Introduction

Xponance has always sought to lead the industry in providing support, resources, and services to entrepreneurial managers. As part of this effort, we strongly believe that optimal and innovative pathways are forged through collaboration with both our manager and client partners. In December 2023 Tina Byles Williams, Founder, CEO and CIO of Xponance, hosted 24 CEOs from among the firm’s currently funded sub-advisors to participate in a roundtable discussion on the most pertinent challenges to emerging and diverse investment management companies.

|

“I felt honored to be part of this group and am very appreciative of Xponance for putting this together. It was a selfless act designed to help us plan for growth, look at ways to scale and compare best ideas. The only thing asked in return was to promote emerging managers programs, which is something we always try to do.” Alex Woodward |

The event was held over two days. On day one, the CEOs discussed business and strategic challenges they had previously indicated to be most pertinent, based on Tina’s annual business check-ins with Xponance’s funded managers. On day 2, attendees broke into small working groups to derive an action plan for improving success outcomes both for their businesses and the industry. To encourage candid and unvarnished conversations and facilitate relationship-building among the CEOs, the two days operated under “Chatham House Rules” (The quotes included in the report were used with permission). The roundtable was limited to the CEO attendees, Tina, and Cesar Gonzales, the Director of Xponance’s Manager Development Program and Client Portfolio Manager. Some discussion sessions were guided by subject-matter experts and Xponance employees attended the dinner. In the post-round table survey, the CEOs all stated that they would attend subsequent CEO roundtables; most reported the roundtable should be held on an annual basis.

|

“It was an interesting idea to not have Xponance research team present – I think you succeeded in fostering unvarnished CEO interaction as a result.” Robert Snigaroff |

This report on the first Xponance CEO Roundtable delivers an overview of each topic covered during the event, the summarized feedback from the participants, and a list of action items generated through the discussion. The report begins with an update on the state of the emerging and diverse manager industry, as well as changes in the value proposition of small AUM managers. It concludes with a list of actions proposed by the CEOs that industry participants, including asset owners and consultants, should consider going forward to strengthen the pipeline, sustainability, and facilitate the growth of emerging and diverse managers.

The State of the Emerging Manager Industry

The movement to diversify the institutional investment management industry began over 40 years ago, driven by asset allocators and fiduciaries, elected officials, and, most importantly, African American, Hispanic, Asian, and women investment professionals who left large shops to launch their firms. These trailblazers saw the value proposition of small AUM products—nimble execution in capital markets, results-driven decision-making, and the ability to mine the lower capitalization segments of public markets for alpha potential—and created an industry unto itself. Allocators created investment sleeves or programs targeted to source, evaluate, and fund early-stage, small AUM (generally defined as less than $2 billion firmwide), entrepreneurial investment firms led by diverse and women professionals. Manager of managers firms were retained to source and invest through portfolios comprised of emerging managers and in so doing, developed specialized approaches for sourcing, seeding and providing strategic support to these managers. This innovation swam against the industry tide, while simultaneously riding the wave of active management alpha in public equities and fixed income. Industry-wide aggregate allocations grew from a few hundred million dollars at the outset to multi-billions of dollars in the early 2000s.

However, aggregate allocations to emerging and diverse managers stalled in the mid-2010s and declined from 2015 to 2023. This paralleled the decline in active management alpha and the ascent of low-cost passive investment options. According to Emerging Manager Monthly’s (“EMM”) 2024 annual State of the Industry Report, “there are currently 30 defined benefit pension plans with emerging manager-of-managers programs in the U.S. tracked by EMM, with a total of nearly $14.8 billion allocated to them.” This is down from over $19 billion in aggregate assets in 2015.1

