#derisking #asset allocation #equities #bonds #yield curve # stagflation # inflation # real assets # hedge funds # private equity

Our analysis suggests that:

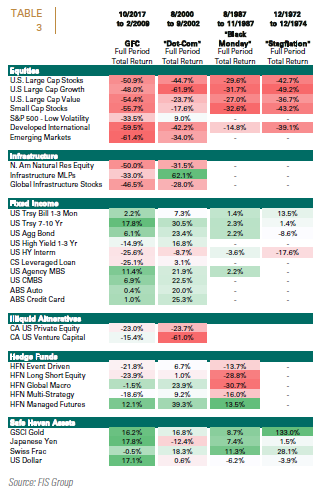

- Low volatility strategies outperformed among publicly traded equities

- Exposure to corporate default risk reduced bonds’ downside protection. Intermediate and core bond strategies, as well as securitized products, such as U.S. agency MBS and CMBS performed relatively well during the GFC and dot com bear markets.

- Real Assets (as proxied by a basket of publicly traded infrastructure companies) had nuanced downside protection, but Infrastructure MLPs generated strong positive performance during the dot com bear market.

- Among Hedge funds, Managed Futures provided the most consistent downside protection followed by global macro strategies.

- Private equity strategies (represented by Cambridge Associates’ U.S. Private Equity and Venture Capital Indices) generated heavy losses during the dot com bear market; with the losses on venture funds exceeding that of public equity markets. During the GFC, private equity and venture fund losses were about one-half of the losses generated by public equity markets

- During the early 1970s stagflation period, the risk adjusted performance of equities underperformed bonds. Among fixed income sectors, short and intermediate strategies outperformed longer duration strategies. Credit risk was also less rewarded during this period, as both the aggregate and high yield bonds underperformed.

- When we lengthened the stagflation analysis by using changes in inflation expectations to identify high inflation periods, small cap and value stocks outperformed large and growth stocks.

You can read our 2019 analysis of institutional investor derisking trends, Battening Down the Hatches, Part 2