Interest in environmental, social, and governance oriented investing, or ESG investing has increased substantially in the past few years. More and more asset owners and asset managers are embracing the idea of focusing on investments with better ESG profiles and this is starting to have a subtle but noticeable impact on the performance of stocks. This focus has contributed to the widening of a substantial divergence between the returns in different parts of the equity market.

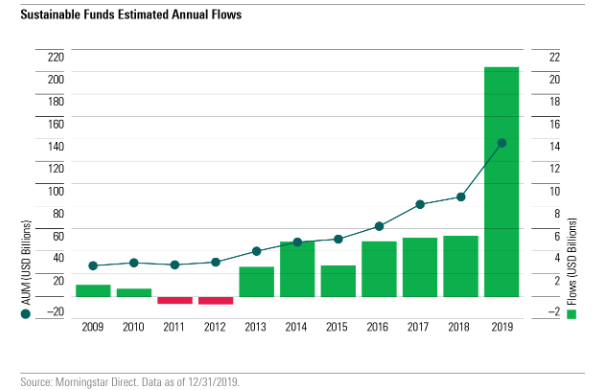

Investors have been voicing concerns about ESG issues for several decades. But not until recently have they translated their words into action. While dedicated ESG funds still constitute a fractional part of investment strategy offerings , the broader trend is that all asset managers are starting to focus on these issues even if they are not explicitly ESG-oriented. Unlike the earlier concept of socially responsible investing (SRI), environmental, social, and governance (ESG) investing focuses more on quantifying the material impact of these issues on financial returns versus the exclusion of companies from the investable universe. The chart below illustrates the drastic increases in fund flows to ESG investing and the sharp rise in inflows in 2019.

While the measurement for ESG metrics is still evolving, a look under the hood shows that companies with stronger ESG scores tend to have better earnings growth, momentum, and quality characteristics and companies with weaker ESG scores have lower valuations and lesser momentum. The extreme divergence in the performance of growth and value stocks has provided a tailwind for ESG investing, especially in the last couple of years.

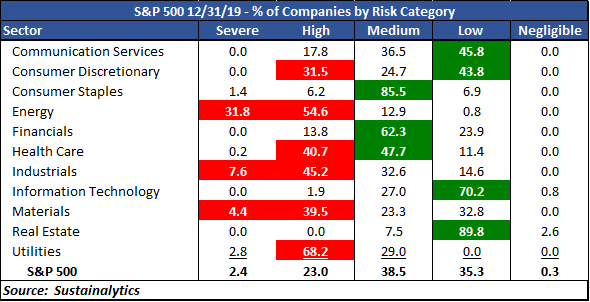

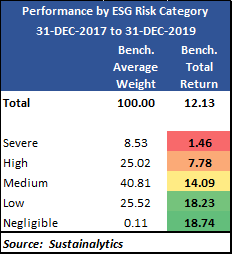

The first table below shows the sector breakdown of the S&P 500 companies into severe, high, medium, low, and negligible ESG risk categories at the end of last year. There exists a clear sector bias in these numbers. Information Technology, Communication Services, and Real Estate have the highest percentage of names with low ESG risk. On the other hand, sectors like Energy, Industrials, and Materials have more names that fall in the high and severe ESG risk categories. The second table shows the performance of these categories in the past two years. The numbers illustrate the favorable performance impact of overweighting companies with lower ESG risk.

The ESG Risk Rating measures the degree to which a company’s economic value is at risk driven by ESG factors. Based on this assessment, it sorts companies into five risk categories (negligible, low, medium, high, severe).

Why is it that ESG investing favors certain sectors and industries? It is obvious why ESG investing would avoid companies that have fossil fuel reserves and high carbon footprints, that conduct animal testing for non-medical purposes, that derive a substantial amount of revenues from opioid sales, that sell guns and tobacco, etc. These are the core tenets of ESG investing. The near collapse of the banking system in 2008 woke investors up to the dangers of prioritizing short-term profitability. The increasing threat from climate change has played a big role too. Demographic trends, like the emergence of the more socially conscious millennial generation, female investors and retiring baby boomers, who can now afford to fund their causes has been another contributor to the popularity of ESG investing. Support from organizations like the United Nations and the European Commission has given ESG a further boost.

While we view the increased interest in ESG as a positive development, investors need to understand what they are signing up for and the financial impact of these investments. Analyzing ESG factors involves a fair degree of subjectivity. It is possible to measure a company’s carbon footprint, but much harder to assess its social impact or business ethics. It is also hard to tie such complex issues together or determine which is the most important. It may be argued that ESG investing should outperform over the long term because it avoids companies that have unsustainable business habits. That may be true but getting the timing right is tricky. ESG investing hasn’t been through a full investment cycle in its current size. As the level of ESG focused assets grows it may result in funds crowding into the same companies resulting in overvaluation. That could create arbitrage opportunities for non-ESG investors. Moreover, companies perform differently across the phases of a business cycle. For example, coming out of a recession, investors have shown a tendency to favor value driven names which are considered low quality and often have higher ESG risks associated with them. It is yet to be seen how ESG investing fares in that environment. If this sector has a bad spell, ESG-oriented investors may prove just as fickle as less ethically motivated ones.

Source: Reuters Breakingviews, Morningstar, Sustainalytics, WSJ