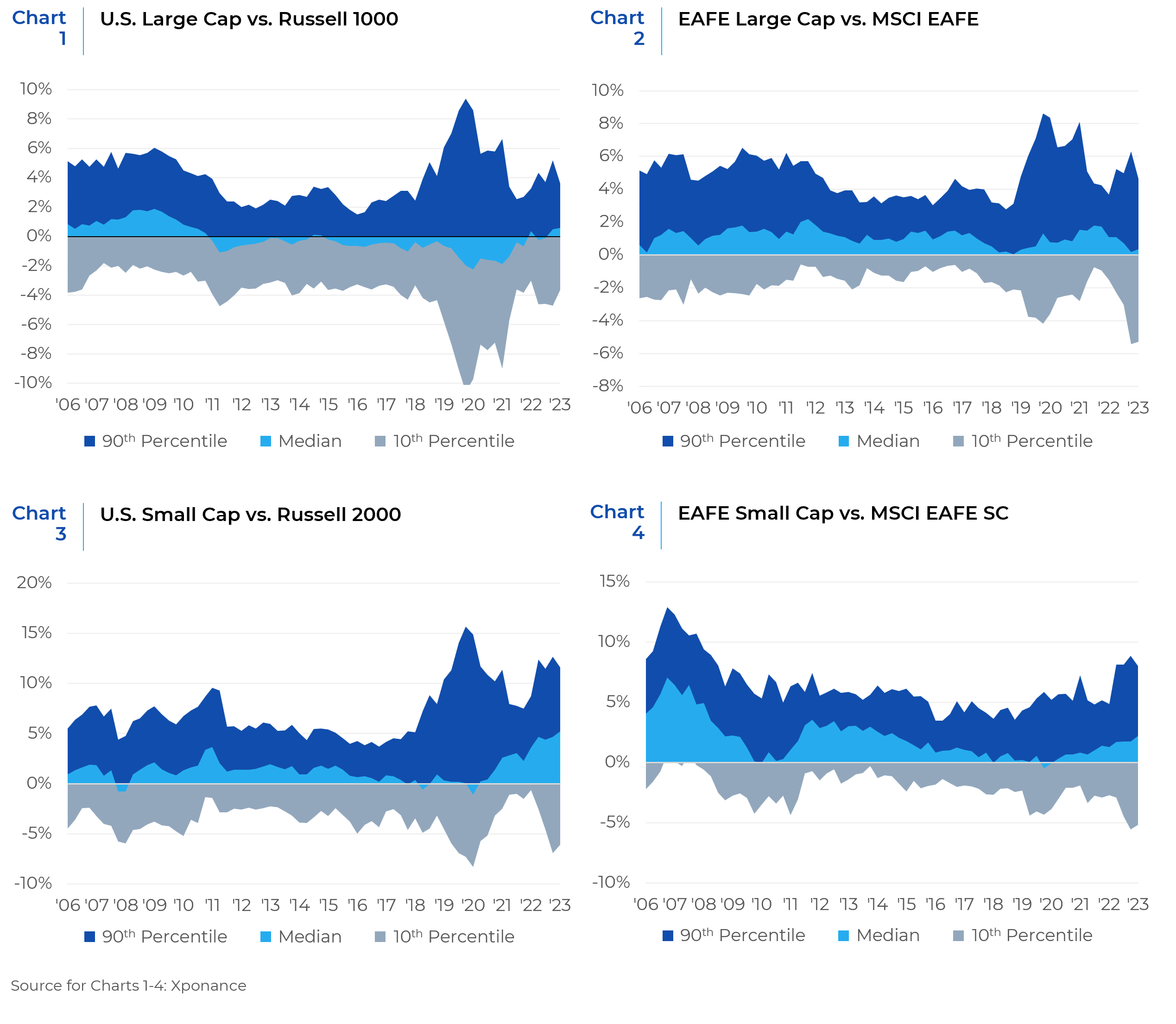

During this period, active managers, which included the vast majority of emerging managers, also faced performance pressure as extraordinary monetary policies in the post GFC period reduced discount rates to historic levels and flooded the financial markets with significant levels of liquidity. This policy backdrop along with increasing indexation, led to significant and self-feeding price momentum around the most liquid and high quality stocks. Moreover, in the absence of economic growth, the markets became highly skewed towards a few high quality growth stocks, which further hampered the performance of diversified stock portfolios. Thus, active managers in very liquid and efficient stock universes, such as U.S. Large Cap equity, found it difficult to generate excess return. For further discussion on the changing dynamics of active management, please refer to the Xponance research papers listed in the endnotes. However, active Small Cap and non-U.S. equity managers were able to generate alpha during this period. The charts below evaluate the rolling three-year excess return of the median, 90th and 10th percentile managers in the eVestment Universe. Since the GFC, the median U.S. Large Cap manager underperformed the benchmark (until the most recent period). While there was a clear pattern of cyclicality, the median manager bested the benchmark for most rolling periods for Small Cap and non-U.S. strategies (except for the most recent period for EAFE).

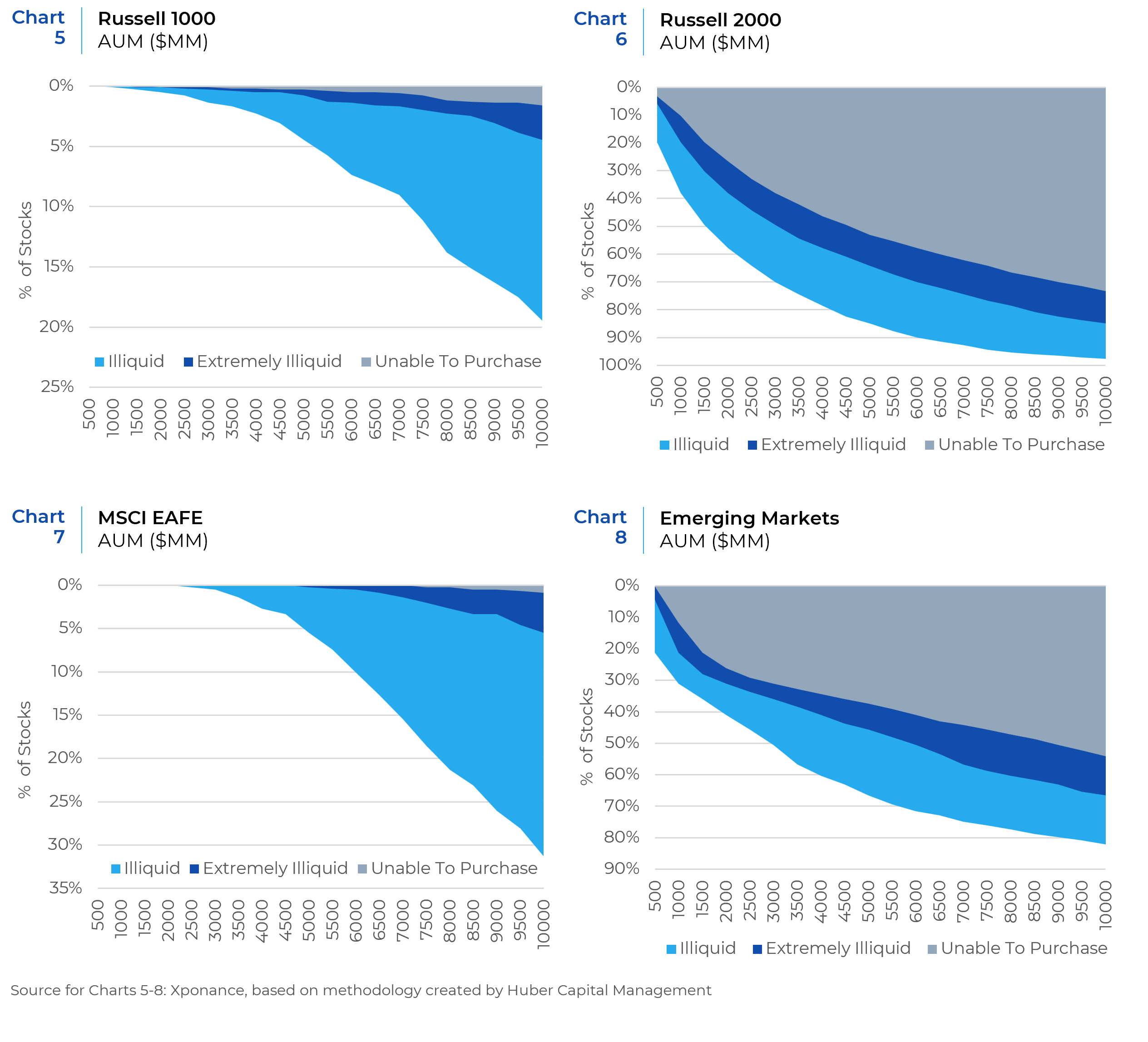

Holding investment acumen equal, entrepreneurial firms can gain a performance edge through more nimble trading and easier access to illiquid names with higher alpha potential in some market conditions, especially in capacity-constrained asset classes. Regarding the latter, the charts below, based on a methodology created by Huber Capital Management and evaluated in Xponance’s “Survival of the Nimble” research paper, illustrate the trade-off between the AUM of a manager’s portfolio and access to all securities in the relevant benchmark, assuming a maximum 5% investment in a company’s outstanding shares. In U.S. Large Cap, liquidity does not limit the investable universe nearly as much as the other commonly invested equity categories until product size is well above $10B$. In contrast, at $5B in AUM, it is very difficult for a Small Cap manager to build a 5% position for over 80% of Russell 2000 index stocks. The Developed non-U.S. stock universe (next page) is slightly less liquid than U.S. Large Cap universe, while Emerging Markets are more akin to the U.S. Small Cap universe. These liquidity dynamics are also impacted by the macro environment. In the most recent hyper-liquid markets (catalyzed in part by post-GFC central bank policies), momentum has been paramount, and the performance pressure caused by high AUM has been less important.

