The impact of timing, turnover, and opportunity sets in Value Investing

In our previous report, “Too Good to Be True: The Failure of Defensive Managers During Recent Inflationary Shocks,” we examined the challenges in assessing the performance of quality growth managers since the onset of the COVID-19 pandemic and the subsequent global fiscal responses. Inspired by the same period, we shift our approach to delve into another critical aspect of manager selection: how a value manager’s philosophical approach to turnover influences returns in different market environments. Specifically, within low turnover value strategies, we explore how the market conditions at the time of a strategy’s inception can have a lasting impact on its performance for years. Understanding these dynamics is crucial, as the choice between low and high-turnover approaches can dramatically affect a strategy’s ability to generate returns, depending on the prevailing market conditions.

There are various approaches to consider when constructing a “value” portfolio. This analysis specifically focuses on the common trade-off faced by boutique value managers—breadth versus depth. Managers who exhibit lower turnover typically fall into the ‘depth’ category. They focus on identifying stocks trading at a discount to intrinsic value using methods like Discounted Cash Flows (DCF) and Net Asset Value (NAV). Relative market valuations may inform target prices or terminal values, but each investment idea is evaluated on its own merits.

Conversely, high turnover managers tend to adopt a broader approach, dynamically adjusting their portfolios to capitalize on relative opportunities across a wider universe of stocks. While they may also use intrinsic value methods similar to their low turnover counterparts, their evaluation process is more frequent and comparative, often considering a broader universe. Quantitative strategies are generally aligned with this high turnover group. One key distinction between these approaches is that low turnover managers usually maintain higher concentration levels within their portfolios while being less conscious of the opportunity cost of their decisions.

It is unrealistic to expect managers to shift seamlessly between these approaches, as each demands a distinct mindset, skill set, and investment process. Instead, we should focus on how well a manager’s chosen strategy performs given the market environment in which the performance was generated. In highly volatile markets, a manager specializing in short-term value opportunities may outperform due to their ability to capitalize on temporary inefficiencies. On the other hand, absent significant market dislocations, a manager who focuses on long-term value through mispriced assets, earnings or dividends may deliver superior returns. To define the 2 groups, we use annual reported turnover1, with products <25% classified as “Low” and >50% classified as “High” turnover strategies.

Focusing on low turnover strategies, it is logical (and something we have anecdotally observed) that the market in which the strategy is launched is much more important. The tradeoff between depth and breadth (opportunity cost) is more meaningful when a major valuation dislocation occurs after a portfolio is fully invested.

The Market in 2020

The COVID-19 pandemic compressed years of market cycles into mere months. The speed at which the global economy moved from contraction to recovery was unprecedented. Lockdowns and targeted government support caused extreme supply and demand imbalances, with extreme market moves following suit.

To illustrate the dynamics impacting value managers that led us down our current path of inquiry, we will use 2 examples:

