#derisking #assetallocation #portfoliomanagement#equities#bonds#stagflation#oil supply shock#recession#bear market#downturn#fed policy

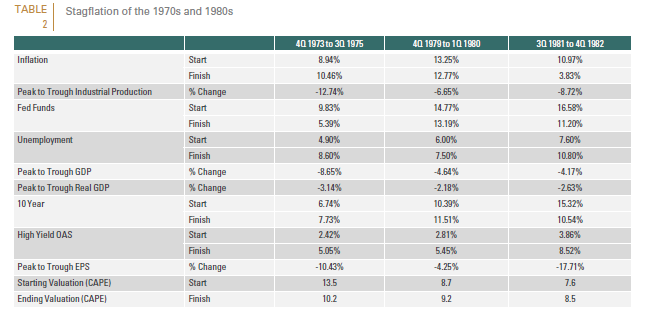

The three preconditions that led to the stagflation period of the 1970s are less likely today. But the relationship between trade disruptions and growth could catalyze a global recession and the relationship between oil prices and inflation expectations could abort the easy monetary policy which current asset prices discount.

- Nixon administration policies that sowed the seeds of stagflation. These include a 90-day freeze on wages and prices that conveniently ended by the 1972 presidential election; a 10% tariff on imports, and the removal of the U.S. from the gold standard, a once in a lifetime event which propelled the price of gold and sunk the dollar. These last two policies raised import prices. Since U.S. companies’ couldn’t lower wages either, the only way to reduce costs was to lay off workers. According to the OECD, the current trade imbroglio has slowed global growth. A meaningful escalation could catalyze a global recession.

- Changes in the Fed’s policies and limitations. The early 1970s stagflation period preceded the Federal Reserve Reform Act of 1977, which explicitly set price stability as a policy goal. Moreover, the Fed’s stop-and-go policies of the 1970s were ultimately counterproductive. However, with the conventional monetary instrument – short-term interest rates – already zero or negative in much of the developed world and extremely low in the U.S., the Fed and central banks globally are facing a zero lower bound constraint. In past recessions, interest rates have typically been moved down by around 500 basis points. This shift isn’t possible now without negative rates.

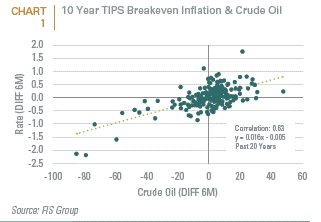

- The impact of oil supply shocks. All 3 recessions in the stagflation period were preceded by an oil supply shock. Today, the U.S. economy’s relationship with oil has changed with emergence of shale fracking technology, which has turned the U.S. into a significant energy producer. Additionally, substitution away from oil, improved fuel efficiency and the growth of the service sector relative to manufacturing have all lessened the negative economic impact from higher oil prices. However, in light of the correlation between inflation expectations and oil prices (See Chart) and the importance of the former on the Fed’s interest rate policy, U.S. asset prices could be more vulnerable to an oil shock than the U.S. economy.

You can read our 2019 analysis of institutional investor derisking trends, Battening Down the Hatches, Part 2