#derisking#asset allocation#portfolio management#equities#bonds#stagflation#recession#bear market# recession# cyclical downturn#leveraged loans#stocks#high yield bonds#private equity#LBO

As a backdrop to our portfolio derisking recommendations, we evaluate the macro background, asset return sensitivities and market responses during economic downturns over the last 30 years. For stagflation, we evaluate the 1970s and 1980s as well as periods of heightened changes in inflation expectations and bottom quartile growth from 1970 to the present.

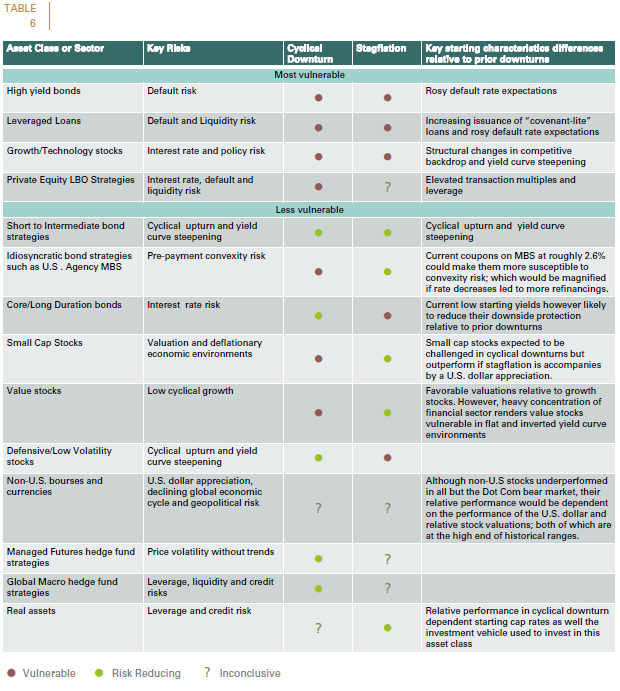

A key predicate and vulnerability of the entire structure of global financial markets; the bifurcation in valuations between unloved value and overvalued growth stocks; and the massive asset flows into leveraged loans, VC, and ETF/passive equity flows are predicated on the assumption that the Fed will prevent a sustained widening of credit spreads. We therefore close with an analysis of which assumptions need to be revisited and which asset relationships would appear to be unsustainable. (See table).

You can read our 2019 analysis of institutional investor derisking trends, Battening Down the Hatches, Part 2.