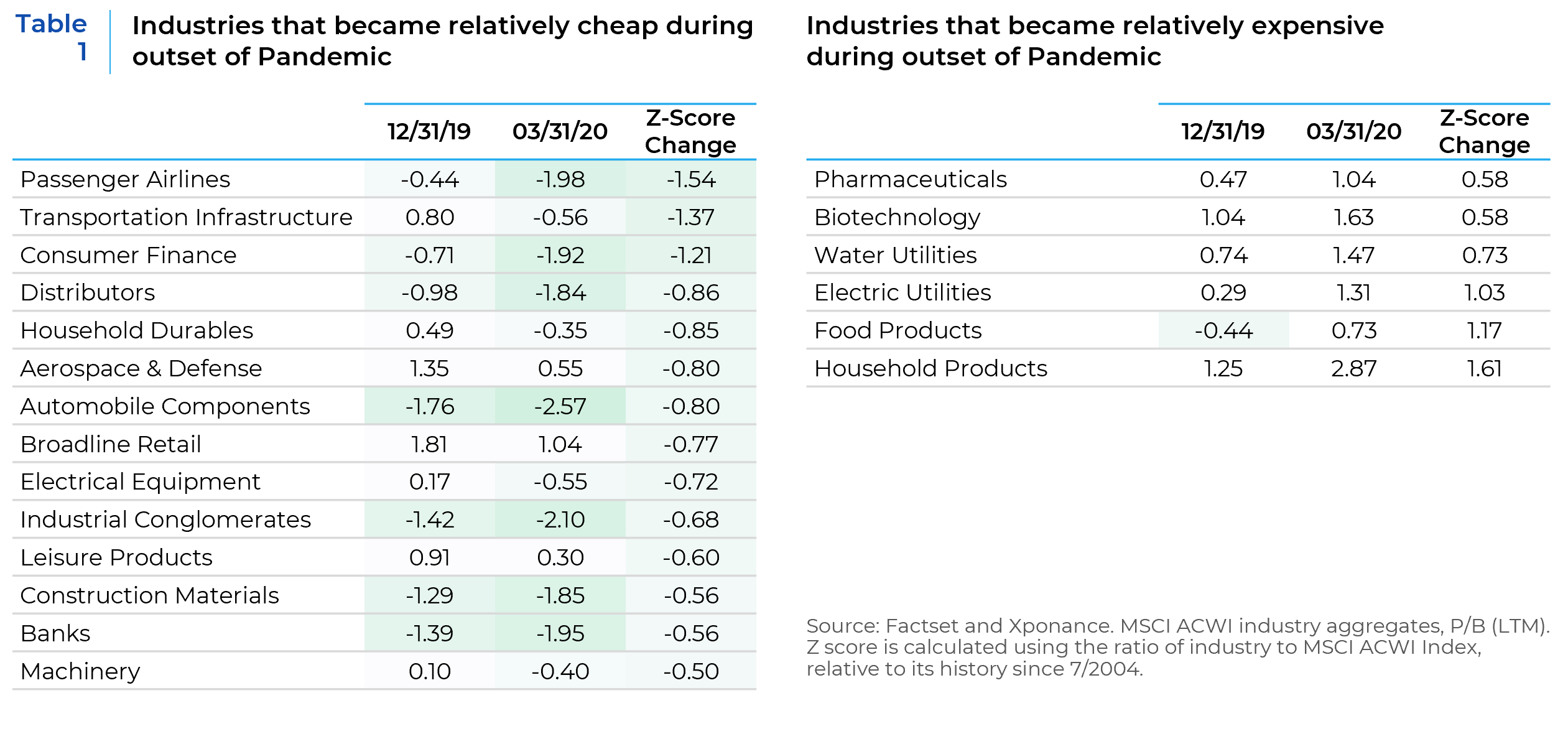

- Airlines: At the beginning of 2020, airlines were relatively inexpensive, with the industry trading at about 70% of the price-to-book (P/B) ratio of the overall market. Historically, this level was cheaper than about two-thirds of the previous 20 years. However, due to the cyclical and capital-intensive nature of the industry, this relative cheapness likely did not attract the attention of most value managers. Fast forward three months, and the industry was trading at less than 40% of the broad market, making it cheaper than 98% of the trailing 20 years.

- Food Products: Conversely, food product stocks were relatively inexpensive prior to the pandemic, trading at a discount greater than about 70% of the periods in the prior two decades. Within a quarter, this typically low-volatility, defensive industry was trading at a significant premium to both the market and its historical levels.

During this period, and in the highly volatile years that followed, we observed anomalies among our sub-manager partners that we did not anticipate. By late 2020 and 2021, we began to see overlapping exposures between value and growth managers in lockdown-sensitive stocks and industries. This overlap was most apparent in more opportunistic, higher turnover strategies, which, in hindsight, is not surprising.

The overlap with growth managers was less significant among low-turnover, deep-dive fundamental value managers. These managers are generally not accustomed to evaluating cyclical growth companies and tend to be biased against selling existing positions that continue to exhibit attractive fundamentals and valuations. However, the same manager launching their strategy in 2021 would likely have taken the time to research these industries, not anchored to prior portfolio investments. This period underscored how a manager’s preferred turnover rate can significantly influence their opportunity set, depending on their approach and inherent biases.

In an ideal world, every manager would conduct in-depth research on every stock in the universe and adjust their portfolio in real-time as their finely tuned risk-reward metrics justified the transaction costs. However, the resources required to implement such an approach are usually associated with asset levels that limit portfolio liquidity to the largest-cap stocks. For boutique managers, such expectations are as unrealistic as expecting Noah Lyles to keep his gold medal pace to win the marathon in 1 hour, 8 minutes and 45.4 seconds.2 Investing optimally involves trade-offs, particularly between the depth and breadth of research. This trade-off is even more pronounced among emerging boutique managers, with whom we spend most of our time due to their proven ability to generate above-average alpha.

