Our employee-owned firm, Xponance®, is led by an experienced team of women and diverse professionals with a shared passion to act in good conscience for our clients, communities and each other. As part of this mission, we take environmental, social and governance (ESG) issues seriously. We live and experience it every day and every way from the “S” perspective of ESG derived from both our gender-lens and diversity-focused viewpoints. We understand that ESG factors can have an impact on financial performance of companies and these considerations are aligned with our firm’s mission to be a catalyst for positive change. We continue to work on and develop our incorporation of sustainability factors in all areas of our business. In our Manager of Managers business, we are vigilantly looking for talented emerging, minority, and women owned managers who take ESG factors into account. In our direct investment management business, we incorporate ESG factors in both stock selection and portfolio construction in all our active systematic equity strategies. We also provide customized ESG-screened factor-based and passive equity strategies. Lastly, we incorporate our analysis and use of green bonds in our fixed income strategies.

In this post, we wanted to look at how ESG companies and ESG strategies have performed in the first quarter of 2020 and share some thoughts on what implications the COVID-19 pandemic has on ESG investing and what lessons can be learnt from this unprecedented experience.

ESG Performance in an Unprecedented Quarter (Quarter 1, 2020)

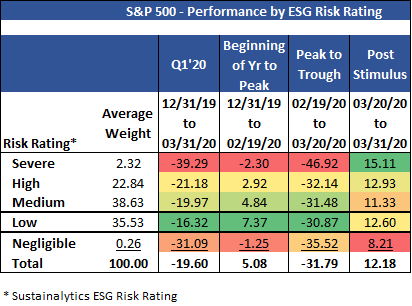

We looked at the performance of S&P 500 companies ranked by ESG scores for the first quarter of 2020. Companies with a low risk of material negative economic impact driven by ESG factors have outperformed YTD and across all sub-periods. Sector, Style and Size concentrations within categories impacted performance over these short time periods – Technology and Large Growth account for ~50% of the Low Risk category periods vs. the low weighted Severe category, which is concentrated in Energy and Industrial companies. A more reasonable comparison is versus the larger, more diverse, High and Medium categories. The underperformance of the small Negligible category is mostly due to the underperformance of REIT’s.

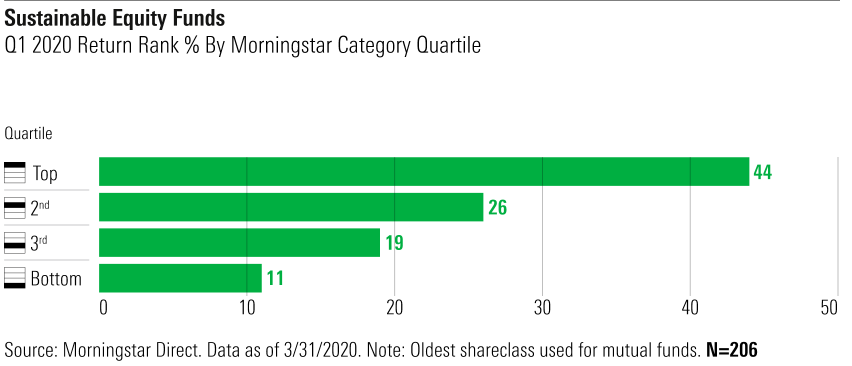

Like all equity funds, sustainable equity funds suffered sudden and large losses during the first quarter of 2020 because of the coronavirus pandemic, but they held up better than conventional funds. Funds that are based on ESG investing lost less than their peer groups. Based on a comparison of the first-quarter returns of 206 sustainable equity open-end and exchange-traded funds available in the United States with those of their respective categories, sustainable funds performed better on a relative basis. During the volatile first quarter, the returns of sustainable equity funds were clustered in the top halves of their respective categories, and more sustainable funds’ returns ranked in their category’s best quartile than in any other quartile.

Beyond the deeply felt strains on health and humanity, this crisis has been a defining moment for ESG issues. From a social perspective, the role of companies has been illuminated like never before in light of the actions they have taken related to their employees, customers, and communities in this most trying of times. From an environmental perspective, this crisis will bring an even greater attention to the impacts of climate change. And lastly, from a governance standpoint, the roles of the board and management of a company will have to be revisited and expanded to encompass futures thinking and the adoption of more robust operational models. In many ways, ESG investing asks one simple question: is your business resilient in the face of massive change?

