A Brief History of Japanese Corporate Reforms and Our Boutique Manager Views

In our recent paper diving deep into the asset allocations of Japanese institutional and household investors (This Time is Different in Japan, But Maybe Not for the Reasons You Think), we discussed how the demand curve for Japanese equities appears likely to have shifted higher given changes in the risk preferences of Japanese households. While this should change the expected long-term valuations on Japanese equities, fundamental active managers focus largely on the value created by individual holdings and their expected returns to shareholders. Here too, there is reason to be bullish on Japanese equities, due to market reforms and interventions over the past decade. In this note, we will recap those reforms we see as most relevant for global stock pickers, followed by insights from a selection of our high conviction boutique managers.

Timeline of Significant Japanese Market Interventions and Reforms

Reforms and policy adjustments in Japan over the past decade have cultivated a more favorable climate for shareholders, largely by fostering an uptick in profitability. Streamlining excessively burdened balance sheets will be a crucial driver for achieving sustained enhancements in Return on Equity (ROE).

Those policies and efforts spanning several decades were intensified following Prime Minister Abe’s re-election in late 2012, as summarized as below.

2013 – Quantitative and Qualitative Easing (QQE)

In 2013, the Bank of Japan (BOJ) introduced Quantitative and Qualitative Easing (QQE) to combat deflation by simultaneously expanding the monetary base and effecting qualitative adjustments to the bank’s balance sheet. The quantitative aspect entailed the aggressive purchase of various assets, predominantly Japanese government bonds (JGBs), with the ambitious goal of doubling the monetary base within a two-year period. Qualitative enhancements increased purchases of Exchange-Traded Funds (ETFs) and Japanese Real Estate Investment Trusts (J-REITs), aimed at influencing the pricing dynamics of higher-risk assets. Notably, the BOJ’s approval of JGBs across all maturity profiles, including 40-year bonds, further underscored its commitment to addressing deflationary pressures and revitalizing the Japanese economy. 10 years later, we can see that QQE failed to materially stimulate aggregate demand for Japanese equities among Japanese households or foreign investors, but in addition to the direct support it gave the Japanese equity market, QQE can be seen in hindsight as having supported Japanese institutional allocations to local equities.

2014 – Ito Review

The Ito review was chaired by Professor Kunio Ito and backed by the Ministry of Economy, Trade and Industry (METI). Ito proposed the establishment of the “Management Investor Forum (MIF)” designed to facilitate regular face-to-face engagements between company management and investors, aimed at “realizing sustainable corporate value creation”. The comprehensive 132-page report also highlighted the potential for Japan’s substantial household savings, estimated at JPY 800 trillion, to enhance the robustness of the investment ecosystem. Furthermore, it emphasized the transformative role individual investors could play in bolstering the mid to long-term corporate value creation process within the broader investment landscape. The Ito Review catalyzed corporate reforms in Japan whose fruit we are beginning to see today with increased buybacks, profitability, and reductions in cross-shareholding.

2016 – Yield Curve Control

At the end of 2016, the BOJ transitioned from its conventional quantitative easing (QE) approach to a yield curve control (YCC) policy. Under this framework, the BoJ aimed to maintain the yield on 10-year Japanese government bonds (JGBs) at 0% with the objective of stimulating the Japanese economy. This involved proactive interventions by the central bank, wherein it would buy or sell bonds to influence the yield whenever it deviated from the specified target range. Noteworthy is the profound impact of this policy shift on the volume and frequency of bond purchases. Between 2016 and the onset of the pandemic, the BoJ implemented purchases at a notably slower pace compared to its previous QE program, signaling a strategic recalibration in its approach to monetary stimulus. For equity investors, this was important in establishing crucial forward guidance for modeling debt prices as well as the future value of earnings. It was at this time that we saw Japanese institutional investors increase their allocations to Japanese equities.