Neither approach is inherently superior. Our objective is to understand the environmental factors that either support or hinder a manager’s ability to generate alpha so that we can evaluate their performance within the appropriate context.

Analysis Focus

Our analysis aims to identify performance patterns among high versus low turnover value managers under different market conditions. The condition we are most interested in is extreme valuation dispersions within a market. Our hypothesis is that low turnover strategies may be at a structural disadvantage when they are already invested before a significant market dislocation. Conversely, these strategies might have an advantage during periods of prolonged valuation compression when momentum takes hold among value stocks.

However, data limitations make direct analysis challenging. Among active Global and Non-US value managers with at least three years of returns over the past 20 years, only 67 have an annual turnover of less than 25%. With just three periods of “peak” valuation dispersion, the existing sample of managers is too limited for a formal statistical analysis.

While small sample sizes should not be used to draw definitive conclusions, they can serve as early warnings and help focus our research on specific circumstances. With that in mind, we approached the analysis with the following questions:

- What are the aggregate performance patterns of high versus low turnover managers in global and non-US value strategies?

- Is there a vintage year effect in low turnover strategies?

- What special considerations should an allocator take into account when evaluating a low turnover value strategy?

Aggregate Performance Patterns

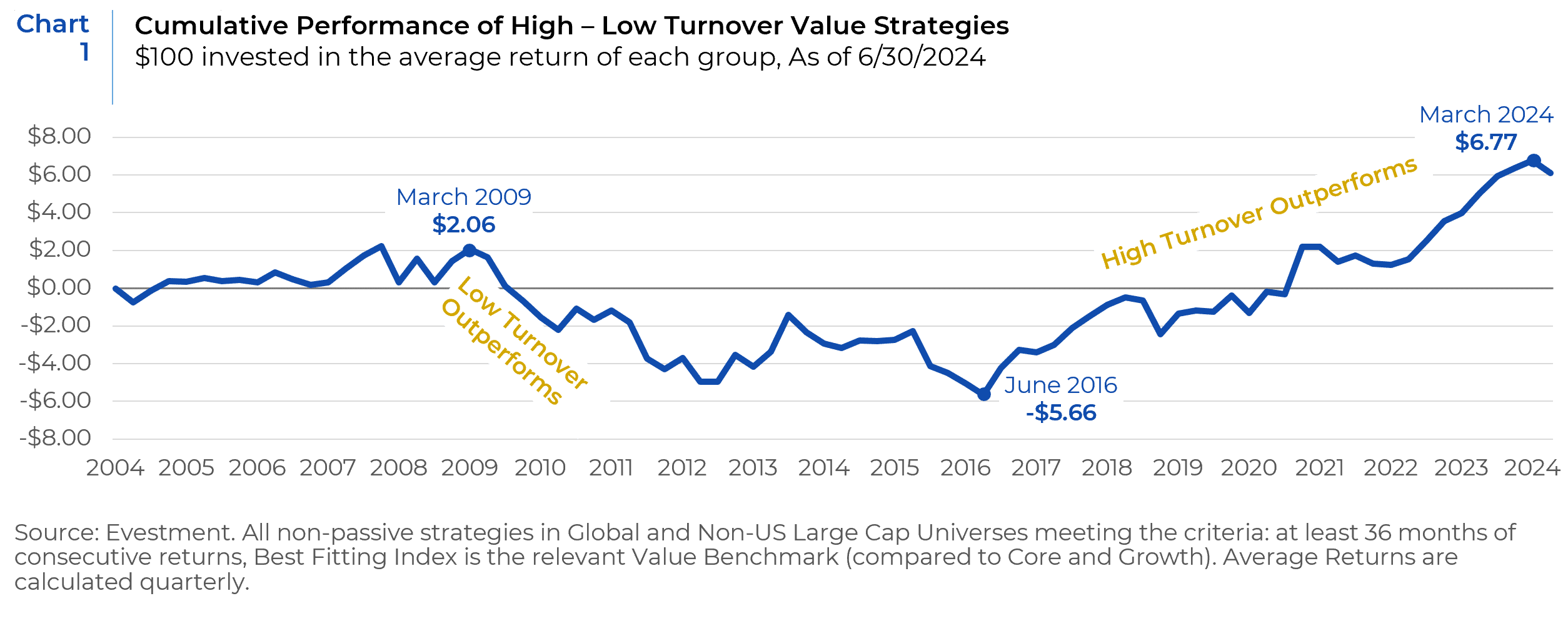

In Non-US and Global markets, there have been two distinct regimes concerning the utility of turnover within value-based approaches. From the end of the Global Financial Crisis (GFC) through mid-2016, a low turnover, patient approach yielded higher excess returns. However, from mid-2016 onwards, higher turnover strategies have been favored by the market (Chart 1).

