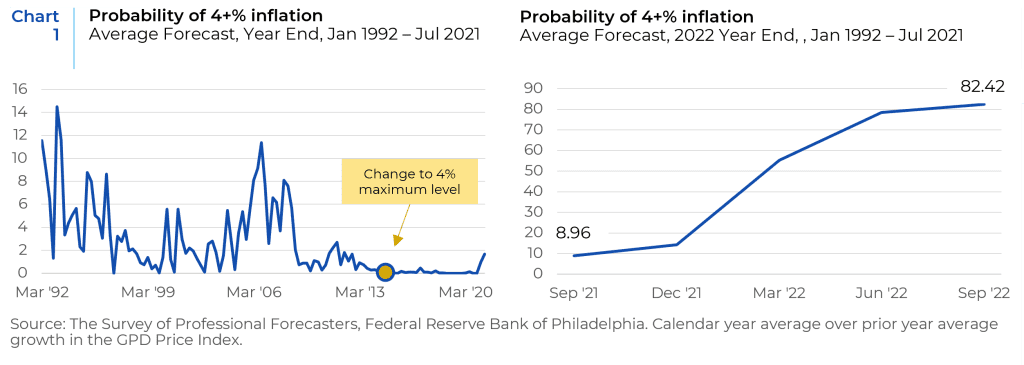

One possible explanation for this apparent myopia is simple complacency brought on by a period of historically low volatility. That was certainly true for anyone trying to predict inflation. A perfect example of institutional complacency is the Survey of Professional Forecasters, which is the oldest quarterly survey of macroeconomic forecasts in the US (run by the Philly Fed). As part of the survey, they ask professional economists to forecast the probability of various year end inflation numbers. For the GDP price index, the survey offered ranges from negative through 8+% inflation from 1992 until 2014. In 2014, the upper range was adjusted to 4+% (see Chart 1). We should not be shocked by group think when the national arbiter of inflation views outcomes above 4% as unlikely enough to group as tail events.

After 30 years of never having to seriously consider 4+% inflation. Professional economists had to adjust their probabilities 10-fold in the last 12 months (see Table 1). We only hope they don’t have to dust off the scales used in the mid-70s (ironically, they started at 16+% and grouped all outcomes below 3% inflation together in a truncated tail group).