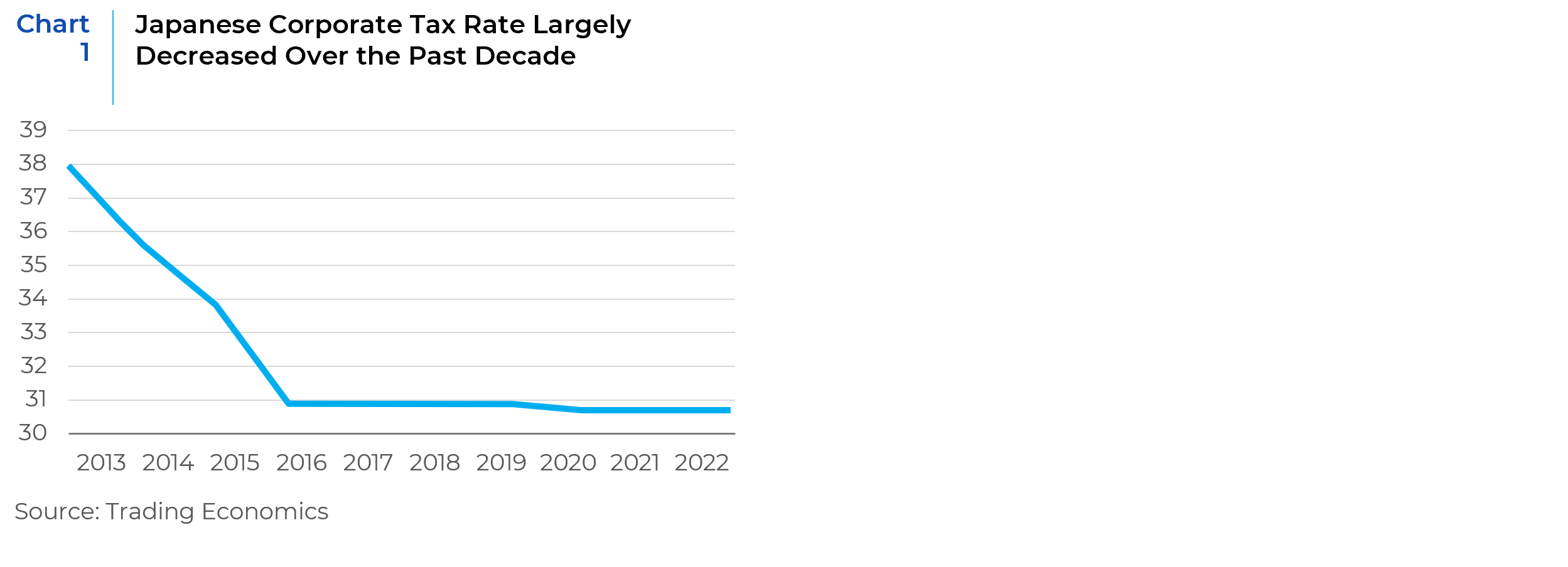

Corporate Tax Cuts

Over the past decade, there has been a notable reduction in corporate tax rates in Japan, declining from nearly 40% to 30% through a series of strategic cuts. This downward trajectory in tax rates has contributed to enhancing the overall profitability landscape for businesses operating within Japan’s equity markets.