However, as global central banks normalize policies and drain liquidity from the financial markets, price momentum in the most liquid segments of the market would be expected to diminish, and the ability to access the entire securities universe and trade nimbly should provide a performance advantage for smaller AUM. This tradeoff is magnified in the capacity constrained markets Xponance focuses on for multi-manager portfolios (U.S. Small Cap, International, and EM with Non-U.S. Small Cap).

Footnote: The unable to purchase zone in the chart is defined as an asset manager needing to buy 15% of a security’s market cap to establish their desired portfolio weight. The same methodology we are about to discuss is also used for the 10% of company (Extremely Illiquid) and 5% of company (Illiquid) ranges. It assumes that it takes 3% of a manager’s portfolio to establish their desired portfolio weight.

Underwriting entrepreneurial firms typically involves more intensive and comprehensive operational due diligence and assistance. Over the years, investment managers’ operating costs continued to trend upward, from compliance, sales and marketing, rent, salaries and particularly data-related costs. This is why Xponance established its Ecosystem in 2012 to foster the provision of discounted operational support (in areas such trading and order management systems, as well as compliance and marketing services) through independent third party providers. Xponance has also enhanced manager development and coaching, with an emphasis on working with early stage Black and Hispanic owned managers to help them navigate the challenges of entrepreneurship amid the headwinds of our industry. Accordingly, 47% of Diverse & Woman Business Enterprises (DWBE) products currently funded by Xponance could not be found in third party manager databases such as eVestment prior to our funding; and Xponance was the first institutional investor for 32% of the DWBE global and international equity manager products in eVestment.

On the positive side, we have found that entrepreneurial firms who are not trapped by expensive legacy operating systems and methods, continue to be a source of innovation. Before the global pandemic, for example, several emerging managers had already implemented the technological and cultural connections required for a distributed workforce in order to efficiently access the best talent on limited budgets.

AUM growth in the industry has been largely driven by M&A activity, in response to an increasingly challenging operating environment as well as shifts in distribution opportunities away from traditional defined benefit plans (which typically hire through separate account mandates) to defined contribution, OCIO and TAMP asset pools, which typically access managers through more complex and expensive commingled vehicles. Industry wide, deal activity rose from 2022-2023 (although averaged deal size decreased); 2024 is expected to see an increase in M&A activity.2 Emerging and diverse firms are not immune to this dynamic. Strategic combinations continue to be a source of growth for these firms and to enable them to better respond to these fundamental changes in both the operating and distribution environments. Consequently, we encourage asset owners to be more open to these new operating models that will continue to be critical for the survival and growth of emerging managers.

Readout on CEO Roundtable

The areas examined on Day One were:

- Navigating the Life Changes/Stages of a Firm

- Brand and Distribution Management

- Sharing Economics and Succession Planning

- Controlling Data and Compliance Costs

- Incorporating Geopolitical Volatility

- Incorporating ESG and DEI

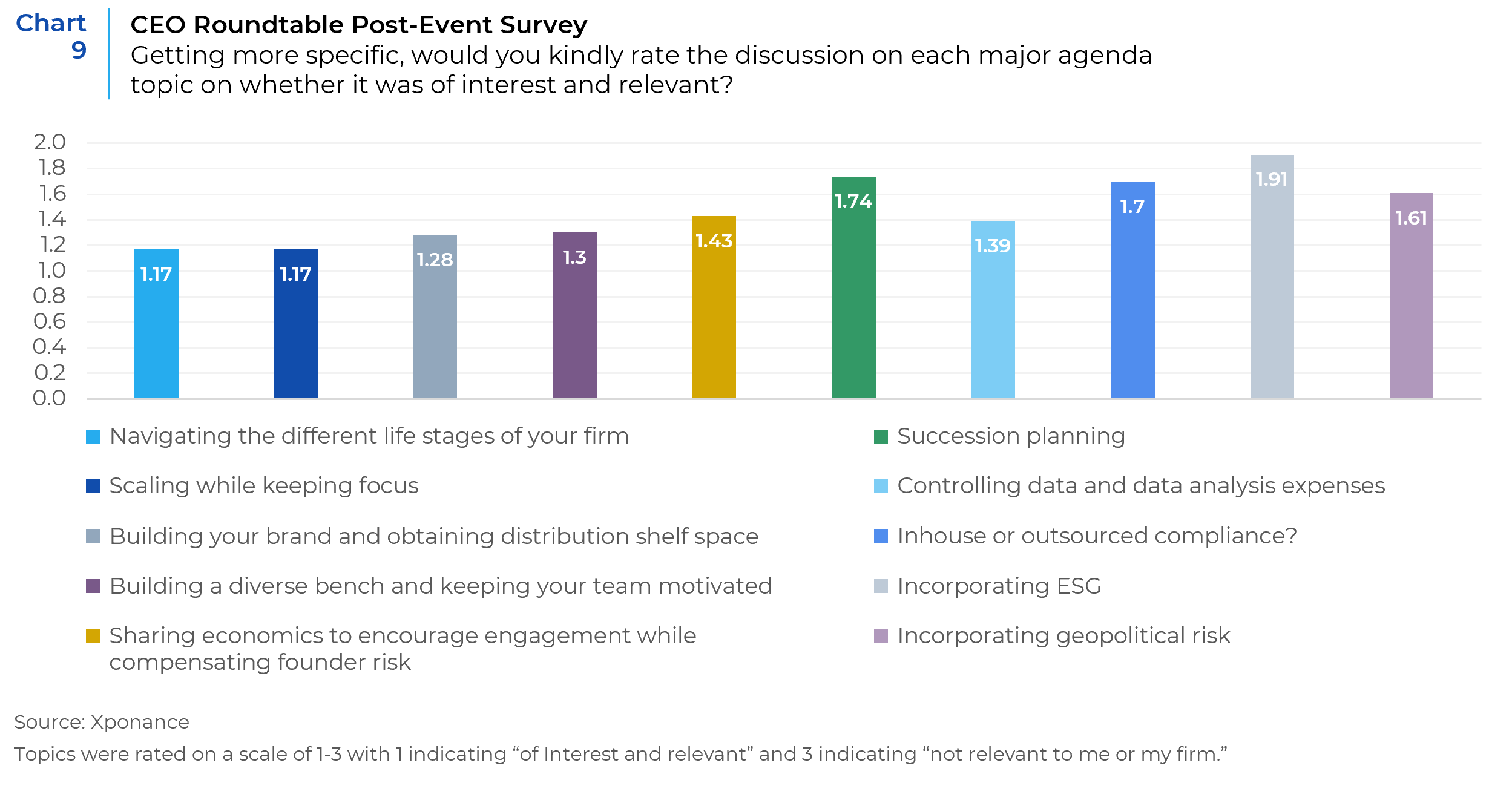

Our post-roundtable survey showed that the attendees rated these topics as highly relevant:

Participants were given a discussion guide as well as subject matter materials and research to prepare for the roundtable through a dedicated Microsoft Teams site. Each topic listed above was covered in the discussion guide and examined during a 1 hour guided discussion, led by Tina. See the discussion guide.

1. Navigating the Life Stages of a Firm

Overview

Emerging manager programs were initially created to provide allocations to early-stage firms. This is reflected in the guidelines of most programs that still limit (with a few exceptions) firm-wide assets under management to $2 billion or less and often discourage managers from staying in the portfolio for more than 3-5 years. However, a company, like a person, has a life cycle, and often we observe firms growing beyond these parameters to reach a tenuous environment in which they are forced to exit emerging manager programs and lose the support they need at the mid-level and later stages. Therefore, CEOs must carefully maneuver their organizations through the environment operationally, while continuing to manage their firm’s growth.

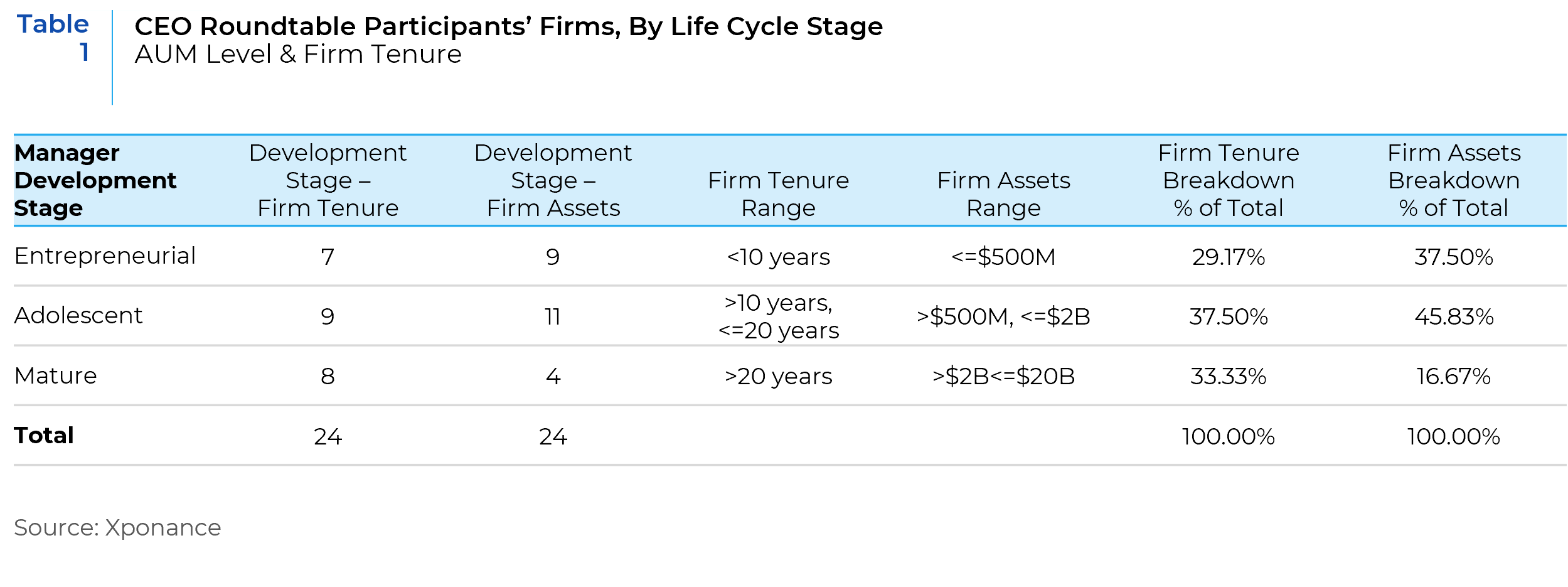

This session explored how CEOs are leading their organizations through the 4 stages of firm development as outlined in the discussion guide (Entrepreneurial, Adolescence, Maturity and Large-to-Mega Firm).3 This discussion was grounded in the fact that emerging firms are in a constant state of change. The 24 participants in the 2024 Roundtable were classified as follows according to their developmental stage:

Among the topics covered were:

- Having a Clear Sense of Your Firm’s And/or Product’s “Why”

- Firm Culture and Values

- Evolving Decision Rights

- Strategic Hiring

- Compensation

- Succession

- Balancing Creativity and Structure

As the founders of emerging and diverse managers pilot their firms through the stages of the life cycle, we discussed balancing the investment talent and passion required to generate alpha (Creativity) with the systematic organization management skills needed to manage a business (Structure). In the Entrepreneurial phase of the manager life cycle, the founder may play multiple key roles: portfolio management, CEO, client service and marketing. All of the 24 CEOs who participated in the 2023 Roundtable have multiple responsibilities, largely out of necessity due to the size and tenure of their respective firms; most also serve in investment roles including chief investment officer and portfolio manager. Those CEOs who are not investment professionals also lead their firm’s business operations or distribution processes. As firms become more mature (Adolescent stage and beyond), the differentiation of roles becomes imminent and necessary. The challenge for emerging firms remains how to separate responsibilities, delegate responsibility effectively, and then communicate changes in key personnel in a manner that builds the confidence of institutional clients and consultants.