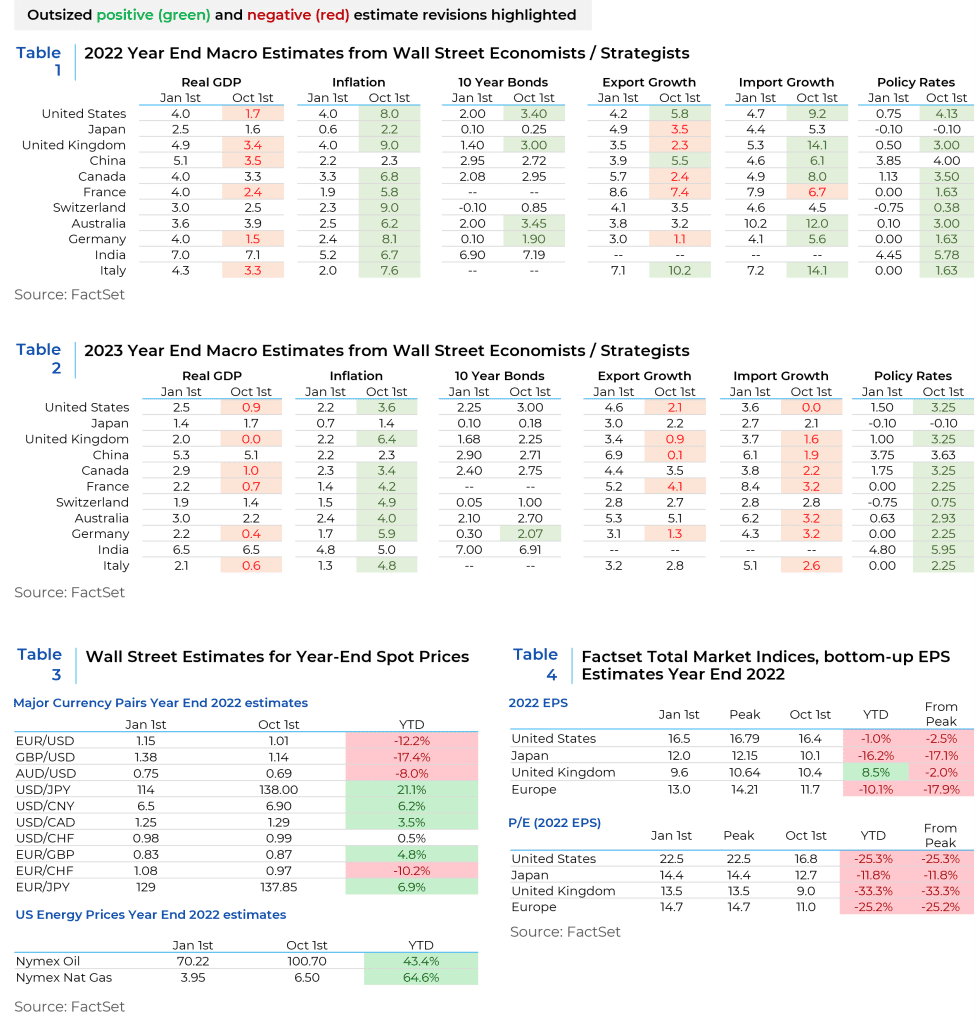

Investment professionals faired no better in identifying this regime change. All key variables impacting equity markets required extreme in-year adjustments.

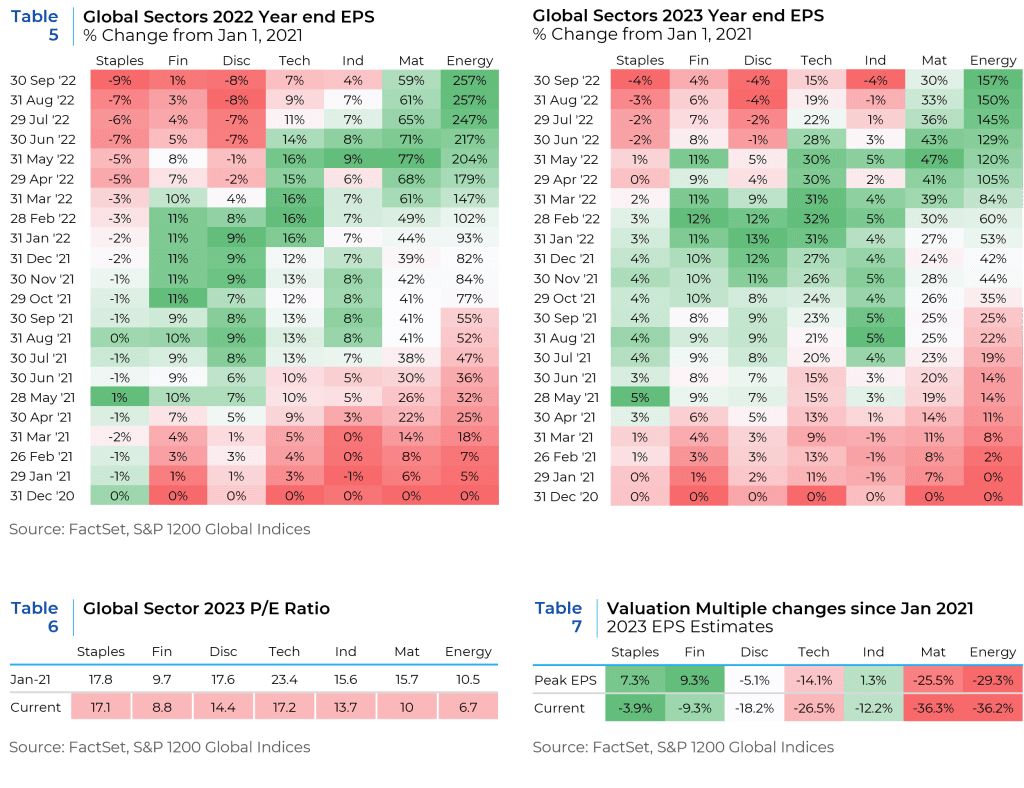

In the global sector forecasts (below), we can see the steady evolution of the forecasters predictions by sector and the radical change in estimates in energy and materials companies even from month to month.

In light of the profound struggles of our industry’s economic weather forecasters to correctly predict today’s storm roiling the markets, we turn instead to the bottom-up insights of our boutique managers (most of whom do not pay for or follow such forecasting data anyway) for their views on today’s inflationary spiral and market swoon. We asked a selection of our high conviction portfolio managers about the current macro environment, how it compares to prior episodes of macroeconomic market madness in their careers, and how they are (or are not) changing their approaches or positioning in the current environment.