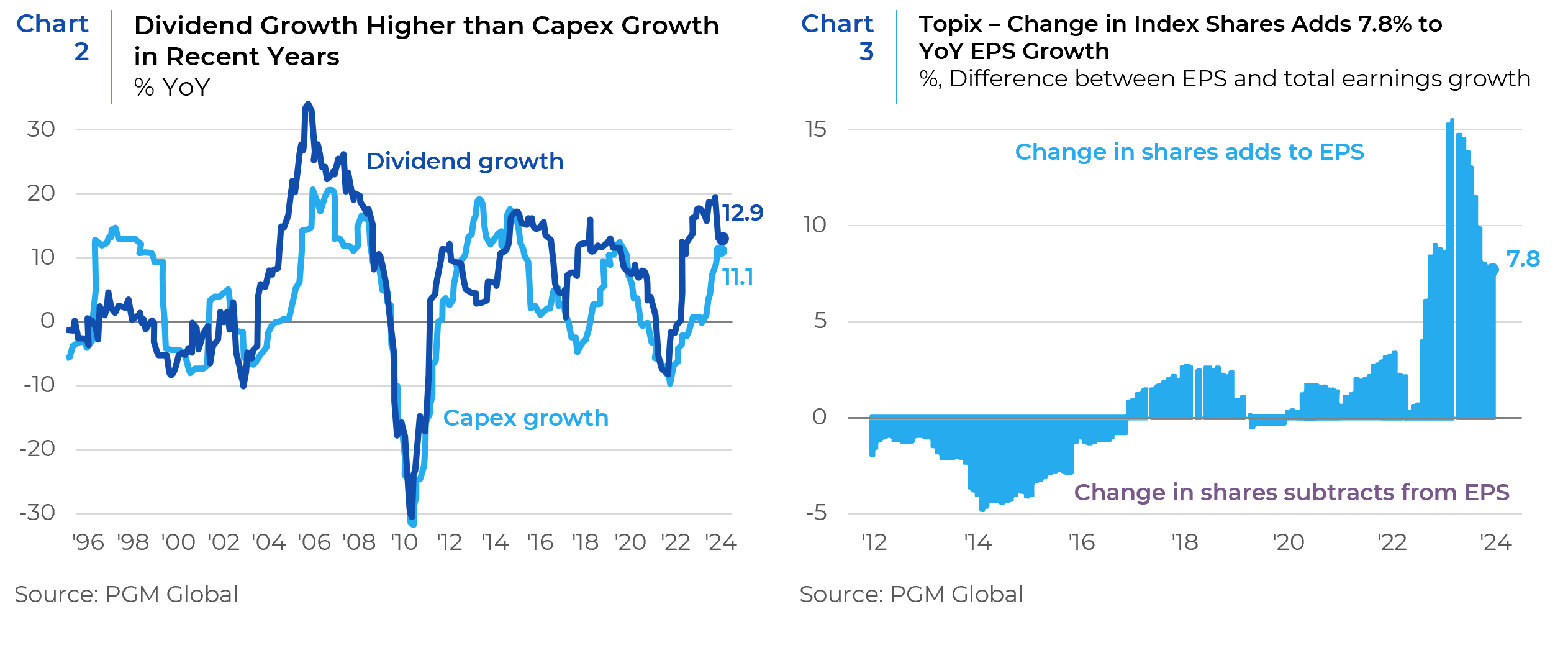

2022 – New Policies Announced by Tokyo Stock Exchange

In 2022, the Tokyo Stock Exchange formally urged all listed companies trading at below book value to elevate their price/book multiple above 1x. Companies failing to meet this benchmark were required to publish a plan outlining steps to achieve compliance or face potential delisting. Half of the companies listed on the Tokyo Stock Exchange traded at a P/B ratio below one, compared with 4% within the S&P 500 index. As a result, more Japanese companies have increased their dividends (see Chart 2) and share buybacks (see Chart 3) over the last two years.