Discussion Highlights

- Having a Clear Sense of Your Firm’s And/or Product’s “Why”

-

- Create your definition of success, and a plan for what growth will look like for your team.

- Understand the firm you would like to build up front; this will help you to determine the necessary financial, human capital and operational infrastructure requirements in order to meet your goals.

- Be clear on the roles and responsibilities of senior leadership internally, i.e., investment professionals are focused on investing, etc.

- Outsourcing business operations can allow investment professionals to focus on their core responsibilities; however, outsourcing (particularly regarding compliance and legal) comes with potential risks.

- Present your firm externally based on where it is in the life cycle.

- Firm Culture and Values

-

- Maintaining a consistent firm culture is important when navigating through a manager’s life cycle.

- Talent is not enough, without cultural fit. Brilliant jerks should not be tolerated.

- The stronger a firm’s culture, and the more consistently it is nurtured and demonstrated (especially by its leaders), the less important processes and bureaucracy are for results.

- Evolving Decision Rights

-

- Decision rights must evolve as people’s tenure within the firm evolves. But it is important to do so systematically and transparently.

- Founders who initially have both investment and client service responsibilities will eventually need to communicate to clients the necessity to focus more on the investment process. As the firm grows, the founder will need to be direct in communicating the trade off between direct client face time and managing their portfolios.

- Strategic Hiring

-

- Having the right people in the correct roles is essential. Hire slow and fire quickly, because one wrong hire has a big negative impact on a small team.

- Developing a hiring process that reduces biases will eventually lead to a diverse team from different backgrounds and ways of thinking.

- An alternative way to source talent is to hire qualified candidates who are not “attractive” to large firms since they do not fit the stereotypical “type.”

- Compensation

-

- As you build your firm, you must assess what is important to your team members so that you can develop the right compensation package that is in line with their goals. Not everyone wants to be an “owner.”

- Not everyone is motivated by compensation, but some value a sense of appreciation for their contributions to the firm.

- At some point you need to be paid for taking the Founder’s risk.

- Valuation metrics will vary depending on what the Founder/Firm values.

- Succession

-

- Senior leadership must know when it is time to pass on the baton to other team members.

- Not everyone is meant to be a partner and/or a leader.

- If you communicate a leadership transition plan, you must commit to it to avoid market confusion.

- Succession involves both management and financial transition. You need to develop a plan early to solve for: 1. Management transition; 2. Business continuity; 3. Liquidity for founder or primary shareholder.

- Utilize an advisory board and have a plan for coaching identified individuals.

- It is important to have a succession plan for each key role.

- For the succession to be successful, the Founder or current key leadership must slowly empower the next generation of leadership and let them fail in order to learn what leadership approach will result in a successful transition.

- Communicating the plan internally is important but is equally important for the outside world. Eventually your clients will figure out if the transition is supported internally and successful.

- Balancing Creativity and Structure

As a firm grows and its management becomes more layered and complex, the Founder needs to retain specialized corporate management and hold them accountable over their respective domains. But it is important to retain the creative energy behind the firm’s founding and mission (initially embodied by the founder(s) and over time, imbued through its culture).

2. Brand and Distribution Management

Overview

The material for this session was primarily provided by Prosek, a marketing and PR firm that specializes in investment firms.4 This session focused on creating a unique and authentic brand strategy and determining the firm’s unique lane in thought leadership.

While many firms believe that thought leadership is non-essential, half of US investors consider it crucial to understanding and getting to know a manager.5 In a market environment in which many strategies are commoditized, institutional investors and their consultants increasingly weight though leadership as an important factor in manager selection.

Launching commingled products is also key to small managers accessing institutional defined contribution assets and wealth management platforms. This session included a detailed discussion of the pros and cons of various vehicles, comparing the legal, compliance and administrative features of collective funds, LLCs, and registered funds and how different types of investors adopt them.

Most emerging and diverse managers serve institutional clients, primarily large public defined benefit plans. Penetrating the B2B wholesale distribution marketplace, while challenging for these firms, could be a significant opportunity for entrepreneurial managers. The opportunity side is driven by a sea change in client demographics as assets transition from baby boomers to the millennial generation. More than other cohorts, millennial investors show interest in impact investing and funds that meet environmental, social, and governance (ESG) or socially responsible investing (SRI) criteria.6 Millennial investors who want to live their values may push their advisors to create inclusive investment options. Additionally, retail/wealth management clients are looking for more consultative relationships with their advisors, rewarding managers for helping them to achieve personal financial goals. As a result, there is increased pressure on asset managers to provide insights into how specific fund recommendations impact the balance of risk and return best suited for achieving a client’s financial goals. Asset managers that effectively impart cogent advice via the wholesale channel on topics such as expected return, volatility and diversification stand to gain market share.

Finally, the role of institutional investment consultants in a firm’s brand and distribution management plan was discussed in detail. Consultants have an important role, serving as intermediaries for 86% of U.S. institutional assets in 2022.7 Asset concentration has also impacted investment consultants, with the 20 largest firms controlling 84% of assets as of 2022. It is still an uphill battle for small AUM managers to get on the radar of institutional investment consultants.

Discussion Highlights

- Creating content on a regular basis based on what would benefit your clients will keep you relevant in your clients’ eyes especially when performance is poor.

- Determining when to use digital presence depends on your target market(s). However, you must have a good pulse on how your clients or prospects process information.

- Digital marketing could help lower your costs if used effectively.

- There is a generational shift taking place among asset owners and the younger generation increasingly consumes information from social media sites, such as LinkedIn.

- Penetrating consultants is a long-game for emerging managers and often takes several years. But it can be profitable once a manager gains traction. Some of the CEOs of larger and more mature firms gave examples of successful interactions with consultants. There are no shortcuts!

- Each consulting firm differs with respect to client focus, as well as avenues for engagement. For some, the client-facing consultants are involved in manager evaluations; whereas for others, that function is entirely conducted by a manager research group which often specializes by asset class. Therefore, before engaging with a consultant, investment advisers should research their client profile, whether they have a particular research focus, and what their model is for conducting research.

