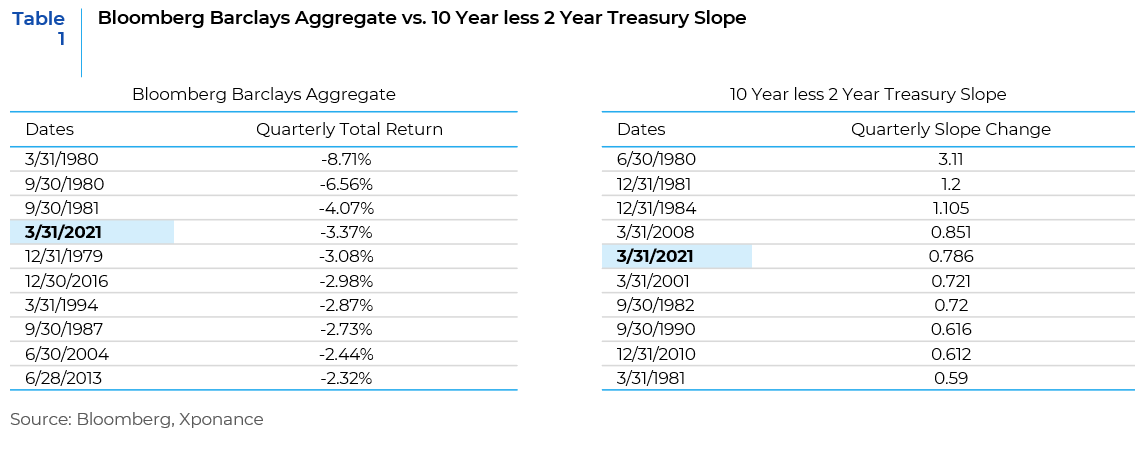

The start to 2021 was among the worst for the broad bond market, and its constituent sectors, in quite a long while. To put this in historical perspective, first quarter 2021 was the 4th worst total return for the Bloomberg Barclay’s Aggregate since the inception of the index at the beginning of 1976. Put another way, even during the Volcker Fed there were only three quarterly periods with worse returns. Moreover, the slope of the yield curve changed dramatically over the course of the quarter, also recording a spot in the historical rankings for fastest quarterly increases.

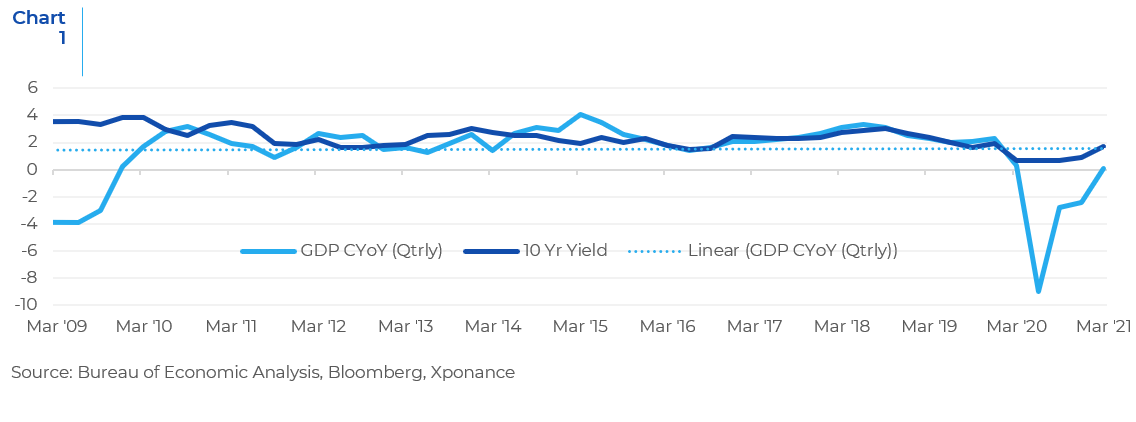

Beyond the historical comparisons, however, what does that tell us about the state of the economy as seen through fixed income markets? And what does this mean in a practical portfolio sense? Clearly, U.S. rate markets have become more orderly and consolidated around higher levels. Is this a pause before another move higher? Economists and market participants have been calling for higher rates nearly every year since the beginning of the bond bull market over 30 years ago, and the calls have become ever louder the lower rates have gone. Also recall that U.S. real GDP growth for the post-Great Financial Crisis (GFC) period has been well below 2% on average. This stagnant growth environment, coupled with both Quantitative Easing and ultra-low interest rate regimes among advanced economies and many emerging economies has led us here.

