Multi-Manager Platform

The multi-manager platform emphasizes diversity and inclusion and strong firm governance in our sub-manager evaluation process. We strive to provide opportunity for diverse and female owned firms and evaluate the full DEI profile of all partner firms, including helping them improve their practices over time. We only invest with boutique, employee-owned firms where strong governance practices are essential.

Systematic Global Equities

We have the ability to incorporate data from Sustainalytics in stock selection or portfolio construction for all our active strategies. We also manage index-like strategies with values-based overlays. Our partnership and exclusive agreement with As You Sow has led to the launch of our DEI & ESG focused strategy.

U.S. Fixed Income

We have the ability to utilize data from Sustainalytics to screen out potential corporate investments that have low ratings, with an emphasis on governance. We also use this data to evaluate existing holdings and monitor the impact changes in scores may have on risk premia going forward.

Proxy Voting

Data Sources

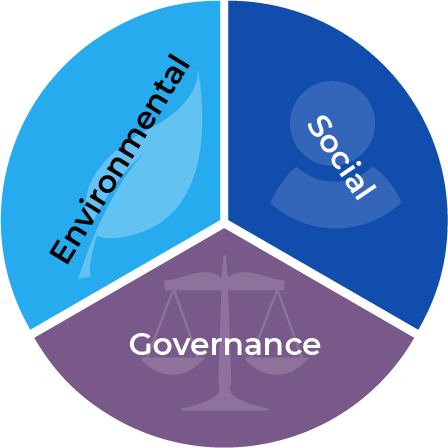

ESG Risk Ratings from Sustainalytics measure a company’s exposure to material ESG risks and how well a company is managing those risks. These ratings are used in all our active strategies.

Community Social Responsibility

Xponance delivers investment solutions to clients, while simultaneously acting as a catalyst for positive change. We seek to make a difference every day not only by connecting investors with innovative investment strategies and research but also by giving back. We organize and support impactful initiatives designed to foster financial literacy, democratize access to capital, and alleviate food insecurity in our local communities.