- There are thousands of managers vying for consultants’ attention so investment advisers should effectively and concisely present their value proposition, how their investment process and team can effectively and repeatably deliver alpha, and establish an understanding of future communication protocol with the consultant. Before a meeting, also inquire which team members should participate in the call.

- Be transparent and consistent in communicating firm, personnel, and performance updates. No one wants to be surprised (especially when there is bad news). The Teams site for the seminar included contact preferences for many of the major consultants, as well as their 2023-2024 research focus.

In order to increase the probability of meaningful penetration among consulting firms, it helps to offer one’s products through both separate accounts and commingled vehicles in order to be recommended to clients of various sizes, vehicle preferences and requirements.

3. Sharing Economics and Succession Planning

Overview

As firms progress through the life stages, broadening the economics and succession planning become vital to the organization’s continued growth and stability. These processes enable talent acquisition and retention, as well as asset growth. Just as important is the compensation of the founder(s) and the transition of power to the next generation of a company’s leaders. This session involved a careful and deep discussion of multiple ways to successfully transition a firm’s ownership and leadership team including M&A activity, the pros and cons of employee stock ownership plans, and private equity and debt.

As firms progress through the life stages, broadening the economics and succession planning become vital to the organization’s continued growth and stability. These processes enable talent acquisition and retention, as well as asset growth. Just as important is the compensation of the founder(s) and the transition of power to the next generation of a company’s leaders. This session involved a careful and deep discussion of multiple ways to successfully transition a firm’s ownership and leadership team including M&A activity, the pros and cons of employee stock ownership plans, and private equity and debt.

Discussion Highlights

- The group heard a presentation from Tim Jochim of Walter Haverfield, which is the nation’s foremost expert on Employee Stock Ownership Plans (or ESOPs). He discussed various vehicles for distributing ownership, including options, phantom shares, ESOPs, as well as obtaining strategic capital through private equity stakes. Most of the discussion centered on the latter two vehicles.

- Tina Byles Williams also explained Xponance’s journey in distributing the company’s shares, as well as the mechanics of Xponance’s ESOP.

- An ESOP can address the financial conundrum that often occurs with successful closely held private companies that have accumulated substantial enterprise value. In order to affordably distribute ownership, the founder or principal shareholder often has to grant or substantially discount the price of the company’s shares. But there is a limit to which the owner/principal shareholder can grant and/or substantially discount their interests in order to be fairly compensated for their initial risk capital, particularly with respect to teammates that may not have borne any of the company’s founding risk. This is why many founders turn to third parties to gain liquidity, which can sometimes be disruptive to the company’s operations and/or culture.

- Tina explained that Xponance’s predecessor firm, FIS Group, issued both stock grants and substantially discounted shares. But the ESOP helped to address the conundrum of affordability to employees and a fair and market-based price for her shares. The company bought 32 percent of her shares based on a third-party valuation firm. Shares were distributed to employees in accordance with the company’s payment of a 10-year loan, between it and Tina.

- To provide assurance to employees on the validity of their ESOP accounts, the company’s ESOP shares are valued annually by a third-party valuation firm using financial data from the annual financial audit. That valuation must be reviewed and approved by an independent ESOP trustee. Each employee receives a report from a third-party ESOP administrator. Since the value of an employee’s ESOP account is primarily driven by a combination of their longevity with the firm, transaction market multiples for peer firms, the company’s trailing revenues, and pre-tax earnings—which is highly correlated with how well Xponance performs for and serves its clients—the ESOP as an important tool for aligning the firm’s compensation structure with a culture of ownership, accountability, and client performance.

- The downside of an ESOP is that the share distribution is formulaic, based on the plan structure and DOL rules. Share allocation in any given period cannot reflect nuanced factors, such as the relative performance of different team members during the year. (But that is reflected in annual bonuses). ESOPs can also be more expensive to administer, particularly if the company retains third parties to oversee and value the shares (which is the Xponance model).

- The group also discussed private equity as a path for either share re-distribution or achieving strategic goals. Two of the CEOs reported that they had positive experiences with private equity partners, both in terms of funding and strategic advice and assistance. They counseled that in addition to the financial terms, that CEOs should weigh the strength of their potential private equity partner’s value creation capabilities (in terms of distribution, management, and operating assistance) as well as their liquidity horizon, which is in turn determined by the Limited Partnership terms between the private equity fund sponsor and its LPs.