Relative Value – International Equities Boutique

Based in Princeton, NJ – Bayard Asset Management

For Bayard, while macroeconomic factors are always considered, as a highly concentrated, bottom-up investor, the impact on the portfolio is usually moderate-to-low. However, “since Q4 2021 though, understanding the global inflation impulse and how central bankers around the world would respond to it, has become a key step in managing our exposures, weighting sectors and determining portfolio beta. We think that this unusually prominent seat at the table that macro analysis currently enjoys in our investment process is likely to continue for some more time – at least till most of the incremental negative news we still expect on services inflation, followed by interest rate increases by central banks and resultant downward earnings revisions, rising discount rates and expanding equity risk premia is fully discounted by equity markets. The big macro driven opportunity, we think, will be to re-weight significantly into economic recovery plays – small caps, cyclicals and the like – but, we feel there’s still some wood left to chop before we get to the point that marks the start of a sustained economic and market recovery.”

Core Growth – Global Small Cap Equities Boutique

Based in Chicago, IL – Lizard Investors

For Lizard, “this is the most challenging investment environment we have faced as small cap international investors.” “In the near term, the macro risks are driving us away from exposure in certain geographies,” especially Europe. Longer-term, however, Lizard offered this perspective:

“Most economists think the US is best positioned to navigate the economic pain and will deliver good economic growth over the next decade. However, a contrarian view may be more prudent. In 2008 the US Dollar hit a low against a basket of other currencies as measured by the DXY Index. This helped to fuel American competitiveness, growth and equities for the next decade. Today, in late 2022, the US Dollar is at a 30 year high. Europe will get through this energy crisis and inflation will subside. When this happens, the rest of the world will have cheap currencies that will fuel economic growth for a sustained period. Valuation in non-US equities on an absolute and relative basis (compared to US equities) are both very attractive. While the precise timing is unknown, our bet is that a meaningful reversal in market leadership is coming and will favor non-US assets for an extended period, especially when measured in US Dollars.”

GARP – Global Equities Boutique (long only and hedged)

Based in San Francisco, CA – Trinity Alps

“We believe that central banks are no longer behind the inflation curve and may in fact be ahead of it. Inflation break-evens have moved back into the 2% range. Our bottom-up work suggests that 85% of the components in CPI are now deflating on a month-on-month basis. We believe this will continue to take some time to play out, but this has several implications for our strategies. First, cyclical stocks are already pricing in substantial earnings downgrades and recession. Second, quality global growth stocks de-rated as the market priced in higher discount rates. Combined with the substantial depreciation of the GBP and EUR, valuations across Europe look extremely attractive.”

“Elevated risk premiums are likely to persist until some subset of the following happens: 1) Headline inflation begins to decline; and/or 2) the Russian war ends. Economic growth is getting increasingly scarce globally, and those companies that can demonstrate secular or cyclical growth will be more value and eventually re-rate. Finding secular growth that is misunderstood will redefine quality growth in the next cycle. We believe that we are very near to that inflection point, with global stocks offering generationally inexpensive valuations, just as inflation peaks.”

Core Growth – Global Equities Boutique

Based in Boston, MA – Redwood Investments

“A multi-polar, geopolitically tense, and inflationary world requires a different playbook from the one used by many investors over the last 20+ years. As the economic and Central-Bank liquidity-induced tide goes out, investors will finally see which countries, sectors, and companies are swimming without bathing suits. Specifically, we have and will continue to see significant divergences in country performance, even within similar industries and business models. 2022 has mostly been a matter of betas, but as the world enters a recession the fundamentals will increasingly diverge, setting up for real opportunities for alpha generation.”

Redwood is increasingly intrigued by emerging growth themes due to three particular trends:

- “Energy fundamentals and the security of supply have moved front and center as Europe battles to keep its lights on and heaters pumping this upcoming winter. In our view, the most obvious long-term beneficiary is seaborne LNG and related infrastructure, including containment systems.

- The global impulse towards digital transformation that accelerated during the COVID-19 pandemic remains intact. While a recession will impact growth rates in the immediate term, the promise of increased productivity, profitability, and resilience from digitalization is a multi-decade driver of adoption.

- The Emerging Market consumer represents the greatest driver of consumption over the long term. Macroeconomics can wreak havoc on these less mature economies in the short term, but we remain focused on the fact that ~90% of the world’s population under the age of 30 years old resides in emerging countries. These consumers are underpenetrated in terms of consumption/capita, smartphone penetration, travel & leisure, and transportation.”

Core Growth – Global Equities Boutique

Based in New York, NY – Fithian Investment Advisors

“We are reminded, once more, of how quickly Wall Street changes its thinking. Venture capital firms have switched almost overnight to demanding profitable growth from companies. Just a few months ago, only top line growth mattered. We never bought into that logic: the lack of financial discipline seemed misguided to us. We have invested only in companies that generate decent returns on capital. This market reminds us to think for ourselves, focusing on how individual businesses may evolve over the next few years.” They are finding the combination of sharply lower valuations and low currency for European companies especially attractive today.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.