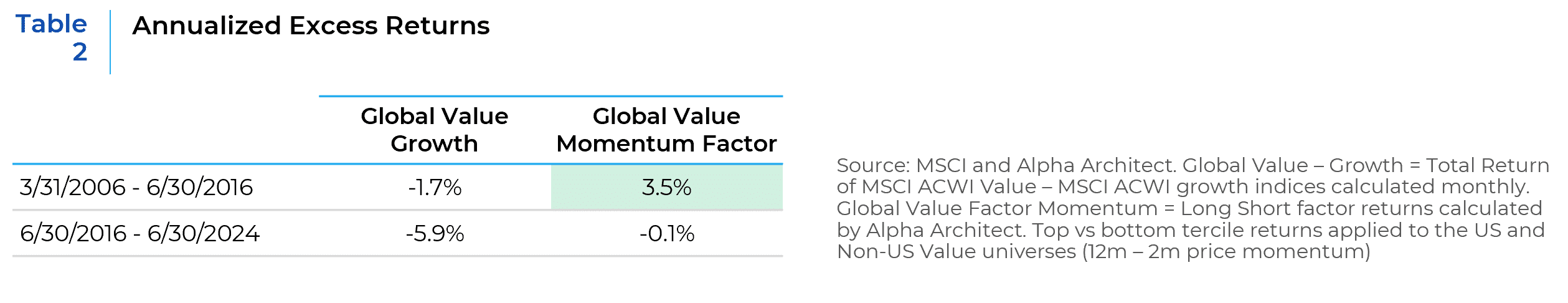

In both regimes, value indices underperformed their growth counterparts. It is intuitive that strong trends within the universe of value stocks should support lower turnover strategies, as the data confirms. Higher turnover strategies are more likely to recycle capital into underperforming stocks, trading against the trend. While inflation and interest rates were low throughout the post GFC period, there was a notable shift lower in global rates around 2016, as the BoJ and ECB adopted negative interest rate, with the 10 year rate of Japan and Germany both falling below zero during the first half of 2016. This coincided with the period in which momentum became indistinguishable from Growth and Quality. The direction of causation is not essential for this analysis. We want to recognize that the 2 approaches appear to have distinct regimes in which they have alpha headwinds or tailwinds.