4. Controlling Data and Compliance Costs

Overview

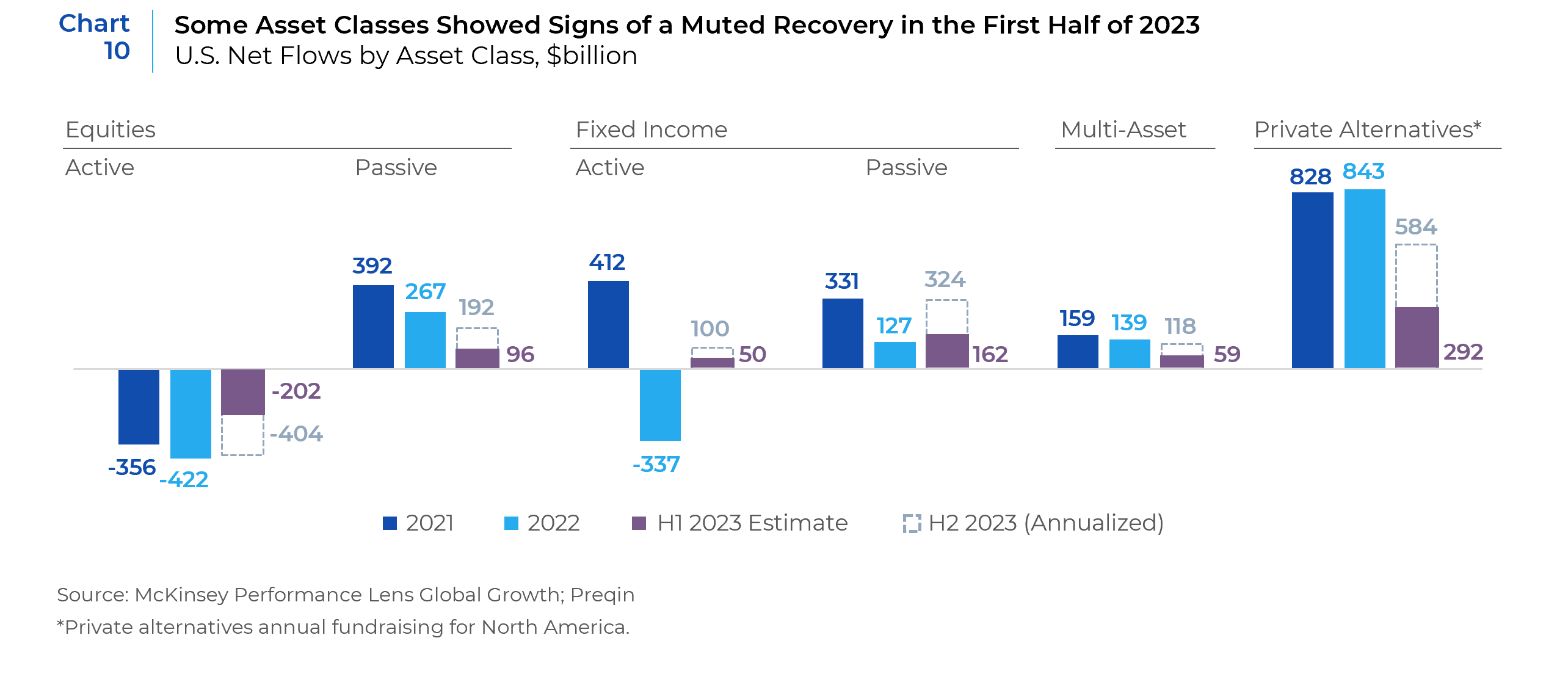

The industry is facing declining profit margins (particularly among long-only product managers), muted asset flows (for traditional and alternative asset classes) and annual fixed operating cost increases. Two of the fastest growing expenses are data analytics and regulatory compliance. This module discussed the operating expense realities and potential strategies for bending the cost curve while meeting regulatory requirements as well as client, consultant, and institutional standards.

The CEOs discussed the potential for AI-powered natural language powered (NLP) tools to reduce costs across investment and business operations functions including:

- Research

- Marketing & Distribution (via robo-advisors)

- Algorithmic trading & maintain trading systems

- Compliance monitoring

- Client service

- Back office

- Liquidity management

One of the largest fixed operating costs facing public equity managers (including the firms participating in the roundtable) is index data. These costs include fees charged by the index providers as well as the additional fees to access DM and EM core benchmarks via data analysis systems and accounting systems, such as FactSet and Advent.

Over the last 5 years, the pricing associated with accessing index data increased well above inflation and has become a significant pain point for emerging managers. The CEOs posited that consolidation among data providers has allowed for monopolistic pricing by the market leaders, even though the rules-based nature of their product—benchmark performance and data—is highly replicable. Xponance’s comparative analysis of the performance and risk data between the market leaders and alternative benchmark providers, such as Bloomberg and Solactive, over the trailing 10 years suggested a high degree of equivalency. (A copy of this analysis is in the discussion guide). However, the relative cost of these alternative benchmarks was meaningfully below that of the market leaders. Going forward, large language models behind AI would be expected to further reduce the costs of index creation and maintenance and thereby foster even more firms that can produce quality index data. AI will also facilitate more granular or new types of market segmentation. Thus, the current practice of singling out the market leader benchmark providers, such as MSCI, Russell, or S&P in Investment Management Agreements (IMAs) appears to be out of step with both the competitive landscape and emerging technology. Moreover, it supports aggressive price hikes by these firms, which has become a major pain point for emerging managers. Xponance thus agreed to spearhead a conversation with asset owners and consultants to explore their openness to greater flexibility in only naming certain benchmark providers in their Investment Management Agreements, as long as the benchmark proposed by the manager reasonably represent/reflects the passive performance and risk characteristics of the market segment that they were hired to manage.

|

“There is a significant brains and experience “trust” in the room—we should definitely find ways to harness this more.” Delphine Govender |

|

Discussion Highlights

Controlling Compliance Costs – Outsource vs. Inhouse CCO

The compliance discussion was led by Xponance’s General Counsel and CCO, Shelley Simms. The salient points of her presentation were:

- There are three people who are “personally” liable when things go awry: the CEO, CIO and CCO.

- Outsourcing can expose a manager to a broader range of asset class expertise than a single internal CCO. However, it is important to understand that outsourcing the compliance function does not absolve the firm’s principals from their responsibility to comply with the laws and regulations governing investment advisors.

- Firms are required to disclose whether their COO is internal or external on Form ADV. Outsourced COO usage may receive greater scrutiny from the SEC.

- The outsourced CCO might have difficulty understanding/practicing the firm’s culture relative to the rest of the firm.

- To maintain better control of their regulatory exposure while taking advantage of the potential cost efficiencies of an outsource model, emerging managers should consider a hybrid model in which they maintain an internal CCO to coordinate their compliance program and maintain some responsibilities (such as the annual filings with the SEC), but outsource certain functions, such as compliance testing, mock audit, training & vendor due diligence.

5. Incorporating Geopolitical Volatility

Overview

This discussion was facilitated through a presentation by Xponance’s CEO, Tina Byles Williams. The discussion highlights were as follows:

This discussion was facilitated through a presentation by Xponance’s CEO, Tina Byles Williams. The discussion highlights were as follows:

- Geopolitics always mattered for corporate earnings and financial markets. It’s just that for the quarter century between 1985 and 2010, it operated in the background as an under-appreciated tailwind. For example, the raging 30-year bull market in bond prices was as much a result of the deflationary impact of trade globalization (primarily catalyzed by China’s 2001 entry into the World Trade Organization), as the Federal Reserve Bank’s attempts to slay inflation through double-digit interests. Moreover, the so-called “Washington Consensus” proffered by U.S. President Reagan and U.K. Prime Minister Margaret Thatcher, which favored laissez-faire, regulation-light policies, and economic orthodoxy, created a benign backdrop for corporate profits and financial markets.

- The Washington Consensus policy framework so dominated the late 20th century that subsequent politicians on both the left and right adhered to its policy foundation. Thus, though the average annual real rate of return on US equities since 1872 has been 3.2 percent, in the period of general peace and prosperity following World War II, stocks returned 4.8 percent per year, and 6.2 percent per year in the post-Cold War period. These geopolitical and political tailwinds are being challenged on two fronts.