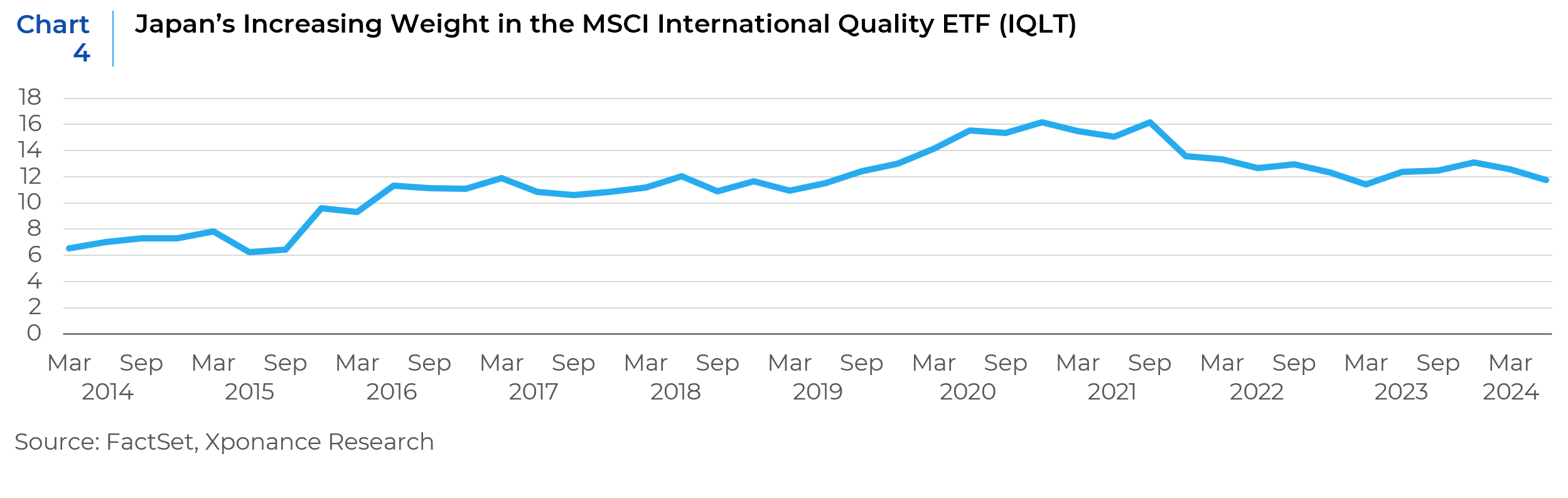

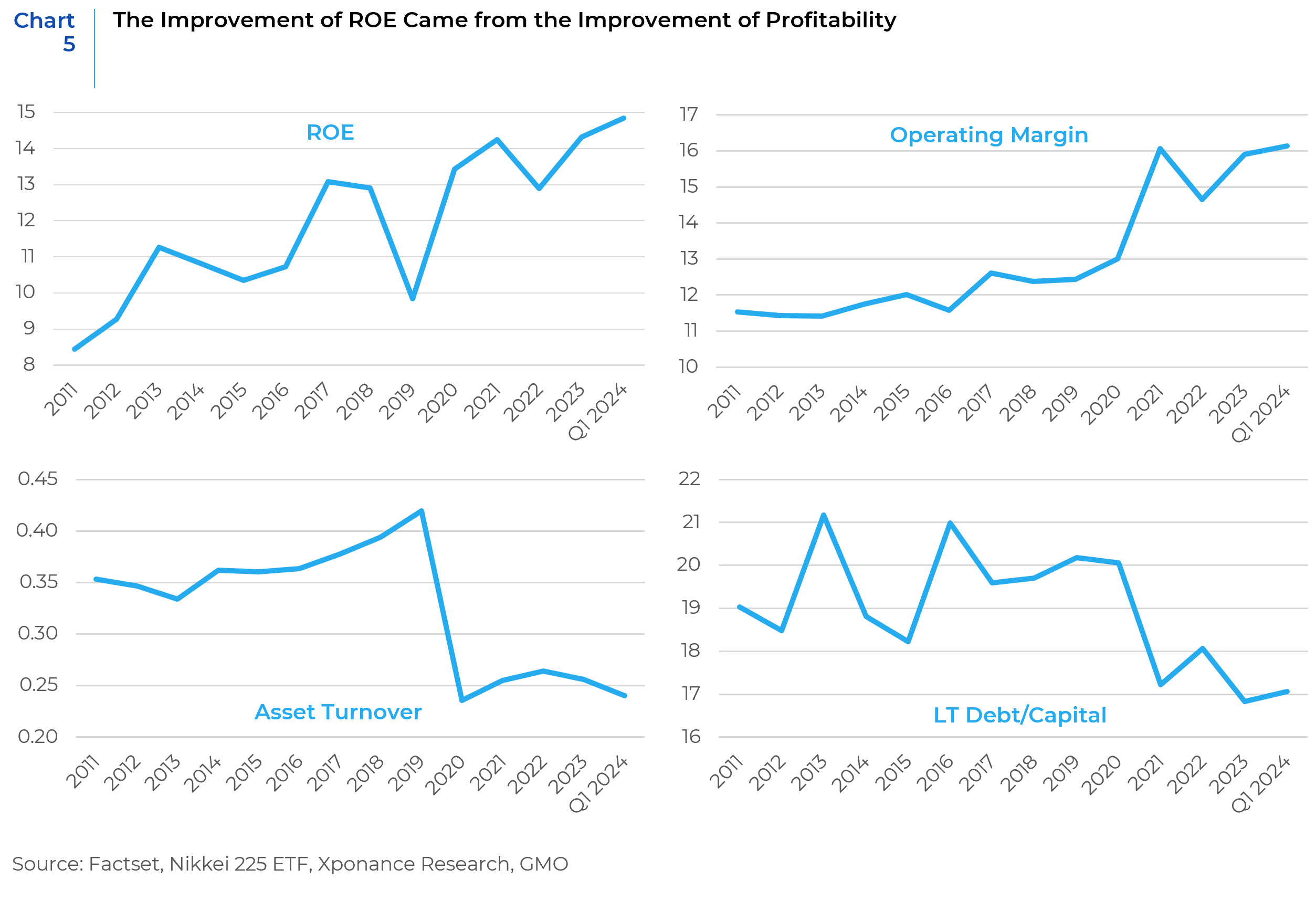

Improvements in the “quality” (often measured by profitability or ROE) of Japanese corporates is the ultimate objective of many of these policy initiatives, which has shown significant success. Japan’s weight in the MSCI International Quality Factor ETF (IQLT) has doubled from 6% to 12% over the past decade (see Chart 4). The notable improvement of ROE in Japan has primarily been propelled by increasing profit margins, from the perspective of the Dupont Model. This model also evidences declining asset turnover and leverage ratios over the past decade (see Charts 5).