Vintage Year Performance

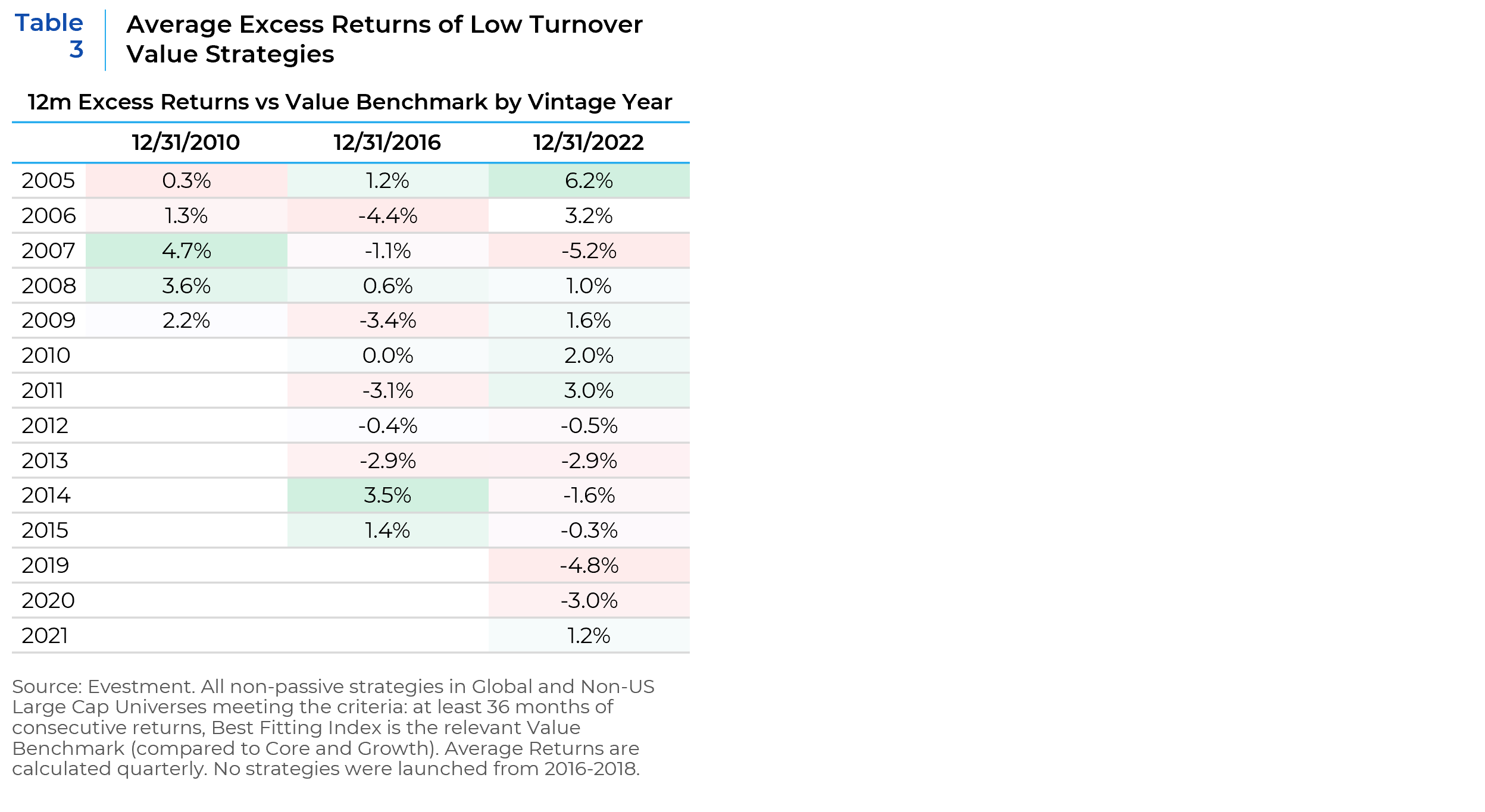

Our anecdotal observations suggest that low-turnover strategies are structurally disadvantaged when they are already invested before a significant market dislocation. This hypothesis is logical but requires further confirmation.

