The US equity markets exhibit observable biases over time, alternately favoring one group of stocks over others: large cap vs. small cap; value vs. growth; defensive vs. dynamic; sector rotation, etc. We questioned whether there was a longer term benefit to favoring one group of stocks over the others.

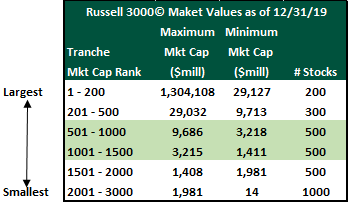

We sought to identify and quantify the investment opportunity or edge within various market capitalization segments. To test this thesis, we divided the Russell 3000© universe into six tranches by market capitalization in order to analyze the equal-weighted returns of the various segments:

The tranches were rebalanced monthly and roughly approximate the divisions of the market as defined by Russell.

- Tranche 1 (largest, stocks 1-200) approximates the Russell Top 200©, i.e. mega cap stocks;

- Tranches 2-3 (stocks 201-1000) approximate the Russell Midcap©;

- Tranches 4-6 (stocks 1001-3000) approximate the Russell 2000©, i.e. small cap stocks; etc.

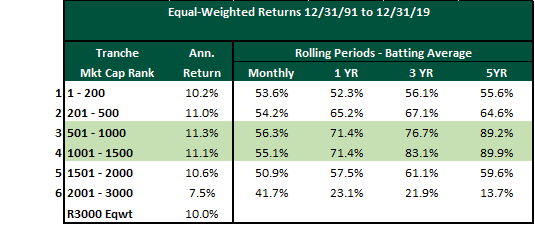

As shown in the table above, tranches 3 and 4 (market cap ranks 501-1000 and 1001-1500) exhibit a compelling advantage over the study period. We analyzed the batting averages (or the percentage of periods of outperformance versus the benchmark) of each tranche over monthly and rolling 1, 3- and 5-year periods within the study period. As the table shows, the results are striking from this perspective. Tranches 3 and 4 stand out, out-performing the universe of stocks – the Russell 3000 Equal-Weighted Index – in more than 70% of the rolling one and three-year periods and more than 80% of the rolling five-year periods.

This group of stocks (ranked 501 to 1500) are what we call small to mid-stocks, i.e. SMID. These stocks constitute the bottom 500 names in the Russell 1000 Index and the top 500 names in the Russell 2000 Index. These two tranches constitute the bridge between companies at the upper end of the small market capitalizations and stocks at the lower end of the mid-cap valuation range. While the traditional SMID benchmark is the Russell 2500 Index (Tranches 3 to 6), our research identifies the top 1000 names in this benchmark as the “Sweet Spot” for this asset class. This bucket leverages the high risk, high reward aspects of small-cap stock investing while blending in seasoned medium-sized companies that partially offset the challenges and volatility experienced by their smaller peers. The advantages of investing in this space are high relative returns over time, less business risk than smaller cap companies, greater latitude for the manager to go up and down the market cap spectrum as market conditions change, a larger pool of candidates to purchase from, and less liquidity issues involved with trading securities.

In our next post, we will discuss in more detail the reasons behind the competitive edge that the stocks in Tranche 3 and Tranche 4 of the Russell 3000 have in comparison to their larger and smaller cap counterparts.

Sources: FTSE Russell, Factset