Actionable Takeaways

Many investment strategies have a component of “High Quality” in their desired investment characteristics. The definition may be nebulous, but it is clear from our conversation with active managers that Japan is becoming a more important part of their initial universe. Allocators should spend time ensuring that these investors have the depth of knowledge to properly evaluate a country that has been much less important to quality focused managers. While the corporate governance practices have made tremendous progress, there still exists the deeply embedded cultural practices of Japanese management, especially the emphasis on long term relationships and consensus building. In addition, the Japanese market includes a much larger percentage of small companies than other developed markets. While language barriers have declined, it can still be a challenge doing company level due diligence without a Japanese speaking analyst.

For further insight on this, we asked some high conviction boutique managers how they have dealt with stock selection in Japan relative to other major developed markets.

Manager Insights

Core Growth – Global Small Cap Equities Boutique

Based in Chicago, IL – Lizard Investors

Lizard applies adjusted metrics to evaluate company quality, which is particularly helpful in Japan because of the excess cash holdings. “What we would typically look at related to identifying a quality business would be the following:

- Return on Tangible Capital – Net Operating Profit After Tax (you could use pretax) / PP&E + working capital less cash

- Return on Intangible Capital – Net Operating Profit After Tax (you could use pretax) / PP&E+ Goodwill + working capital less cash

The first should find “quality” operating business. The second will find quality business, but also take into account how successful management has been with acquisitions over time. Both strips out inefficient balance sheets that usually skew the ROE calculation.”

Relative Value – International Small Cap Boutique

Based in Tampa, FL – MAC Alpha Capital Management

MAC Alpha focuses on companies with strong competitive advantages available at discounts to their estimated intrinsic value. ”Our proprietary quality metrics (of which there are multiple) are how we measure sustainable competitive advantage and they allow us a more accurate cross border comparison than traditional metrics. Relying just on ROE in Japan would likely cause one to miss some quality businesses due to their typical balance sheet structure (i.e. conservatism).

The Japanese corporate approach to saving is very different than western standard. High variance in cash levels vs. western ones will have a large impact on a company’s stated returns and makes cross border comparisons difficult. We would expect the gap to converge over time. Quality has become an increasingly important to companies in Japan and is the driver behind the TSE’s 1x PB initiative and previous creation of a JPX index that only included companies above a 10% ROE. Kishida’s creation of an “Asset Management Special Zone” also likely drives standards higher as global markets have different requirements for disclosure. This kind of cultural change occurs very slowly but is coming.”

Aggressive Growth – International Equities Boutique

Based in Chicago, IL – CastleArk Management LLC

CastleArk’s portfolios have had a higher weighting to Japan than many of their growth-oriented peers and their team visits companies in Japan every year. “While absolute ROE may not be the best metric in Japan, [we] break the market into ROE quintiles and look at companies in the top quintile of ROE vs. the bottom quintile and then segment by leverage levels to take out companies that have Net Debt/EBITDA >1x and are artificially inflating ROE. By taking this approach it might help assess quality in the context of Japan and also help assess quality in a more multi-faceted way.

When we look at Japan today we see a number of changes on the demographic, regulatory, and economic front that are leading to inflection points in areas that have historically been out of favor by investors (e.g. Japanese banks). Higher growth and a stabilization in interest rates are driving higher margins for banks. Furthermore, Japanese banks are unwinding cross shareholdings and returning capital to shareholders all of which is leading to an improvement in ROE. Meanwhile, analysts continue to anchor to the past and model zero growth and declining margins and banks are trading at a significant discount to global peers. On the other hand, we are seeing a number of other sectors such as healthcare where Japanese companies are seeing deceleration post-COVID and where valuations are extended. We can see this divergence in earnings estimates for Japanese banks and healthcare where financials are getting consistent earnings upgrades while healthcare has not and therefore enjoying an improving growth profile that is misunderstood by the market relative to healthcare.”

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.