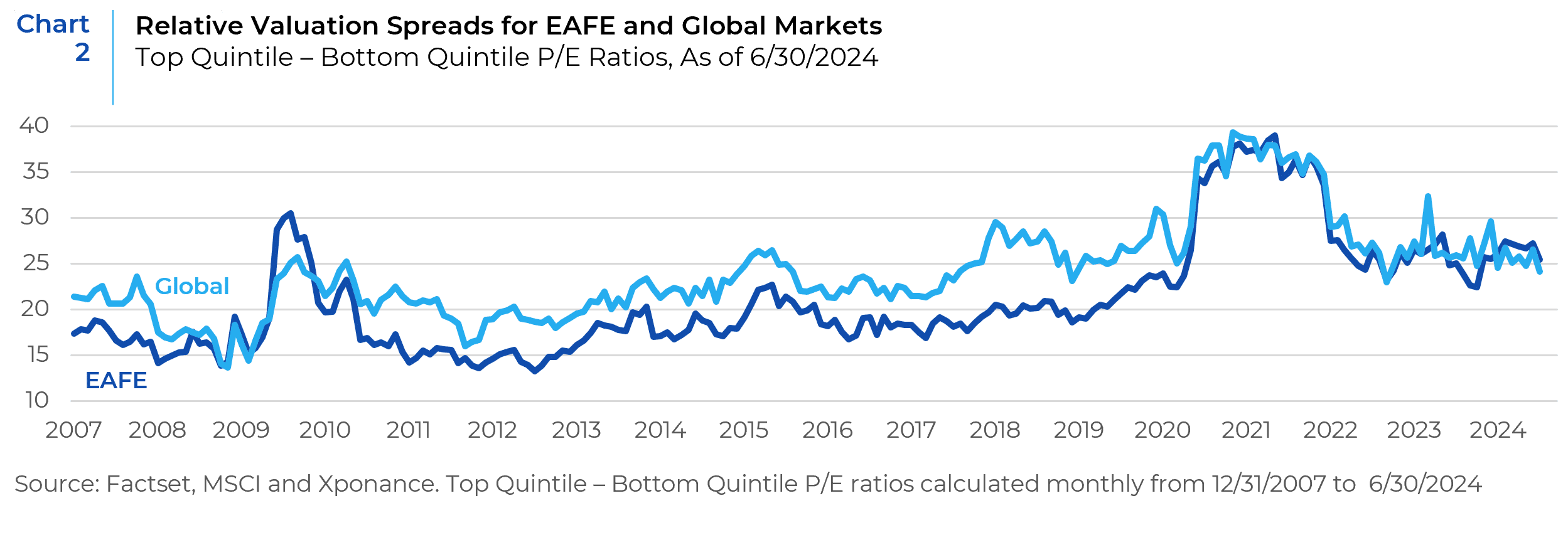

The first step in testing this hypothesis is identifying periods of significant market dislocation. We define a dislocation by the valuation spread within markets, theorizing that these points represent the most significant opportunity set for value-focused managers. The peak dispersion occurred on the following dates: Q3 2009, Q2 2015, and Q3 2021 (Chart 2).

If our hypothesis is correct, we expect stronger performance among managers who launched their strategies during periods of heightened opportunity, as indicated by high valuation spreads.

Although the limited data prevents a thorough analysis, the expected pattern holds for 2010 and 2016 annual returns. More recent vintage years outperformed older vintages. The same was true in 2022, though to a much lesser extent. Notably, strategies with 10 or more years of vintages performed best during 2022. While speculative, these strategies may have been launched when inflation was a more immediate concern, and inflation-sensitive stocks comprised a larger portion of global equity markets (Energy and Materials were 18.9% of the ACWI IMI index in 2012, falling to 9.9% in 20223). There was also a significant shift over time away from asset-centric valuation measures, such as price-to-book, to more “efficient,” quality-centric metrics during the last 10 years, which hurt performance during the inflation and rate shock of 2022.

Conclusion and Actionable Takeaways

The analysis conducted in this report highlights the nuanced relationship between market conditions and the performance of high vs low turnover value strategies. The findings suggest that the effectiveness of a value-oriented approach, particularly those with low turnover, is highly influenced by the market environment over short time horizons.

Key Insights

Market Environment Matters: Low-turnover strategies can be structurally disadvantageous during periods of significant market dislocation. This disadvantage is primarily due to the unwillingness or lack of experience in rebalancing portfolios quickly in response to extreme market shifts. In contrast, when there is strong momentum within value stocks, a low turnover approach is beneficial.

Consideration of Vintage Year: The vintage year of a strategy’s inception plays a critical role in its performance, particularly for low-turnover strategies. Strategies launched during market turmoil or dislocation may offer opportunities that older vintages, which entered during more stable periods, do not.

Actionable Recommendations

Tailored Manager Evaluation: Investors should tailor their evaluation based on the market environment and the manager’s approach. While the approach should be specific to the strategy, there are some general guidelines we find useful:

- Compare higher turnover value managers to a custom peer group of high turnover strategies. This can help level set alpha expectations during periods when strong value momentum is a headwind to their approach

- Understand how much turnover you should expect from deep-dive, concentrated value managers. Are they constantly judging current positions vs a broad opportunity set, or are decisions made position by position. Consider what you should reasonably expect from a manager in various environments (and hypothetical environments) and make your assessment accordingly, You do not want a manager to suddenly change their philosophy reactively to a market event, it is unfair to judge them for failing to do so.

- Level-set performance expectations for low-turnover managers based on their inception date. 2018 and 2020 were very different environments for selecting a buy-and-hold portfolio. Avoid overvaluing manager returns if they launch after a short-lived market dislocation.

- Diversification of Strategy Types: Allocators should consider balancing low and high-turnover strategies within their portfolios. This diversification can help mitigate the risks of relying on a single approach in the wrong regime.

1 As reported to eVestment: The lesser of purchases and sales and divided by the average annual market value of the investment multiplied by 100%.

2 Yes, we did the math. Yes, our office is divided on relative greatness of US vs Jamaican sprinters.

3 https://www.msci.com/documents/1296102/28995615/MSCI-_-Impact-_-ACWI-IMI-sector-breakdown.pdf

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospective clients for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.