- The first is rising income equality, largely because the Anglo-Saxon world has done a poor job of managing the socio-economic fallout from globalization and technological change. The discontent caused by income inequality has been a boon for populist politicians who are both propagators and symptomatic of median voter preferences that have soured on laissez-faire policies and globalization. Populist policies have historically led to higher inflation, more nativist trade policies and nationalism – macro trends that typically undermine the performance of financial assets.

- The second front is hegemonic instability, which the pre-eminent economic historian Charles Kindleberger described as the interregnum between the British and American empires. During periods of hegemonic instability, policy coordination among nations which is most critical during periods of global crisis, has proven to be challenging and market disruptive.

- How might managers and asset owners incorporate geopolitical risk?

- Some geopolitical trends are structural (multipolarity, increased protectionism) and some are cyclical (such as supply-demand dynamics of oil and natural gas).

- Geopolitical risk can be viewed as a source of alpha and/or a factor for risk avoidance.

- The simplest way to incorporate or consider geopolitical risk is to map a portfolio’s exposures to countries and regions to publicly available Geopolitical Risk Indices or other risk ranking systems to determine whether valuations for their country, sector or security holdings appropriately reflect potential geopolitical risk. (Most of the participants that evaluated geopolitical risk used this method).

- One of the participants incorporated geopolitical risk by modeling robust conditionally into their model’s information coefficients. For example, the market-relevant effects of geopolitical risk – such as increases in the price of commodities due to a geopolitical event – would be expected to alter the performance of different factors (growth vs. value, hard vs. soft-asset companies, and oil-consuming companies and countries). These relationships can be systemically incorporated into portfolio models.

- The constraints vs. preferences framework developed by Marko Papic, Chief Strategist for the Clocktower Group, provides another method for evaluating geopolitical risk. (Roundtable participants were provided a copy of Papic’s book, “Geopolitical Alpha”). This framework begins with an understanding that information on any geopolitical event will be incomplete (and that so-called geopolitical experts also have incomplete information). Its other foundational premise is that despite a leader’s rhetoric, his or her outcomes will ultimately be prescribed by what is materially available. Therefore, focusing on the historical, political, economic, constitutional/legal, and military contexts and constraints in which leaders operate, will allow you to cut through the media’s tendency to sensationalize and personalize geopolitical events into human interest stories and develop a more accurate (and actionable) estimate of the outcomes of their actions.

6. Incorporating ESG and DEI

Overview

While we are observing political backlash against ESG and DEI spill into the institutional investment landscape, they continue to be key priorities for fiduciaries in asset allocation (ESG) and manager selection (DEI). In 2022 58% of U.S. institutional investors surveyed by Greenwich Associates reported that they considered DEI in manager selection.8 53% of North American institutional investors used ESG strategies in their portfolios.9

While we are observing political backlash against ESG and DEI spill into the institutional investment landscape, they continue to be key priorities for fiduciaries in asset allocation (ESG) and manager selection (DEI). In 2022 58% of U.S. institutional investors surveyed by Greenwich Associates reported that they considered DEI in manager selection.8 53% of North American institutional investors used ESG strategies in their portfolios.9

Discussion Highlights

- To help strengthen the value proposition of ESG, managers must present third party studies to support the value add of ESG. One CEO in attendance referenced an Italian study, “Mind the Gap,” which she stated clearly shows the alpha contributions of ESG.

- There is a lot of greenwashing involving ESG investing. As a result, the SEC has instituted some validation mechanisms to ensure fairness in representation.

- Another CEO mentioned the CFA Institute now requires that managers verify their ESG representations.

- There is a lot of talk on ESG investing by allocators. However, the money does not follow as much as the interest it is getting.

- A participant stated that value companies tend to be heavy carbon emitters. Therefore, he has found engagement with those companies to decrease their carbon emissions companies to be very impactful while increasing shareholder value.

Conclusions

The inaugural Xponance CEO Roundtable was created to enhance our support of emerging and diverse managers as they navigate an increasingly complex and challenging landscape. By presenting relevant topics and enabling peer-to-peer interactions we sought to source solutions from these leaders that can be shared with the industry.

The event resulted in a list of action items:

- Create a forum (Slack or LinkedIn etc.) exclusive to Xponance and attendees in order to continue the camaraderie and support channels fostered by the CEO roundtable

- Distribute brief manager profiles and best contact info etc

- Xponance will explore more granular alternatives to MSCI benchmarks and engage asset owners and consultants to consider more flexible benchmark specifications in IMA’s

- Xponance to feature an emerging manager each month on social media and on our website

- Evaluate a shared services company or cooperative to provide back and middle office services to emerging managers

- Xponance to provide annual Aapryl (Xponance’s proprietary manager analysis system) profiles including information on how we ranked each funded manager’s investment products

Based on these results we will continue to host this event and share our findings, with the goal of increasing funding opportunities for emerging and diverse firms, empowering them to offer alpha opportunities for institutional investors.

|

“This CEO Seminar hosted by Xponance may have been one of the best uses of any two days away from my investment screens and spreadsheets in the (nearly) 13 years since I founded [my firm]..” Deepinder Bhatia |

|

For a compilation of all survey questions, please see Appendix A.

[1] A Look Inside the Current Emerging Manager Programs, Emerging Manager Monthly, January 2024

[2] “2024 investment management outlook: Winning in tomorrow’s world with the lessons of today”, Deloitte Center for Financial Services

[3] Source: Focus Consulting

[4] Xponance is a Prosek client.

[5] Coalition Greenwich-Voice of Client 2022 Maximizing Brand Impact Study

[6] “How asset managers can transform distribution,” KPMG, 2020

[7] Coalition Greenwich-Voice of Client 2022 Global Institutional Investor Study

[8] Coalition Greenwich-Voice of Client 2022 Global Institutional Investor Study

[9] Coalition Greenwich-Voice of Client 2022 Global Institutional Investor Study; Coalition Greenwich-Voice of Client 2022 Delivery on ESG Study

Xponance research papers that discuss changes in alpha availability or alpha generated by emerging managers:

- Alpha Availability: Identifying the Drivers of Active Manager Returns Across Markets and Investment Styles – Part 1

- Alpha Availability: Identifying the Drivers of Active Manager Returns Across Markets and Investment Styles – Part 2

- Alpha Availability: Identifying the Drivers of Active Manager Returns Across Markets and Investment Styles – Part 3

- Is Active Equity Management Alpha On Permanent Or Temporary Disability?

- Survival of the Nimble – The Alpha Case for Emerging Managers

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.