Clearly, the 2020 bounce back and the 2021 growth expectations (thus far borne out by economic data) will be the high-water marks for the post-lockdown period. The real question for interest rates becomes whether trend growth can remain higher than the previous decade. Further, is there reason to expect a higher and persistent level of inflation? And if both these conditions occur, will fixed income market participants demand a premium in the form of higher real interest rates? The argument for near-term inflation is compelling and reasonable. There has been a supply shock coupled with (or potentially caused by) a demand pull. Supply chains have been impacted by various bottlenecks and business decisions made during the height of the initial phase of the pandemic are exacerbating these bottlenecks. Labor is also in short supply in many of the industries that were hardest hit by the pandemic. These factors, coupled with inflationary base effects, have conspired to create near-term inflation and a narrative around a longer-term inflationary cycle.

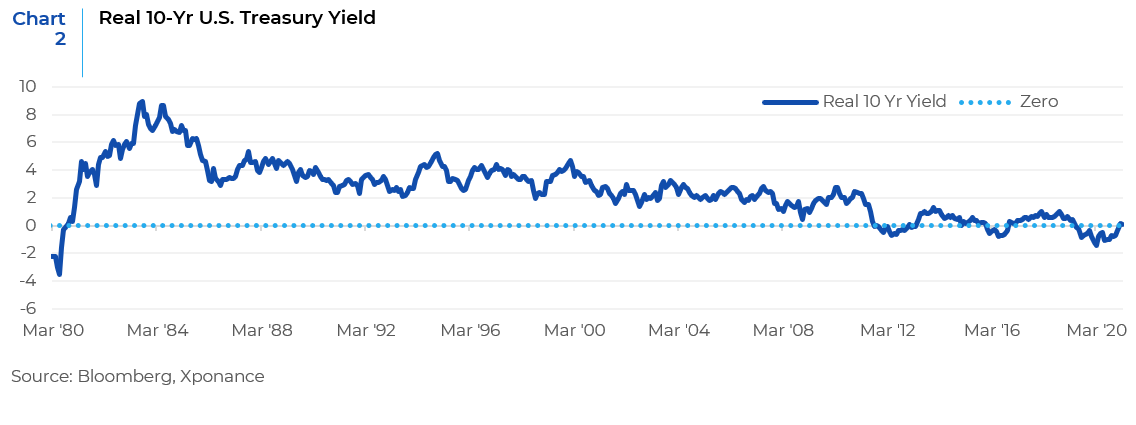

Since the end of the Great Financial Crisis, short bursts of outsized quarterly growth relative to trend have resulted in significant optimism priced into the 10-year Treasury yield. We also observe this phenomenon when comparing the Producer Price Index to yields, where short term above trend bouts of producer price inflation do not drive rates higher. Any market reaction has tended to be short lived as the data series revert to the mean and expectations for some sort of GDP liftoff recede. As a result, fixed income investors became conditioned to accept negative real yields. It would seem to require a prolonged bout of upside inflationary surprises to change market sentiment to the point where investors demand meaningfully positive real rates.

While we think yields are still biased to the upside, any sort of breakout to pre-GFC levels would require a unique set of circumstances, in our view. The Phillips curve would need to return to being a functional economic tool (i.e falling unemployment leads to an increase in wages and therefore inflation). The infrastructure bill would need to pass and subsequently result in significant upgrades to infrastructure, not just simply repair existing roads and bridges (i.e. the broadband and green energy components). Corporations would need to increase capital expenditures, adding private investment to the public investment inherent in the infrastructure bill.

The other wild card is the Federal Reserve itself. If we look at the data presented here against the historical experience since the GFC, patience in raising the Fed Funds rate would seem to be in order. The Fed’s own expectations suggest the target rate will not increase until 2023 at the earliest, while the market’s expectations are sometime in late 2022. The neutral rate of interest (as defined by the Laubach-Williams model) suggests patience is in order as well. If data continues to surprise to the upside, however, or if the Phillips curve dynamic does return, the Fed could either be forced to raise rates earlier than the market expects or appear to be behind the curve. We could return to a situation where good economic news is perceived to be bad news for the fixed income markets (causing rates to rally and spreads to widen) because of the perception that the Fed is likely to “take the punch bowl away” and ultimately cause a recession.

What is the play book for the current uncertain market environment? Given that yields are so low and credit spreads are quite narrow for very short maturities, a rotation into floating rate paper is a cheap hedge. As we noted in a prior outlook, short, high quality high yield offers a compelling risk/reward relationship by booking the yield now and holding to maturity. Underfollowed but improving balance sheet stories in the corporate space should outperform as the recovery continues and weaker performing companies are no longer buoyed by bullish sentiment alone. The broad bond market continues to offer an array of instruments that should perform relatively well against the economic backdrop we have discussed.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.