Revisiting Responsibilities

The pandemic has brought into focus the need to revisit the responsibilities of businesses towards their employees, their customers, and their shareholders. Last year the Business Roundtable of the United States released a formal statement seeking to redefine the purpose of corporations, moving away from shareholder primacy to include a commitment to all stakeholders, including customers, employees, suppliers and communities, in addition to shareholders. The changing nature of work from manufacturing to service-oriented and from physical to intellectual-focused, the ability of employees to work remotely, and the rampant use of contract workers without health benefits are some of the things that companies must explore. Companies that unfairly restrict paid sick leave, lay off workers earlier than is necessary, or fail to provide a safe working environment are harming employees, their investors, and the economy. In addition, the need to invest in communities and people whose economic circumstances are diminished has grown more important. Businesses need to step up their actions around human and labor rights. One example is the exploitation surrounding the gig economy. We are seeing the consequences for millions of day-to-day workers in precarious positions and shadow economy roles as COVID-19 takes hold across the globe, exacerbating existing inequalities. The growing income inequality gap in the United States has never been more evident than now as we see long lines at food banks around the country, and sharply rising unemployment claims.

Building Resiliency and Flexibility

Businesses will have to build resiliency into their operating models to sustain themselves over prolonged period of disruption. Company boards should learn from this global challenge and invest more time and thought in exploring business risks. Preparedness for “black swan” events like the COVID-19 crisis includes embracing the idea of futures thinking, scenario analysis, and conducting simulation exercises. Companies need to build and explore various scenarios to help them map and understand possible pathways to create more desirable future outcomes. Management teams need to better understand the dependencies of their supply chains and improve their supply chain management. Bain & Co recently estimated that up to 60% of executives have no knowledge of the items in their supply chain beyond the Tier 1 level. Reliance on one country or geographical region can prove disastrous for supply chains. Flexibility in operating models will allow companies to adapt quickly to changing conditions during a crisis. The use of leverage is another factor that feeds into the resiliency of a company’s balance sheet and its ability to endure a crisis. When profits are high and cash flow is positive, companies must strike a balance between building up their reserves for a rainy day and buying back their own shares or raising dividends.

Environmental Impact

The coronavirus pandemic may finally prompt many to start taking environmental issues more seriously. One obvious impact of the shelter-in-place rules that are being used for fighting the virus has been the respite provided to Mother Nature. All over the world, pollution levels are down, skies are clearer, oceans are cleaner, and various species of animals, birds, and fishes are being spotted in places from where they had disappeared over the years as humans encroached into their living spaces. Destruction of habitats and ecosystems only risks further pandemics as diseases spread between animals and humans. Trees are cut, animals are killed or caged and sent to markets to satisfy the hunger of an ever-increasing human population. Ecosystems are disrupted as a result and viruses are shaken from their natural hosts and transferred to humans. There are concerns that climate change may provide opportunities for pathogens to expand or shift their geographic ranges.

Building Partnerships and Working Together

The crisis has shown us what is possible when government, business, investors and civil society all come together. It goes without saying that globalization has led to all of us being connected and interdependent; the spread of the virus proves just how true that is. Conversely, this difficult episode also teaches us the importance of collaborative solutions. There is no point in suffering the negative consequences of our connectedness without leveraging the benefits. In response to the virus, we’re seeing a far more human-centric economic response from governments and businesses. This response has been helped by the emergence of a more progressive mindset over the past decade which reflects a shift in values that has been embodied in the ESG philosophy. The focus should be to align investments with long-term value creation and drive a more holistic approach to the role that corporations play in society.

Good things can come from bad times and there are several lessons that we are learning from the COVID-19 pandemic. These include the potential rise of telecommuting and virtual events; positive changes in social norms, from hygiene to handshakes; paid sick leave, especially for minimum-wage and contingent workers; more centralized emergency response, and the strengthening of the social fabric, especially at the neighborhood and community levels. The actions we collectively take over the coming weeks, months, and years will lay the foundation for a more stakeholder-friendly and sustainable global economy — one that aligns people, profit, and planet.

Sources: Sustainalytics, PRI (Principles for Responsible Investment), Morningstar, greenbiz.com